crypto blog

Curve Finance resolves site exploits, directs users to revoke recent contracts: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you significant developments over the last week. This past week, cross-bridge protocols became the center of DeFi discussions as a new report showed RenBridge was used to launder $540 million in stolen funds. Curve Finance, on the other hand, resolved its site exploit and directed users to revoke any recent contracts. Interlay, a London-based blockchain firm, launched a Bitcoin (BTC)-based cross-chain bridge on Polkadot named interBTC (iBTC), DeFi platform Oasis.app says that sanctioned addresses will no longer be able to access the application. The majority of the top-100 DeFi tokens saw a new surge in bullish momentum along with the rest of the market, with se...

Indian authorities freeze more crypto funds over money laundering allegations

India’s Directorate of Enforcement (ED) announced Friday that it has frozen the financial accounts of Bengaluru-based financial services company Yellow Tune Technologies, some of which were held by Flipvolt crypto exchange, the Indian branch of Singaporean Vauld. The move is linked to an ongoing investigation into money laundering by China-linked instant loan companies. This is the second time this week the agency has taken action in the crypto sphere in connection with that case. The financial watchdog announced it was freezing Yellow Tune’s bank balances, payment gateway balances and balances in the Flipvolt cryptocurrency exchange for a total of 3.7 billion rupees, or $46.4 million after determining that the company was a shell entity incorporated by two Chinese nationals using ps...

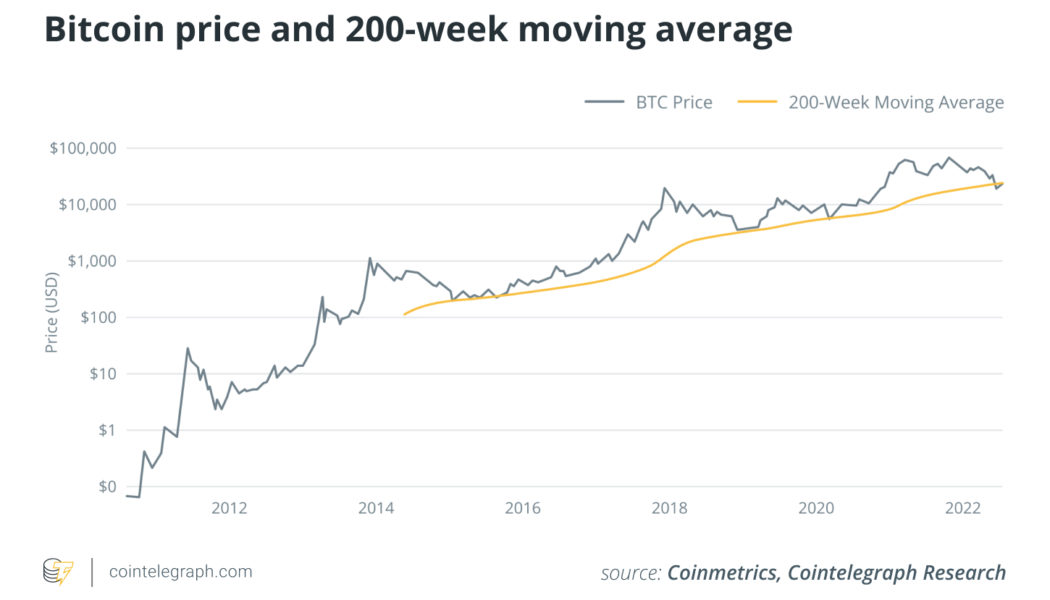

Fallout from crypto contagion subsides but no market reversal just yet

The blockchain industry showed some surprising resilience in July, which may point to a period of greater fundamental support for the crypto space overall in the short term. In looking at a wide variety of indicators, including Bitcoin’s (BTC) price action, open interest on Ether (ETH) and activity in GameFi, there are some strong signals to suggest that a bullish sentiment is returning to this space. Smooth sailing from now on is not a given, though. Cointelegraph Research’s latest Investor Insights analyzes key indicators from different sectors of the blockchain industry to navigate those potentially treacherous crypto waters. In the latest edition, Cointelegraph Research’s bearish-to-bullish index was a level C indicating a short-term cautionary time. While there are still mixed signals...

