crypto blog

What’s next for Bitcoin and the crypto market now that the Ethereum Merge is over?

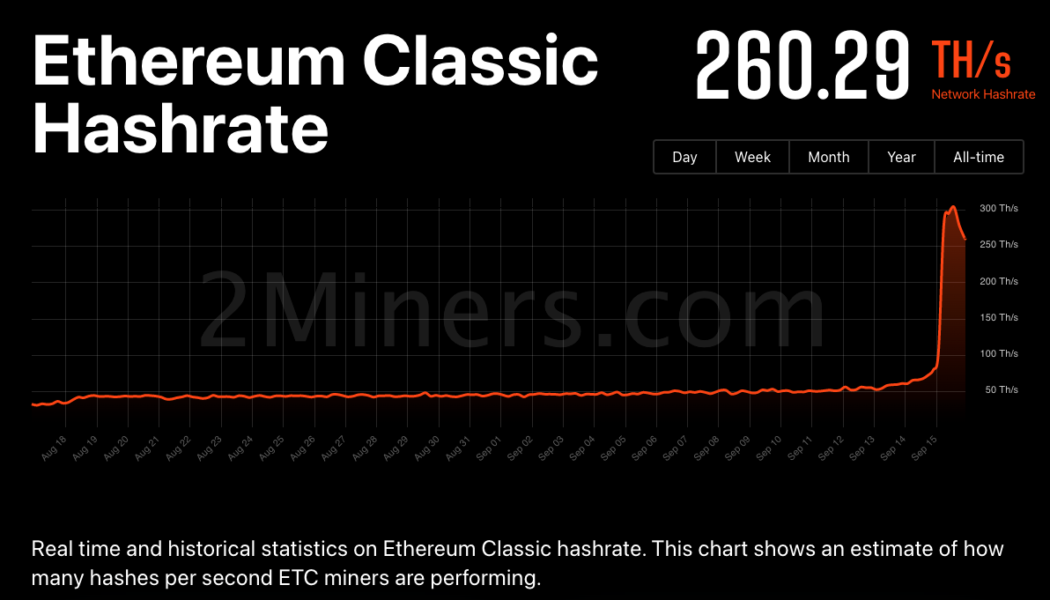

The Ethereum Merge came and went, leaving investors to ponder what the next trending development in the market could look like. In a Cointelegraph Twitter Space with Capriole founder Charles Edwards, the analyst mentioned that excitement over the Ethereum Merge and its bullish price action had somewhat been holding up hope across the market. Now that the event has come and gone, the crypto market has been selling off, with Bitcoin’s (BTC) price trading below $20,000 and Ether’s (ETH) under $1,500. Eventually, new narratives and market trends will emerge, and if the fundamentals are right, traders will rotate funds as these new leaders emerge. Let’s take a look at a few potential trends. Where will the former ETH miners go? The Ethereum network successfully shifted to a proof-of-stake...

DOJ publishes second report on EO digital asset crime, announces new expert network

The United States Department of Justice (DOJ) published its latest report in response to President Joe Biden’s March executive order (EO) on the development of digital assets on Sept. 16. At the same time, it announced the formation of a new Digital Asset Coordinator Network (DAC) “in furtherance of the department’s efforts to combat the growing threat posed by the illicit use of digital assets to the American public.” The report, titled “The Role of Law Enforcement in Detecting, Investigating, and Prosecuting Criminal Activity Related to Digital Assets,” complements its June report on international law enforcement cooperation. The new report characterizes digital asset criminal exploitation, with particular attention to nonfungible tokens (NFTs) and decentralized finance (DeFi) and goes o...

White House publishes ‘first-ever’ comprehensive framework for crypto

Following President Joe Biden’s executive order on Ensuring Responsible Development of Digital Assets, federal agencies came up with a joint fact sheet on 6 principal directions for crypto regulation in the United States. It sums up the content of 9 separate reports, which have been submitted to the president to “articulate a clear framework for responsible digital asset development and pave the way for further action at home and abroad.” The fact sheet was published on the White House official website on Sept. 16, and consists of 7 sections: (1) Protecting Consumers, Investors, and Businesses; (2) Promoting Access to Safe, Affordable Financial Services; (3) Fostering Financial Stability; (4) Advancing Responsible Innovation; (5) Reinforcing Our Global Financial Leadership and Competitiven...

Global inflation mounts: How stablecoins are helping protect savings

Economies around the world are facing a motley of challenges caused by rising inflation. High inflation devalues national currencies, which, in turn, pushes up the cost of living, especially in scenarios where earnings remain unchanged. In the United States, the government has responded aggressivelyto inflation. The nation hit a 9.1% inflation rate in June, prompting the Federal Reserve to implement a series of fiscal countermeasures designed to prevent the economy from overheating. Hiking interest rates was one of them. Soaring Fed interest rates have consequently slowed down consumer spending and business growth in the country. The counter-inflation approach has also strengthened the value of the U.S. dollar against other currencies due to tight dollar liquidity checks. As 79.5% of all i...

