crypto blog

Aid for Ukraine’s $54M crypto fund buys vests, scopes and UAVs

The crypto community has poured in an impressive $54 million worth of crypto funds through Aid For Ukraine, aimed at supporting the country’s military efforts against Russia, the Ukrainian Deputy Prime Minister has revealed. The $54 million has been funneled in through the Ukrainian government-run initiative Aid For Ukraine, according to Ukraine’s Deputy Prime Minister Mykhailo Fedorov’s Twitter post on Thursday, who thanked the crypto community for their support: “Every helmet, bulletproof vest, and night vision device save the lives of Ukrainian soldiers. Thus, we must continue to support our defenders. Thanks so much to everyone from the crypto community for supporting Ukraine!” According to the Ministry of Digital Transformation of Ukraine, Aid For Ukraine’s $54 million has mostl...

Aussies buy fuel and chips with crypto across 175 fuel outlets

Convenience store and petrol station brand On The Run (OTR) has launched crypto payment support across all 175 of its petrol stations and convenience stores across Victoria, South Australia (SA), and Western Australia (WA) as of Thursday. As previously reported, the move is part of a collaboration between OTR, Singapore-based exchange Crypto.com and DataMesh, a Sydney-based payment systems provider. The exchange has provided its Pay Merchant service as a payment settlement layer, while Datamesh has provided the point of sale terminals. Speaking with Cointelegraph, Crypto.com’s Asia & Pacific general manager Karl Mohan noted that it only took “eight weeks to from the time of proof of concept to the point of actually getting a full scalable production-ready environment.” Mohan noted that...

Crypto ad spending may be down, but awareness remains critical: Experts

Crypto television advertising spending has reportedly fallen off a cliff in the United States, reflecting the current state of the markets. However, that’s no excuse to take a break, two crypto firms tell Cointelegraph. A Wednesday report from Bloomberg highlighted that television ad spending among the largest crypto trading firms hit the lowest mark in over a year, with only $36,000 spent in July according to ISpot, down 99.9% from $84.5 million in February. The $84.5 million ad spend was achieved during the U.S. Superbowl period when Crypto.com, FTX US, and Coinbase splurged on high-profile ads to raise awareness of their services. Despite the reported decline in TV ad spending, some crypto firms such as Singapore-based digital asset management firm IDEG Limited say they conti...

Aussie asset manager to offer crypto ETF using unique license variation

Australian asset manager Monochrome Asset Management has landed the country’s first Australian financial services license (AFSL) for a spot crypto exchange-traded fund (ETF). Speaking to Cointelegraph, Jeff Yew, CEO of Monochrome Asset Management, said the AFSL approval is significant, as until this point, approved crypto ETFs in Australia only operate under general financial asset authorization and only indirectly hold crypto-assets. Yew noted that Monochrome’s crypto ETFs, on the other hand, will directly hold the underlying crypto-assets and is specifically authorized by the Australian Securities & Investments Commission (ASIC) to do so. The Monochrome executive said the approval represents a significant step forward for both the advice industry and retail investors: “We see c...

Fed adds a new layer of bureaucracy for US banks engaging in crypto asset activities

The United States Federal Reserve Board issued a letter Tuesday to its supervisory officers, staff and the banks they supervise regarding activities with crypto assets. The letter covers the preliminary steps a bank must go through before engaging in activities with crypto and instructs banks to notify the board before proceeding with those activities. The letter, signed by the directors of the regulatory and community affairs divisions, applies to all banks supervised by the Fed with no threshold of minimum assets. It begins with a warning about the risks associated with crypto, specifically mentioning evolving technology and its governance, Anti-Money Laundering and transparency and the stability of assets such as stablecoin. The Fed is monitoring banks’ activities, the letter noted: “Gi...

European Central Bank addresses guidance on licensing of digital assets

The European Central Bank, or ECB, laid the foundation for the criteria it would be considering when harmonizing the licensing requirements for crypto in Europe. In a Wednesday statement, the ECB’s banking supervision division said it would be taking steps to regulate digital assets as “national frameworks governing crypto-assets diverge quite extensively” and given the seemingly differing approaches to harmonization following the passage of the Markets in Crypto-Assets (MiCA) regulation and the Basel Committee on Banking Supervision issuing guidelines for banks’ exposure to crypto. The ECB said it would apply criteria from the Capital Requirements Directive — in effect since 2013 — to assess licensing requests for crypto-related activities and services. Specifically, the central bank will...

‘There’s a lot less land to go around’ — why White Rock established off-the-grid mining in Texas

Amid many cryptocurrency mining firms in Texas scaling down operations to reduce the load on the power grid, at least one company set up miners not quite as affected by the state’s energy requirements during extreme heat. In June, White Rock Management expanded its crypto mining operations to Texas — its first in the United States — but reported its facility in the Brazos Valley region would mine Bitcoin (BTC) using “environmentally responsible” methods. While the firm’s mining operations in Sweden used hydroelectric power, White Rock CEO Andy Long told Cointelegraph that its Texas facility was “off grid”, powered only by natural gas that would otherwise be burned. “The U.S. is where the action is in terms of markets, so we plan to be in at least another couple of states as well as Texas w...

