crypto blog

What is decentralized identity in blockchain?

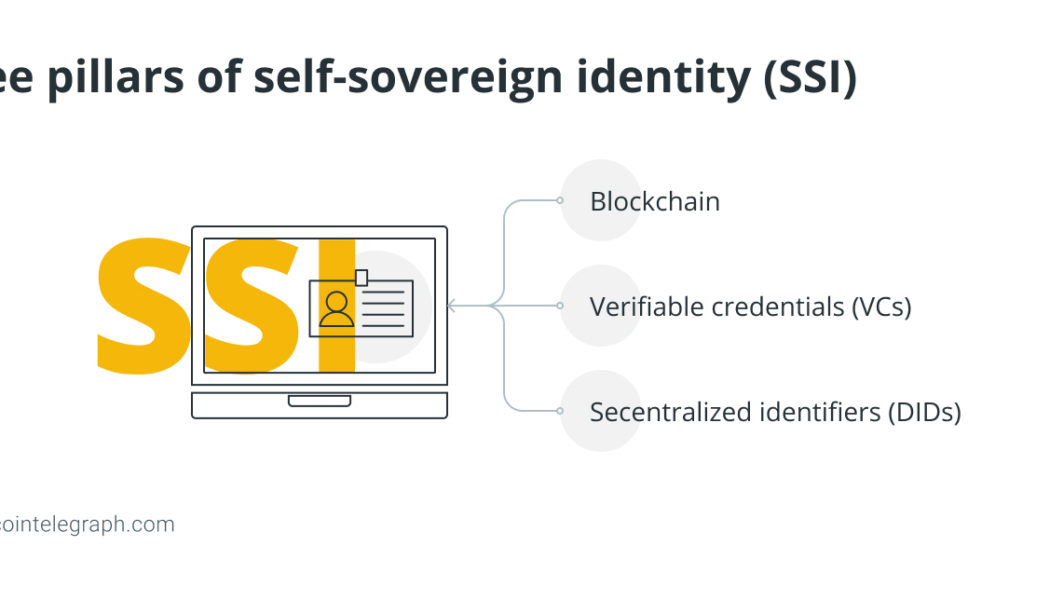

Self-sovereign identity is a concept that refers to the use of distributed databases to manage PII. The notion of self-sovereign identity (SSI) is core to the idea of decentralized identity. Instead of having a set of identities across multiple platforms or a single identity managed by a third party, SII users have digital wallets in which various credentials are stored and accessible through reliable applications. Experts distinguish three main components known as the three pillars of SSI: blockchain, verifiable credentials (VCs) and decentralized identifiers (DIDs). Blockchain is a decentralized digital database, a ledger of transactions duplicated and distributed among network computers that record information in a way that makes it difficult or impossible to change, hack or cheat. Seco...

Saylor gets sued, FBI warns about DeFi exploits and Crypto.com drops $495M sponsorship: Hodler’s Digest, Aug. 28-Sept. 3

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week DC Attorney General sues Michael Saylor and MicroStrategy for tax evasion MicroStrategy co-founder Michael Saylor faces charges of evading United States income taxes he allegedly incurred while living in Washington, DC. The office of the region’s attorney general, Karl Racine, has sued Saylor and MicroStrategy on claims that the firm helped Saylor evade over $25 million in DC income tax. The charges, stemming in part from an amendment to DC’s False Claims Act encouraging whistleblowers to report tax evasion, m...

Binance identifies KyberSwap hack suspects, involves law enforcement

Helping investigate a $265,000 hack on decentralized crypto exchange KyberSwap, crypto exchange Binance narrowed down two suspects that seem responsible for the attack. On Sept. 1, Kyber Network succumbed to a frontend exploit, allowing the attacker to make away with $265,000 worth of user funds from KyberSwap. While investigations were underway, KyberSwap offered a 10% bounty — of roughly $40,000 — to the hacker as means to remediate the situation. Parallelly, based on an independent investigation, Binance’s security team identified two suspects that may be responsible for orchestrating the virtual heist. Binance CEO Changpeng ‘CZ’ Zhao confirmed that the intel had been sent to the Kyber team. #Binance security team has identified two suspects for yesterday’s KyberSwap hack. W...

Bitcoin market dominance plumbs 4-year lows as BTC price ditches $20K

Bitcoin (BTC) traded below $20,000 on Sep. 3 as commodities declined on news of a G7 Russian energy ban. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView All down after gloomy macro week Data from Cointelegraph Markets Pro and TradingView showed ongoing lackluster performance on BTC/USD, which traded around $19,800. The largest cryptocurrency looked increasingly unable to flip $20,000 to firm support as the weekend began, and the mood among market participants was jaded. Eyeing the 8-day exponential moving average (EMA), popular trader Cheds noted its strength as intraday resistance continuing into September. $BTC if you are trading this and not watching daily EMA 8 you are literally asleep at the wheel. No excuses https://t.co/cTGEHWQNYo pic.twitter.com/WwMmwCLFO5 — Cheds (@Big...

