crypto blog

How adoption of a decentralized internet can improve digital ownership

Known as Web2, the current iteration of the internet emphasizes creating and distributing user-generated content. Websites like YouTube, social media apps like Instagram and Twitter, news sites, personal blogs and more make up a large part of the internet. Web2 is a step up from Web1, which was mainly a read-only web version filled with simple static websites. Web3 aims to bring decentralization and token-based economies to the internet. Web2 versus Web3 The development of several different web protocols at the beginning of the twenty-first century made it possible for programs and content to be linked via read-and-write interactions. Web2, in its present form, enables users to consume material created by other users and create their own content. Readers are probably best acquainted Web2. ...

Crypto insurance a ‘sleeping giant’ with only 1% of investments covered

While on-chain insurance has been around since 2017, only a measly 1% of all crypto investments are actually covered by insurance, meaning the industry remains a “sleeping giant,” according to a crypto insurance executive. Speaking to Cointelegraph, Dan Thomson, the CMO of decentralized cover protocol InsurAce said there is a massive disparity between the total value locked (TVL) in crypto and decentralized finance (DeFi) protocols and the percentage of that TVL with insurance coverage: “DeFi insurance is a sleeping giant. With less than 1% of all crypto covered and less than 3% of DeFi, there’s a huge market opportunity still to be realized.” Though plenty of investment has poured into smart contract security audits, on-chain insurance serves as a viable solution for digital asset protect...

Aussies already lost $242M to investment and crypto scams in 2022

Australians have continued getting duped by investment and crypto-related scams, losing 242.5 million Australian dollars to scammers so far in 2022, according to Scamwatch’s latest data. From January to July of this year, the majority of all funds lost to scams of all types were investment scams, which range from romance baiting scams to classic Ponzi schemes and cryptocurrency scams. The figure is already 36% higher than the figures across all of 2021, which revealed that Australians lost 178.2 million AUD to investment scams in the year. Source: Scamwatch It’s a threat that has prompted consumer advocates to push for banks to shoulder more responsibility for reimbursing scams to “drive greater investment in stopping fraud.” According to a Sept. 8 report from the Austral...

Exchanges criticized for ‘nothingburger PR’ posts on upcoming LUNC tax burn

As the upcoming Terra Classic (LUNC) burning mechanism gained more hype, some crypto exchanges thought it would be a good idea to express their support. However, the crypto community quickly responded, calling out the exchanges for what some believe to be public relations stunts. On Sept. 1, Terra community member Edward Kim submitted a proposal to implement a 1.2% tax burn for every on-chain LUNC transaction in an effort to revive the crypto. The transaction tax will be sent to a dead address, removing part of the circulating supply permanently. Following the proposal, the LUNC token soared by 250%, as the hype surrounding the project showed signs of life. Because of this, crypto exchanges KuCoin, Gate.io and MEXC Global decided to express their support for the token-burning efforts...

Fireblocks records $100M+ revenue in subscriptions amid bear market

Fireblocks, a New York-based blockchain security service provider, made over $100 million in Annual Recurring Revenue (ARR) this year, confirming the rising interest in the crypto ecosystem that contradicts negative investor sentiments. ARR relates to the recurring revenue earned by a company based on subscriptions. As a software-as-a-service provider, Fireblocks witnessed overwhelming interest in decentralized finance, blockchain and Web3 technologies. The reason behind increased revenue amid an ongoing bear market can be attributed to an overall change in mindset, as companies and investors seem more inclined toward exploring crypto use cases rather than chasing market volatility for a quick buck. Sharing insights into its growing customer base, Fireblocks co-founder and CEO Michael Shau...

Music NFTs will take gaming to new levels

The GameFi industry has surged since 2020, with some estimating a market capitalization of $55.4 billion as of February 2022. While others have much lower estimates closer to $3 billion, one thing is for sure: The industry grew rapidly from zero and is poised for continued growth. What matters, however, is not the day-to-day or even month-to-month market cap, but rather the continued rise of users who feel like they’re extracting value. Games are created so that people have fun. But the rise of “gamification” refers to the application of gaming principles into otherwise boring, but usually value-enhancing, activities. For example, many educational activities can be boring until they are gamified. Technology can be applied to more complicated classes in mathematics and science, but it can a...

