crypto blog

Sept. 22 is the date for Cardano’s Vasil hard fork launch, 3 months after target date

Cardano has set September 22 as the date for its Vasil mainnet upgrade, founder of the blockchain Charles Hoskinson announced on his YouTube vlog Friday. The hard fork was originally scheduled for June of this year and rescheduled twice. According to Cardano-associated R&D company Input Output Hong Kong (IOHK), which worked on the update, three necessary critical mass indicators have been reached: “1. 75% of mainnet blocks being created by the final Vasil node candidate (1.35.3) 2. approximately 25 exchanges upgraded (representing 80% of ada liquidity) 3. top 10 DApps by TVL confirming they have upgraded to 1.35.3 on PreProduction and are ready for mainnet.” IOHK wrote that, of the top 12 crypto exchanges, MEXC and Bitrue are “ready” for the upgrade, while Binance is “nearl...

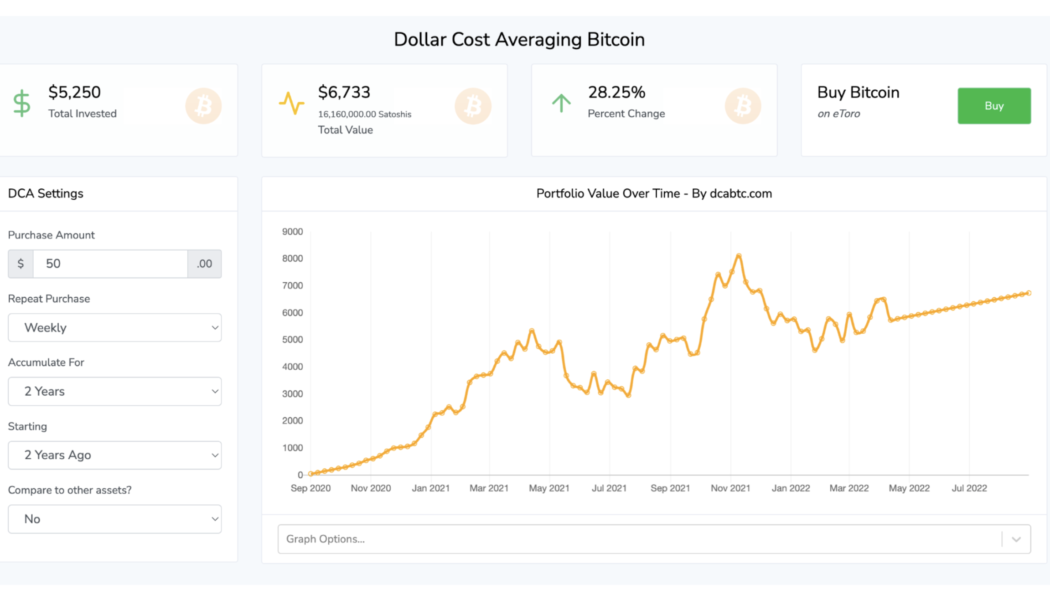

3 ways to trade Bitcoin and altcoins during a bear market

Markets are scary right now, and while the situation is likely to worsen, it doesn’t mean investors need to sit out and watch from the sidelines. In fact, history has proven that one of the best times to buy Bitcoin (BTC) is when no one is talking about Bitcoin. Remember the 2018–2020 crypto winter? I do. Hardly anyone, including mainstream media, was talking about crypto in a positive or negative way. It was during this time of prolonged downtrend and lengthy sideways chop that smart investors were accumulating in preparation for the next bull trend. Of course, nobody knew “when” this parabolic advance would take place, but the example is purely meant to illustrate that crypto might be in a crab market, but there are still great strategies for investing in Bitcoin. Let’s take a look at th...

Bitcoin hits new September high on US payrolls, G7 Russian energy cap

Bitcoin (BTC) passed $20,400 for the first time this month on Sept. 2 as United States economic data outperformed expectations. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Declining dollar accompanies BTC price rebound Data from Cointelegraph Markets Pro and TradingView showed BTC/USD approaching $20,500 after the Wall Street open, marking new highs for September. The pair had responded well to U.S. non-farm payroll data, which in August showed inflows dropping less than expected. A further boost came from news that the G7 had agreed to implement a price cap on Russian oil, with the European Union also planning to target the country’s gas imports. While the S&P500 and Nasdaq Composite Index both added 1.25% after the first hour’s trading, the U.S. dollar conversely fell...

Bnk To The Future eyes acquisition of crypto lender SALT

Crypto lending platform SALT has received a buyout offer from a prominent online investment platform — a move the company said could potentially enhance its product offerings and advance its mission of making digital assets more accessible to mainstream audiences. Bnk To The Future, or BF, has submitted a letter of intent to acquire SALT for an undisclosed amount, the companies disclosed Friday. The acquisition is contingent on both parties signing definitive agreements and requires regulatory approval. Robert Odell, SALT’s chief product officer, described the potential acquisition as being a unity of first-movers in the cryptocurrency market: “This potential union will combine SALT, the world’s first crypto lending platform, with BF, the world’s first Bitcoin and crypto securi...