Are Bitcoin transactions anonymous and traceable?

It can be difficult to track Bitcoin transactions when people use various wallets and Bitcoin mixers. These factors disrupt the search process and take up a lot of time. Despite the fact that it is challenging for users of a Bitcoin wallet to conduct transactions completely anonymously, there are several ways to get close to anonymity. For example, it is possible to use a cryptocurrency mixer. In this case, it is a Bitcoin mixer, which ensures that it is more difficult to make Bitcoin traceable. This is done by mixing BTC transactions from different people together in a pool, then sending the transactions to the intended addresses. In addition, wallets can also be very difficult to monitor. If someone does not want their activities on the Bitcoin network to be traceable, it is possible to ...

Surge or purge? Why the Merge may not save Ethereum price from ‘Septembear’

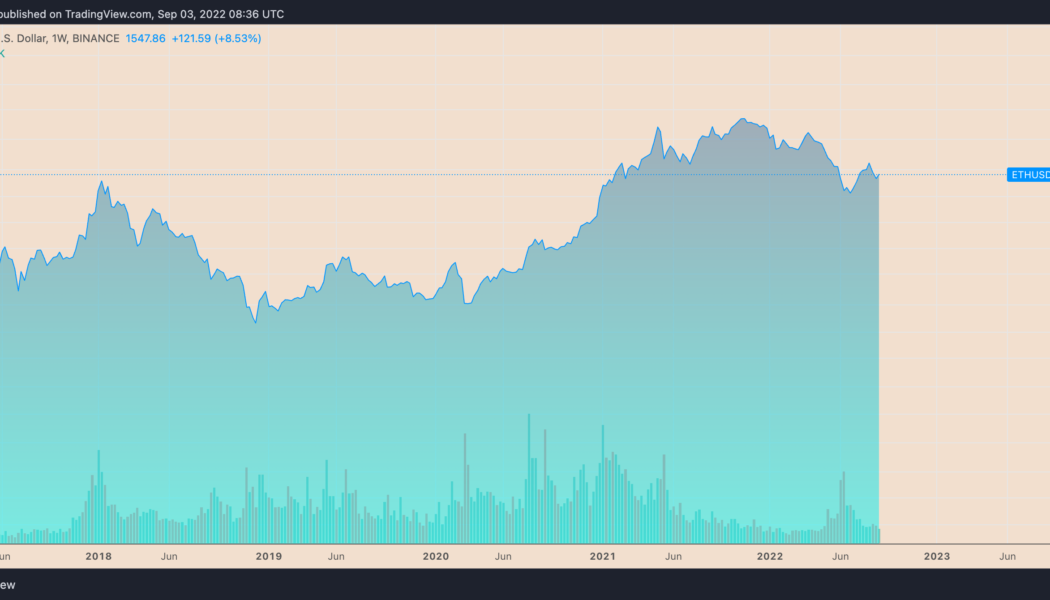

Ethereum’s native token, Ether (ETH), is not immune to downside risk in September after rallying approximately 90% from its bottom of around $880 in June. Much of the token’s upside move is attributed to the Merge, a technical upgrade that would make Ethereum a proof-of-stake (PoS) protocol, slated for Sep. 15. But despite logging impressive gains between June and September, Ether still trades almost 70% below its record high of around $4,950 from November 2021. Therefore, its possibility of heading lower remains on the cards. ETH/USD weekly price chart. Source: TradingView Here are three Ethereum bearish market indicators that show why more downside is likely. Sell the Ethereum Merge news Ethereum options traders anticipate Ether’s price to reach $2,200 f...

Snapchat’s parent company shutters Web3 division amid layoffs

Snap Inc’s CEO Evan Speigel announced in a note on Friday that the company had made the difficult decision to reduce the size of its workforce by approximately 20%. The note said that this round of layoffs comes after the company experienced slow revenue growth, a slump in stock prices, and a general lag behind its financial targets. Speigel shared: “Our forward-looking revenue visibility remains limited, and our current year-over-year QTD revenue growth of 8% is well below what we were expecting earlier this year.” Snap Inc. will now undertake the task of restructuring in an attempt to ensure the company’s success in a highly competitive space where Instagram and TikTok are currently dominating. As part of its restructuring process, the company has axed its entire We...

Brazilian SEC seeks to change its role in cryptocurrency regulation

The Brazilian Securities and Exchange Commission is reportedly pursuing changes in the country’s legal framework with regard to its regulation of cryptocurrencies. According to local media, one major concern is that the bill in question does not appear to consider tokens as digital assets or securities — and they therefore wouldn’t fall under SEC regulation. The updated position of the nation’s SEC follows the appointment of a new board and the increased relevance of the crypto sector in the country’s financial services. Brazilian lawmakers have been working on regulations for cryptocurrencies since 2015, but the Senate only approved the final version of a bill in April 2022. Once Brazil’s Congress finishes its final revisions, the bill will be sent to t...

