crypto blog

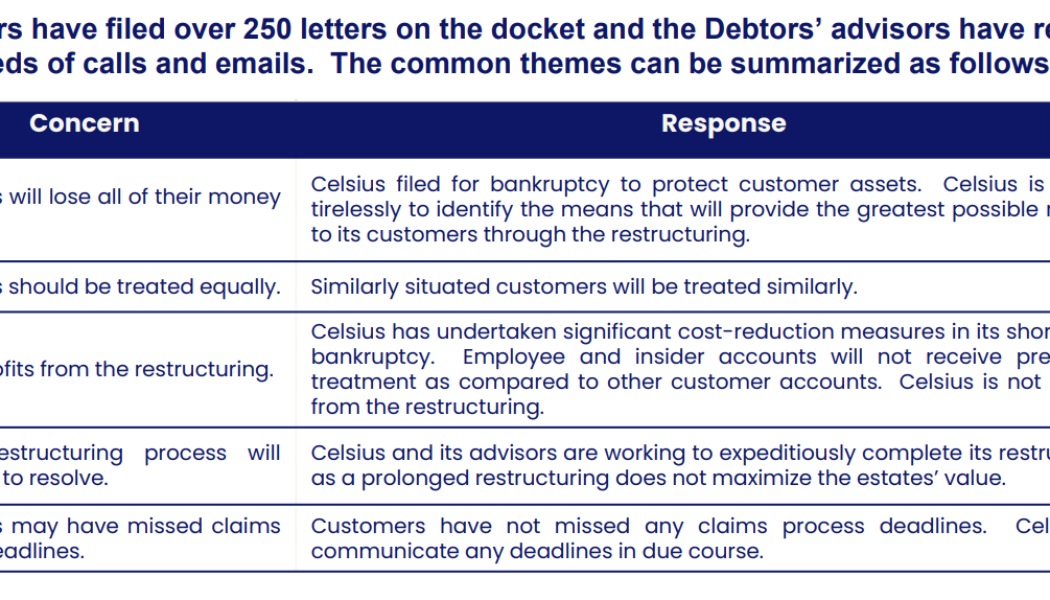

For greater good: NY judge allows Celsius to mine, sell Bitcoin

Not even 24 hours after revealing a three-month cash flow forecast that threatens total exhaustion of funds, a New York judge allowed crypto lender Celsius Network to mine and sell Bitcoin (BTC) during its bankruptcy. Since July 2022, Celsius Networks stands at the crosshair of United States officials after reports of bankruptcy surfaced, which risks losing the live savings of numerous crypto investors. Last week many got very upset with me as I said @CelsiusNetwork would run out of money & solutions needed to be acted upon faster. I was told I don’t understand Chapter 11. They have now confirmed they run out of money by October. https://t.co/CyzjgKpId7 pic.twitter.com/vBIRIGEmG2 — Simon Dixon (Beware Impersonators) (@SimonDixonTwitt) August 15, 2022 During the second day of the case h...

EOS price jumps 20% for biggest gain in 15 months — What’s fueling the uptrend?

EOS rose approximately 20% to reach $1.66 on Aug. 17 and was on track to log its best daily performance since May 2021. Initially, the EOS rally came in the wake of its positive correlation with top-ranking cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which gained over 2% and 3.75%, respectively. But, the upside move was also driven by a flurry of uplifting updates emerging from the EOS ecosystem. EOS/USD daily price chart. Source: TradingView EOS incentive program launch On Aug. 14, the EOS Network Foundation (ENF), a nonprofit organization that oversees the growth and development of the EOS blockchain, opened registrations for its upcoming Yield+ incentive program. The Yield+ is a liquidity incentive and reward program to attract decentralized finance (DeFi) application...

What is CeDeFi, and why does it matter?

Among the advantages of CeDeFi are lower fees, better security, accessibility, speed and lower cost. CeDeFi’s innovative approach to decentralized banking enables users to trade CeDeFi crypto assets without requiring a centralized exchange. This implies that users may transact directly with one another, removing the need for an intermediary. Among CeDeFi’s major advantages is lower fees. CeDeFi transactions cost lower than those on comparable platforms since there are fewer middlemen involved, especially on networks that are not Ethereum-based. Ethereum has very high gas fees, for instance, with DEX transactions running into hundreds of dollars. It also often causes network congestion issues, leading to delays. Binance CeDeFi, on the other hand, has much lower fee...

