crypto blog

Reversible transactions could mitigate crypto theft — Researchers

Stanford University researchers have come up with a prototype for “reversible transactions” on Ethereum, arguing it could be a solution to reduce the impact of crypto theft. In a Sept. 25 tweet, Stanford University blockchain researcher Kaili Wang shared a run down of the Ethereum-based reversible token idea, noting that at this stage it is not a finished concept but more of a “proposal to provoke discussion and even better solutions from the blockchain community,” noting: “The major hacks we’ve seen are undeniably thefts with strong evidence. If there was a way to reverse those thefts under such circumstances, our ecosystem would be much safer. Our proposal allows reversals only if approved by a decentralized quorum of judges.” The proposal was put together by blockchain researchers...

Is post-Merge Ethereum PoS a threat to Bitcoin’s dominance?

While Ethereum (ETH) fans are enthusiastic about the successful Merge, Swan Bitcoin CEO Cory Klippsten believes the upgrade will lead Ethereum into a “slow slide to irrelevance and eventual death.” [embedded content] According to Klippsten, the Ethereum community picked the wrong moment for detaching the protocol from its reliance on energy. As many parts of the world are experiencing severe energy shortages, he believed the environmental narrative is taking the back seat. In an exclusive interview with Cointelegraph, Klippsten said “I think the world is just waking up to reality and Ethereum just went way off into Fantasyland at the exact wrong time.” “It is just really bad timing to roll out that narrative. It just looks stupid.” According to some predictions, institutional capital...

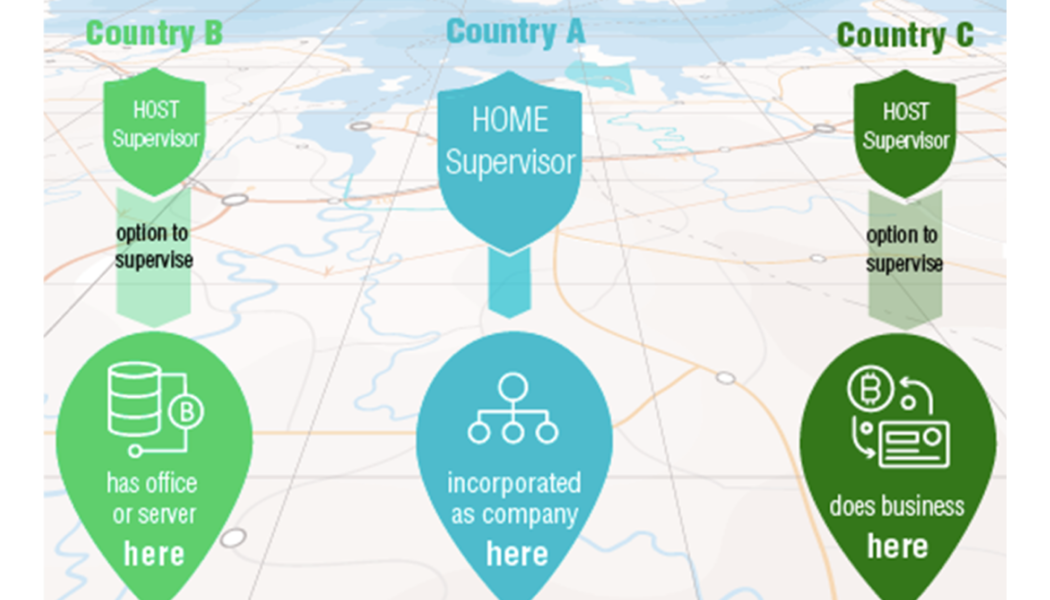

The European Union is stifling stablecoin adoption

The digital asset landscape in the European Union is evolving ahead of the passage of the Markets in Crypto-Assets (MiCA) regulation framework that aims to instill regulatory clarity around crypto assets. While well-intentioned, the current structure of MiCA may throttle innovation. But if a revised version of this policy passes, it could see the European Union become one of the leaders in the digital payment space. If not, then there is a genuine possibility of the continent falling behind. MiCA aims to set a regulatory framework for the crypto asset industry within the EU. At this point, much still needs to be codified and clarified, but the broad strokes are now known. Simultaneously, financial technology firm Circle launched a stablecoin called Euro Coin (EUROC). Euro Coin impleme...

Throw your Bored Apes in the trash

It’s time to move on from the Bored Ape Yacht Club. They’re bad for nonfungible tokens (NFTs). They give critics ammo and distract from the technology, which is where the real value lies. For those on the outside looking in, NFTs are nothing more than overpriced monkey JPEGs. Or whichever choice of animated animal profile picture is in the firing line. NFTs, of course, are much more than that. But, because of Bored Apes, and the countless imitations they’ve spawned, NFTs are getting a bad rep. “Bubble,” “money laundering” and “scams” are all terminology associated by critics with the new “Beanie Babies craze.” It’s a disparaging distraction. Related: Bored Ape Yacht Club is a huge mainstream hit, but is Wall Street ready for NFTs? Yes, Bored Apes are still priced at more than $100,00...

