crypto blog

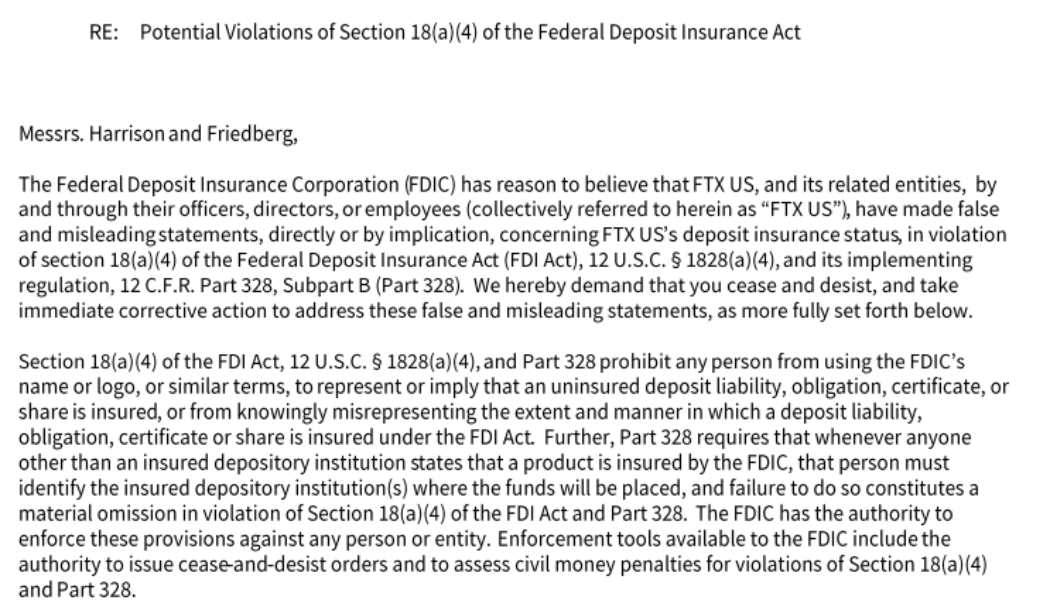

FTX US among 5 companies to receive cease and desist letters from FDIC

The Federal Deposit Insurance Corporation (FDIC) has issued cease and desist letters to five companies for allegedly making false representations about deposit insurance related to cryptocurrencies. FDIC issued a Friday press release disclosing cease and desist letters for cryptocurrency exchange FTX US and websites SmartAssets, FDICCrypto, Cryptonews and Cryptosec. In the letters, which were issued on Thursday, the government agency alleges that these organizations misled the public about certain cryptocurrency-related products being insured by FDIC. “These representations are false or misleading,” the FDIC said in regard to “certain crypto-related products” being FDIC-insured or that “stocks held in brokerage accounts are FDIC-insured.” The regulator said these companies must “take immed...

FTX blocks Aztec Network privacy DApp, calling it a ‘high risk’ mixer

FTX has reportedly begun blocking accounts that have sent coins through zk.money, a private layer-2 chain provided by the Aztec Network on Ethereum. According to Twitter users, FTX has identified the DApp as a mixer — a service it deems a “high-risk activity” prohibited by the exchange. Reports of blocked transactions on FTX began appearing on Twitter on Thursday, sometimes with commentary about FTX’s motives and allegations that zk.money is not a mixer. Twitter users also noted that blocking transactions connected to the protocol may imply a ban with far-reaching effects, similar to the sanctions imposed by the United States Treasury Department on Tornado Cash users. The U.S. agency placed over 40 USDC and ETH addresses on the Office of Foreign Asset Control (OFAC) List of Specially ...

United Texas Bank CEO wants to ‘limit the issuance of US dollar-backed stablecoins to banks’

Scott Beck, chief executive officer of United Texas Bank, called on members of the state’s blockchain working group to recommend policy for leaving stablecoins to banks rather than crypto firms. Speaking before the Texas Work Group on Blockchain Matters in Austin on Friday, Beck suggested limiting the issuance of U.S. dollar-backed stablecoins to licensed banks rather than issuers like Circle. The United Texas Bank CEO cited a November report from the President’s Working Group on Financial Markets, in which the group said stablecoin issuers should be held to the same standards as insured depository institutions including state and federally chartered banks. “If such stablecoins are defined to be ‘money’, banks are the proper economic actor to issue and manage stablecoins,” said Beck. “Bank...

