crypto blog

Tether also confirms its throwing weight behind the post-Merge Ethereum

Hot on the heels of an official announcement from USD Coin (USDC) issuer Circle Pay, stablecoin giant Tether has now also officially confirmed its support behind Ethereum’s upcoming Merge upgrade and switch to a Proof-of-Stake (PoS) consensus mechanism-based blockchain. The announcement came on the same day as its stablecoin competitor, who pledged they will only support Ethereum’s highly anticipated upgrade. In an Aug. 9 statement, Tether labeled the Merge one of the “most significant moments in blockchain history” and outlined that it will work in accordance with Ethereum’s upgrade schedule, which is currently slated to go through on Sept. 19. “Tether believes that in order to avoid any disruption to the community, especially when using our tokens in DeFi projects and platforms, it’s imp...

Iran makes $10M import with crypto, plans ‘widespread’ use by end of Sept

Struggling through decades of economic sanctions, Iran has placed its first international import order using $10 million worth of cryptocurrency, according to a senior government trade official. News that the Islamic republic placed its first import order using crypto was shared by Iran’s Deputy Minister of Industry, Mine & Trade Alireza Peyman-Pak in a Twitter post on Aug. 9. While the official did not disclose any details about the cryptocurrency used or the imported goods involved, Peyman-Pak said that the $10 million order represents the first of many international trades to be settled with crypto, with plans to ramp this up over the next month, noting: “By the end of September, the use of cryptocurrencies and smart contracts will be widely used in foreign trade with ta...

DeFi needs a ‘killer app’ to go next level, says Ripple exec

A “killer app” for consumers is what will be needed to bring the decentralized finance (DeFi) sector to a level that draws in a mainstream audience, said Ripple Lab’s head of DeFi markets Boris Alergant. Alergant nade the comments during a panel at the Blockchain Futurist Conference titled “The Future of Decentralized Finance” on Aug. 9, which was covered by Cointelegraph reporters on the ground in Toronto, Canada. Alongside Alergant, Aventus Ventures CEO Kevin Hobbs, FLUIDEFI co-founder and CEO Lisa Loud, and Teller Finance CEO and co-founder Ryan Berkin also featured on the panel. The general sentiment among the panelists was that centralized finance institutions will ultimately push DeFi towards mainstream adoption. Alergant suggested that growth will likely come from a user...

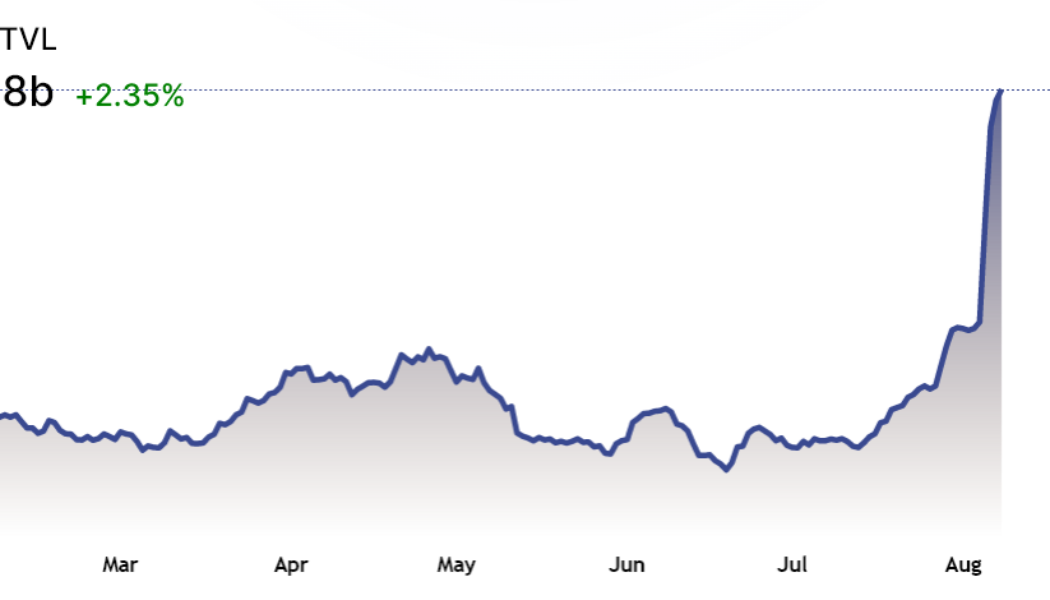

Total value locked in DeFi dropped by 66%, but multiple metrics reflect steady growth

The aggregate total value locked (TVL) in the crypto market measures the amount of funds deposited in smart contracts and this figure declined from $160 billion in mid-April to the current $70 billion, which is the lowest level since March 2021. While this 66% contraction is worrying, a great deal of data suggests that the decentralized finance (DeFi) sector is resilient. The issue with using TVL as a broad metric is the lack of detail that is not shown. For example, the number of DeFi transactions, growth of layer-2 scaling solutions and venture capital inflows in the ecosystem are not reflected in the metric. In DappRadar’s July 29 Crypto adoption report, data shows that the DeFi 2Q transaction count closed down by 15% versus the previous quarter. This figure is far less concerning...

