crypto blog

Senators Stabenow, Boozman introduce crypto bill that extends CFTC’s regulatory powers

United States Senate Agriculture Committee chair Debbie Stabenow and ranking member John Boozman introduced the Digital Commodities Consumer Protection Act bill on Wednesday. The bill has been expected for several months. Like the Digital Commodities Exchange Act (DCEA) introduced into the House of Representatives by members of the House Agriculture Committee in April, the new bill enlarges the role of the Commodity Futures Trading Commission (CFTC). The new bill is not the companion to the DCEA, however. According to the summary, the bill’s definition of digital commodities “includes Bitcoin and Ether and excludes certain financial instruments including securities,” which are regulated by the Securities and Exchange Commission (SEC). The bill mandates registration by t...

EU crypto community has two weeks to join conversation on crypto data

The European Union’s securities regulator continues to strengthen its focus on cryptocurrency regulation, initiating a move to implement increased scrutiny of crypto transactions. The European Securities and Markets Authority (ESMA) on Tuesday issued a public tender document aiming to collect additional information about trading data on crypto transactions. The regulator is specifically looking for “crypto off-chain data” or crypto-related transactions that do not originate from a blockchain. According to ESMA, such transactions include spot and derivatives trade at centralized exchanges or over-the-counter trading platforms. “The coverage should encompass all major exchanges and crypto assets so that it provides a fair representation of the crypto market landscape,” the document reads.&nb...

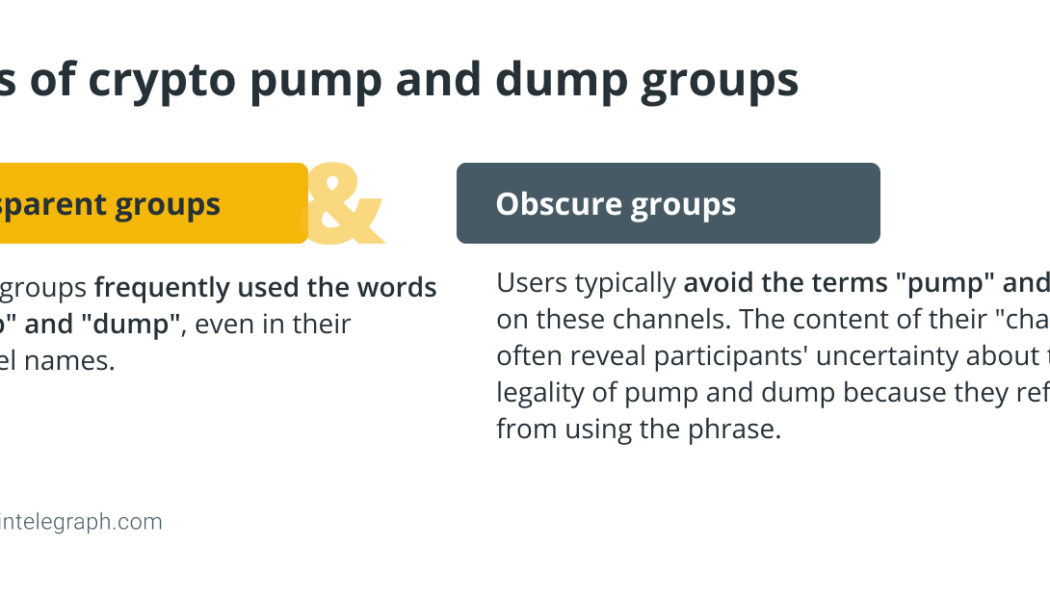

What are crypto pump and dump groups? Are they legal?

Pump-and-dump operations, which fraudulently manipulate prices by disseminating false information, have existed in economic contexts since at least the 1700s. For instance, con artists with shares in the South Sea Company started making false statements about the business and its revenues in the beginning of the eighteenth century. The plan was to inflate the stock price artificially before selling it to uninformed consumers misled into thinking they were investing in a promising good. Contemporary con artists are following their example with a pump-and-dump strategy known as the South Sea Bubble. However, with the advent of blockchain technology and the rise of crypto trading, the issue has become broader and more severe. Because government regulation has lagged, cryptocurrencies ar...