Another depeg — Acala trace report reveals 3B aUSD erroneously minted

High-profile security incidents continue to be a theme in 2022 as the Acala Network joined a long list of stricken platforms to fall prey to exploits. Acala’s aUSD token, which acts as the native stablecoin for the Polkadot and Kusama blockchains, saw its value plummet 99% after a misconfiguration of the iBTC/aUSD liquidity pool was exploited after its launch on Aug. 14. Initial estimates from Acala noted that 1.2 billion aUSD were minted without the necessary collateral – seeing the token’s value depeg from its 1:1 USD ratio to a bottom of $.01. Acala put its network in maintenance mode to freeze funds and eventually managed to recoup a significant portion of the uncollateralized tokens. The Acala community proposed and voted on a referendum to identify and destroy the erroneously m...

IRS takes out John Doe summons on crypto prime dealer SFOX to find tax cheat customers

The Central District of California federal court entered an order Monday to authorize the United States Internal Revenue Service (IRS) to serve a John Doe summons on SFOX, a Los Angeles-based cryptocurrency prime dealer. The IRS filed suit to receive the order, which directs SFOX to reveal the identities of customers who are U.S. taxpayers and documents relating to their cryptocurrency transactions equivalent to at least $20,000 carried out between 2016 and 2021. The IRS filed suit in the Southern District of New York to receive a John Doe summons on SFOX as well. SFOX’s partner bank, M.Y. Safra, is headquartered in New York. The bank provides Federal Deposit Insurance Corporation (FDIC) insured accounts for SFOX institutional traders. Related: Crypto dealer SFOX gets trust charter a...

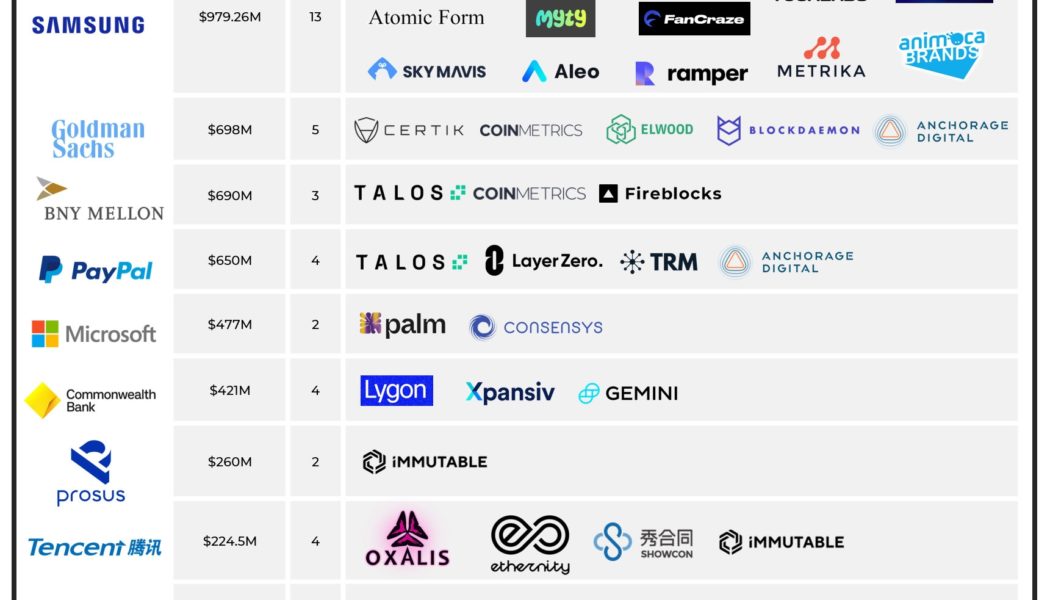

Google invested a whopping $1.5B into blockchain companies since September

Google parent company Alphabet poured the most amount of capital into the blockchain industry compared to any other public company, investing $1.5 billion between Sep. 2021 and Jun. 2022, a new report shows. In an updated blog published by Blockdata on Aug. 17, Alphabet (Google) was revealed as the investor with the deepest pockets compared to the top 40 public corporations investing in blockchain and crypto companies during the period. The company invested $1.5 billion into the space, concentrating on four blockchain companies including digital asset custody platform Fireblocks, Web3 gaming company Dapper Labs, Bitcoin infrastructure tool Voltage, and venture capital company Digital Currency Group. This is in stark contrast to last year, where Google diversified its much smaller $60...

