crypto blog

Bitcoin price cracks $21K as trader says BTC buy now ‘very compelling’

Bitcoin (BTC) circled $21,000 at the Sep. 9 Wall Street open as newly-won gains endured. Meanwhile, the total cryptocurrency market capitalization has crossed back above the $1 billion mark. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView BTC price gives “confirmation” of trend change Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as its “short squeeze” punished late bears. After a brief consolidation, the pair set new multi-week highs of $21,254 on Bitstamp, and now faced resistance in the form of an old support level abandoned in late August. For market commentators, however, the latest move had already proved decisive — and should favor bulls beyond short timeframes. “This impulse up is THE confirmation,” popular Twitter trader and ange...

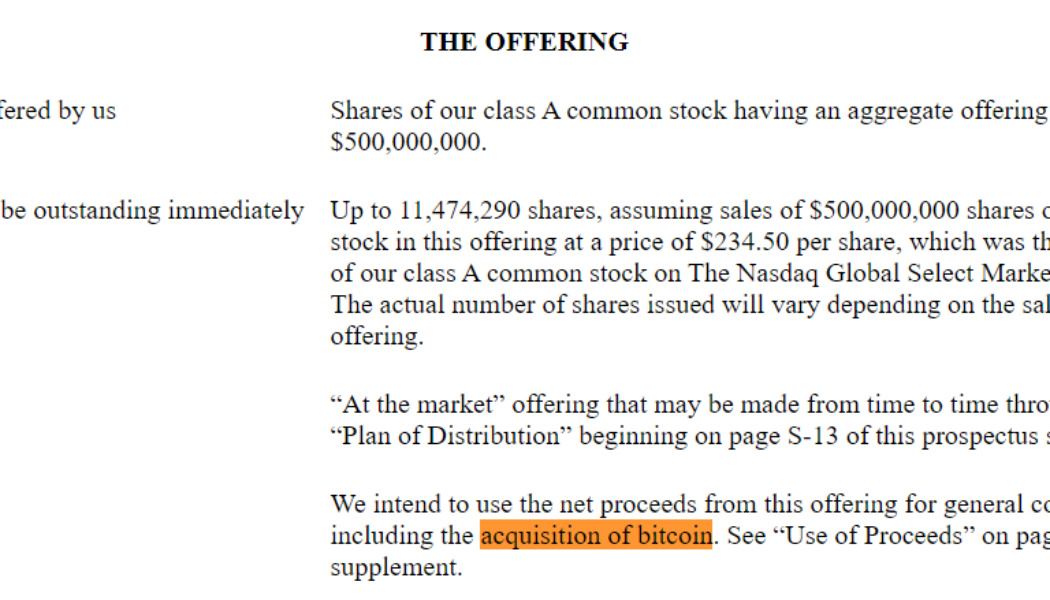

SEC to address growing crypto issuer filings with specialized offices

In light of the influx of filings from cryptocurrency issuers in the United States, the Securities and Exchange Commission (SEC) decided to set up two new offices this fall to provide specialized support to the seven offices currently responsible for reviewing issuer filings. Under the Division of Corporation Finance’s Disclosure Review Program (DRP), the SEC announced plans to add two offices — an Office of Crypto Assets and an Office of Industrial Applications and Services — purely focused on dealing with crypto assets and industrial applications and services, respectively. Sharing insights into the move, Renee Jones, director of the Division of Corporation Finance, stated: “The creation of these new offices will enable the DRP to enhance its focus in the areas of crypto asse...

