crypto blog

Rushing ‘token mapping’ could hurt Aussie crypto space — Finder founder

Australian crypto entrepreneur and investor Fred Schebesta has described the Australian government’s prioritization of token mapping as “wonderful,” but warns that rushing it could lead to detrimental effects on the economy. Schebesta’s comments come after Australian Treasurer Jim Chalmers released a statement on Aug. 22 stating that the “treasury will prioritize token mapping work” in 2022 to show how “crypto assets and related services should be regulated.” Speaking to Cointelegraph, Schebesta believes Australia already has a “fledgling” crypto industry but needs to “align with the other major markets and their regulations.” Schebesta added that the “intricacies” of token mapping are not clear, and “things are changing as well.” Schebesta is an Austral...

Many NFT projects lack adequate smart contract testing, says nameless founder

Jimmy McNelis, the founder of Web3 tech firm nameless, says there are too many NFT projects rushing to market without proper smart contract testing — potentially leading to millions lost. Speaking with Cointelegraph, McNelis suggested that a lot of NFT projects often rush to market without fully simulating how its smart contracts will work, even skipping extensive audits in some cases. McNelis said an example of this was observed during the sale of the Akutars NFT collection in February 2021 — featuring 15,000 tokens that went up for sale on Winklevoss-owned NFT marketplace Nifty Gateway. McNelis said while the NFT drop sold out, a major bug saw $33 million worth of Ether (ETH) generated from the sale locked up in a smart contract that the devs have no access to, explaining: “Tha...

Fork, yeah! Cardano Vasil upgrade goes live

After several months of delays, the Cardano Vasil upgrade and hard fork has finally gone live as of Thursday at 9:44 pm UTC, bringing “significant performance and capability” enhancements to the blockchain. The success of the Cardano mainnet hard fork was announced by blockchain company Input Output Hong Kong (IOHK) on Twitter on Thursday, while others also observed the hard fork tick over in a live Twitter Spaces with Cardano co-founder Charles Hoskinson. #Vasil mainnet HFC event successful! We’re happy to announce that today, at 21:44:00 UTC, the IOG team, in collaboration with the @CardanoStiftung, successfully hard forked the Cardano mainnet via a HFC event, thus deploying new #Vasil features to the chain.1/5 — Input Output (@InputOutputHK) September 22, 2022 IOHK previously stated the...

Rep. Warren Davidson: Stablecoin bill has ‘outside chance’ of finalizing this year

There is a small chance the U.S. House of Representatives could pass the bill to regulate stablecoins by year-end, though it’s more likely it will pass in the first quarter of 2023, says U.S. Congressman Warren Davidson. According to a Thursday report from Kitco, Davidson made the remarks at the Annual Fintech Policy Forum on Sept. 22, where he suggested: “There’s an outside chance we find a way to get to consensus on a stablecoin bill this year.” The “stablecoin bill” seemingly refers to draft legislation aimed at “endogenously collateralized stablecoins” which came to light this week — and would place a two-year ban on new algorithmic stablecoins such as TerraUSD Classic (USTC). However, Davidson went on to say that while “there’s a chance we get...

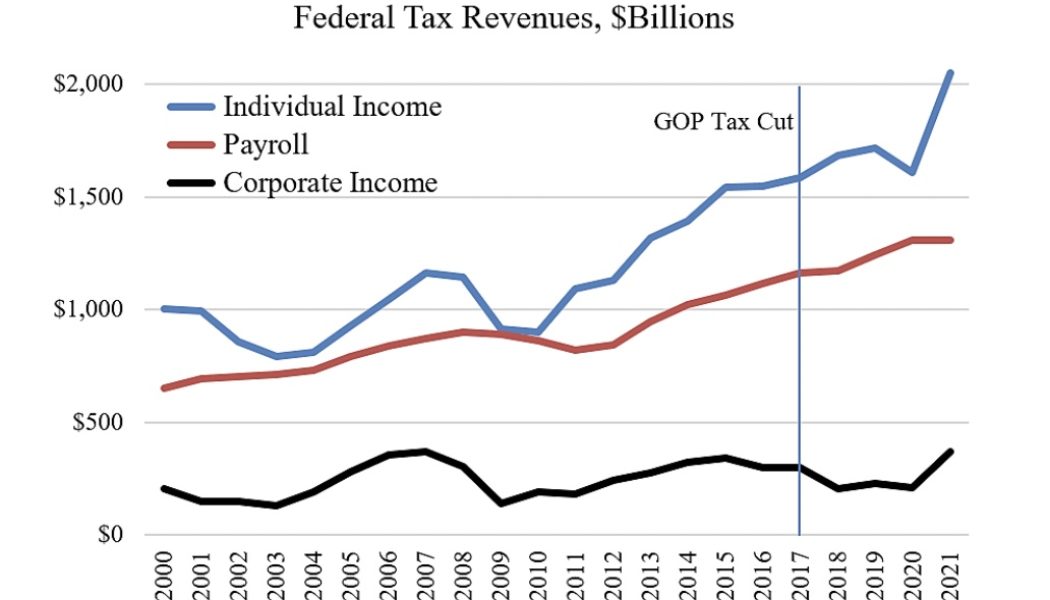

Get ready for even more incompetence at the IRS in 2023

The Internal Revenue Service is hiring 87,000 new agents, but taxpayers will not feel the pain for another two to three years. That’s how long it will take the agency to hire and train agents. Few have discussed the extent of this pain. Still, it’s something to think about when you consider the majority of coming audits will be conducted by new agents, many of whom will have been hastily hired and operating with minimal supervision. Playing the audit lottery will not be smart in future tax years. Taxpayers should protect themselves now, especially when profiting from statutory gray areas — such as cryptocurrency staking, investing through decentralized autonomous organizations (DAOs) and other decentralized finance (DeFi) products. When I started my career in the mid-2000s, business audits...

