crypto blog

Crazy outcomes when current laws applied to NFTs and the metaverse

NFTs can now serve as court documents… but they might also be unregistered securities, illegal loot boxes, or come with impossible tax demands. Nonfungible tokens (NFTs) are thought of by most people as just funny pictures that degens on the internet spend far too much money on for poorly understood reasons. But Jason Corbett, managing partner of global blockchain law firm Silk Legal, says new and innovative use cases are beginning to emerge. “We’ve seen recently the courts allowing the serving of court documents by way of an NFT,” Corbett says, referring to a recent decision by a United Kingdom court to allow notice of the case to be served by airdropping court documents as NFTs to wallets allegedly stolen from the claimant. A bunch of legal absurdities occurs when you apply existin...

A range-break from Bitcoin could trigger buying in ADA, ATOM, FIL and EOS this week

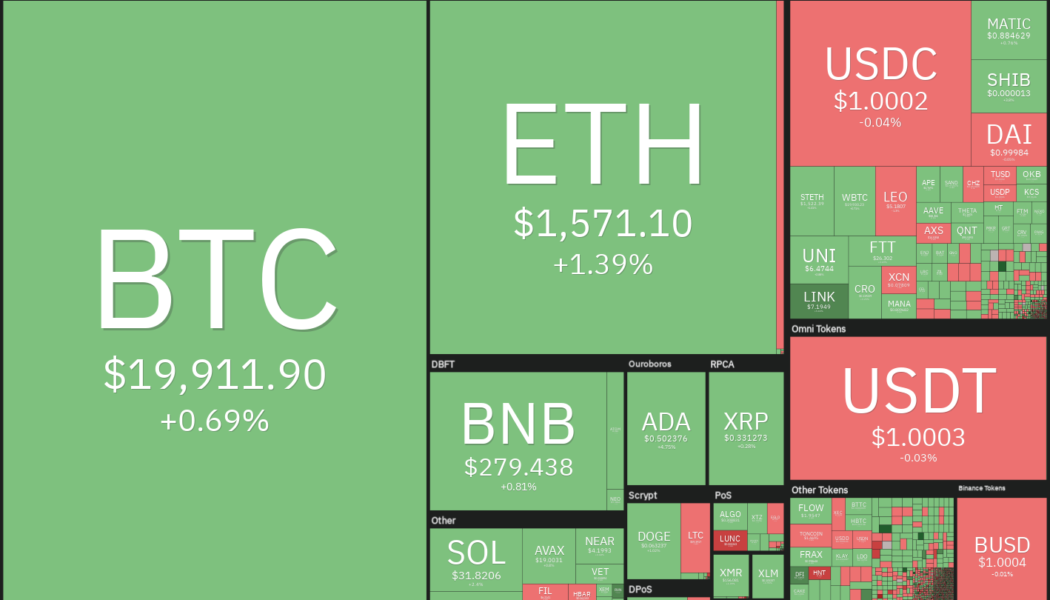

The decline in the United States equities markets last week extended the market-wide losing streak to three consecutive weeks. The Nasdaq Composite fell for six days in a row for the first time since 2019. The markets negative reaction to a seemingly positive August jobs report suggests that traders are nervous about the Federal Reserve’s future steps and its effects on the economy. Weakness in the U.S. equities markets pulled Bitcoin (BTC) back below $20,000 on Sept. 2 and bears sustained the price below the level during the weekend. This pulled Bitcoin’s market dominance to just under 39% on Sept. 4, its lowest level since June 2018, according to data from CoinMarketCap. Crypto market data daily view. Source: Coin360 Although the sentiment remains negative and it is difficult to call a b...

Crypto winter teaches tough lessons about custody and taking control

The crypto winter has pumped new life into the adage “Not your keys, not your coins,” particularly after the collapse of some high-profile enterprises like the Celsius Network, whose funds were frozen in June. Just last week, Ledger CEO Pascal Gauthier hammered home the point further, warning: “Don’t trust your coins and your private keys to anyone because you don’t know what they’re going to do with it.” The basic idea behind the adage, familiar to many crypto veterans, is that if you don’t personally hold your private keys (i.e., passwords) in an offline “cold wallet,” then you don’t really control your digital assets. But, Gauthier was also framing the issue in a larger context as the world moves from Web2 to Web3: “A lot of people are still in Web2 […] because they want to stay i...