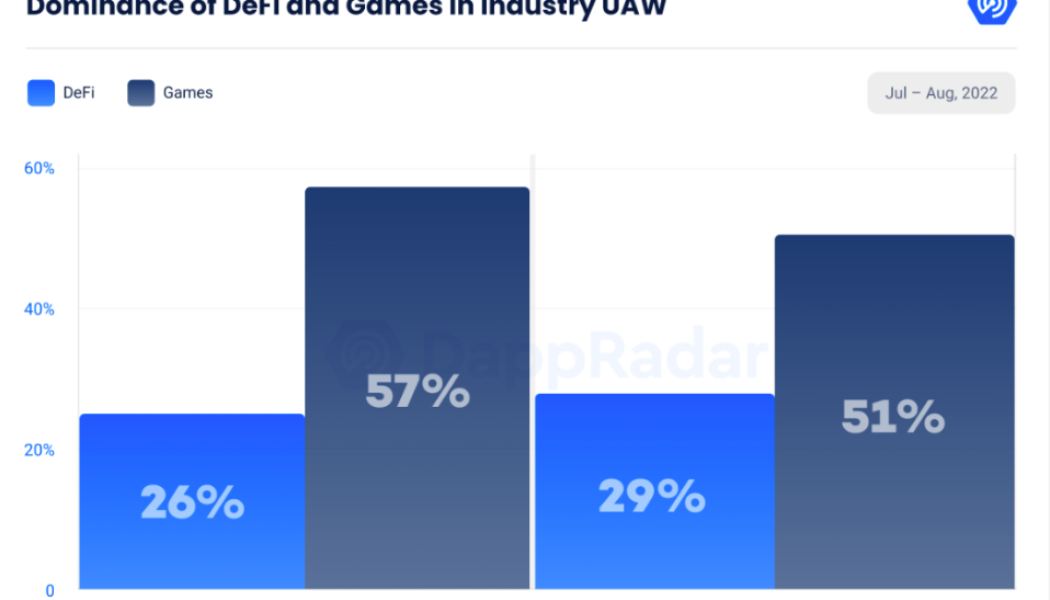

Gaming makes up over half of blockchain industry usage, DappRadar

New data from DappRadar suggests that gaming remains a vital organ to the blockchain industry. According to the report, the gaming sector accounts for approximately 50.51% of industry usage month-over-month (MoM), as per August numbers. While overall the numbers are a good indicator for the sector, it is a decrease from the previous month. Last month, the gaming sector made up approximately 57.30% of industry usage (MoM). The data from DappRadar comes from the daily Unique Active Wallets (UAW). According to the surveyor, there are around 847,230 gaming-related UAW active daily with nearly $698 million in transactions. Source: DappRadar Gaming has long been touted as a gateway to the world of Web3, blockchain, and crypto. Another recent survey from ChainPlay highlighted that of 2,428 survey...

Kyber Network offers bounty following $265K hack of decentralized exchange

KyberSwap, the decentralized exchange built on liquidity protocol Kyber Network, has offered a hacker 15% of the funds from a $265,000 exploit as a bug bounty. In a Thursday blog post, Kyber Network said a hacker had used a frontend exploit to pilfer roughly $265,000 worth of user funds from KyberSwap. The protocol said it will compensate all users for any missing funds related to the exploit, and directly addressed the hacker to give them an opportunity to return the funds in exchange for “a conversation with our team” and 15% of what was taken — roughly $40,000. “We know the addresses you own have received funds from central exchanges and we can track you down from there,” said Kyber Network. “We also know the addresses you own have OpenSea profiles and we can track you through the NFT c...

62% of wallets did not sell Bitcoin for a year amid the bear market: Data

Despite the uncertainties brought about by the bear market, on-chain metrics show that the majority of Bitcoin (BTC) traders have been using a very simple trading strategy for more than a year: hodling. According to data from the trading analysis platform TipRanks, while on-chain signals remain bearish for BTC, 62% of wallets have held BTC for one year and above. On the other hand, 32% of wallets are shown to have held for a month up to a year. Lastly, those who have been holding for less than a month are only 6%. Apart from holding, the site also showed its analysis of profitability in holding Bitcoin. According to the data, among the current holders, 48% are in profit while the same amount of holders is in losses. The data also highlighted that the remaining 4% are neither in profi...

