crypto blog

64% of US blockchain-versed parents want crypto taught in schools: Survey

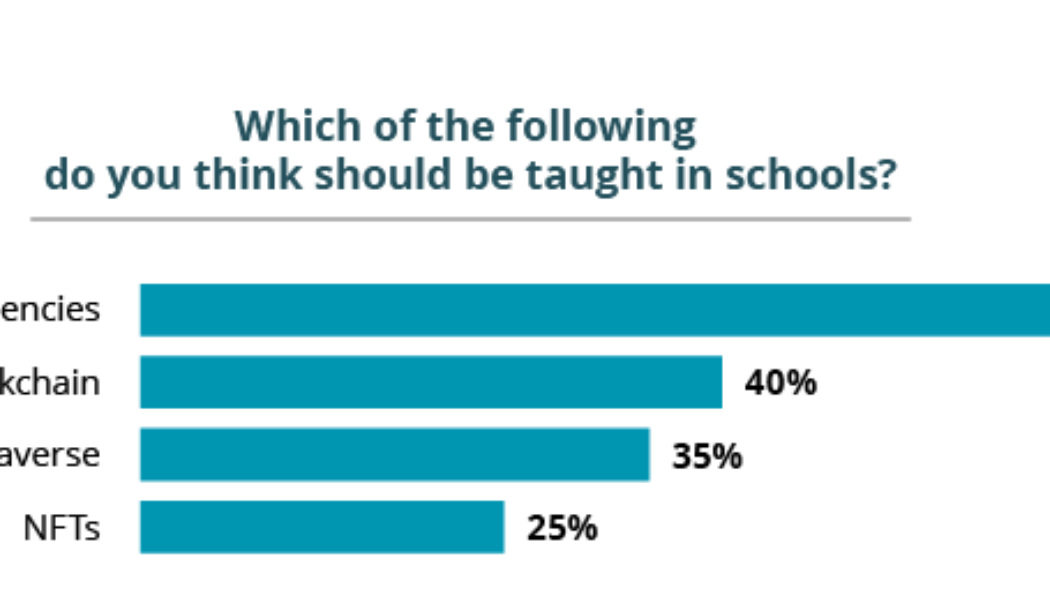

Over two-thirds of U.S. parents and college graduates with an understanding or involvement in crypto believe that crypto should be taught in schools in order for students to “learn about the future of our economy,” a new study has found. In a newly released survey from the online educational platform Study.com, the firm found that 64% of the parents 67% of the college graduates surveyed believed that cryptocurrencies should be part of mandatory education. Source: 2022 Study.com Survey Both groups had a slightly different view when it came to the blockchain, the Metaverse, and non-fungible tokens (NFTs) however, with only around 40% believing those subjects should be included in the curriculum as well. In order to take part in the survey, the parents and college grads were scree...