Bitcoin’s 60% year-to-date correction looks bad, but many stocks have dropped by even more

Bitcoin’s (BTC) and Ether’s (ETH) agonizing 60% and 66% respective drops in price are drawing a lot of criticism from crypto critics and perhaps this is deserved, but there are also plenty of stocks with similar, if not worse, performances. The sharp volatility witnessed in crypto prices is partially driven by major centralized yield and lending platforms becoming insolvent, Three Arrows Capital’s bankruptcy and a handful of exchanges and mining pools facing liquidity issues. For cryptocurrencies, 2022 has definitely not been a good year, and even Tesla sold 75% of its Bitcoin holdings in Q2 at a loss. The quasi-trillion dollar company still holds a $218 million position, but the news certainly did not help investors’ perception of Bitcoin’s corporate adoption. Cryptocurrencies are n...

Coinbase counters WSJ claim its Risk Solutions group engaged in $100M proprietary trade

The Wall Street Journal and Coinbase are having a difference in definitions. The newspaper published an alleged account of the digital asset exchange’s trading activities earlier this year that it claims amount to proprietary trading. Coinbase responded in a blog post that it had done no such thing. Relying on information supplied by “people at the company,” the WSJ wrote on Thursday that Coinbase made a $100-million transaction that was viewed inside the company as a test trade by the company’s Risk Solutions group, which had been formed for the purpose of proprietary trading. Proprietary trading is the practice by banks and financial institutions of trading their own money for their own gain, rather than doing so to earn a commission from a client. It would not have been illegal for Coin...

Helium migrates its blockchain to Solana following T-Mobile partnership

On Thursday, the Helium Foundation announced that it would be moving its mainnet to the Solana blockchain following a community vote. According to the proposal, proof-of-coverage and Data transfer mechanisms will be moved to Helium Oracles. It’s official! The HIP 70 vote has ended. #Helium will be moving to the @Solana blockchain! pic.twitter.com/V2WIajou7R — Helium (@helium) September 22, 2022 Meanwhile, Helium’s tokens and governance will relocate to that of the Solana blockchain. As told by developers, the benefits of the move would include more of its native token HNT available to subDAO reward pools, more consistent mining, more reliable data transfer, more utility for HNT and subDAO tokens, and more ecosystem support. Helium is a blockchain wireless communications protocol...

Ethereum risks another 10% drop versus Bitcoin as $15.4M exits ETH investment funds

Ethereum’s Merge on Sep. 15 turned out to be a sell-the-news event, which looks set to continue. Notably, Ether (ETH) dropped considerably against the U.S. dollar and Bitcoin (BTC) after the Merge. As of Sep. 22, ETH/USD and ETH/BTC trading pairs were down by more than 20% and 17%, respectively, since Ethereum’s switch to Proof-of-Stake (PoS. ETH/USD and ETH/BTC daily price chart. Source: TradingView What’s eating Ether bulls? Multiple catalysts contributed to Ether’s declines in the said period. First, ETH’s price fall against the dollar appeared in sync with similar declines elsewhere in the crypto market, driven by Federal Reserve’s 75 basis points (bps) rate hike. Second, Ethereum faced a lot of flak for becoming too centralized ...

Chamber of Digital Commerce gets approval to join the SEC vs Ripple lawsuit

A United States crypto advocacy group, the Chamber of Digital Commerce (CDC), has been granted approval from the Court of Southern District of New York to participate as an amicus curiae in the U.S. Securities and Exchange Commission (SEC) case against Ripple Labs. The status of “friend of the court” permits them to assist a court by providing information, expertise or insight. An order was signed by Judge Analisa Torres on Sept. 21. The CDC shall file its brief by Sept. 26. While explaining its interest in the case, the CDC legal team emphasized the far-reaching consequences of the court decision, namely, whether the law applicable to the securities transaction is properly distinguished from the one applicable to secondary transactions. The case was opened in 2020 when the SEC alleg...

Binance establishes Global Advisory Board to work on regulatory and political issues

As the crypto community grows, issues within the crypto community become more complex. Regulatory, political and social issues often get in the way of crypto adoption, slowing the advancements within the space. In response to these issues, crypto exchange Binance formed a task force called the Global Advisory Board (GAB). The board consists of individuals expected to tackle any issues that may arise as the exchange continues its initiatives to advance crypto, blockchain and Web3 adoption. The group will be led by a former United States Senator, Max Baucus. Members include various figures like Ibukun Awosika, HyungRin Bang, Bruno Bezard, Leslie Maasdorp, Henrique de Campos Meirelles, Adalberto Palma, David Plouffe, Christin Schäfer, Lord Vaizey and David Wright. In a press relea...

JPMorgan CEO calls crypto ‘decentralized Ponzi schemes’

While testifying before United States (U.S.) lawmakers, JPMorgan Chase CEO Jamie Dimon referred to himself as a “major skeptic” on “crypto tokens that you call currency like Bitcoin,” labeling them as “decentralized Ponzi schemes.” Dimon was asked what keeps him from being more active in the crypto space during an oversight hearing held by the House Financial Services Committee on Sept. 21. Dimon emphasized that he sees value in blockchain, decentralized finance (DeFi), ledgers, smart contracts, and “tokens that do something,” but then proceeded to lambast crypto tokens that identify as currencies. Asked for his thoughts about the draft U.S. stablecoin bill, Dimon said he believes that there is nothing wrong with stablecoins that are properly regulated and that the regulation sh...