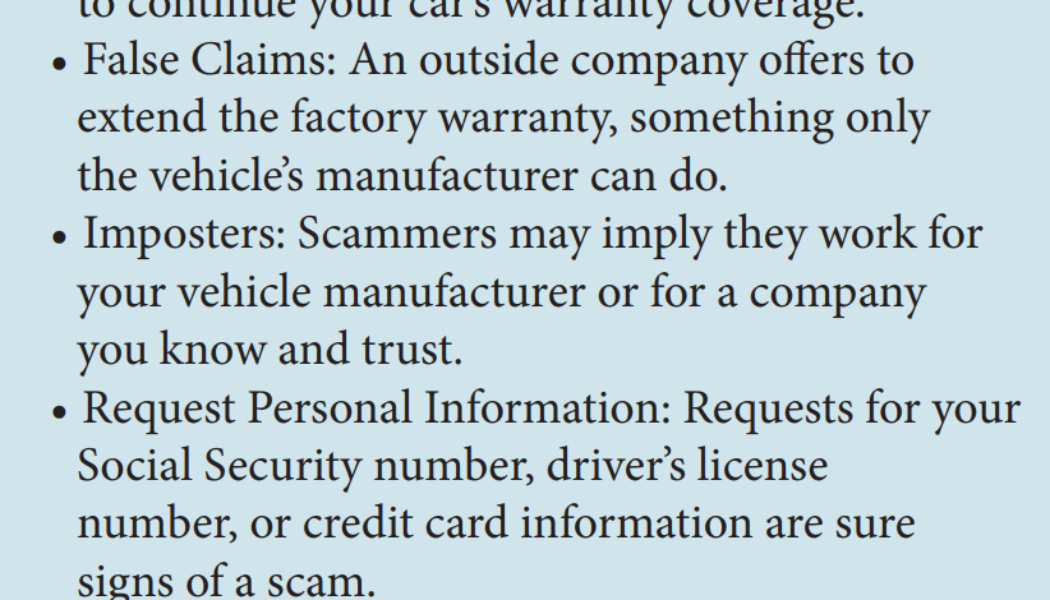

Florida govt warns against auto warranty scammers asking crypto payments

The Florida Department of Agriculture and Consumer Services (FDACS) issued a warning sharing insights into identifying robocall scam marketing auto warranties, which includes being asked to pay for the services via gift cards and cryptocurrencies. Consumer complaints against increasing robocall scams — wherein scammers use prerecorded calls to market and sell fraudulent services — led the Enforcement Bureau to order phone companies to avoid carrying robocall traffic. Regardless of the methods used by scammers to contact potential victims, the FDACS newsletter highlighted five red flags that indicate scams. Five red flags for identifying scams. Source: fdacs.gov Stressing on some of the go-to payment methods often being recommended by the scammers, the announcement read: “Payment...

Ethereum’s potential fork ETHPOW has crashed 80% since debut — More pain ahead?

The listing of ETHPOW (ETHW) across multiple crypto exchanges has been followed by a huge drop in price despite some initial success. ETHPOW drops 80% On the daily chart, ETHW’s price dropped by more than 80% to $25 on Sept. 10, over a month after its market debut. ETHW/USD daily price chart. Source: TradingView For starters, ETHPOW only exists as a futures ticker, for now, conceived in anticipation that an upcoming network update on Ethereum could result in a chain split. Ethereum will undergo a major protocol change called the Merge by mid-September, switching its existing consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS). Therefore, Ethereum will obsolete its army of miners, replacing them with “validators,” which are nodes that woul...

3 major mistakes to avoid when trading cryptocurrency futures markets

Many traders frequently express some relatively large misconceptions about trading cryptocurrency futures, especially on derivatives exchanges outside the realm of traditional finance. The most common mistakes involve futures markets’ price decoupling, fees and the impact of liquidations on the derivatives instrument. Let’s explore three simple mistakes and misconceptions that traders should avoid when trading crypto futures. Derivatives contracts differ from spot trading in pricing and trading Currently, the aggregate futures open interest in the crypto market surpasses $25 billion and retail traders and experienced fund managers use these instruments to leverage their crypto positons. Futures contracts and other derivatives are often used to reduce risk or increase exposure and are not r...

Binance removes 3 stablecoins, Russia eyes cross-border crypto payments and UK exudes crypto positivity: Hodler’s Digest, Sept. 4-10

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week US Fed vice chair Michael Barr favors hard line on crypto, OCC acting head no friendlier Global crypto regulation remains a prevalent topic looming over the sector. Recent comments from United States Federal Reserve Board Vice Chair for Supervision Michael Barr and Acting Comptroller of the Currency Michael Hsu favored a lean toward more government overwatch. Barr expressed a desire for stablecoin regulation as well as crypto-related banking regulations. Hsu’s comments included looking at the industry cautious...

Liquid staking is key to interchain security

Bitcoin’s genesis in 2009 will probably go down in history as one of the most notable technological events of all time. Demonstrating the first real use case for the immutable, transparent and tamper-proof ledgers — i.e., blockchain — it established the cornerstone for developing the crypto and other blockchain-based industries. Today, just over a decade later, these industries are thriving. The total crypto market capitalization hit an all-time high of $3 trillion at its peak in November 2021. There are already more than 300 million crypto users worldwide, while forecasts suggest the figure may cross 1 billion by December 2022. Although phenomenal, this journey has merely begun. Several factors have contributed to the blockchain and cryptocurrency industry’s success so far. But abov...

