crypto blog

Summer doldrums? Crypto volumes are down 55%, according to CoinShares

Crypto investment products registered minor weekly outflows last week as volumes plunged to their second-lowest levels of the year, signaling weak demand among institutional investors during the tail end of summer. Outflows from digital asset investment products totaled $8.7 million in the week ending Sunday, CoinShares reported Monday. Bitcoin (BTC) investment products saw a third consecutive week of outflows totaling $15.3 million. Funds with direct exposure to Solana (SOL) also registered minor outflows totaling $1.4 million. Meanwhile, Ether (ETH) and multi-asset investment products registered small weekly inflows of $2.9 million and $2.7 million, respectively. Overall, crypto investment products registered $1 billion in weekly volumes, which is 55% below the yearly average. CoinShares...

Australia’s new government finally signals its crypto regulation stance

Three months after being elected into power, the Australian Labor Party (ALP) has finally broken its silence on how it’s planning to approach crypto regulation. Treasurer Jim Chalmers announced a “token mapping” exercise, which was one of the 12 recommendations in a senate inquiry report last year on “Australia as a Technology and Financial Center.” The report was warmly welcomed by the industry which has been anxiously waiting to see if the ALP government would embrace it. Aimed at being conducted before the end of the year, the token mapping exercise is expected to help “identify how crypto assets and related services should be regulated” and inform future regulatory decisions. Cointelegraph understands that Treasury will also undertake work on some of the other recommendations in ...

Ronin hackers transferred stolen funds from ETH to BTC and used sanctioned mixers

The hackers behind the $625 million Ronin bridge attack in March have since transferred most of their funds from Ether (ETH) into Bitcoin (BTC) using renBTC and Bitcoin privacy tools Blender and ChipMixer. The hacker’s activity has been tracked by on-chain investigator ₿liteZero, who works for SlowMist and contributed to the company’s 2022 Mid-Year Blockchain Security report. They outlined the transaction pathway of the stolen funds since the March 23 attack. The majority of the stolen funds were originally converted into ETH and sent to now sanctioned Ethereum crypto mixer Tornado Cash before being bridged over to the Bitcoin network and converted into BTC via the Ren protocol. I’ve been tracking the stolen funds on Ronin Bridge.I’ve noticed that Ronin hackers have trans...

8 sneaky crypto scams on Twitter right now

Cybersecurity analyst Serpent has revealed his picks for the most dastardly crypto and nonfungible token (NFT) scams currently active on Twitter. The analyst, who has 253,400 followers on Twitter, is the founder of artificial intelligence and community-powered crypto threat mitigation system, Sentinel. In a 19-part thread posted on Aug. 21, Serpent outlined how scammers target inexperienced crypto users through the use of copycat websites, URLs, accounts, hacked verified accounts, fake projects, fake airdrops and plenty of malware. One of the more worrisome strategies comes amid a recent spate of crypto phishing scams and protocol hacks. Serpent explains that the Crypto Recovery Scam is used by bad actors to trick those who have recently lost funds to a widespread hack, stating: “Simply pu...