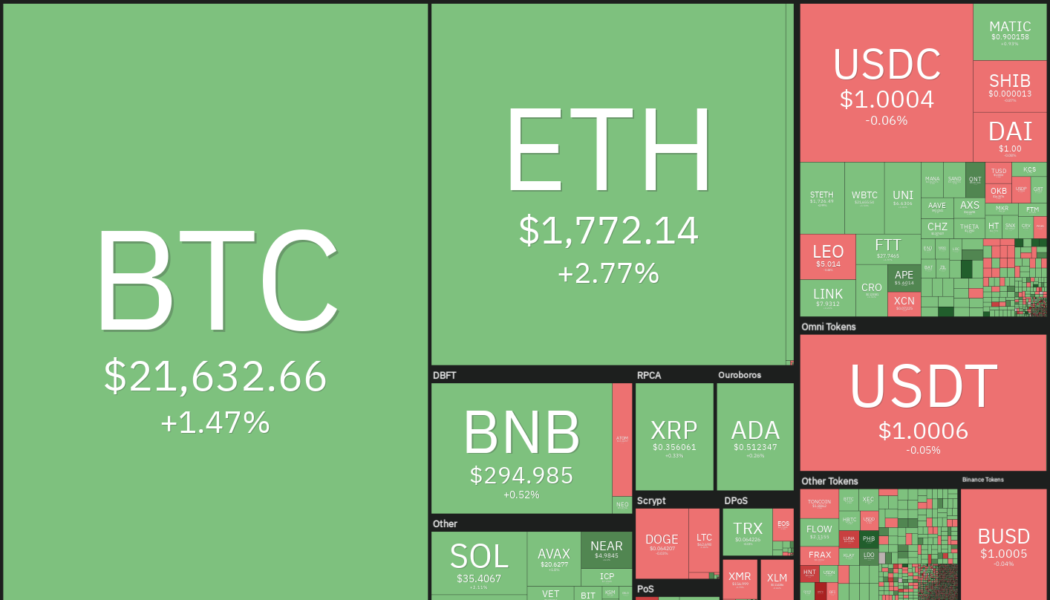

Crypto traders eye ATOM, APE, CHZ and QNT as Bitcoin flashes bottom signs

The United States equities markets rallied sharply last week, ending a three-week losing streak. The S&P 500 rose 3.65% last week while the Nasdaq Composite soared 4.14%. Continuing its close correlation with the U.S. equities markets, Bitcoin (BTC) also made a strong comeback and is trying to end the week with gains of more than 7%. The sharp rally in the stock markets and cryptocurrency markets are showing signs of a bottoming formation but it may be too early to predict the start of a new bull move. The equities markets may remain on the edge before the release of the U.S. inflation data on Sept. 13 and the Federal Reserve meeting on Sept. 20-21. Crypto market data daily view. Source: Coin360 Along with taking cues from the equities markets, the cryptocurrency space has its own impo...

Bitcoin short squeeze ‘not over’ as BTC price eyes 17% weekly gains

Bitcoin (BTC) stayed higher into the Sep. 10 weekly close as optimistic forecasts favored $23,000 next. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView $23,000 targets remain in place Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting $21,730 on Bitstamp overnight — the most since Aug. 26. The pair managed to conserve its prior gains despite low-volume weekend trading conditions being apt to amplify any weakness. Among analysts, excitement was palpable going into the new week, one which should prove pivotal for short-term crypto price action. The Ethereum (ETH) Merge and fresh United States inflation data were the top catalysts expected to influence the market. “Expect volatility to pick up around next week’s economic data,” on-chain monitoring res...

Latin America is ready for crypto — just integrate it with their payment systems

Thriving on exploiting users’ data, Web2 monopolies like Facebook and Google have ushered in an era of massive internet centralization in recent years. This concentration of power has enabled huge shares of communication and commerce closed platforms, giving users little control over how their data is collected. An emerging concept, Web3, will provide a means to pivot from centralization to an open-source internet. A recent report from Andreessen Horowitz (a16z) found that this new digital economy could reach an astounding 1 billion users by 2031. If executed correctly, the decentralized internet will allow users to take control of their data and content. While Web3 promises to radically change the internet and its ability to provide value to users worldwide, key hurdles must be overcome b...