Solana wallets ‘compromised and abandoned’ as users warned of scam solutions

The cryptocurrency ecosystem has been rocked by a widespread exploit targeting Solana wallets that have been ongoing since Aug. 3. Phantom and Slope, two Solana-based wallet services, initially flagged the attack on their social media platforms, alongside a host of cryptocurrency influencers, blockchain analytic and security firms and victims of the hack as it continued to unfold. A handful of commentators noted that attackers had gained access to user private keys, as transactions were signed on the chain legitimately. Ava Labs CEO and founder Emin Gun Sirer estimated that more than 7,000 wallets had been affected, a number cited by various other individuals and firms online. As investigations begin to unpack the root cause that allowed an attacker to pillage thousands of wallets, affecte...

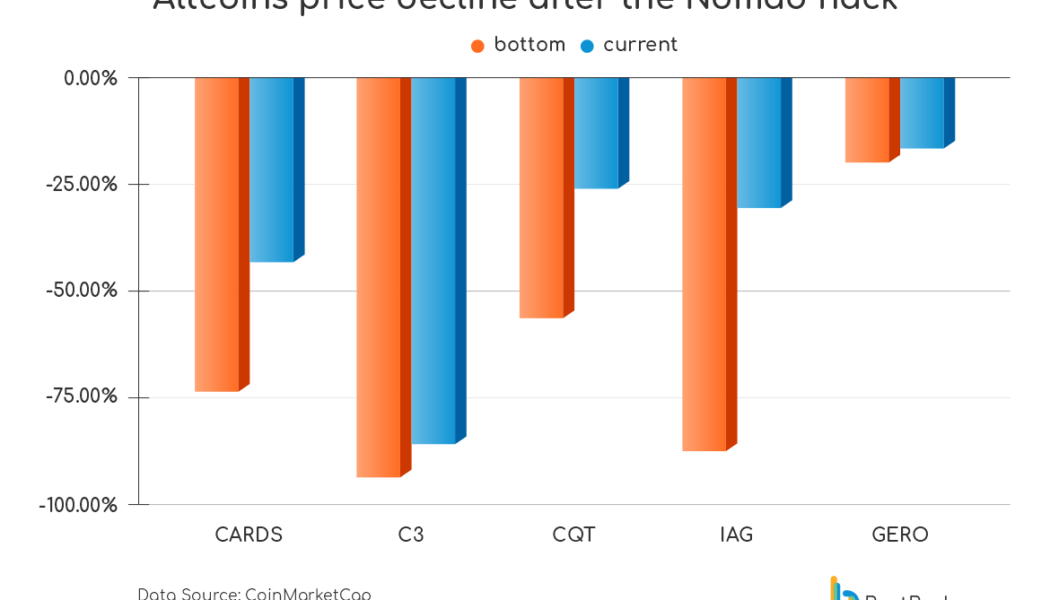

Nomad reportedly ignored security vulnerability that led to $190M exploit

The Nomad token bridge hack on Aug. 3 was the fourth largest crypto hack in history that saw nearly $200 million worth of crypto assets drained from the platform. However, more than the hack, the methodology behind it garnered widespread attention. The exploit took place due to a smart contract vulnerability that saw hundreds of users other than the hacker also get involved, taking away as much as they can by simply copy-pasting the transaction data used by the initial hacker and changing the wallet address to theirs. The event was later deemed as a decentralized robbery by many due to the involvement of normal community members. Later, the Nomad team revealed to Cointelegraph that some of the people who took funds were acting benevolently to protect the crypto from getting into the w...

‘This is on me’ — Robinhood CEO to lay off 23% of staff after Q2 loss

Online brokerage firm Robinhood will lay off nearly a quarter of its employees, citing a continued deterioration of the macro environment and a broad crypto market crash. The bad news came in a Tuesday blog post from co-founder and CEO Vlad Tenev, on the same day the firm released tepid Q2 financial results and the New York State Department of Financial Services announced a $30 million fine for the company’s crypto branch due to alleged Anti-Money Laundering, cybersecurity and consumer protection violations. Tenev wrote that the layoffs would impact all functions in the company, particularly operations, marketing, and program management, with around 23% of the staff let go. The Financial Times estimated the number of employees impacted to be around 780. “Departing Robinhoodies ...