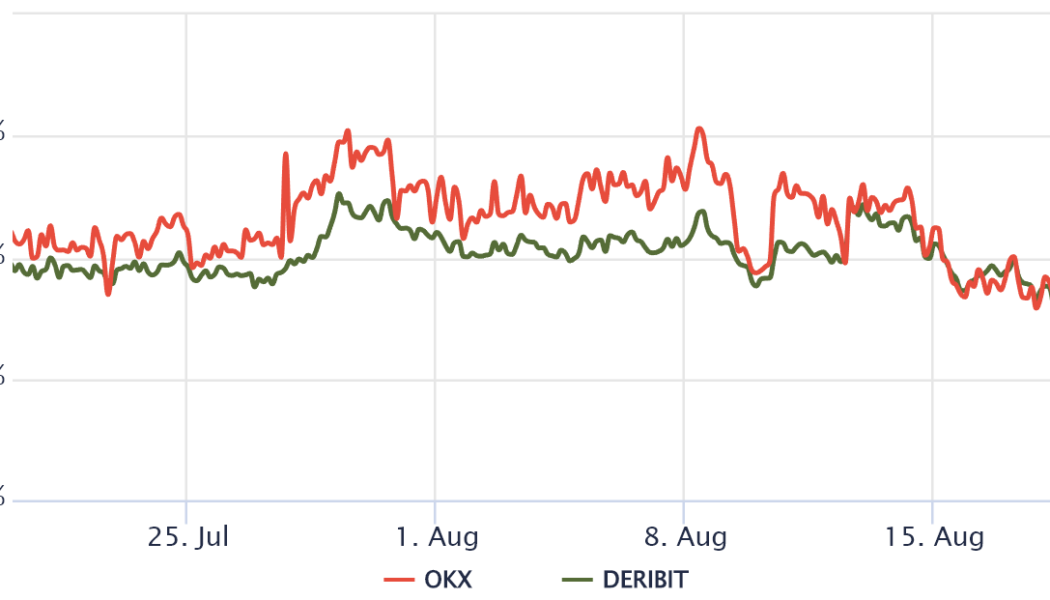

3 reasons why Bitcoin’s drop to $21K and the market-wide sell-off could be worse than you think

On Friday, August 19, the total crypto market capitalization dropped by 9.1%, but more importantly, the all-important $1 trillion psychological support was tapped. The market’s latest venture below this just three weeks ago, meaning investors were pretty confident that the $780 billion total market-cap low on June 18 was a mere distant memory. Regulatory uncertainty increased on Aug. 17 after the United States House Committee on Energy and Commerce announced that they were “deeply concerned” that proof-of-work mining could increase demand for fossil fuels. As a result, U.S. lawmakers requested the crypto mining companies to provide information on energy consumption and average costs. Typically, sell-offs have a greater impact on cryptocurrencies outside of the top 5 asset...

Independent Tether attestation reveals 58% decrease in commercial paper holdings

An announcement from USDT issuer Tether Holdings Limited revealed information from an independent attestation about the company’s previous quarter’s performance. The reviewer, top accounting firm BDO Italia, assessed Tether’s assets as of June 30, 2022. Tether had previously announced a commitment to decreasing its commercial paper holdings by the end of August 2022. Data from the report revealed a 58% decrease in commercial paper exposure since the previous quarter from $20 billion to $8.5 billion. The chief technology officer of Tether, Paolo Ardoino, tweeted that Tether has plans to continue to decrease its commercial paper holdings to $200 million by the end of August and zero them out by the following October. As of June 30th, more than 58% decrease in Tether’s commer...

Price analysis 8/19: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin (BTC) and most major altcoins witnessed a sharp sell-off on Aug. 19, but there does not seem to be a specific trigger for the sudden drop. The sharp fall resulted in liquidations of more than $551 million in the past 24 hours, according to data from Coinglass. Barring a V-shaped bottom, other formations generally take time to complete as buyers and sellers try to gain the upper hand. This tends to cause several random volatile moves that may be an opportunity for short-term traders, but long-term investors should avoid getting sucked into the noise. Daily cryptocurrency market performance. Source: Coin360 Glassnode data shows that investors who purchased Bitcoin in 2017 or earlier are just doing that by holding their positions. The percentage of Bitcoin supply dormant for at least ...

Celsius Network coin report shows a balance gap of $2.85 billion: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, Celsius’s financial troubles mounted further as a new coin report showed the company had a balance gap of $2.85 billion, more than double what it had shown in the bankruptcy filing. Aave (AAVE) called upon community members to commit to the Ethereum proof-of-stake (PoS) Merge. Coinbase CEO said the exchange would rather wind down its staking services than implement on-chain censorship in the form of regulatory compliance. The crypto market saw another depeg this week, with the Acala ecosystem seeing its native stablecoin lose the peg. With a sudden price drop toward the end of the week, the majorit...

Crypto Unicorns founder says P2E gaming is in a long ‘maturation phase’

As the hype surrounding play-to-earn (P2E) games and platforms began to dwindle in early 2022, Web3 participants began to emphasize the need for games to be more “fun” and less finance-oriented. In the most recent episode of NFT Steez, Alyssa Expósito and Ray Salmond spoke with Aron Beireschmitt, the CEO of Laguna games and founder of Crypto Unicorns, about the sustainability of P2E-focused blockchain games. For Beireschmitt, the evolution from a play-to-earn to a play-and-earn model suggests that there is still experimentation and maturation to be seen for these games. “Nothing has changed about making games,” says Beireschmitt, but with blockchain technology, crypto natives and gamers are now able to play, own and potentially monetize from these play-and-earning models. The larger ...

