crypto blog

KuCoin crypto exchange debuts USDT-dominated NFT ETF

Seychelles-headquartered cryptocurrency exchange KuCoin has launched an exchange-traded fund (ETF) tied to major nonfungible token (NFT) assets like Bored Ape Yacht Club (BAYC). KuCoin’s NFT ETF Trading Zone went live on Friday, the firm announced. The new investment product is launched in collaboration with NFT infrastructure provider Fracton Protocol. The KuCoin NFT ETF is a Tether (USDT)-dominated product that marks particular underlying NFT assets like Bored Ape Yacht Club. BAYC is one of five NFT ETFs that KuCoin is launching. Trading under the symbol hiBAYC, the asset is an ERC-20 token representing 1/1,000,000 ownership of the target BAYC in the BAYC meta-swap of Fracton Protocol. The ETF aims to increase liquidity as it enables exposure to NFTs via the USDT stablecoin instead of Et...

Pro-Russian groups raised only 4% of crypto donations sent to Ukraine

According to data from crypto analytics firm Chainalysis, users have sent more than $2 million in crypto to 54 pro-Russian groups since Feb. 24, a fraction of that received by many wallets controlled by the Ukrainian government. In a Friday blog post, Chainalysis said it had tracked funds sent to social media accounts controlled by pro-Russian groups in Bitcoin (BTC), Ether (ETH), Litecoin (LTC), USDT-TRX, and Dogecoin (DOGE) starting with the country’s invasion of Ukraine in February. According to Chainalysis’ data, users sent roughly $2.2 million to the pro-Russian groups, with more than $1 million going to a single unnamed account. While there may be other groups outside of Chainalysis’ investigation of those supporting pro-Russian forces, the available data suggested that the $2.2 mill...

Crypto pumps after Fed rate hike, Zuckerberg pins hopes on Metaverse making hundreds of billions and Tesla posts $64M BTC gain: Hodler’s Digest, July 24-30

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week ‘Bullish rate hike’ — Why crypto spiked in the face of bad news Despite the U.S. Federal Reserve announcing a 75-basis-point interest rate hike on Wednesday, the crypto markets pumped significantly on the same day with the momentum continuing through the week. Quantum Economics founder and CEO Mati Greenspan jokingly called it a “bullish rate hike” and stated that investors were clearly expecting far worse. Analysts such as Swyftx’s Pav Hundal suggested the recent rally may be due to an easing of inflationary ...

Argentinean soccer club welcomes first crypto signing amid economic downturn

Argentina’s economic restrictions have reached the sports industry, with the first signing of a local football player with cryptocurrencies hitting national headlines. The transfer of midfielder Giuliano Galoppo from Banfield’s Athletic Club to Sao Paulo Futebol Clube was made in USD Coin (USDC), exceeding $6 million and up to $8 million depending on the volatile exchange rate of the Argentine peso, according to local sources. The transfer was made possible through a collaboration with the Mexican crypto exchange Bitso. “We are very proud to work with these two clubs for this historical signing of Sao Paulo with all the safety, transparency and flexibility that the crypto economy has to offer,” said Thales Freitas, Bitso’s director in Brazil. The transfer happened amid a difficult ec...

How NFTs can boost fan engagement in the sports industry

Nonfungible tokens (NFTs) have grown a lot in popularity since the release of CryptoKitties in 2017, with the sector expected to move over $800 billion in the next two years. Some of the most well-known use cases for NFTs are picture-for-proof projects such as the Bored Ape Yacht Club and play-to-earn gaming projects. NFTs have also attracted attention from the sports industry, with professional sports leagues setting up their own platforms for fans to engage with their favorite teams or players, but that will be discussed later in this story. NFTs are unique and non-interchangeable pieces of code stored on the blockchain. These strings of alpha-numerical code can be linked to assets such as artwork or digital and physical goods. NFTs are created through a process known as minting, a...

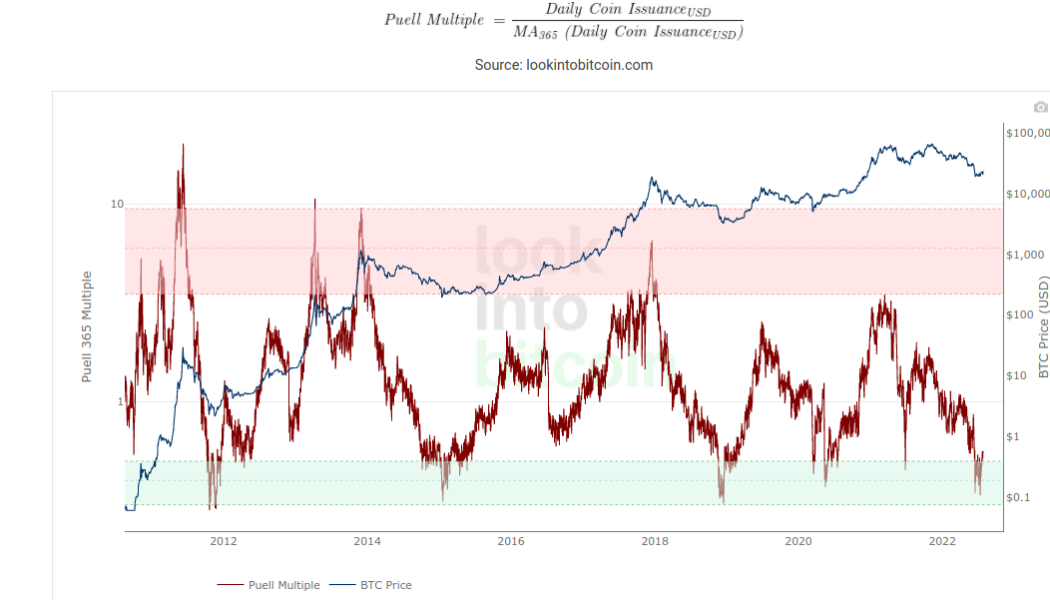

Historically accurate Bitcoin metric exits buy zone in ‘unprecedented’ 2022 bear market

