crypto blog

How to earn passive crypto income in a bear market?

The majority of new investors are in the middle of their first crypto winter, during which most digital assets have depreciated by more than 70% from their November 2021 highs. While a bear market is tough for everyone, it can be especially challenging for those who are new to the space and don’t have much experience dealing with market volatility. That said, there are still opportunities to earn passive income during a bear market — crypto traders just have to know where to look. In this article, we will look at how Wall Street traders persevere and what simple things can be done to make money. Is it time to buy more assets? What are some of the easiest ways to generate cash in a recession? Are there any investment techniques that work during bear markets? What assets to invest in while B...

Tired of losing money? Here are 2 reasons why retail investors always lose

A quick flick through Twitter, any social media investing club, or investing-themed Reddit will quickly allow one to find handfuls of traders who have vastly excelled throughout a month, semester, or even a year. Believe it or not, most successful traders cherry-pick periods or use different accounts simultaneously to ensure there’s always a winning position to display. On the other hand, millions of traders blow up their portfolios and turn out empty-handed, especially when using leverage. Take, for example, the United Kingdom’s Financial Conduct Authority (FCA) which requires that brokers disclose the percentage of their accounts in the region that are unprofitably trading derivatives. According to the data, 69% to 84% of retail investors lose money. Similarly, a study by the U.S. ...

Ethereum completes Merge, Do Kwon faces arrest warrant and Bitcoin dives after rally: Hodler’s Digest, Sept. 11-17

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Breaking: Historic day for crypto as Ethereum Merge to proof-of-stake occurs Ethereum’s highly anticipated conversion to a proof-of-stake (PoS) consensus algorithm, dubbed “the Merge,” took place at 6:42:42 am UTC on Sept. 15. The move is a key part of an overarching multi-year transition for the Ethereum blockchain. “It starts a chain reaction of changes,” Eli Ben-Sasson, co-founder and president of StarkWare, told Cointelegraph regarding the Merge. The Merge will reportedly help the Ethereum blockchain reduc...

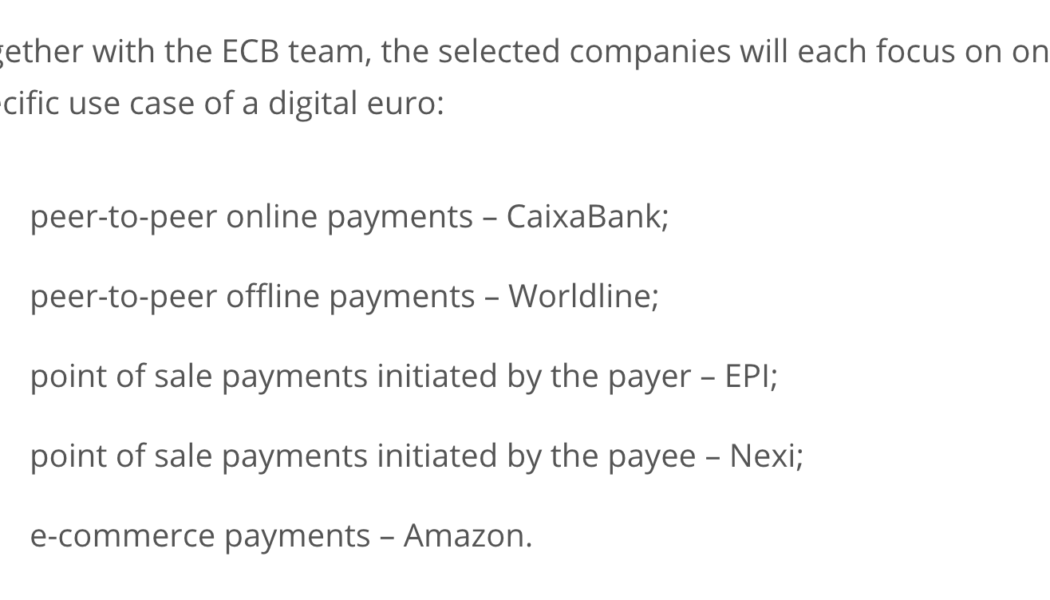

European Central Bank chooses Amazon and 4 other firms to prototype digital euro app

The European Central Bank, or ECB, has announced it will be collaborating with five companies for the development of potential digital euro user interfaces. In a Friday announcement, the ECB said it had chosen “Big Four” tech company Amazon, fintech firm Nexi, Spanish digital bank CaixaBank, French payments platform Worldline and the European Payments Initiative, or EPI, to each focus on developing a prototype based on specific use cases of the digital euro. According to the central bank, the firms will create front-end prototypes, which will not be used in later phases of the digital currency project. Source: ECB The ECB chose the five companies based on their fulfilling “specific capabilities” when compared to 50 other front-end developers that responded to the central bank’s...