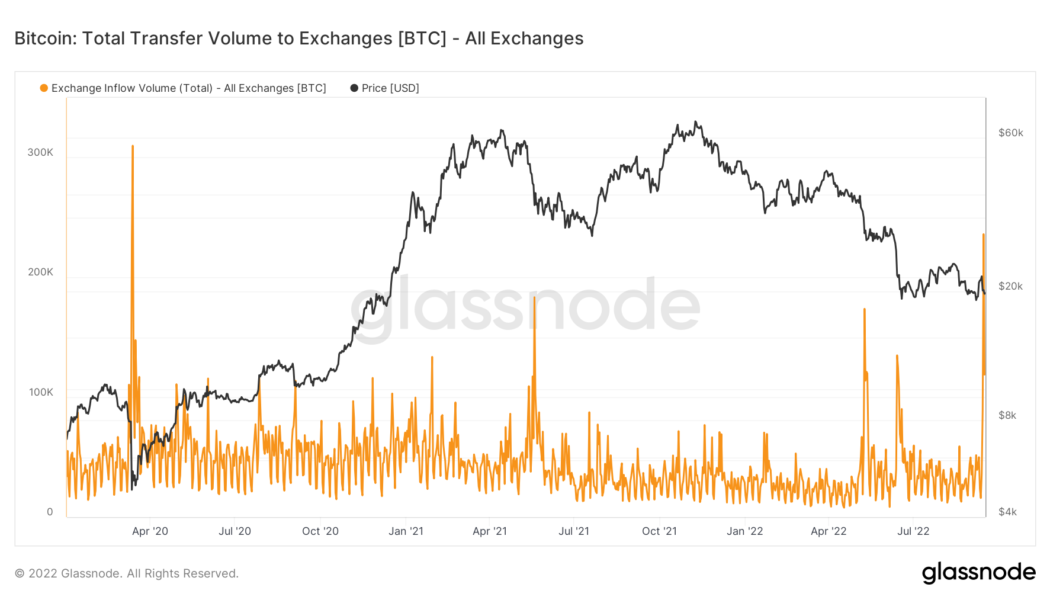

Bitcoin exchange inflows see biggest one-day spike since March 2020

Bitcoin (BTC) exchanges have seen huge volumes this month as price declines lead to renewed interest in trading. Data from sources including on-chain analytics firm Glassnode shows exchange inflows hitting their highest since March 2020. “The scent of volatility is in the air” On Sept. 14, over 236,000 BTC made its way to the 1 major exchanges tracked by Glassnode. This was the largest single-day spike since the chaos that surrounded Bitcoin’s dip to just $3,600 in March 2020. Bitcoin total transfer volume to exchanges chart. Source: Glassnode The sell-offs in May 2021 and May and June this year failed to match the tally, suggesting that more of the Bitcoin investor base is currently aiming to reduce exposure. Separate data from analytics firm Santiment covering both centralize...

Ether staking could trigger securities laws — Gensler

Ethereum’s upgrade to proof-of-stake may have placed the cryptocurrency back in the crosshairs of the Securities and Exchange Commission (SEC). Speaking to reporters after the Senate Banking Committee on Sept. 15, SEC chairman Gary Gensler reportedly said that cryptocurrencies and intermediaries that allow holders to “stake” their crypto may define it as a security under the Howey test, according to The Wall Street Journal. “From the coin’s perspective […] that’s another indicia that under the Howey test, the investing public is anticipating profits based on the efforts of others,” WSJ reported Gensler as saying. The comments came on the same day as Ethereum’s (ETH) transition to proof-of-stake (PoS), meaning the network will no longer rely on energy-intensive “...