Anonymous user sends ETH from Tornado Cash to prominent figures following sanctions

On Tuesday, one day after the U.S. Treasury sanctioned cryptocurrency mixer Tornado Cash for its alleged role in cryptocurrency money laundering operations, intervals of 0.1 Ether (ETH) transactions began materializing from the smart contract to prominent figures such as Coinbase CEO Brian Armstrong and American television host Jimmy Fallon. It is not possible to trace the source of the transactions per Tornado Cash design, and as a result, either one individual or multiple individuals or entities could be involved in the operation. Notable individuals/companies who just received funds from a government-sanctioned entity: – Jimmy Fallon– Shaquille O’Neal– PUMA– Randi Zuckerberg– Logan Paul– Brian Armstrong– Steve Aoki– Uk...

Circle plans to only support Ethereum PoS chain after Merge is complete

On Tuesday, Circle, the issuer of the USD Coin (USDC) stablecoin, pledged its full support for the transition of Ethereum to a proof-of-stake, or PoS, blockchain after the much-anticipated Merge upgrade. The firm views the Merge as an important milestone in the scaling of the Ethereum ecosystem, writing: “USDC has become a core building block for Ethereum DeFi innovation. It has facilitated the adoption of L2 solutions and helped broaden the set of use cases that today rely on Ethereum’s vast suite of capabilities. We understand the responsibility we have for the Ethereum ecosystem and businesses, developers and end users that depend on USDC, and we intend to do the right thing.” Currently, USDC is both the largest dollar-backed stablecoin issued on Ethereum and the largest ERC-20 asset ov...

Curve Finance resolves site exploit, directs users to revoke any recent contracts

On Aug 9, automated market maker Curve Finance took to Twitter to warn users of an exploit on its site. The team behind the protocol noted that the issue, which appeared to be an attack from a malicious actor, was affecting the service’s nameserver and frontend. Don’t use https://t.co/vOeMYOTq0l site – nameserver is compromised. Investigation is ongoing: likely the NS itself has a problem — Curve Finance (@CurveFinance) August 9, 2022 Curve stated via Twitter that its exchange — which is a separate product — appeared to be unaffected by the attack, as it uses a different DNS provider. However, the issue was quickly addressed by the team. An hour after the initial warning, Curve said it had both found and reverted the issue, directing users to have approved any contracts o...

1inch plugs into Klaytn as Asia continues to climb aboard

South Korea’s most popular metaverse blockchain Klaytn is set to benefit from deeper liquidity and improved token swaps through a new partnership with decentralized finance (DeFi) protocol 1inch Network. Klaytn has enjoyed success in South Korea as the country continues to see prolific nonfungible token (NFT) and GameFi use. Klaytn is a product of tech behemoth Kakao, which commands a user base of some 52 million people that use its flagship KakaoTalk application and suite of software products. Klaytn derived its proprietary blockchain technology from the Ethereum Virtual Machine and powers various play-to-earn and AAA games, NFT marketplaces and Metaverses. As its user base continues to grow, the platform is looking to improve its scalability, efficiency and affordability. Klaytn al...

Bitcoin dominance hits 6-month lows as metric proclaims new ‘alt season’

Bitcoin (BTC) is facing fresh competition from altcoins this month as data shows that — technically — it is already “alt season.” Figures from CoinMarketCap and TradingView show that BTC currently makes up around 41% of the overall crypto market capitalization — its lowest since the start of 2022. Bitcoin sheds market cap prowess After suffering at the hands of the Terra LUNA — now renamed Terra Classic (LUNC) — collapse, altcoin markets have rallied considerably in recent months. Alongside Bitcoin’s return from 18-month lows of $17,600 in June, altcoins have enjoyed their own renaissance, one tha is now giving Bitcoin bulls a run for their money. According to CoinMarketCap, Bitcoin’s market cap share is now at its lowest since mid-January, with the larg...

Is your SOL safe? What we know about the Solana hack | Find out now on The Market Report

On this week’s episode of “The Market Report,” Cointelegraph’s resident experts discuss the latest updates concerning the recent Solana (SOL) hack. To kick things off, we broke down the latest news in the markets this week: Bitcoin realized price bands form key resistance as bulls lose $24K, significant whale activity between $22,000 and $24,800 adds to the complexity of the current spot market setup. Bitcoin (BTC) consolidated lower on Aug. 9 after familiar resistance preserved a multi-month trading range. When will we finally break out of this price range and make the move towards $30K? Institutions flocking to Ethereum for 7 straight weeks as Merge nears: Report, “Greater clarity” around the Merge has driven institutional inflows into Ethereum products, according to a CoinShares report....

BitMEX former executive pleads guilty to violating the Bank Secrecy Act

Another top executive joins three co-founders of the crypto exchange BitMEX, pleading guilty in the United States District Court for the Southern District of New York. The court case under the headline “U.S. v. Hayes et al.” goes on for two years, with BitMEX management being indicted for violating the U.S. Bank Secrecy Act. According to the Wall Street Journal, on Aug. 8, a one-time head of business development at BitMEX, Gregory Dwyer, admitted his guilt of violating the Bank Secrecy Act in court. As part of a plea deal, Dwyer would pay a $150,000 fine. As Manhattan Attorney Damian Williams commented on this development: “Today’s plea reflects that employees with management authority at cryptocurrency exchanges, no less than the founders of such exchanges, cannot willfu...