Senator asks FDIC about allegations it discourages bank relations with crypto companies

Pennsylvania Senator Pat Toomey, ranking member of the United States Senate Banking Committee, has sent a letter to Federal Deposit Insurance Corporation (FDIC) director and acting chairman Martin Gruenberg informing him of allegations made by a whistleblower concerning FDIC activities. The senator suspects the FDIC “may be improperly taking action to deter banks from doing business with lawful cryptocurrency-related (crypto-related) companies.” Toomey wrote that there is corroboration of whistleblower allegations that “personnel in the FDIC’s Washington, D.C. headquarters are urging FDIC regional offices to send letters to multiple banks requesting that they refrain from expanding relationships with crypto-related companies, without providing any legal basis for sending such letters...

Fake Manchester United token soars 3,000% after Elon Musk jokes about buying team

Manchester United Fan Token (MUFC) is a dead coin and not related to the sports franchise, but one Elon Musk tweet was enough to revive it on Aug. 17. Also, I’m buying Manchester United ur welcome — Elon Musk (@elonmusk) August 17, 2022 Fake Man U token pumps after Elon Musk’s tweet To clarify, MUFC is not an official Manchester United crypto token. It came to life in August 2021 after a team of programmers, who are said to be hardcore Manchester United fans, falsely claimed that holding MUFC would give buye influence on the football club’s decisions. The team later conducted an “airdrop” round of 10,000,000,000 MUFC in November 2021, promising to provide 10,000 MUFC to users who followed its official social media handles. The prospects of getting free MUFC tok...

Bitcoin price dives pre-FOMC amid warning $17.6K low was not the bottom

Bitcoin (BTC) dropped to weekly lows at the Aug. 17 Wall Street open as upcoming Federal Reserve comments unsettled risk assets. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar climbs as Fed minutes due Data from Cointelegraph Markets Pro and TradingView tracked a more than 2% daily decline in BTC/USD, which hit $23,325 on Bitstamp. Already showing signs of weakness, the pair slid further as United States equities began trading, hours before the Federal Open Markets Committee (FOMC) was due to release minutes from its latest meeting. While not involving a decision on interest rates, the meeting was cued to give an insight into the Fed’s thinking in terms of the next rate tweak due in September. “The important event tonight with the FOMC minutes, through which information...

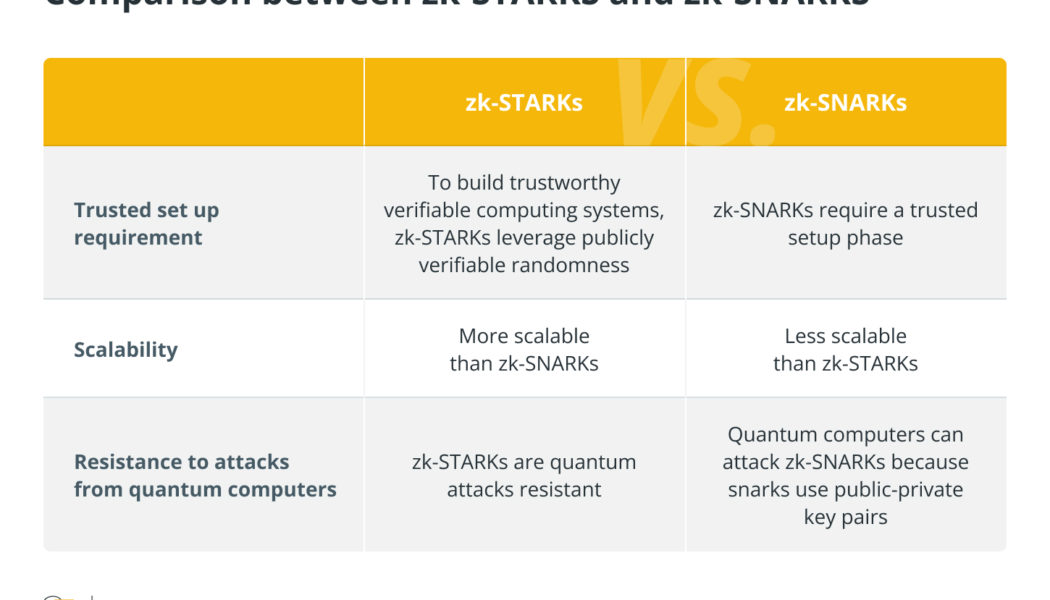

Pushing Bitcoin to become more scalable with zero-knowledge proofs

For all the good that Bitcoin brings to the table, it also possesses a commonly accepted issue in scalability. Bitcoin can only process a limited number of transactions per block and, as of Aug. 17, 2022, can handle about five transactions per second, which in comparison to most other blockchains is low. The factor limiting scalability lies in Bitcoin’s cryptographic algorithm. The Elliptic Curve Digital Signature Algorithm (ECDSA) is the essential cryptographic algorithm that powers Bitcoin and ensures that only the rightful owner can access and manage their funds. Currently, verification of the ECDSA, a Bitcoin signature allowing to carry out transactions and send Bitcoin (BTC), is not efficient and limits the scalability of the Bitcoin blockchain. A potential solution is using zero-know...

Ethereum Foundation clarifies that the upcoming Merge upgrade will not reduce gas fees

According to a new clarification by the Ethereum Foundation on Wednesday, the network’s upcoming proof-of-stake transitory upgrade — dubbed the “Merge,” — will not reduce gas fees. Regarding this, the Ethereum Foundation wrote: “Gas fees are a product of network demand relative to the network’s capacity. The Merge deprecates the use of proof-of-work, transitioning to proof-of-stake for consensus, but does not significantly change any parameters that directly influence network capacity or throughput.” The Merge, which seeks to join the existing execution layer of the Ethereum mainnet with its new proof-of-stake consensus layer, the Beacon Chain, will eliminate the need for energy-intensive mining. It is expected to land within the third or final qua...