crypto blog

Top 5 cryptocurrencies to watch this week: BTC, BNB, UNI, FIL, THETA

Bitcoin (BTC) has made a strong comeback in the month of July and is on track for its best monthly gains since October 2021. The sharp recovery in Bitcoin and several altcoins pushed the Crypto Fear and Greed Index to 42/100 on July 30, its highest level since April 6. Investors seem to be making the most of the depressed levels in Bitcoin. Data from on-chain analytics firm Glassnode shows that Bitcoin in exchange wallets has dropped to 2.4 million Bitcoin in July, down from the March 2020 levels of 3.15 million Bitcoin. This has sent the metric to its lowest level since July 2018. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodity strategist Mike McGlone highlighted that the United States Federal Reserve’s indication to consider rate hikes on a “meeting...

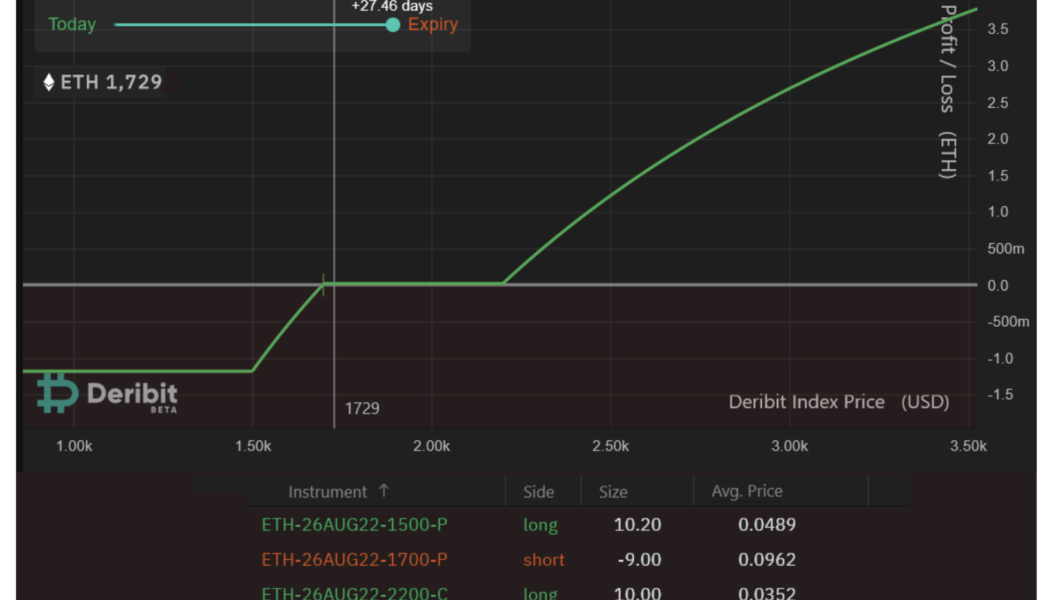

Pro traders may use this ‘risk averse’ Ethereum options strategy to play the Merge

Ether (ETH) is reaching a make-it or break-it point as the network moves away from proof-of-work (PoW) mining. Unfortunately, many novice traders tend to miss the mark when creating strategies to maximize gains on potential positive developments. For example, buying ETH derivatives contracts is a cheap and easy mechanism to maximize gains. The perpetual futures are often used to leverage positions, and one can easily increase profits five-fold. So why not use inverse swaps? The main reason is the threat of forced liquidation. If the price of ETH drops 19% from the entry point, the leveraged buyer loses the entire investment. The main problem is Ether’s volatility and its strong price fluctuations. For example, since July 2021, ETH price crashed 19% from its starting point within 20 d...

The worst places to keep your crypto wallet seed phrase

Under the mattress, in the seams of a piece of luggage or even rolled into a cigar, what are the worst and best ways for keeping a seed phrase safe? The key to unlocking and recovering cryptocurrency, a seed phrase, should be secured and safe. Especially now that prices are low and the crypto tourists have checked out, it might be time for a crypto security spring clean. Security starts with a seed phrase, sometimes called a recovery phrase. There’s no denying it: Bitcoin and the crypto space writ large are in the clutches of a bear market. Since Do Kwon’s Terra experiment went up in smoke, a crypto contagion has choked the most reputable of exchanges, causing many self-sovereignty advocates to chant, “not your keys, not your coins.” Indeed, hardly a day goes by that another “trusted...

Crypto contagion deters investors in near term, but fundamentals stay strong

The past six-odd months have been nothing short of a financial soap opera for the cryptocurrency market, with more drama seemingly unfolding every other day. To this point, since the start of May, a growing number of major crypto entities have been tumbling like dominoes, with the trend likely to continue in the near term. The contagion, for the lack of a better word, was sparked by the collapse of the Terra ecosystem back in May, wherein the project’s associated digital currencies became worthless almost overnight. Following the event, crypto lending platform Celsius faced bankruptcy. Then Zipmex, a Singapore-based cryptocurrency exchange, froze all customer withdrawals, a move that was mirrored by crypto financial service provider Babel Finance late last month. It is worth noting that si...

Bitcoin due ‘one of greatest bull markets’ as July gains circle 20%

Bitcoin (BTC) spoofed a breakout to fresh six-week highs into July 31 as a showdown for both the weekly and monthly close drew near. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Bart Simpson” greets traders into BTC monthly close Data from Cointelegraph Markets Pro and TradingView showed BTC/USD canceling out all its gains from early in the weekend, dropping from $24,670 to $23,555 in hours. The resulting chart structure was all too familiar to long-term market participants, creating a “Bart Simpson” shape on hourly timeframes. Liquidations nonetheless remained manageable, with the cross-crypto tally totaling $150 million in the 24 hours to the time of writing, according to data from analytics resource Coinglass — less than on previous days. Crypto liquidations chart. ...