Textbook publisher Pearson wants to use NFTs to capture second-hand sales

Textbook publisher Pearson has revealed its plans to use non-fungible tokens (NFTs) to keep track of digital textbook sales and effectively “diminish the secondary market.” According to a Bloomberg report on August 1, Pearson CEO Andy Bird wants to assign NFTs to its digital textbooks in order to keep better track of sales and capture revenue that was previously lost on the secondhand market. Bird hopes the company can use the technology to earn commission on second-hand sales of its textbooks, which are normally done privately from one student to another. Bird noted: “Technology like blockchain and NFTs allows us to participate in every sale of that particular item as it goes through its life. The possibility to participate in downstream revenues […] I find really interesting....

Ongoing Solana-based wallet hack seeing millions drained

An ongoing, widespread hack has seen as much as $8 million in funds drained so far across a number of Solana-based hot wallets. At the time of writing, Solana (SOL) is currently trending on Twitter as countless users are either reporting on the hack as it unfolds, or are reporting to have lost funds themselves, warning anyone with Solana-based hot wallets such as Phantom and Slope wallets to move their funds into cold wallets. Blockchain investigator PeckShield on August 2 said the widespread hack is likely due to a “supply chain issue” which has been exploited to steal user private keys behind affected wallets. It said the estimated loss so far is around $8 million. #PeckShieldAlert The widespread hack on Solana wallets is likely due to the supply chain issue exploited t...

Contagion only hit firms with ‘poor balance sheet management’ — Kraken Aus boss

The crypto contagion sparked by Terra’s infamous implosion this year only spread to companies and protocols with “poor balance sheet management” and not the underlying blockchain technology, says Kraken Australia’s managing director Jonathon Miller. Speaking with Cointelegraph, the Australian crypto exchange head argued that sectors such as Ethereum-based decentralized finance (DeFi) revealed its fundamental strength this year by weathering severe market conditions: “Some of the contagion that we saw across some of the lending models in the space, [was in] this traditional finance kind of lending model sitting on top of crypto. But what we didn’t see is a kind of catastrophic failure of the underlying protocols. And I think that’s been recognized by a lot of people.” “Platforms...

Crypto users spent $2.7B minting NFTs in first half of 2022: Report

According to new market research published by blockchain data firm Nansen, crypto users spent 963,227 Ether (ETH), worth $2.7 billion, minting nonfungible tokens (NFTs) on the Ethereum blockchain in the first half of 2022. An overwhelming majority of minting took place on OpenSea.io. Minting occurred across 1.088 million unique wallet addresses on Ethereum during this period, Nansen said. In comparison, about $107 million worth of NFTs were minted on BNB Chain and $77 million for Avalanche. A total of 263,800 unique wallet addresses were involved in NFT minting on the two blockchains. 1/ Market participants spent 963,227 $ETH (approximately $2.7b) on minting NFTs in the first half of 2022. So what did the NFT projects do with the money they raised? Read our latest research here: http...

CoinShares reports $21.7M loss tied to Terra implosion

On Tuesday, European cryptocurrency investment firm CoinShares posted its interim Q2 2022 results. Compared to the prior year’s quarter, the firm’s revenue declined from 19.6 million pounds ($23.89 million) to 14.2 million pounds ($17.31 million). At the same time, its net income fell from 26.6 million pounds ($32.42 million) in Q1 2021 to 0.1 million pounds ($0.12 million). CoinShares explained that the losses were largely tied to its exposure to the Terra (LUNA) — now called Terra Classic (LUNC) — ecosystem, which collapsed in May of this year: “While our Asset Management business continued to generate solid profit, the Capital Markets business experienced a one-off loss of £17.7 million following the de-pegging of Terra Luna. The financial impact of this epi...