How GameFi contributes to the growth of crypto and NFTs

The crypto industry has grown tremendously over the past couple of years, and one of its biggest drivers is the GameFi industry. GameFi — a portmanteau of gaming and finance —enables gamers to earn rewards while playing. The market has been growing steadily and presently has a token market cap of approximately $9.2 billion. Notably, GameFi networks have continued to thrive despite the crypto winter. Indeed, the industry is forecasted to reach a $74.2 billion valuation by 2031. How GameFi networks work GameFi ecosystems are based on blockchain technology and use different in-game economic setups to reward players. The rewards are usually in the form of nonfungible tokens (NFTs) that are tradable on major marketplaces. The items are typically in the form of virtual lands, costumes and ...

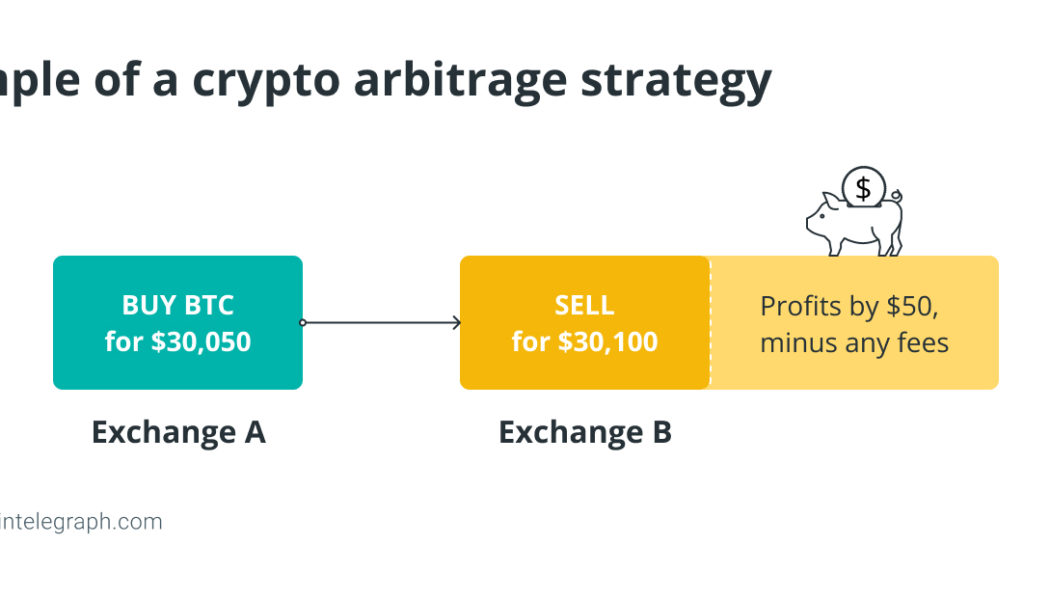

How does high-frequency trading work on decentralized exchanges?

Following the decentralized finance (DeFi) boom of 2020, decentralized exchanges (DEXs) solidified their place in the ecosystems of both cryptocurrency and finance. Since DEXs are not as heavily regulated as centralized exchanges, users can list any token they want. With DEXs, high-frequency traders can make trades on coins before they hit major exchanges. Plus, decentralized exchanges are noncustodial, which implies that creators cannot pull an exit fraud — in theory. As such, high-frequency trading firms that used to broker unique trading transactions with cryptocurrency exchange operators have turned to decentralized exchanges to conduct business. What is high-frequency trading in crypto? High-frequency trading (HFT) is a trading method that uses complex algorithms to analyze larg...

‘We’re not giving crypto a pass’ on enforcement action, says SEC’s Gurbir Grewal

Gurbir Grewal, the enforcement director for the United States Securities and Exchange Commission, said the financial regulator will continue to investigate and bring enforcement actions against crypto firms, despite the narrative of “picking winners and losers” and “stifling innovation.” In written remarks for a Friday program hosted by the Practising Law Institute, Grewal pushed back against criticism that the SEC “somehow unfairly targeted crypto” in its enforcement actions when compared with those against financial products or traditional markets. He also hinted that the SEC had a responsibility to many “non-White and lower-income investors” drawn to crypto projects, who may feel as though the financial system and its regulators “failed, or simply ignored, them.” “It often seems c...