6 Questions for Kim Hamilton Duffy of Centre

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Kim Hamilton Duffy, director of identity and standards at Centre Consortium — an open-source technology project designed to create a more inclusive global economy. Kim is a leader in the emerging decentralized identity field and has architected successful open-source projects such as Verite, Blockcerts and the Digital Credential Consortium toolkit. 1 — Which countries are doing the most to support blockchain, and which ones will be left behind? Rather than assessing this through the narrow lens of whether certain crypto transactions are taxed, I think about whether countries are supporting innovati...

Charles Schwab’s asset management arm launches crypto-linked ETF

Schwab Asset Management, the asset management arm of financial giant Charles Schwab, has launched an exchange-traded fund (ETF) with exposure to firms linked to cryptocurrencies. In a Friday announcement, Schwab said its Crypto Thematic ETF was expected to be available for trading on the New York Stock Exchange’s Arca under the ticker STCE on Aug. 4. The fund tracks Schwab’s Crypto Thematic Index, providing an investment vehicle with exposure to companies “that may benefit from the development or utilization of cryptocurrencies and other digital assets.” Likely because the United States Securities and Exchange Commission, or SEC, has not given the green light to ETFs providing direct exposure to Bitcoin (BTC), the Schwab fund will indirectly invest in crypto through companies. Schwab...

Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

Bitcoin (BTC) may already be beginning its new macro uptrend if historical “hodl” habits repeat. That was the conclusion from research into the latest data covering the amount of the BTC supply dormant for one year or more as of July 2022. Hodled BTC hints that the bear market is over According to independent analyst Miles Johal, who uploaded the findings to social media on July 29, a “rounded top” formation in “hodled” BTC is in the process of completing. Once it does, the price should react — just like on multiple occasions before. The clue lies in Bitcoin’s HODL Waves metric, which breaks down the supply according to when each Bitcoin last moved. One year ago or more — the one-year HODL Wave — currently reflects the majority of the supply. Johal’s accompanying ch...

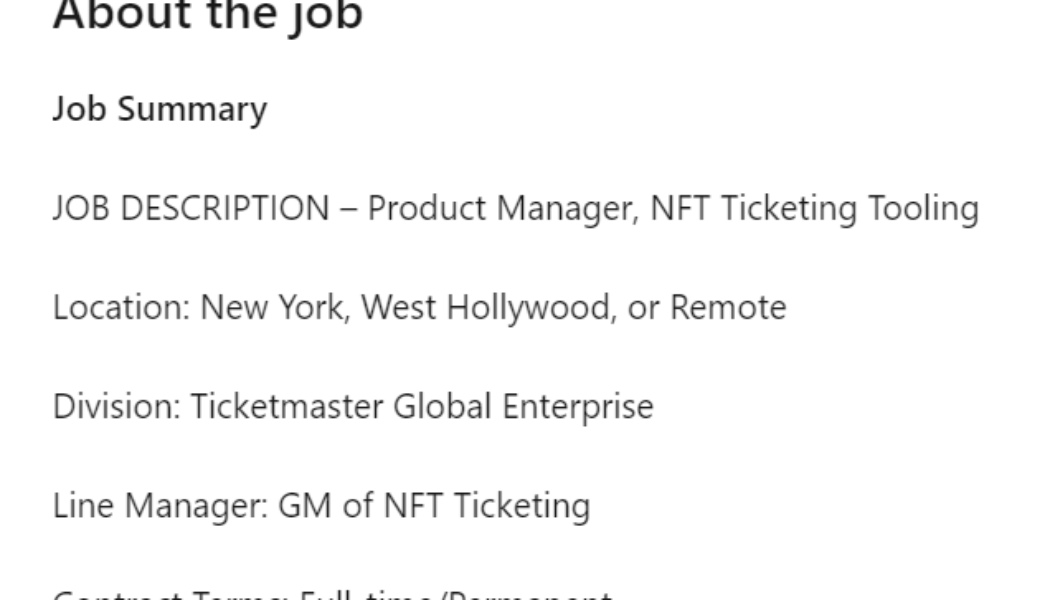

Ticketmaster scouts productization of enterprise NFTs beyond ticketing

A new job posting by America’s biggest ticketing company, Ticketmaster, reveals mainstream interest in exploring new revenue streams using nonfungible tokens (NFTs). Over the past two years, artists, musicians and the sports industry helped thrust the NFT ecosystem into the limelight as the technology served its purpose as a powerful fan engagement tool. Conversely, most of the general public boarded the hype train seeking profits via reselling collectibles in the secondary markets. With the NFT hype eventually slowing down by mid-2022, entrepreneurs and companies are looking for new use cases beyond collectibles. A study conducted by Big 4 accounting firm Deloitte in May 2022 highlighted the untapped potential of the crypto ecosystem to open up newer markets for the sports industry:...

Ethereum will outpace Visa with zkEVM Rollups, says Polygon co-founder

zkEVM Rollups, a new scaling solution for Ethereum, will allow the smart contract protocol to outpace Visa in terms of transaction throughput, said Polygon co-founder Mihailo Bjelic in a recent interview with Cointelegraph. Polygon recently claimed to be the first to implement a zkEVM scaling solution, which aims at reducing Ethereum’s transaction costs and improving its throughput. This layer-2 protocol can bundle together several transactions and then relay them to the Ethereum network as a single transaction. The solution, according to Bjelic, represents the Holy Grail of Web3 as it offers security, scalability and full compatibility with Ethereum, which means developers won’t have to learn a new programing language to work with it. “When you launch a scaling solution,...