Nearly half of US adults say their crypto punts are worse than expected: Survey

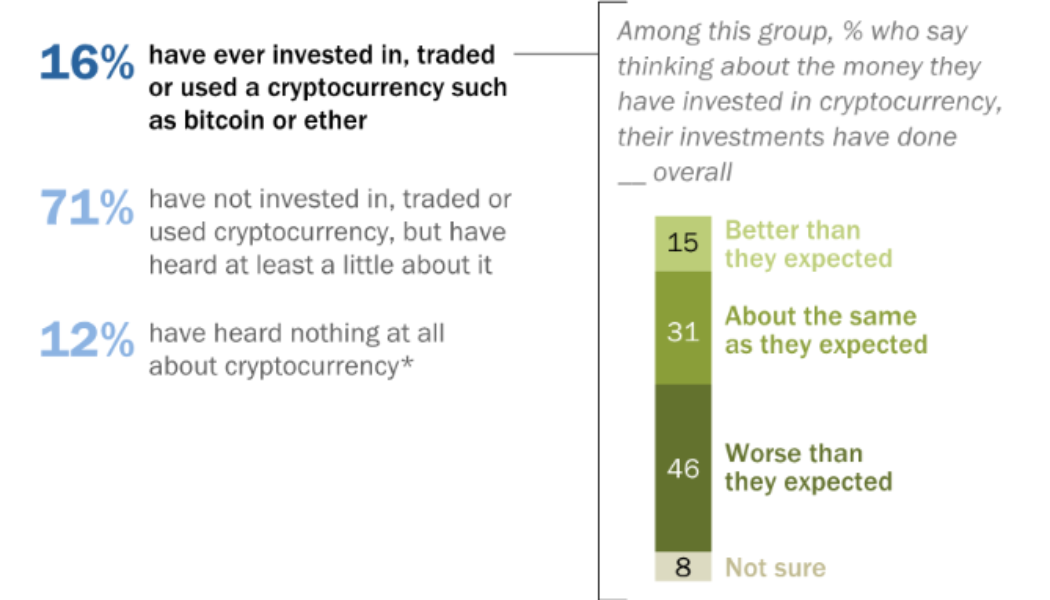

Amid the ongoing crypto winter, new data from a Pew Research Centre survey has shown that 46% of adult crypto users in the United States are seeing lower than expected returns on their crypto investments. The survey gathered responses from over 6,000 randomly-selected adults across the United States, with panelists participating in self-administered web surveys. Conducted from July 5 to 22 of this year, the majority of respondents who said they had invested in crypto said they saw lower than expected returns than expected while only 15% of people surveyed said their crypto investments had done better than expected. Meanwhile, around 31% said it was “about the same as they expected.” Source: Pew Research Center It’s unfortunate, given the vast majority of crypto user respondents...

Rep. Emmer demands an explanation of OFAC’s Tornado Cash sanction from Sec. Yellen

United States Congressman Tom Emmer sent a four-page letter to Treasury Secretary Janet Yellen on Tuesday regarding the Treasury Department’s sanctioning of cryptocurrency mixer Tornado Cash on Aug. 8. In his letter, Emmer posed a series of questions that seek to clarify the position of the Treasury Department’s Office of Foreign Assets Control (OFAC). Emmer said that OFAC, acting under Executive Order 13694 to place Tornado Cash on its Specially Designated Nationals and Blocked Persons List (SDN), has for the first time extended the EO’s definition of person or individual to include code. He pointed to the distinction made by the Treasury’s Financial Crimes Enforcement Network (FinCEN) between anonymizing services and anonymizing software to illustrate the issue he saw in OFAC’s action wh...

Celsius calls out Prime Trust in court, alleging firm didn’t turn over $17M in crypto

Crypto lending platform Celsius Network has filed a lawsuit claiming that custodian Prime Trust failed to turn over roughly $17 million worth of cryptocurrency. In a Tuesday filing with the U.S. Bankruptcy Court in the Southern District of New York, Celsius’ legal team brought a complaint against Prime Trust, alleging the company did not return $17 million worth of crypto assets in June 2021 when it terminated its relationship with the lending firm. According to Celsius, Prime Trust acted as crypto custodian for New York- and Washington-based users from 2020 through mid-2021, returning $119 million in crypto following the end of the business arrangement but holding back some funds: 398 Bitcoin (BTC), 3,740 Ether (ETH), 2,261,448 USD Coin (USDC) and 196,268 Celsius (CEL). “Upon the commence...

Iconic brands including Nike, Gucci have made $260M off NFT sales

The hype surrounding nonfungible tokens (NFTs) has allowed some of the world’s most iconic brands to rake in hundreds of millions of dollars in additional revenue, underscoring the mass consumer appeal of digital collectibles. Leading brands including Nike, Gucci, Dolce & Gabbana, Adidas and Tiffany have amassed a combined $260 million worth of sales from NFTs, according to data from Dune Analytics that was first reported by NFTGators. Nike’s NFT drops have amassed $185.3 million in revenue, with volumes in secondary markets approaching $1.3 billion. Dolce & Gabbana has generated $25.6 million worth of NFT revenue. Tiffany, which only recently launched its NFTiff token allowing CryptoPunk holders to mint customized pendants, has amassed $12.6 million in NFT-related sales. Tot...

A bullish Bitcoin trend reversal is a far-fetched idea, but this metric is screaming ‘buy’

Bitcoin (BTC) price remains pinned below $22,000 as the lingering impact of the Aug. 19 sell-off at $25,200 continues to be felt across the market. According to analysts from on-chain monitoring resource Glassnode, BTC’s tap at the $25,000 level was followed by “distribution” as profit-takers and short-term holders sold as price encountered a trendline resistance following a 23-consecutive-day uptrend that saw BTC trading above it’s realized price ($21,700). Bitcoin total inflows and outflows to all exchanges (USD). Source: glassnode The firm also noted that the “total inflows and outflows to all exchanges” metric shows exchange flows at multi-year lows and back to “late-2020 levels,” which reflects a “general lack of speculative interest.” Stocks and crypto clearly risk off until we...