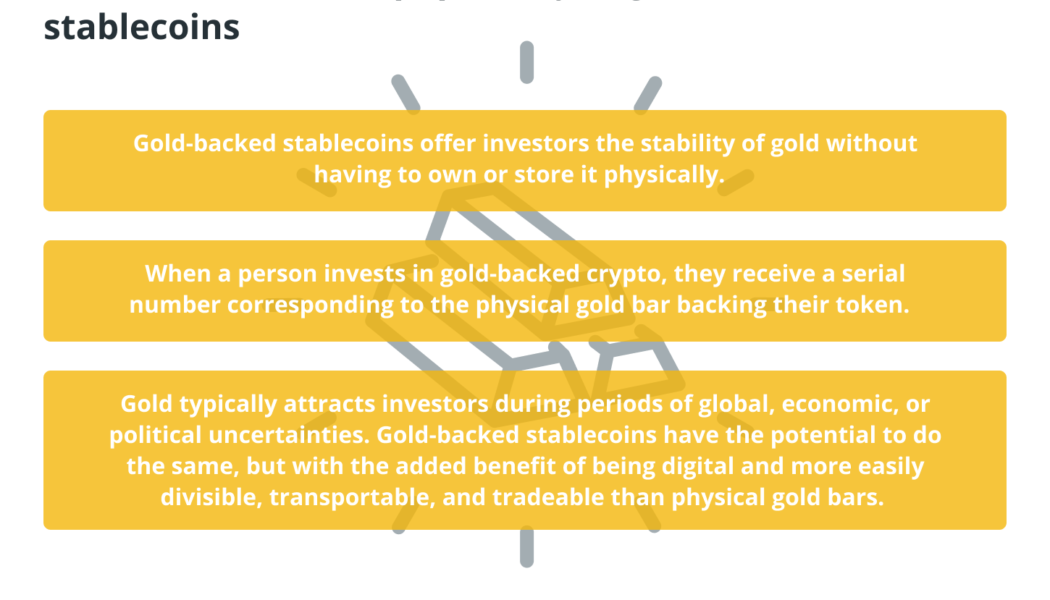

What is a gold-backed token and how does it work?

What is a gold-backed cryptocurrency? A gold-backed cryptocurrency is a type of digital currency that is backed by physical gold. The currency’s value is based on the current market price of gold and can be used for transactions just like any other type of cryptocurrency. Some cryptocurrencies are backed by gold in order to tie the derivative asset (crypto) to a tangible asset (gold), thereby preventing excessive fluctuations in price. Thus, gold-backed cryptocurrency is often more stable than other digital currencies. This is because the price of gold is generally less volatile than the prices of other assets, such as stocks or cryptocurrencies. Gold-backed cryptocurrency can also be used as a hedge against inflation. If the price of gold rises, the value of the currency will also increas...

Bitcoin squeeze to $23K still open as crypto market cap holds key support

Bitcoin (BTC) returned to $20,000 on Sep. 2 amid renewed bets on a “short squeeze” higher. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader eyes $20,700 short squeeze trigger Data from Cointelegraph Markets Pro and TradingView showed BTC/USD recovering from another dip below the $20,000 mark on the day, continuing rangebound behavior. The pair gave little insight into which direction the next breakout could be, with opinions differing on the surrounding environment. Amid downside pressure on risk assets and a strong U.S. dollar, overall consensus appeared to favor long-term weakness continuing. For popular trader Il Capo of Crypto, however, there was still reason to believe that a relief bounce could enter first. Thanks to the majority of the market expecting immediate lo...

El Salvador Bitcoin bond delayed due to security concerns: Tether CTO

El Salvador, the Central American nation that adopted Bitcoin (BTC) as a legal tender in September last year, has delayed the launch of its billion-dollar Bitcoin bond again. The Bitcoin bond, also known as the “Volcanic bond” or Volcanic token, was first announced in November 2021 as a way to issue tokenized bonds and raise $1 billion in return from investors. The fundraiser will then be used to build a “Bitcoin City” and buy more BTC. The bond was set to be issued in the first quarter of 2022 but was postponed to September in the wake of unfavorable market conditions and geopolitical crises. However, earlier this week, Bitfinex and Tether chief technology officer Paolo Ardoino revealed that the Bitcoin bond will be delayed again to the end of the year. Ardoino, in...

CFTC and SEC open comments for proposal to amend crypto reporting rules for large hedge funds

The United States Securities and Exchange Commission, or SEC, and the Commodity Futures Trading Commission, or CFTC, have called for comments on a proposal which would require large advisers to certain hedge funds to report exposure to crypto. In a joint proposed rule published to the Federal Register on Sept. 1, the SEC and CFTC established a 40-day comment period for amendments to Form PF, the confidential reporting document for certain investment advisers to private funds of at least $500 million. The proposal suggested qualifying hedge funds report exposure to crypto in a different category other than “cash and cash equivalents,” as the current iteration of Form PR does not specifically mention cryptocurrencies. Members of the public have until Oct. 11 to submit comments regarding the ...

Former blockchain skeptic David Rubenstein discloses investments in crypto companies

Carlyle Group co-founder David Rubenstein acknowledged on Sept. 2 that he has invested personally in a number of crypto companies, and is optimistic about the industry’s path to regulation in the United States. Speaking with CNBC’S Squawk Box on Thursday, the billionaire said he believes that government regulation will be positive for the industry, and that the U.S. Congress will tak a collaborative approach to boost an innovation environment in the country. “The crypto constituency is very strong in congress [and] they tend to be very Republican [or] very libertarian,” he noted. “The industry is not likely to be soft when dealing with members of Congress.” Previously skeptical about cryptocurrencies, Rubenstein reportedly changed his mind ...