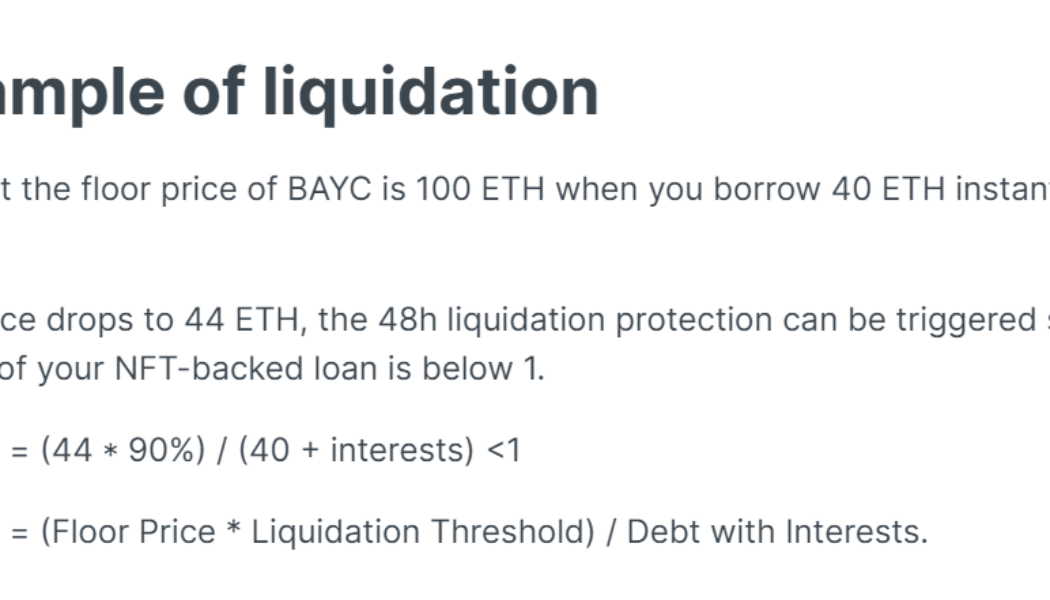

Nearly $55M worth of Bored Ape, CryptoPunks NFTs risk liquidation amid debt crisis

Many owners of precious Bored Ape Yacht Club (BAYC) and CryptoPunks NFTs, who used them as collateral to take out loans in Ether (ETH), have failed to repay their debts. The situation could lead up to the NFT sector’s first massive liquidation event. gm. As a result of the floor dropping to 72, the first BAYC liquidation auction on BendDAO has begun Starting price of 68.4e… Any takers or is this going to be the first bad-debt domino that falls for the platform? pic.twitter.com/7qxsIi661e — Cirrus (@CirrusNFT) August 18, 2022 BAYC “death spiral” incoming? DoubleQ, the founder of web3 launchpad Double Studio, says lending service BendDAO could liquidate up to $55 million worth of NFTs to recover its loans, fearing the so-called “health factor” of these deb...

NFTs democratize music industry and redistribute song rights

The music industry continues to find inventive ways to integrate decentralized technology into new releases to benefit both artists and their fans. Electronic dance music (EDM) artist R3HAB and blockchain-based music community anotherblock released a single on Aug. 19 with the idea of “democratizing music rights.” The nonfungible token (NFT) included in the drop allows holders to earn royalties based on streaming popularity. The single, “Weekend on a Tuesday,” debuted bundled with an exclusive NFT. Each of the 250 NFTs available entitles the holder to a 0.02% share in the streaming revenue. Anotherblock’s platform provides a value tracking tool so holders can estimate payouts and overall value. Many artists have been using digital assets as a way to connect with their fan base t...

SBI lost 40% of hash rate after stopping mining in Russia: Data

Japanese financial giant SBI Holdings has partly terminated cryptocurrency mining in Russia due to geopolitical uncertainty and the crypto winter. SBI Holdings suspended mining operations in Russia’s crypto mining-rich region of Siberia, citing reasons like Russia-Ukraine conflict and the ongoing bear market, Bloomberg reported on Thursday. The Japanese online brokerage shut down the Siberian mining operations shortly after Russia started a military intervention in Ukraine on Feb. 24, a spokesperson for the firm reportedly said. The termination contributed to SBI’s crypto asset business reporting a pretax loss of 9.7 billion yen ($71 million) in Q2 202. As a result, the Sumitomo Mitsui Financial Group-backed group recorded a 2.4 billion yen ($17.5 million) in net losses, reportedly posting...

Biden is hiring 87,000 new IRS agents — and they’re coming for you

The Inflation Reduction Act, signed into law this month by President Joe Biden, empowers the IRS with nearly $80 billion in new funds. The world’s most powerful tax collection agency is using the money to go on a hiring spree to fuel much tougher enforcement efforts. It is widely assumed that the audits will be brutal and widespread. Taxes start with tax returns, which must be signed under penalties of perjury. The Biden administration has said that the audits on steroids are for fat cats who have escaped having to pay their fair share for too long. The administration has suggested the IRS would perform no new audits on anyone making less than $400,000 annually. Republicans tried to include that in the law, but every Senate Democrat voted against the amendment, as well as IRS audit protect...