Terra back from the dead? LUNA price rises 300% in September

Terra has become a controversial blockchain project after the collapse of its native token LUNA and stablecoin TerraUSD (UST) in May. But its recent gains are hard to ignore for cryptocurrency traders. LUNA rising from the dead? After crashing to nearly zero in May, LUNA is now trading for around $6, a whopping 17,559,000% price rally in less than four months when measured from its lowest level. Meanwhile, LUNA’s performance in September is particularly interesting, given it has rallied by more than 300% month-to-date after a long period of sideways consolidation. LUNA/USDT daily price chart. Source: TradingView Terra ecosystem in September It is vital to note that LUNA also trades with the ticker LUNA2 across multiple exchanges. In detail, Terraform Labs, the firm behind...

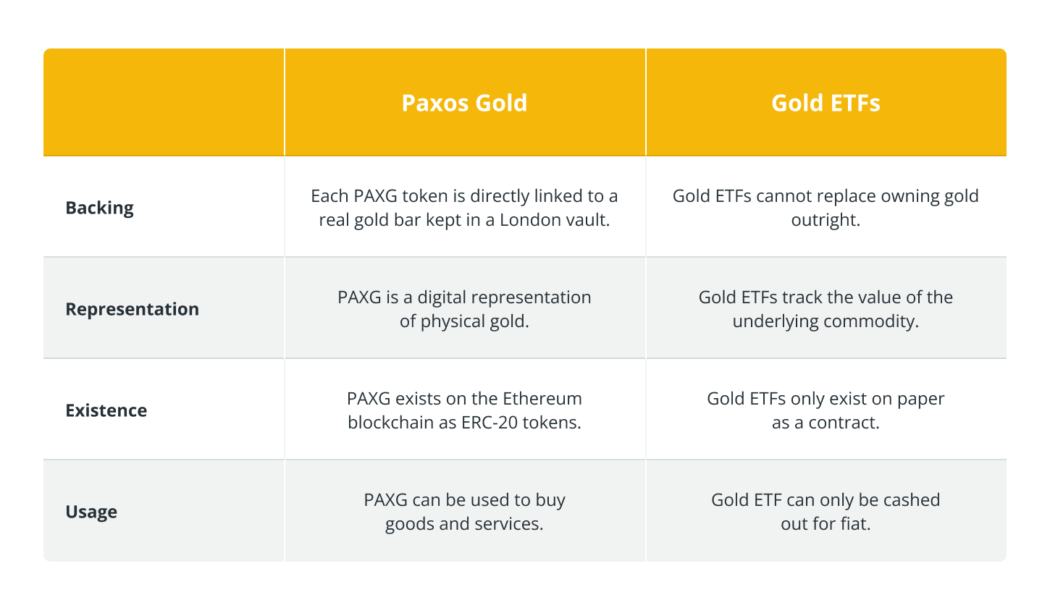

What is PAX Gold (PAXG) and how does it work?

In recent years, nonfungible tokens (NFTs), cryptocurrencies and other modern investment options have become trendy. However, physical commodities such as gold are still in high demand. In 2021, the global market capitalization for cryptocurrency surpassed $2 trillion. Now, investors must ask themselves: which option should I choose — crypto or gold? Gold is a commodity that dates back thousands of years as a store of value and as a means of exchange and is still successful today. Even with the invention of decentralized digital cryptocurrency, gold has remained just as prominent. Although, for most individual investors, owning gold can be difficult and out of reach. There is one crypto company, PAX Gold (PAXG), whose goal is to make gold ownership more democratic and available to everyday...

Why quantum computing isn’t a threat to crypto… yet

Quantum computing has raised concerns about the future of cryptocurrency and blockchain technology in recent years. For example, it is commonly assumed that very sophisticated quantum computers will one day be able to crack present-day encryption, making security a serious concern for users in the blockchain space. The SHA-256 cryptographic protocol used for Bitcoin network security is currently unbreakable by today’s computers. However, experts anticipate that within a decade, quantum computing will be able to break existing encryption protocols. In regard to whether holders should be worried about quantum computers being a threat to cryptocurrency, Johann Polecsak, chief technology officer of QAN Platform, a layer-1 blockchain platform, told Cointelegraph: “Definitely. Elliptic curve sig...