crypto blog

Influential celebrities that joined the crypto club over the past year

The inclusive crypto ecosystem has become home to numerous A-list celebrities over the years — primarily driven by the nonfungible tokens (NFT) hype of 2021. However, despite the prolonged bear market and an evident dip in cryptocurrency prices, celebrities continue to pour in support for the crypto market. Over the past year, celebrities have started exploring sub-ecosystems beyond NFTs, trying to diversify their presence across trading, gaming and other investment avenues. In this light, here’s an overview of some of the most influential celebrities that got into crypto over the past year and how well-prepared they are for the next bull run. Connor McGregor partners with Tiger.Trade UFC superstar Connor McGregor, one of the highest-paid athletes, recently partnered with Tiger.Trade...

Goldman Sachs’ bearish macro outlook puts Bitcoin at risk of crashing to $12K

A sequence of macro warnings coming out of the Goldman Sachs camp puts Bitcoin (BTC) at a risk of crashing to $12,000. Bitcoin in “bottom phase?” A team of Goldman Sachs economists led by Jan Hatzius raised their prediction for the speed of Federal Reserve benchmark rate hikes. They noted that the U.S. central bank would increase rates by 0.75% in September and 0.5% in November, up from their previous forecast of 0.5% and 0.25%, respectively. Fed’s rate-hike path has played a key role in determining Bitcoin’s price trends in 2022. The period of higher lending rates — from near zero to the 2.25-2.5% range now — has prompted investors to rotate out of riskier assets and seek shelter in safer alternatives like cash. Bitcoin has dropped by almost 60% year-to-date and is...

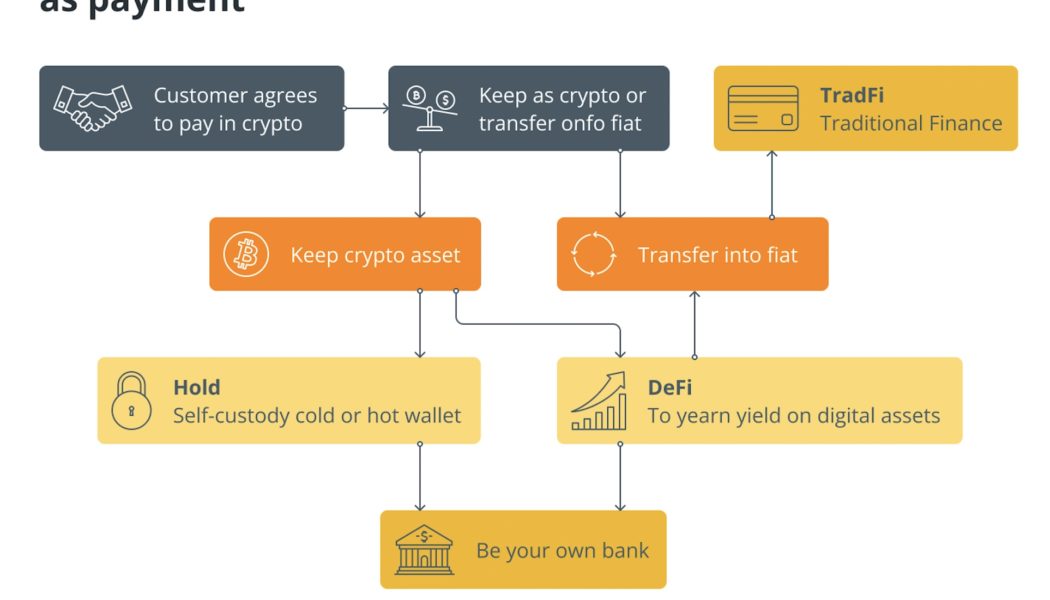

Business owners should get off PayPal and move to the blockchain

Do you believe that in five years every second transaction in e-commerce will be settled on blockchain? No? Well, that’s what people thought of plastic credit cards versus cash a few decades ago when it came to traditional stores. There is no doubt that Web3 will drastically transform the way e-commerce operates. Using cryptocurrency payments in e-commerce stores will become just as common as accepting PayPal, Klarna, Visa or Mastercard. Stores that don’t adapt their e-commerce platforms to accept cryptocurrencies will soon find themselves out of business. How Web3 has changed the e-commerce landscape Thanks to the converging forces of Web3 — blockchain, decentralized finance (DeFi), AI and machine learning — new, smart algorithms can analyze and adapt to provide user-centric experie...