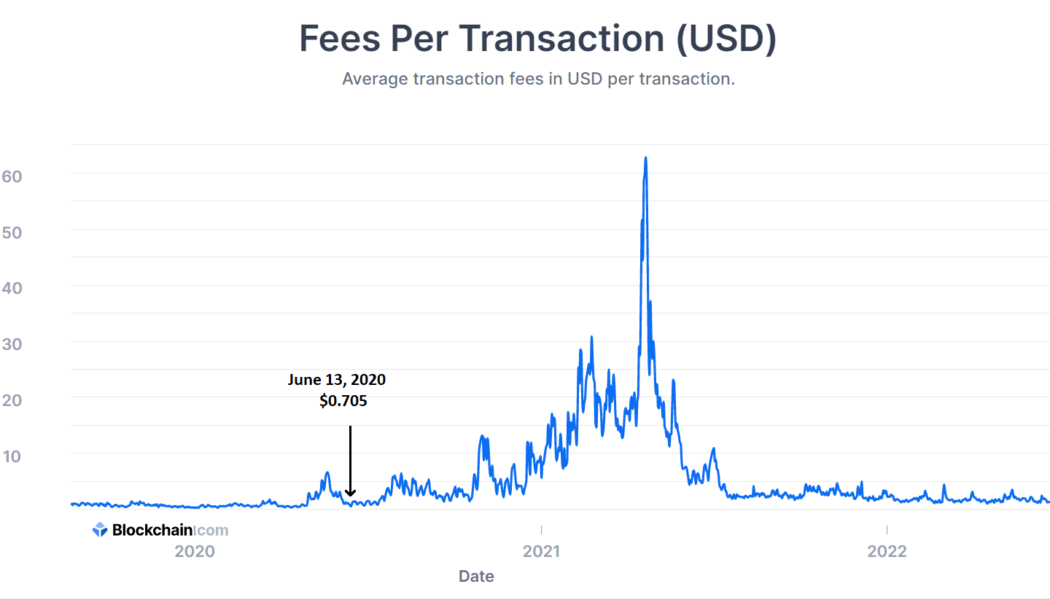

Average Bitcoin transaction fee drops under $1 as network difficulty recovers

The average transaction fees on the Bitcoin (BTC) blockchain fell below $1 for the first time in over two years, further strengthening its use case as a viable mainstream financial system. High transaction fees over blockchain networks work against the users, especially when making low-value transactions. For example, transaction fees over Ethereum (ETH) blockchain skyrocketed several times during the nonfungible token (NFT) hype, inducing stress on general users. While the Bitcoin ecosystem has also endured its fair share of high transaction fees in the past, timely upgrades — including the Lightning Network and Taproot — guarantee faster and cheaper transactions over time. As of Aug. 22, the average Bitcoin transaction fees fell down to $0.825, a number last seen on June 13, 2020. Averag...

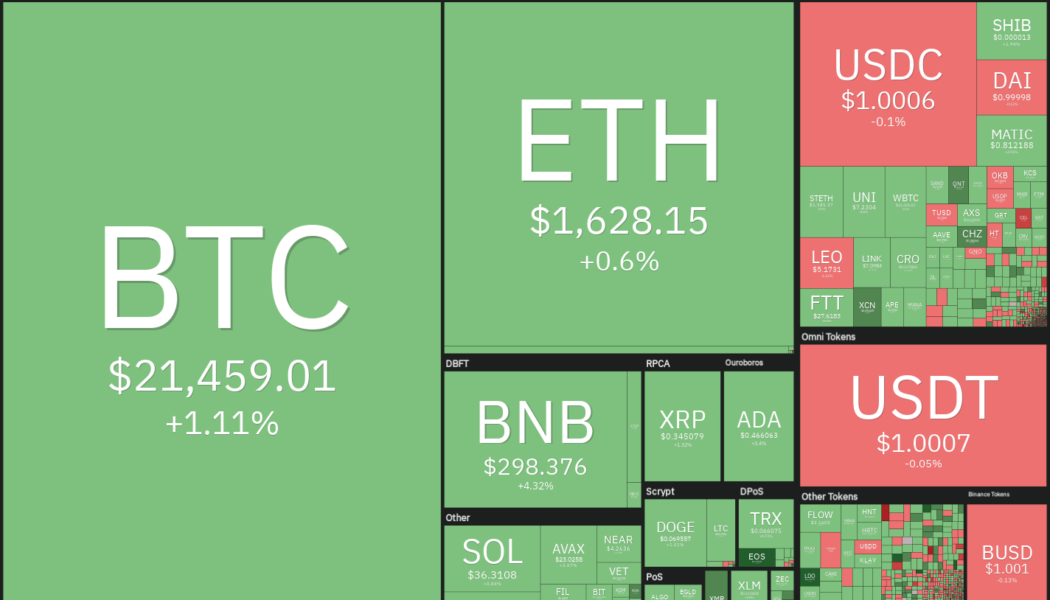

Here’s 5 cryptocurrencies with bullish setups that are on the verge of a breakout

The S&P 500 ended its four-week-long recovery last week after minutes from the Federal Reserve’s July meeting hinted that the central bank’s rate hikes will continue until inflation is under control. Members of the Fed said there was no evidence that inflation pressures appear be easing. Another dampener was the statement by St. Louis Fed president James Bullard who said that he would support a 75 basis point rate hike in September’s Fed policy meeting. This reduced hopes that the era of aggressive rate hikes may be over. Crypto market data daily view. Source: Coin360 Weakening sentiment pulled the S&P 500 lower by 1.29% for the week. Continuing its close correlation with the S&P 500, Bitcoin (BTC) also witnessed a sharp decline on Aug. 19 and is likely to end the week with ste...