Bitcoin (BTC) is enjoying what some are calling a “bear market rally” and has gained 20% in July, but price action is still confusing analysts. As the July monthly close approaches, the Puell Multiple has left its bottom zone, leading to hopes that the worst of the losses may be in the past. Puell Multiple attempts to cement breakout The Puell Multiple one of the best-known on-chain Bitcoin metrics. It measures the value of mined bitcoins on a given day compared to the value of those mined in the past 365 days. The resulting multiple is used to determine whether a day’s mined coins is particularly high or low relative to the year’s average. From that, miner profitability can be inferred, along with more general conclusions about how overbought or oversold the market...

Can blockchain be used without cryptocurrency?

A blockchain without cryptocurrency is a distributed ledger that stores data associated with nonfungible tokens (NFTs), supply chain initiatives, the Metaverse and more. Even though Bitcoin (BTC) is the most known application of a decentralized ledger or blockchain, there is a wide range of other uses of blockchain technology. For instance, blockchain technology can be utilized in various financial services including remittances, digital assets and online payments because it enables payments to be settled without a bank or other middleman. Furthermore, the next generation of internet interaction systems including smart contracts, reputation systems, public services, the Internet of Things (IoT) and security services are among blockchain technology’s most promising applications.&a...

Dubai permits full operation to FTX subsidiary FZE via first MVP license

On Friday, FZE, a subsidiary of crypto exchange FTX, was awarded Dubai’s first Minimal Viable Product (MVP) license, allowing full operation of the exchange in the region. Dubai’s Virtual Asset Regulatory Authority (VARA) issued the operating license to FZE under the MVP program, which according to Helal Saeed Almarri, the director general of Dubai WTC Authority, is designed for secure and sustainable growth in Dubai. For now, the FTX FZE exchange’s operations are in the test phase and will be focused on providing various crypto services. According to FTX CEO Sam Bankman-Fried, the newly licensed exchange will operate under a model incorporating regulatory oversight and Financial Action Task Force (FATF) compliance controls catering to Tier 1 international financial markets. In addit...

Positivity blazing through a bear market: Blockchain Economy Istanbul 2022

Held at Hilton Bomonti, a fancy hotel next to a renovated and repurposed beer factory in Istanbul, the fourth iteration of the Blockchain Economy Summit 2022 (BE2022) proved to be a significant step-up compared to its pre-pandemic predecessors. The previous summit, BE2020, was held at the WOW Convention Center two years back. In addition to being situated in a harder-to-reach part of Istanbul, the summit coincided with the COVID-19 outbreak, further impacting the overall attendance. Since the sole purpose of that venue was organizing large-scale events, the crypto community from two years prior was just not big enough to fill the space. As a direct result of the aforementioned factors, the BE2020 felt like a two-day trip to a ghost town. Pre-show pictures: Great music and performances at @...

Uniswap’s 80% gains in July are in danger with UNI price painting a classic bearish pattern

Uniswap (UNI) looks ready to post its best monthly performance in more than a year as it rallied approximately 80% in July, but signs of an extended pullback in the near term are emerging. Uniswap price nearly doubles in July UNI’s price is having one of its best months ever, reaching nearly $9 on July 30 versus nearly $5 at the beginning of the month, best returns since January 2021’s 250% price rally. UNI/USD monthly price chart. Source: TradingView Merge FOMO an UNI “fee switch” proposal Uniswap’s gains primarily surfaced due to similar upside moves in a broader crypto market. But they turned out to be relatively massive due to an ongoing euphoria surrounding “the Merge.” Notably, the Ethereum blockchain’s potential transition ...

Bitcoin price eyes $24K July close as sentiment exits ‘fear’ zone

Bitcoin (BTC) dropped volatility on the last weekend of July as the monthly close drew near. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView 200-week moving average in focus for July close Data from Cointelegraph Markets Pro and TradingView showed BTC/USD retaining $24,000 as resistance into July 30. The pair had benefitted from macro tailwinds across risk assets in the second half of the week, these including a flush finish for United States equities. The S&P 500 and Nasdaq Composite Index gained 4.1% and 4.6% over the week, respectively. With off-speak trading apt to spark volatile conditions into weekly and monthly closes thanks to thinner liquidity, however, analysts warned that anything could happen between now and July 31. “Just gonna sit back and watch the market up ...

Bitcoin price rejects at $24K as ‘classic short setup’ spoils bulls’ fun

Bitcoin (BTC) saw fresh volatility after July’s final Wall Street open as highs north of $24,000 remained solid resistance. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Resistance strikes BTC at $24,000 Data from Cointelegraph Markets Pro and TradingView reflected bulls’ continuing struggle as BTC/USD lurched around the $24,000 mark on July 29. The pair had attempted to match the week’s local top of $24,450, this ultimately failing to materialize as a resurgent U.S. dollar pressured crypto despite the gains of U.S. stocks . The U.S. dollar index (DXY) continued higher during the Wall Street trading, passing 106 after falling to its lowest levels since July 5. U.S. dollar index (DXY) 1-hour candle chart. Source: TradingView Record eurozone inflation&nbs...