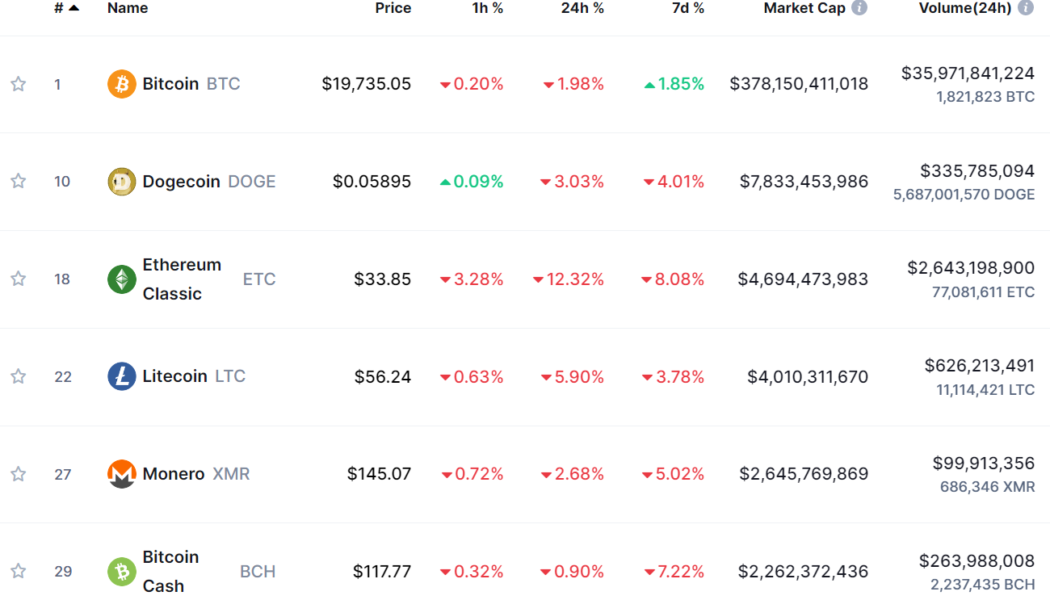

Dogecoin becomes second largest PoW cryptocurrency

Meme-inspired cryptocurrency Dogecoin (DOGE) is now officially the second largest proof-of-work (PoW) crypto in terms of market cap, following the Ethereum network’s proof-of-stake upgrade on Sept. 15. Bitcoin (BTC) of course remains miles ahead of Dogecoin’s market cap of $7.83 billion, though the well-followed memecoin is still comfortably ahead of the third place PoW cryptocurrency Ethereum Classic (ETC) (with a market cap of $4.69 billion), Litecoin (LTC) ($4.01 billion) and Monero (XMR) ($2.65 billion). Ranking of PoW-Based Cryptocurrencies by Market Cap. Source: Coinmarketcap.com. One Dogecoin fan appeared to be in disbelief of Dogecoin’s rise to become the second largest PoW cryptocurrency, stating “who would have thought that this would happen. Congrats #Doge...

Nifty News: Rumors of new Yuga Labs collection quashed, Budweiser celebrates the Merge and more…

Yuga Labs co-founder Greg Solana (Garga.eth) has shot down rumors that the Bored Ape Yacht Club (BAYC) creators have plans to launch a new NFT collection dubbed “Mecha Apes” by the end of the year. The rumors started swirling after Protos claimed to have obtained leaked documents detailing that Yuga Labs was looking at raising around $50 million from the sale of 100,000 tokenized land plots. After the news was reported via various outlets online, Garga.eth noted it was all “fake news” via Twitter on Sept. 16. fake news https://t.co/KVMaO18IaF — Garga.eth (@CryptoGarga) September 15, 2022 While the rumors have been quashed, given that Yuga Labs has hit the ball out of the park with each project it’s launched so far, and that it has outlined a broad vision for its Metaverse, another NF...

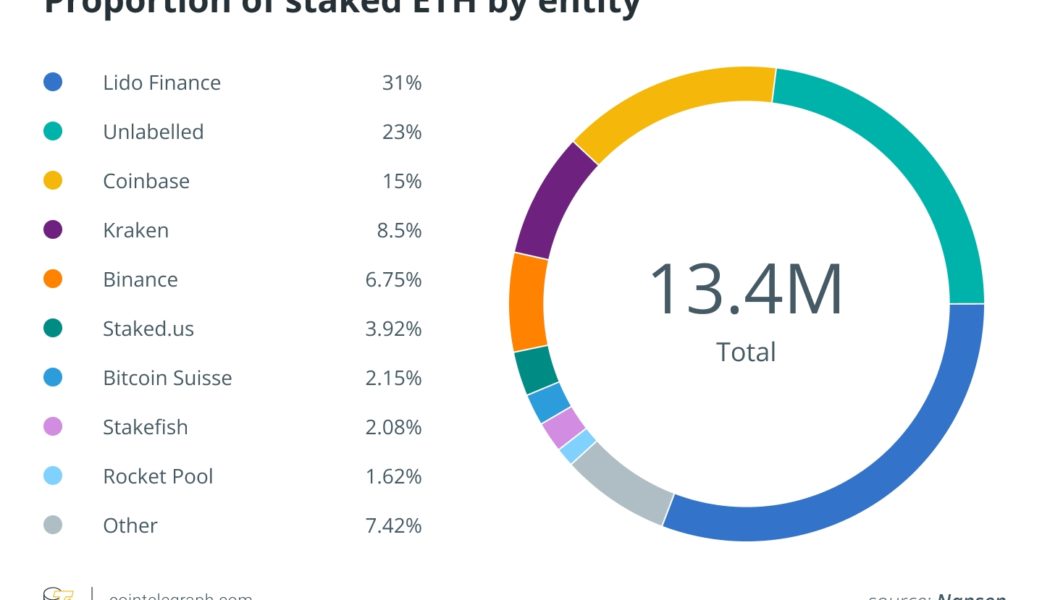

Ethereum may now be more vulnerable to censorship — Blockchain analyst

Ethereum’s upgrade to proof-of-stake (PoS) may make it more vulnerable to government intervention and censorship, according to the lead investigator of Merkle Science. Speaking to Cointelegraph following the Ethereum Merge, Coby Morgan, a former FBI analyst, and the Lead Investigator for crypto compliance and forensic firm Merkle Science expressed his thoughts on some of the risks posed by Ethereum’s transition to PoS. While centralization issues have been broadly discussed leading up to The Merge, Moran suggested the prohibitive cost of becoming a validator could result in the consolidation of validator nodes to the bigger crypto firms like Binance, Coinbase, and Kraken. In order to become a full validator for the Ethereum network, one is required to stake 32 Ether (ETH), which is w...