The floppening? Ethereum price weakens post-Merge, risking 55% drop against Bitcoin

Ethereum’s native token Ether (ETH) has been forming an inverse-cup-and-handle pattern since May 2021 on the weekly chart, which hints at a potential decline against Bitcoin (BTC). ETH/BTC weekly price chart featuring inverse cup-and-handle breakdown setup. Source: TradingView An inverse cup-and-handle is a bearish reversal pattern, accompanied by lower trading volume. It typically resolves after the price breaks below its support level, followed by a fall toward the level at a length equal to the maximum height between the cup’s peak and the support line. Applying the theoretical definition on ETH/BTC’s weekly chart presents 0.03 BTC as its next downside target, down around 55% from Sept. 16’s price. Can ETH/BTC pull a Dow Jones? Alternatively, the ...

Bitcoin better than physical property for commoners, says Michael Saylor

MicroStrategy CEO and Bitcoin (BTC) advocate Michael Saylor doubled down on his support for Bitcoin as he explained the issues related to transferring the value of physical properties such as gold, company stocks or equity and real estate during the Australia Crypto Convention. Speaking about the underlying proof-of-work (PoW) consensus mechanism, Saylor highlighted that Bitcoin is backed by $20 billion worth of proprietary mining hardware and $20 billion worth of energy. He then pointed out that traditional assets such as gold (in high quantity) and land are nearly impossible to carry forward across geographical boundaries, adding: “If you have a property in Africa, no one’s gonna want to rent it from you if they live in London. But if you have a billion dollars of Bitcoin, yo...

Beyond the NFT hype: The need for reimagining digital art’s value proposition

With cryptocurrency prices wavering this year, nonfungible tokens (NFTs) and other sub-ecosystem investors have also found themselves in the grips of a bear market. However, looking beyond the trading value of Ether (ETH), NFTs were primarily created to represent assets and ownership in the real and virtual world. The bear market, as a result, has reignited discussions around how NFTs can backtrack and focus on attending to use cases while the market recovers. In a conversation with Cointelegraph, Tony Ling, the co-founder of analytics platform NFTGo, shared insights into the NFT ecosystem, revealing the expected trajectory of the ecosystem. Cointelegraph: NFTs’ rise to mainstream popularity is often attributed to the various real-world use cases it can and has solved. What is your take on...

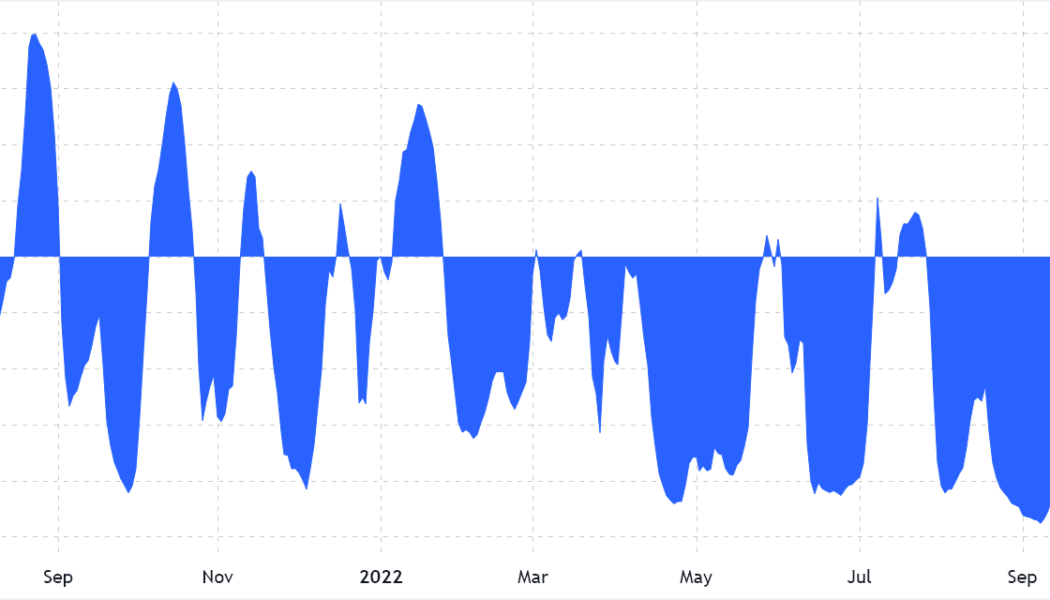

Data challenges the DXY correlation to Bitcoin rallies and corrections ‘thesis’

Presently, there seems to be a general assumption that when the U.S. dollar value increases against other global major currencies, as measured by the DXY index, the impact on Bitcoin (BTC) is negative. Traders and influencers have been issuing alerts about this inverse correlation, and how the eventual reversal of the movement would likely push Bitcoin price higher. Analyst @CryptoBullGems recently reviewed how the DXY index looks overbought after its relative strength index (RSI) passed 78 and could be the start of a retrace for the dollar index. This is literally the only thing you need to look at: The $DXY is crazy overbought right now and due a correction. $BTC is the most oversold it ever has been on the monthly timeframe. BITCOIN AND THE DOLLAR SHARE AN INVERSE CORRELATION. $BTC will...