Flashbots build over 82% relay blocks, adding to Ethereum centralization

Following the completion of The Merge upgrade, Ethereum (ETH) transitioned into a proof-of-stake (PoS) consensus mechanism, helping the blockchain become energy efficient and secure. However, mining data reveals Ethereum’s heavy reliance on Flashbots — a single server — for building blocks, raising concerns over a single point of failure for the ecosystem. Flashbots is a centralized entity dedicated to transparent and efficient Maximal Extractable Value (MEV) extraction, which acts as a relay for delivering Ethereum blocks. Data from mevboost.org show that there are six active relays currently delivering at least one block in Ethereum, namely Flashbots, BloXroute Max Profit, BloXroute Ethical, BloXroute Regulated, Blocknative and Eden. Relays sorted by number of delivered blocks. Source:&n...

Dogecoin has crashed 75% against Bitcoin since Elon Musk’s SNL appearance

Dogecoin (DOGE) may be back in the top-ten cryptocurrency by market capitalization, but its loses in both USD and Bitcoin (BTC) terms since Elon Musk’s SNL appearance are considerable. Dogecoin loses Musk-effect The DOGE/BTC trading pair has fallen 75% after peaking out at 1,287 satoshis on May 9, 2021, a day after Musk was a guest host on Saturday Night Live, including a sketch titled “The Dogefather.” DOGE/BTC daily price chart. Source: TradingView Before his appearance, the billionaire entrepreneur was relentlessly tweeting Dogecoin memes, images, which helped DOGE — a cryptocurrency that started out as a joke — to attain a market capitalization north of $90 billion in May 2021. That’s more than 36,000% gains in just two years. But things have gone downhill ever since. ...

Profanity tool vulnerability drains $3.3M despite 1Inch warning

Decentralized exchange aggregator 1inch Network issued a warning to crypto investors after identifying a vulnerability in Profanity, an Ethereum (ETH) vanity address generating tool. Despite the proactive warning, apparently, hackers were able to make away with $3.3 million worth of cryptocurrencies. On Sept. 15, 1Inch revealed the lack of safety in using Profanity as it used a random 32-bit vector to seed 256-bit private keys. Further investigations pointed out the ambiguity in the creation of vanity addresses, suggesting that Profanity wallets were secretly hacked. The warning came in the form of a tweet, as shown below. RUN, YOU FOOLS ⚠️ Spoiler: Your money is NOT SAFU if your wallet address was generated with the Profanity tool. Transfer all of your assets to a different ...

US Treasury report encourages instant payment, recommends more CBDC research

United States President Joe Biden ordered more than a dozen reports to be written when he released his Executive Order (EO) 14067 “Ensuring Responsible Development of Digital Assets.” Five had due dates within 90 days, and the last three were published simultaneously by the Treasury Department on Sept. 16. The reports were prepared in response to instructions in Sections 4, 5 and 7 of the EO. The report ordered in EO Section 4 is titled “The Future of Money and Payments.” The report looks at the several payment systems currently in use that are operated by the Federal Reserve or the Clearing House, which is owned by a group of major banks. These will be supplemented by the non-blockchain FedNow Service instant payment system that is expected to begin operating in 2023. Stablecoins are intr...