The X.LA Metaverse Revealed In Detail

Cologne, Germany, 23rd August, 2022, Chainwire X.LA Foundation executive Aleksey Savchenko has revealed details of the eagerly anticipated X.LA Metaverse. Before an expectant crowd at Gamescom in Cologne, Germany, Savchenko promised an immersive experience, delineating a vision backed by technology that will shape the way people interact well into the next century. The X.LA Metaverse is built on the promise of a virtual world that mirrors the physical one but is easier to navigate and full of untethered potential. As a visionary in this space, Savchenko brings over 25 years of video game and software development experience and is a major proponent of the metaverse. “It’s not a product – it’s a paradigm shift,” the X.LA Foundation executive told the Gamescom crowd. The X.LA Metaverse will b...

Chingari launches the first ever video-NFT marketplace

Chingari, the world’s fastest-growing on-chain social app has launched the first-ever video-NFT marketplace called Creator Cuts. The marketplace adds to Chingari’s commitment to fostering and proliferating the creator economy. Speaking at the launch of the NFT marketplace, Mr Sumit Ghosh, who is the Co-founder & CEO of Chingari and GARI token said: “At Chingari, empowering and enabling creators to engage effectively and intrinsically with their community has been the cornerstone of our success since our inception. We believe in the immense potential of the Creator Economy and are wholly committed to its growth and democratisation across the spectrum. Towards this, we are always innovating and creating unique programs and propositions which lie at the cross-section of popular culture, e...

DBS bank reports 4X growth in Bitcoin buys on DDEx exchange in June

A major cryptocurrency selloff in June 2022 has sparked more interest in Bitcoin (BTC) from institutional investors, according to data from one of the biggest banks in Singapore. The total number of trades on DDEx more than doubled in June 2022 as compared to April 2022 amid the growing investor appetite for digital assets like Bitcoin and Ether (ETH). Buy orders on DDEx accounted for 90% of all trades in June as cryptocurrencies traded at notable discounts in mid-2022, DBS said. Compared to April 2022, the amount of Bitcoin purchased on DDEx in June saw a fourfold increase, while the quantity of ETH grew 65%, DBS reported. “With the digital asset industry experiencing unprecedented volatility, investors who believe in the long-term prospects of digital assets are gravitating towards trust...

Warren Buffett pivots to U.S. Treasuries — a bad omen for Bitcoin’s price?

Warren Buffett has put most of Berkshire Hathaway’s cash in short-term U.S. Treasury bills now that they offer as much as 3.27% in yields. But while the news does not concern Bitcoin (BTC) directly, it may still be a clue to the downside potential for BTC price in the near term. Berkshire Hathaway seeks safety in T-bills Treasury bills, or T-Bills, are U.S. government-backed securities that mature in less than a year. Investors prefer them over money-market funds and certificates of deposits (COD) because of their tax benefits. Related: Stablecoin issuers hold more US debt than Berkshire Hathaway: Report Berkshire’s net cash position was $105 billion as of June 30, out of which $75 billion, or 60%, was held in T-bills, up from $58.53 billion at the beginning of 2022 o...

Hacker tries to exploit bridge protocol, fails miserably

Cross-chain bridges have increasingly become targeted by malicious entities. However, not all hackers can run away with millions in their exploit attempts. Some end up losing money from their own wallets. In a Twitter thread, Alex Shevchenko, the CEO of Aurora Labs, told the story of a hacker who attempted to exploit the Rainbow Bridge but ended up losing 5 Ether (ETH), worth around $8,000 at the time of writing. According to Shevchenko, the hacker has presented a falsified NEAR block to the Rainbow Bridge contract and submitted the required 5 ETH safe deposit. Thinking that the team would be slow to react during the weekend, the attacker timed the exploit attempt on a Saturday. Despite the hacker’s plan, the CEO highlighted that there were automated watchdogs in place that fou...