US Treasury publishes laundry lists of crypto risks for consumers, national security

The United States Treasury Department released three publications related to digital assets Friday, in response to U.S. President Joe Biden’s Executive rder “Ensuring Responsible Development of Digital Assets.” One of them focuses specifically on crypto assets, and a shorter action plan looks at countering illicit finance risks. The discussion of crypto assets in “Crypto-Assets: Implications for Consumers, Investors, and Businesses” takes a cynical tone from the beginning, with the introductory paragraphs of the report stating: “The potential for blockchain technology to transform the provision of financial services, as espoused by developers and proponents, has yet to materialize.” About half of the report is a descriptive survey of crypto assets, after which the authors turn to the...

Binance partners with Ukrainian supermarket chain to accept crypto through Pay Wallet.

Binance announced Friday that it has partnered with the Ukrainian supermarket chain VARUS, saying it will enable cryptocurrency payments for grocery purchases through its Binance Pay Wallet. The grocery store is one of the largest companies in Ukraine with over 111 stores across 28 cities in the country. The company said that this partnership will allow its customers to access instant cryptocurrency payments and fast delivery in 9 cities in Ukraine, namely; Kyiv, Dnipro, Kamianske, Kryvyi Rih, Zaporizhzhia, Brovary, Nikopol, Vyshhorod, and Pavlograd. The companies have also announced a “reward fund promotion”, where customers who order anything from the VARUS Delivery program worth over UAH 500 and pay with Binance Pay, will be rewarded with UAH 100. A month ago, a Ukrainian POS...

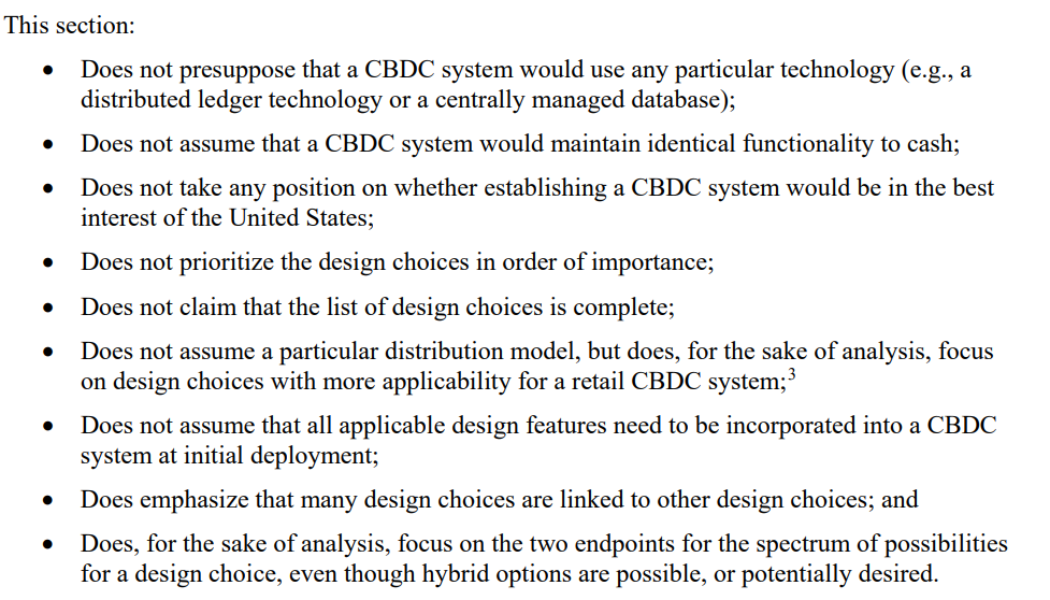

White House OSTP department analyzes 18 CBDC design choices for the US

As directed by the President of the United States, Joe Biden, the Office of Science and Technology Policy (OSTP) submitted a report analyzing the design choices for 18 central bank digital currency (CBDC) systems for possible implementation in the US. The technical analysis of the 18 CBDC design choices was made across six broad categories — participants, governance, security, transactions, data and adjustments. The OSTP foresees technical complexities and practical limitations when trying to build a permissionless system governed by a central bank, adding: “It is possible that the technology underpinning a permissionless approach will improve significantly over time, which might make it more suitable to be used in a CBDC system.” However, the analysis assumed there is a central authority ...