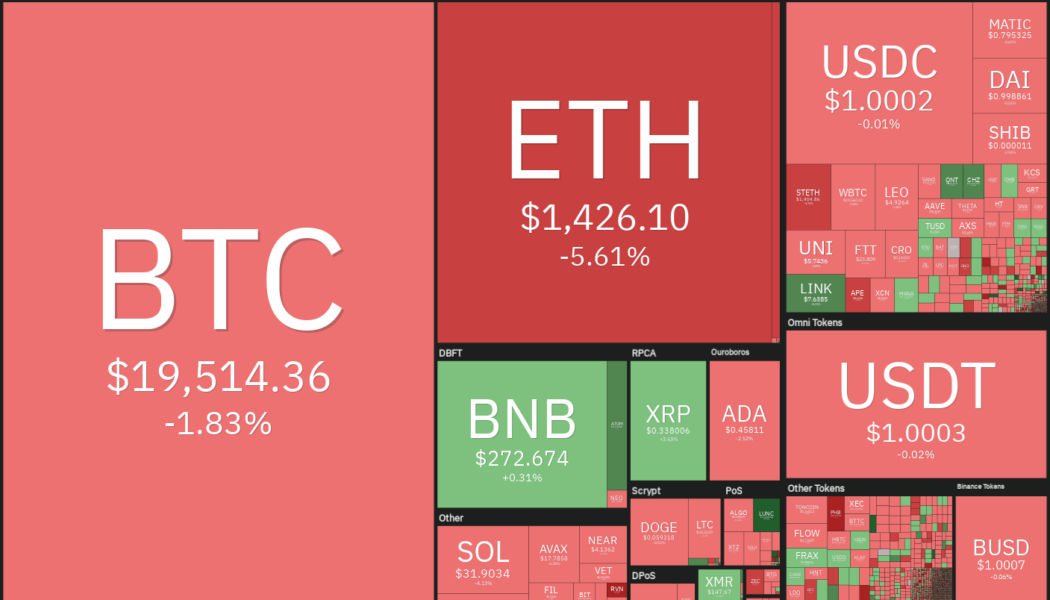

Price analysis 9/16: SPX, DXY, BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT

The World Bank has warned of a possible global recession in 2023. In a press release on Sept. 15, the bank said that the current pace of rate hikes and policy decisions is unlikely to be enough to bring inflation down to pre-pandemic levels. Ray Dalio, the billionaire founder of Bridgewater Associates said in a blog post on Sept. 13 that if rates were to rise to about 4.5% in the United States, it would “produce about a 20 percent negative impact on equity prices.” The negative outlook for the equity markets does not bode well for the cryptocurrency markets as both have been closely correlated in 2022. Daily cryptocurrency market performance. Source: Coin360 The macroeconomic developments seem to be worrying cryptocurrency investors who sent 236,000 Bitcoin (BTC) to major cryptocurren...

Golden cross vs. death cross explained

Compared to the golden cross, a death cross involves a downside MA crossover. This marks a definitive market downturn and typically occurs when the short-term MA trends down, crossing the long-term MA. Simply put, it’s the exact opposite of the golden cross. A death cross is usually read as a bearish signal. The 50-day MA typically crosses below the 200-day MA, signaling a downtrend. Three phases mark a death cross. The first occurs during an uptrend when the short-term MA is still above the long-term MA. The second phase is characterized by a reversal, during which the short-term MA crosses below the long-term MA. This is followed by the start of a downtrend as the short-term MA continues to move downward, staying below the long-term MA. Like golden crosses, ...

Coinbase is fighting back as the SEC closes in on Tornado Cash

On Sept. 8, Coinbase announced it was bankrolling a lawsuit against the United States Treasury Department. The cryptocurrency exchange is funding a lawsuit brought by six people that challenges the sanctions on Tornado Cash. And on Sept. 9, Securities and Exchange Commission (SEC) Chair Gary Gensler announced he was working hard with Congress to create legislation to increase cryptocurrency regulations. But these two stories are not mutually exclusive. The sequence of events proves that governments are purely reactive rather than proactive when it comes to decentralized finance (DeFi). Tornado Cash was sanctioned by the Office of Foreign Assets Control (OFAC) back in August. OFAC claimed the smart contract mixer has helped to launder more than $7 billion worth of cryptocurrency since ...