Elon Musk-crypto video played on S. Korean govt’s hacked YouTube channel

A YouTube channel owned by the government of South Korea was reportedly hacked and renamed SpaceX Invest, following which the channel uploaded fabricated videos of Elon Musk discussing cryptocurrencies. On Sept 3, the South Korean government’s YouTube channel was momentarily hacked and renamed for sharing live broadcasts of crypto-related videos. However, the account was soon restored within four hours following a proactive intervention, confirmed a local report from Yonhap News Agency (YNA). The above screenshot was provided to YNA by a locale that shows the compromised channel being renamed to SpaceX Invest and streaming videos depicting SpaceX CEO Elon Musk. The compromised ID and password of the YouTube channel were identified as the root cause of the hack. Google, too, reportedl...

PwC Venezuela Twitter account hacked, attacker shills fake XRP giveaway

An attacker gained access to PwC Venezuela’s Twitter account and has been actively posting cryptocurrency phishing links for the last 8 hours at the time of the writing. Considering that all the tweets posted by the hacker remain active, it is evident that PwC officials are yet to realize the compromise. Investors clicking on the links remain at risk of being defrauded by the hacker. If not mitigated promptly, the threat may be catastrophic, considering that PwC Veleneula’s Twitter currently boasts over 37,000 followers. Cointelegraph has reached out to PwC Venezuela to inform them about the hack. PwC Venezuela has not yet responded to Cointelegraph’s request for comment. Related: Elon Musk-crypto video played on S. Korean govt’s hacked YouTube channel BlueBenx, a Brazilian crypto le...

Can the government track Bitcoin?

Apart from data analysis done alone or in cooperation with private companies, authorities may request information from centralized exchanges. Due to regulation, centralized exchanges may also be obligated to share such information. However, not all cryptocurrency exchanges collaborate with authorities. A centralized exchange is a cryptocurrency exchange that is run by a single entity, such as Coinbase. To become a licensed operator in a certain country or territory, centralized exchanges need to comply with regulations. For instance, to decrease cryptocurrency anonymity and the illicit use of cryptocurrencies, most centralized exchanges have incorporated Know Your Customer (KYC) checks. KYC is meant to verify customers’ identities alongside helping authorities to analyze activity...

What would you ask Satoshi Nakamoto? Community answers

After more than 10 years since the inception of Bitcoin (BTC), its pseudonymous creator Satoshi Nakamoto still remains a mystery. Being an inspirational figure to the crypto space, Cointelegraph asked Twitter what questions they would have for Nakamoto if they had a chance to talk. From asking about their private keys and thoughts about Bitcoin mining to conspiracy theories about artificial intelligence trying to take control of humanity, the community members shared their most colorful questions for the Bitcoin creator. A Twitter user replied that they would have a conversation with Nakamoto about various topics from the economy to coding, up to their perspectives on the universe, life and health. The community member said that “a brilliant mind has to be heard on anythi...

Crypto Biz: You can’t stop the Tether FUD

In the world of crypto, FUD stands for fear, uncertainty and doubt. It’s often evoked intentionally to draw negative attention to a particular project or business. One of crypto’s most enduring legacies has been the constant FUD surrounding Tether, whose USDT stablecoin commands a market capitalization of nearly $68 billion. Whether intentional or not, The Wall Street Journal ran a story this week claiming that Tether was on the edge of technical insolvency and that it wouldn’t take much to push the stablecoin issuer into financial peril. Of course, Tether didn’t take it lying down and immediately issued a response to what it considered to be a “disinformation” campaign by the Journal. Regardless of which side of the debate you’re on, it’s becoming clear that there is a strong media ...

Price analysis 9/2: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, SHIB

Nonfarm payrolls rose by 315,000 jobs in August, down from the July increase of 526,000 jobs. The report was just below the Dow Jones estimate of 318,000 jobs and the slowest monthly gain since April 2021. The S&P 500 rose in response to the report, but later erased its gains, indicating that bears continue to sell on rallies. That may be because the U.S. dollar index (DXY), which had retreated from its Sept.1 20-year high, recovered part of its losses. The bears will have to pull the DXY lower to boost the prices of stocks and thcryptocurrency markets as both are usually inversely correlated with the dollar index. Daily cryptocurrency market performance. Source: Coin360 Although Bitcoin (BTC) has dropped more than 70% from its all-time high of $69,000, several traders have held on to ...