The Philippines pushes back against foreign exchanges, continuing a protectionist streak

The pressure on crypto is growing swiftly in the Philippines. After a recent series of controversial moves from the state regulators and local think tanks, the country’s central bank published a warning to the citizens, discouraging them from engaging in any operations with unregistered or foreign crypto exchanges. The announcement itself doesn’t sound menacing but taken in the context of accompanying developments, it makes a 112-million nation a restive region for crypto. On Thursday, the Bangko Sentral ng Pilipinas (BSP) published a warning note to the country’s citizens, “strongly urging” them not to deal with virtual asset service providers (VASPs) that are either unregistered or domiciled abroad. The Bank emphasized that any deals with virtual assets are high-risk activities by ...

Huobi explains what went wrong with HUSD after stablecoin is back on track

After recovering the HUSD stablecoin’s dollar peg, crypto exchange Huobi explained what had caused the short-term liquidity problem and assured users that it had been resolved. On Thursday, HUSD started to fall from its dollar value, trading at $0.92 at the start of the day and falling as low as $0.82 a few hours later. This alarmed community members, who speculated what mig happen if the stablecoin doesn’t recover its dollar peg. HUSD was once one of the safest stablecoins. Now it’s off its peg. If HUSD doesn’t return to $1, it’d be the first fully-reserved centralized stablecoin to fail. pic.twitter.com/9WmROQR6lD — John Paul Koning (@jp_koning) August 18, 2022 In response to the concerns, the crypto exchange platform immediately announced that they had been in co...

Fake employees and social attacks: Crypto recruiting is a minefield

Hiring in the crypto world can be difficult. Web3 companies are often disorganized and lack HR departments. Developers sometimes want to remain anonymous — even to their potential employers. Some employees don’t exist at all, while others are secretly juggling three other remote gigs. Then there are those who pretend to be employees but are really just plotting to rug everyone. The job of a hiring manager is no easy one. This goes doubly so for the Web3 world, where expectations both from employers and employees can be drastically different compared to the Web2 corporate world. Magazine spoke to Declan Strain, managing partner of Dubai-based talent consultancy BlockDelta, which helps companies in the Web3 industry connect with workers of all levels. After 20 years as a recruiter, he became...

Merkle trees vs. Verkle trees, Explained

Merkle trees are employed in Bitcoin (BTC) and other cryptocurrencies to more effectively and securely encrypt blockchain data. Verkle trees allow for smaller proof sizes, particularly important for Ethereum’s upcoming scaling upgrades. But, how do you identify a Merkle tree? Leaf nodes, non-leaf nodes and the Merkle root are the three essential parts of a Merkle tree in the context of blockchains. Transaction hashes or transaction IDs (TXIDs) reside in leaf nodes, which can be viewed on a block explorer. Then, above the leaf nodes, a layer of non-leaf nodes is hashed together in pairs. Non-leaf nodes keep the hash of the two leaf nodes they represent below them. Related: What is blockchain technology? How does it work? As the tree narrows as it ascends, half as many nodes ...

FTX revenue reportedly grew 1000% in one year, leaked documents reveal

FTX was among the many crypto exchanges with a front-row seat to witness the crypto hype of 2021, back when Bitcoin (BTC) and other cryptocurrencies hit their all-time highs. Driven by massive customer onboarding, partnerships, sponsorships and other factors, FTX’s revenue reportedly grew 1000% in 2021 — revealed internal documents. Audited financials of FY 2020-2021 show FTX witnessing a 1000% increase in revenue — growing from $90 million in 2020 to $1.2 billion in 2021, claimed CNBC alleging access to the documents. The revenue breakdown discloses a 1842.85% increase in operating income for FTX, from $14 million to $272 million in one year. The crypto exchange amassed $388 million in net income, a 2182.35% increase from last year’s $17 million. FTX has reportedly made $270 million in th...

Can Web3 be hacked? Is the decentralized internet safer?

Web3 came into existence posed as a blockchain-powered disruption to the current state of the internet. Yet, as a nascent technology, a fog of assumptions plagues discussions about the real capabilities of Web3 and its role in our day-to-day lives. Considering the promise of a decentralized internet using public blockchains, a complete transition to Web3 would require scrutiny across several factors. Out of the lot, security stands as one of the most crucial features as, in a Web3-powered world, tools and applications hosted over the blockchains go mainstream. Smart contract vulnerabilities While the blockchains that host Web3 applications remain impenetrable from being hostage to attackers, hackers target the vulnerabilities within the project’s smart contracts. Smart contract attacks on ...