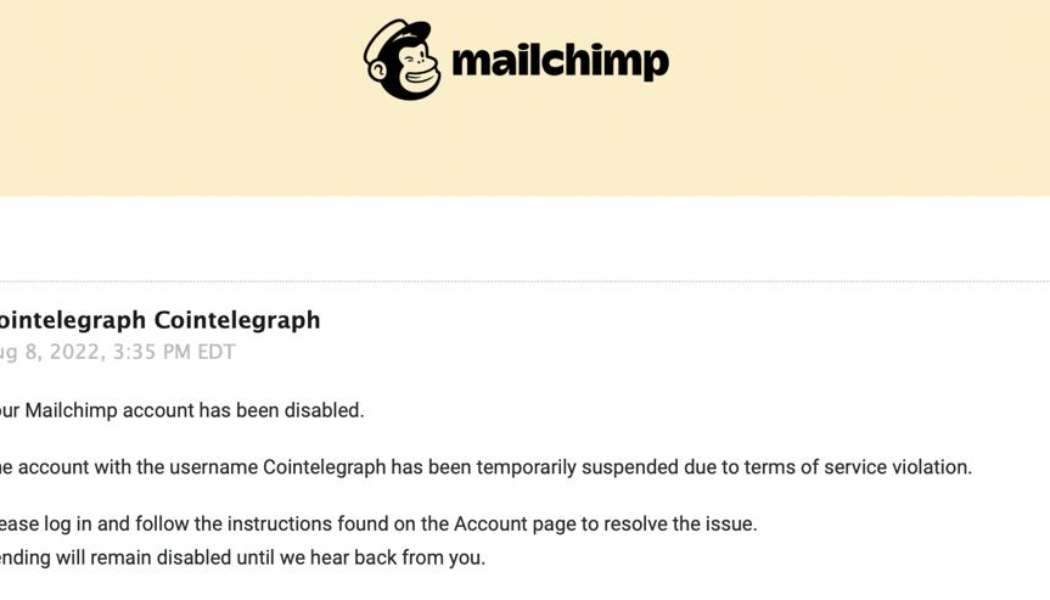

Mailchimp bans crypto content creators without prior notice

The email marketing platform Mailchimp appears to have suspended its services to crypto content creators. Platforms associated with crypto news, content or related services started to have issues logging into accounts, followed by notices of service interruptions that began surfacing this week. Crypto-associated accounts such as the Edge wallet, a provider of self-custody crypto holding services, and Messari, a crypto research company, were among some of the affected. Early this morning, Sam Richards, at the Ethereum Foundation Tweeted that the Ethereum Foundation Ecosystem Support Program is likewise facing suspension. Add @Ethereum Foundation’s @EF_ESP to the list of customers @Mailchimp has rugged. Anyone have good recommendations for email subscription services with solid A...

Crypto markets bounced and sentiment improved, but retail has yet to FOMO

An ascending triangle formation has driven the total crypto market capitalization toward the $1.2 trillion level. The issue with this seven-week-long setup is the diminishing volatility, which could last until late August. From there, the pattern can break either way, but Tether and futures markets data show bulls lacking enough conviction to catalyze an upside break. Total crypto market cap, USD billion. Source: TradingView Investors cautiously await further macroeconomic data on the state of the economy as the United States Federal Reserve (FED) raises interest rates and places its asset purchase program on hold. On Aug. 12, the United Kingdom posted a gross domestic product (GDP) contraction of 0.1% year-over-year. Meanwhile, inflation in the U.K. reached 9.4% in July, the highest figur...

Tornado Cash DAO goes down without explanation following vote on treasury funds

The Tornado Cash DAO went offline after many social media users reported the community discussing ways to challenge sanctions recently imposed by the United States Treasury Department’s Office of Foreign Asset Control. At the time of publication, the Tornado Cash DAO was offline reportedly following a discussion in which community members voted unanimously to add its governance layer as a signatory to its treasury’s multisig wallet, which manages a reported $21.6 million. It’s unclear what was responsible for the decentralized autonomous organization (DAO) going dark, but it followed a series of actions taken by different authorities and private entities in the wake of U.S. sanctions announced against the controversial mixer on Monday. In the last four days, Circle froze more than 75,000 U...