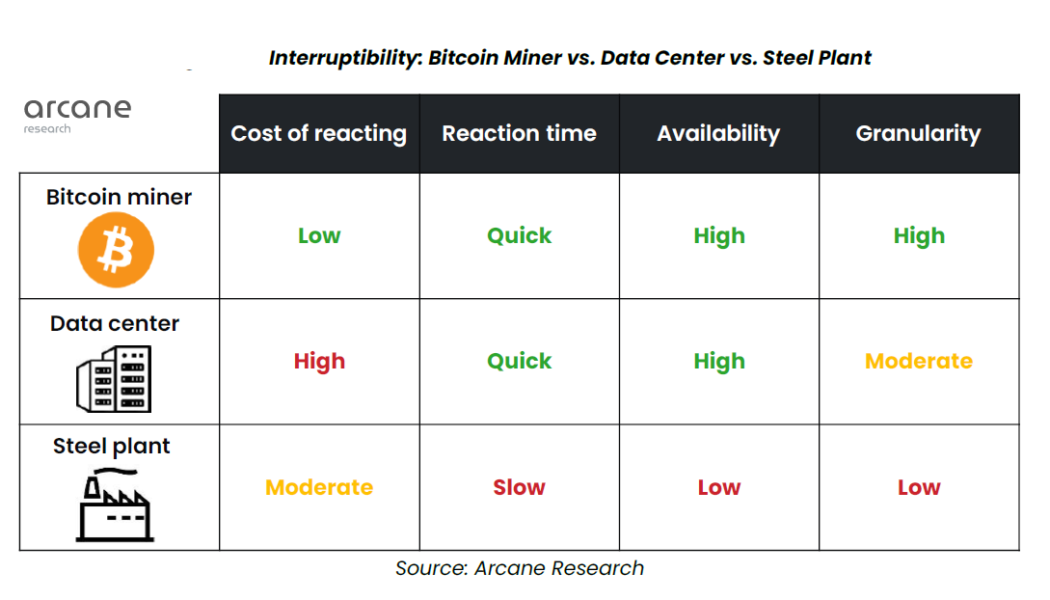

Repurposing Bitcoin mining heat can solve global energy crisis: Arcane

The flexibility behind running Bitcoin (BTC) mining operations can be vital to solving the real-world problems that stand in the way of the energy industry, suggests Arcane research. One of the biggest concerns authorities raise when it comes to Bitcoin’s mainstream adoption is its energy requirements. While innovations in chipset manufacturing have helped reduce operational costs related to Bitcoin mining, a report from Arcane reveals the market’s potential to transform the energy industry. Owing to low cost of reacting, Bitcoin mining complements the growth of wind and solar grids, which often produce unstable and non-controllable energy. Arcane research points out that the Electric Reliability Council of Texas, to date, has only allowed bitcoin miners to participate in the most advanced...

Bitcoin’s in a bear market, but there are plenty of good reasons to keep investing

Let’s rewind the tape to the end of 2021 when Bitcoin (BTC) was trading near $47,000, which at the time was 32% lower than the all-time high. During that time, the tech-heavy Nasdaq stock market index held 15,650 points, just 3% below its highest-ever mark. Comparing the Nasdaq’s 75% gain between 2021 and 2022 to Bitcoin’s 544% positive move, one could assume that an eventual correction caused by macroeconomic tensions or a major crisis, would lead to Bitcoin’s price being disproportionately impacted than stocks. Eventually, these “macroeconomic tensions and crises” did occur and Bitcoin price plunging another 57% to $20,250. This shouldn’t be a surprise given that the Nasdaq is down 24.4% as of Sept. 2. Investors also must factor in that the index’s historical 120-day vo...

The Bitcoin bottom — Are we there yet? Analysts discuss the factors impacting BTC price

When Bitcoin was trading above $60,000, the smartest analysts and financial-minded folk told investors that BTC price would never fall below its previous all time high. These same individuals also said $50,000 was a buy the dip opportunity, and then they said $35,000 was a generational buy opportunity. Later on, they also suggested that BTC would never fall under $20,000. Of course, “now” is a great time to buy the dip, and one would think that buying BTC at or under $10,000 would also be the purchase of a lifetime. But by now, all the so-called “experts” have fallen quiet and are nowhere to be seen or heard. So, investors are left to their own devices and thoughts to contemplate whether or not the bottom is in. Should one be patient and wait for the forecast “drop to $10,000” ...