Coinsquare acquires publicly traded crypto exchange CoinSmart

Canada’s crypto exchange landscape appears to be consolidating after Coinsquare, one of the largest digital asset trading platforms in the country, acquired CoinSmart for an undisclosed amount. On Thursday, Coinsquare announced that it had entered into a definitive agreement to purchase all issued and outstanding shares of CoinSmart’s wholly-owned subsidiary Simply Digital. Once the deal becomes final, CoinSmart will hold a roughly 12% ownership stake in Coinsquare on a pro-forma basis. Shares of the CoinSmart crypto exchange, which trade on the NEO Exchange, were up 67% on Friday, largely in response to the news. The acquisition makes Coinsquare one of Canada’s largest crypto exchanges and expands its operational and business capabilities. Founded in 2014, Coinsquare has expanded it...

California Gov. Newsom vetoes crypto licensing and regulatory framework

Adding to the existing regulatory hurdles for the crypto ecosystems, California Governor Gavin Newsom refused to sign a bill that would establish a licensing and regulatory framework for digital assets. Assembly Bill 2269 sought to allow the issuance of operational licenses for crypto companies in California. On Sept. 1, California State Assembly passed the bill with no opposition from the assembly floor and went on to the governor’s office for approval. Letter of rejection from Gov. Mewsom. Source: leginfo.legislature.ca.gov Opposing the notion, Newsom recommended a “more flexible approach” that would evolve over time while considering the safety of consumers and related costs, adding: “It is premature to lock a licensing structure in statute without considering both this work (...