Binance recovers the majority of funds stolen from Curve Finance

Crypto exchange Binance has recovered a big part of the funds from the recent hack that targeted the decentralized finance (DeFi) protocol Curve Finance. In a tweet, Binance CEO Changpeng Zhao announced that the exchange has frozen and recovered $450,000 of the stolen assets, which is more than 80 percent of the stolen funds. According to Zhao, the hacker tried to send the funds to the exchange in various ways but was detected by Binance. The exchange is currently working to return the funds to their rightful owners. The Curve Finance team detected the hack on Tuesday and alerted their users to refrain from using their website. An hour after the warning, the team announced that it was able to find and resolve the issue. However, the attackers were still able to hijack around $537,000...

Three-quarters of institutions to use crypto in the three years: Ripple

A whopping 76% of surveyed financial institutions plan on using crypto within the next three years, according to the report. Ripple’s new report highlights trends in the adoption and utilization of emerging technologies like crypto and blockchain in enterprise and financial institutions. Both financial institutions and enterprises are understanding the benefits of internal crypto usage. The most common reason is that crypto gives more people access to more financial services, says 42% of financial institutions and 41% of enterprises. According to the survey, portfolio management and payments come forward as the most valuable additions to the enterprise world. Portfolio management is detailed as hedging against inflation, hedging against other asset types and asset appreciat...

Brazilian payment app PicPay launches crypto exchange with Paxos

Major Brazilian payment application PicPay is moving into cryptocurrencies by integrating a crypto exchange service allowing users to buy Bitcoin (BTC) and Ether (ETH). The firm officially announced on Wednesday that PicPay clients can now buy, sell and store two major cryptocurrencies, BTC or ETH, directly on its app. PicPay pointed out that its choice was due to the real use cases provided by these digital assets, including security and many other benefits. The firm stated: “Blockchain technology, which is behind coins like Bitcoin and Ethereum, is already used in the real estate sector, the insurance industry and even the art market, through non-fungible tokens.” The new crypto feature is enabled through a partnership with the major crypto company Paxos and allows customers to use Paxos...

Dutch authorities arrest suspected Tornado Cash developer

Authorities in the Netherlands have arrested a developer that is suspected to be involved in money laundering through the crypto mixing service Tornado Cash. The Fiscal Information and Investigation Service (FIOD), an agency in the Netherlands responsible for investigating financial crimes, officially announced on Friday an arrest of a 29-year-old man in Amsterdam. The man has allegedly been involved in facilitating criminal financial flows and money laundering through the decentralized Ethereum mixer Tornado Cash, the authority said. The FIOD pointed out that it doesn’t rule out multiple arrests in the case, noting that its Financial Advanced Cyber Team (FACT) launched a criminal investigation against Tornado Cash in June 2022. According to the FACT, Tornado Cash has allegedly been used t...

UNCTAD takes aim at crypto in developing world in a series of critical policy briefs

The United Nations Conference on Trade and Development (UNCTAD) released a policy brief Wednesday on cryptocurrency. It is the third brief in a row the agency has dedicated to crypto, and together they represent a detailed assessment of the risks crypto presents for developing economies and options for resolving those risks. UNCTAD Policy Brief No. 102, dated July but newly released, argues that although cryptocurrency can facilitate remittances and encourage financial inclusion, it can also undermine domestic resource mobilization in developing economies by enabling tax evasion by hiding the ownership of financial flows and directing them out of the country. The authors of the brief state, “Cryptocurrencies share all the characteristics of traditional tax havens – the pseudonymity of acco...

DeFi platform Oasis to block wallet addresses deemed at-risk

According to a new community Discord post on Thursday, decentralized finance platform Oasis.app says that sanctioned addresses will no longer be able to access the application. As a result of the change to the terms of service, wallets flagged as high risk are prohibited from using Oasis.app to manage positions or withdraw funds. Instead, such category of users must interact directly with the relevant underlying protocol where funds are stored or find another service. In explaining the decision, Oasis.app team member Gabriel said: “We’ve recently needed to update the Terms of Service of the Oasis.app front-end to comply with the relevant laws and regulations. In line with the latest regulations, Oasis.app has an updated Terms of Service. Any sanctioned addresses will no longer ...