NFT Steez and Lukso co-founder explore the implications of digital self-sovereignty in Web3

Sovereign identity has been a hot topic in blockchain and cryptocurrency, especially with the rise of the creator economy. Currently, there are two types of digital identities. One is federated and centralized whereby data is in the control of the service provider. Self-sovereign digital identity is often cited as a human right that can reclaim agency using blockchain technology, but what frameworks exist that aid in governing it? On Aug. 2, NFT Steez, a bi-weekly Twitter Spaces hosted by Alyssa Expósito and Ray Salmond, met Marjorie Hernandez, the co-founder of LUKSO and The Dematerialized to discuss the state of blockchain-based identities and “Universal Profiles.” According to Hernandez, in the future, “everything will have a digital identity.” Onboarding into the digital realm should b...

Crypto’s adaptability, openness key to ideal monetary system, say BIS execs

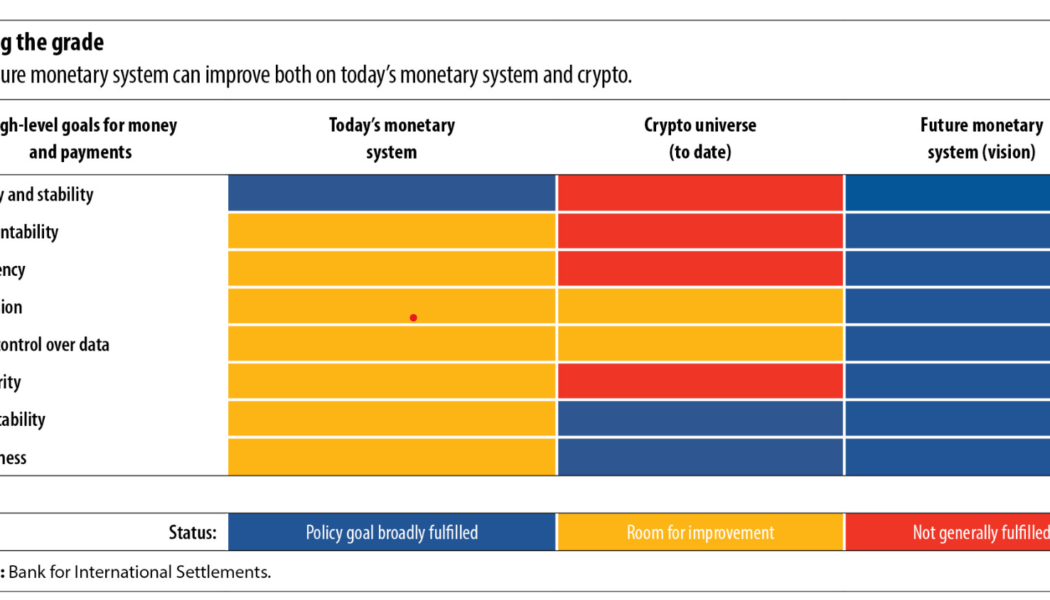

Governments across the globe see central bank digital currencies (CBDC) as a means to improve the existing fiat ecosystem. Cryptocurrency’s technical prowess supported by the central bank’s underlying trust is key to enabling a rich monetary ecosystem, suggests an International Monetary Fund (IMF) publication. “Digital technologies promise a bright future for the monetary system,” reads the publication attributed to IMF deputy managing director Agustín Carstens and BIS executives Jon Frost and Hyun Song Shin. A BIS study from June revealed that cryptocurrencies outdo fiat ecosystems when it comes to achieving the high-level goals of a future monetary system. Some of the most significant flaws preventing present-day cryptocurrencies from mainstream adoption, pointed out by the BIS exe...

Experts weigh in on the Ethereum vulnerabilities after Merge: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. The past week in the DeFi ecosystem saw major developments centered around the Ethereum Merge. Aave (AAVE) community proposed temporarily suspending Ether (ETH) lending before the Merge, citing the potential issue of high ETH utilization that may result in liquidations being hard or impossible and annual percentage yields (APYs) reaching negative figures. An industry expert shared his opinion on possible censorship vulnerabilities that the Ethereum network could eventually face in the wake of its transition to a proof-of-stake (PoS) blockchain. Moving ahead of the Ethereum Merge developments, some other major even...

More than 50% of reported Bitcoin trading volume is ‘likely to be fake or non-economic’ — Report

Bitcoin trading data from 157 exchanges reportedly did not match up to what companies claimed. According to an Aug. 26 report from Forbes, Javier Pax of the news outlet’s digital asset arm said there was a mismatch between the Bitcoin (BTC) trading data reported by crypto exchanges and the actual numbers. The Forbes contributor found that a group of small exchanges had BTC trading volumes roughly 95% less than those reported, while those operating “with little or no regulatory oversight” — including Binance and Bybit — claimed to have more than double the analyzed volume: $217 billion as opposed to $89 billion. “More than half of all reported trading volume is likely to be fake or non-economic,” said Pax. “The global daily Bitcoin volume for the industry was $128 billion on June 14. That i...