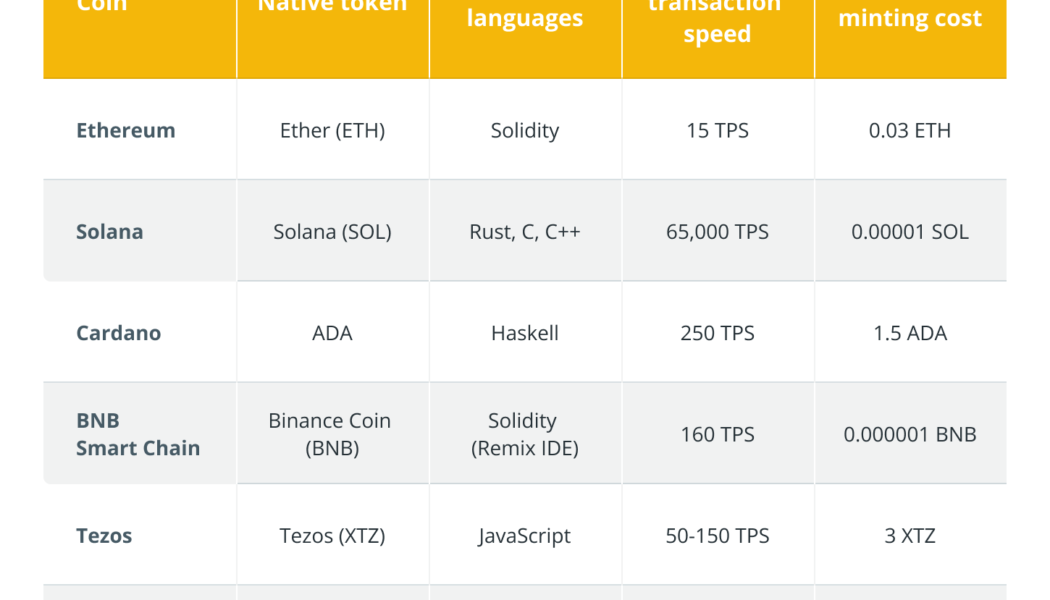

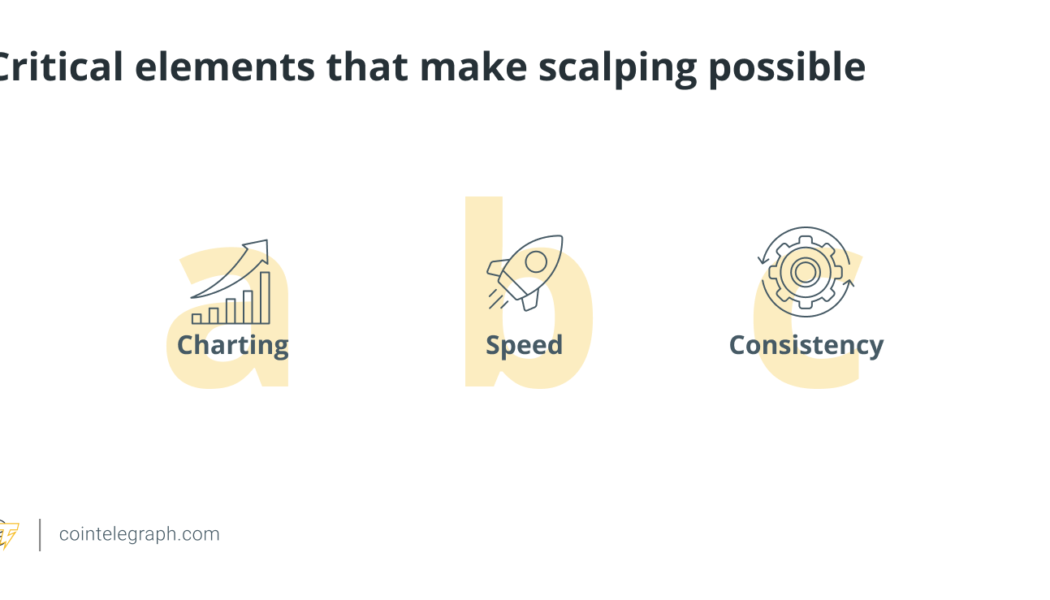

What is scalping in crypto, and how does scalp trading work?

Although cryptocurrencies are known for their volatility, they give traders various opportunities to pocket and reinvest the gains. Scalp trading is a crypto strategy that helps scalpers to take risks and make the most of frequent price fluctuations by observing price movements. This article will discuss scalping, how it works in cryptocurrency, the advantages and disadvantages of scalp trading in crypto, whether it is complicated and how much money you need to engage in it. What is scalp trading? Crypto scalp traders target small profits by placing multiple trades over a short period, leading to a considerable yield generated from small gains. Scalpers step in for highly liquid and significant volume assets that result in greater interest owing to the news. Scalping strategies require kno...

Bitcoin risks worst weekly close since 2020 as BTC price dices with $19K

Bitcoin (BTC) headed for its lowest weekly close since 2020 on Sep. 25 as a week of macro turmoil took its toll. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader prepares for “important week” for BTC Data from Cointelegraph Markets Pro and TradingView showed BTC/USD trading near $19,000 with hours left to run on the weekly candle. While only down $400 since the week began, the pair offered traders little optimism amid fears that the coming days would continue the bleedout across risk assets. “The whole week traded within the monday range. Weekly close gonna be bearish, looking like a pin bar,” popular trading account Crypto Yoddha told Twitter followers in a summary post. “Also consolidating at the range low. So need a bounce first before taking a position. Ne...

Blockchain infrastructure firm Chain will sponsor New England Patriots football team

Chain, a blockchain infrastructure firm that offers developers Web3 services to build and maintain blockchain-based applications, will sponsor the New England Patriots football team as well as other venues and sporting clubs controlled by the Kraft Group. In a Thursday announcement, Chain said it will be the official blockchain and Web3 sponsor of the Patriots, the New England Revolution soccer club, Gillette Stadium in Massachusetts and the shopping center Patriot Place as part of a multi-year partnership deal with Kraft Sports + Entertainment, the marketing and events division of the Kraft Group. Chain will work to develop Web3 experiences for visitors to Gillette Stadium and Patriot Place by “merging the physical with the digital.” Speaking to Cointelegraph, a Chain spokesperson decline...

Lawyers for Celsius investors file motion to have interests represented in court

An international law firm representing groups of Celsius investors has filed a motion to appoint a committee to represent their interests in the crypto lending firm’s bankruptcy case. In a Thursday filing with the U.S. Bankruptcy Court in the Southern District of New York, lawyers with the law firm Milbank requested the appointment of an “Official Preferred Equity Committee” to represent certain Celsius shareholders. According to the filing, the equity holders “urgently require their own fiduciary” for representation in court alongside Celsius debtors and an Unsecured Creditors Committee, or UCC. “The need for a fiduciary to pursue the Equity Holders’ interests is particularly critical when one considers the practical realities of these cases: There are only two groups of real ...

Pentagon contracts with Inca Digital for a security-focused digital asset mapping tool

Digital asset data analytics company Inca Digital will study the implications of digital assets for national security under a year-long contract with the Defense Advanced Research Projects Agency (DARPA), the company announced on Friday. DARPA is the R&D branch of the United States Department of Defense. Inca Digital will work on a project called “Mapping the Impact of Digital Financial Assets,” which will aim to create a “cryptocurrency ecosystem mapping tool” to provide information to the U.S. government and commercial businesses. Besides looking at possible money laundering and sanctions evasions, the project will contribute to understanding interactions between traditional and digital financial systems, money flows into and out of blockchain systems and other uses...

LUNC investors react to CZ’s 1.2% trading tax recommendation on Binance

The infamous collapse of the Terra ecosystem, which erased market prices of TerraUSD (UST) and LUNA tokens, continues to trouble anxious investors as co-founder Do Kwon, crypto exchanges and the community together tries to identify the best route for a sustainable price recovery. Most recently, Changpeng ‘CZ’ Zhao, the CEO of crypto exchange Binance, recommended a flat 1.2% trading tax on LUNC trades that could be burned to reduce the token’s total supply and improve its price performance. Addressing the community, CZ stated: “We will implement an opt-in button (on the Binance exchange), for people to opt-in to pay a 1.2% tax for their LUNC trading.” However, the exchange would begin the taxation for opt-in traders following the consensus of 25% of the LUNC investors, making sure that earl...