Former Goldman Sachs banker explains why Wall Street gets Bitcoin wrong

John Haar, a former asset manager at financial institution Goldman Sachs believes the lack of support from “legacy finance” for Bitcoin stems from a poor understanding of the cryptocurrency. Haar’s views were expressed in an essay on Aug. 14, which was originally sent to private clients of Bitcoin brokerage platform Swan Bitcoin. Haar previously spent 13 years at Wall Street asset management giant Goldman Sachs, before joining Swan Bitcoin as managing director of Private Client Services in April 2022. The essay explains that not only do people in “legacy finance” fail to understand what he considers one of Bitcoin’s (BTC) primary principles, the idea of sound money is lost on them in general, which Haar says leads them to negative opinions about the crypto. “After many con...

Houston Texans becomes first NFL team to sell game suite with crypto

National Football League (NFL) team Houston Texans has become the first organization in the league to sell single-game suites in exchange for crypto. The move comes as part of a deal with Texas-based crypto firm bitWallet, which as of Aug. 16 became the official crypto wallet provider for the team. bitWallet will also provide intermediary services by exchanging crypto for cash for the Houston Texans. According to an announcement from the Houston Texans, local digital marketing agency EWR Digital made the first single-game suite purchasing using crypto shortly after the offer launched, making it the first time a game suite has been sold in exchange for digital assets in the history of the sport. It appears the crypto deal is just for suites, as there has been no mention of being able to pur...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Is Bitcoin really a hedge against inflation?

While Bitcoin (BTC) has failed in countering this year’s rampant global inflation, it should still be considered as an inflation hedge, says Steven Lubka, the managing director of private consumers at Swan Bitcoin. According to Lubka, Bitcoin works well as a hedge against rising prices when inflation is caused by monetary expansion. It is less effective when inflation is caused by the disruption of the food supply and energy, which he sees as the leading cause of this year’s rampant inflation. [embedded content] “In a world where the price of goods is going up because there’s been a radical loss of abundance, Bitcoin isn’t going to protect investors from that,” Lubka said. He also points out that Bitcoin is a better hedge against inflat...

Coinbase will ‘briefly pause’ ETH and ERC-20 token deposits and withdrawals during Ethereum Merge

United States-based cryptocurrency exchange Coinbase has announced it will be temporarily suspending certain token deposits and withdrawals when Ethereum’s core developers transition the blockchain to proof-of-stake, or PoS. In a Tuesday blog post, Coinbase product manager Armin Rezaiean-Asel said that during the Merge event, the crypto exchange will “briefly pause” deposits and withdrawals of Ether (ETH) and ERC-20 tokens “as a precautionary measure” to handle the migration. The exchange also warned users against scammers offering ETH2 tokens, saying crypto users did not need to take additional action to receive staked ETH prior to the Merge. “Although the Merge is expected to be seamless from a user perspective, this downtime allows us to ensure that the transition has been successf...

Coinbase will ‘briefly pause’ ETH and ERC-20 token deposits and withdrawals during Ethereum Merge

United States-based cryptocurrency exchange Coinbase has announced it will be temporarily suspending certain token deposits and withdrawals when Ethereum’s core developers transition the blockchain to proof-of-stake, or PoS. In a Tuesday blog post, Coinbase product manager Armin Rezaiean-Asel said that during the Merge event, the crypto exchange will “briefly pause” deposits and withdrawals of Ether (ETH) and ERC-20 tokens “as a precautionary measure” to handle the migration. The exchange also warned users against scammers offering ETH2 tokens, saying crypto users did not need to take additional action to receive staked ETH prior to the Merge. “Although the Merge is expected to be seamless from a user perspective, this downtime allows us to ensure that the transition has been successf...