crypto blog

Voyager rejects Alameda buyout offer as it ‘harms customers’

Centralized crypto lender Voyager Digital Holdings has rejected an offer from FTX and its investment arm Alameda Ventures to buyout its digital assets on the grounds that the actions “are not value-maximizing” and potentially “harms customers.” In a rejection letter filed in court on July 24 as part of its ongoing bankruptcy proceedings, Voyager’s lawyers denounced the offer made public by FTX, FTX US, and Alameda on July 22 to buy out all of Voyager’s assets and outstanding loans – except the defaulted loan to 3AC. The letter states that making such offers public could jeopardize any other potential deals by subverting “a coordinated, confidential, competitive bidding process,” adding “AlamedaFTX violated many obligations to the Debtors and the Bankruptcy Cou...

Stablecoin projects need collaboration, not competition: Frax founder

Stablecoin projects need to take a more collaborative approach to grow each other’s liquidity and the ecosystem as a whole, says Sam Kazemian, the founder of Frax Finance. Speaking to Cointelegraph, Kazemian explained that as long as stablecoin “liquidity is growing proportionally with each other” through shared liquidity pools and collateral schemes, there won’t ever be true competition between stablecoins. Kazemian’s FRAX stablecoin is a fractional-algorithmic stablecoin with parts of its supply backed by collateral and other parts backed algorithmically. Kazemian explained that growth in the stablecoin ecosystem is not a “zero-sum game” as each token is increasingly intertwined and reliant on each other’s performance. FRAX uses Circle’s USD Coin (USDC) as a porti...

Yuga Labs ‘inappropriately induced’ BAYC investors: Class action

A proposed class-action lawsuit alleges that Yuga Labs “inappropriately induced” the community to buy Bored Ape Yacht Club non-fungible tokens (NFTs) and the project’s affiliated ApeCoin (APE) token. The proposed class-action driven by law firm Scott+Scott was published on July 21, claiming that Yuga Labs used celebrity promoters and endorsements to “inflate the price” of the BAYC NFTs and the APE token. It also alleges that Yuga Labs promoted the growth prospects and chance for huge returns on investment to “unsuspecting investors.” “After selling off millions of dollars of fraudulently promoted NFTs, YUGA LABS launched the Ape Coin to further fleece investors.” “Once it was revealed that the touted growth was entirely dependent on continued promotion (as opposed to actual utility or unde...

The Merge is Ethereum’s chance to take over Bitcoin, researcher says

Ethereum researcher, Vivek Raman, is convinced that Ethereum’s (ETH) upcoming transition to a proof-of-stake system will enable it to take over Bitcoin’s (BTC) position as the most prominent cryptocurrency. “Ethereum does have, just from an economic perspective and because of the effect of the supply shock, a chance to flip Bitcoin,” said Raman in an exclusive interview with Cointelegraph. [embedded content] The Merge, a long-awaited upgrade that will complete Ethereum’s transition from a proof-of-work to a proof-of-stake system, is set to take place in September. In addition, The Merge will transform Ethereum’s monetary policy, making the network more environmentally sustainable and reducing ETH’s total supply by 90%. “After The Merge, Ether...

Top 5 cryptocurrencies to watch this week: BTC, ETH, BCH, AXS, EOS

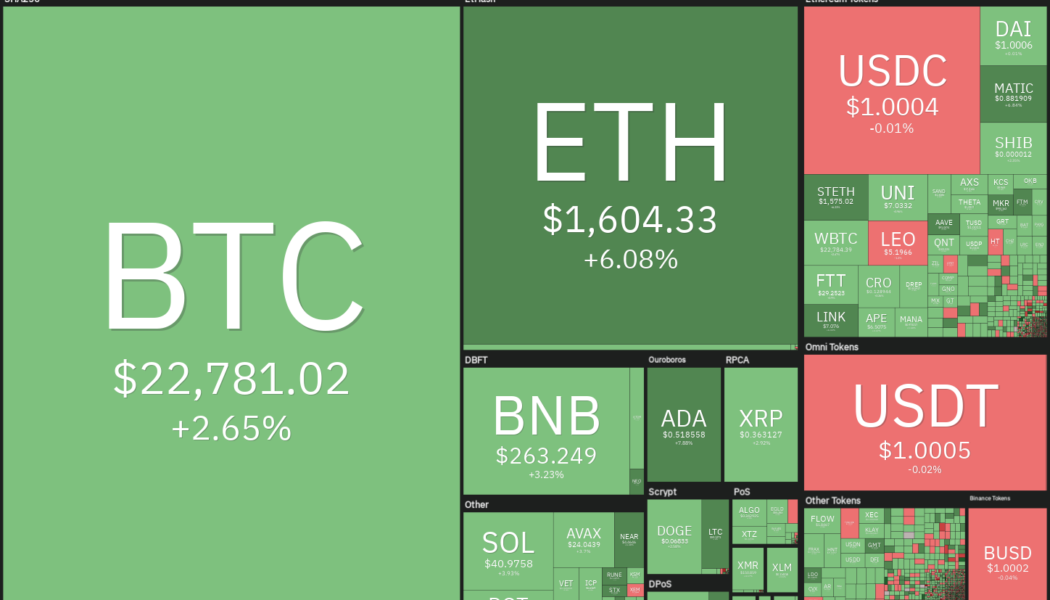

The bulls are attempting to achieve a strong weekly close for Bitcoin (BTC), while the bears are attempting to regain their advantage. Analysts are closely watching the 200-week moving average which is at $22,705 and BTC’s current setup suggests that a decisive move is imminent. Many analysts expect a weekly close above the 200-week MA to attract further buying but a break below it could signal that bears are back in the game. Although the short-term picture looks uncertain, analyst Caleb Franzen said that Bitcoin has been in an accumulation zone since May. Crypto market data daily view. Source: Coin360 Meanwhile, on-chain analytics firm CryptoQuant highlighted increasing outflows of Ether (ETH) from major exchanges, totaling $1.87 million coins on July 22. Usually, outflows fr...

Bitcoin must close above $21.9K to avoid fresh BTC price crash — trader

Bitcoin (BTC) found strength at $22,000 into July 24 with bulls still aiming for a solid green weekly close. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Classic levels for end-of-week price focus Data from Cointelegraph Markets Pro and TradingView showed BTC/USD halting a weekend drop at $21,900 to return towards the $23,000 on the day. The pair held a trading range closely focused on key long-term trendlines, which analysts had previously described as essential to reclaim. These included the 50-day and 200-week moving averages (MAs), the latter particularly important as support during bear markets but which had acted as resistance since May. “Bullish that we perfectly held the 13d ema + horizontal 21.9k,” popular Twitter trading account CryptoMellany argued in part of her ...

6 Questions for Pat Duffy of The Giving Block

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Pat Duffy, co-founder of The Giving Block — a crypto donation solution that provides an ecosystem for nonprofits and charities to fundraise Bitcoin and other cryptocurrencies. Pat is co-founder of The Giving Block, and has raised over $100,000,000 in crypto for nonprofits in the last year. From 2020 to 2022, Pat and his co-founder Alex Wilson grew The Giving Block from a four-person team into one of the fastest growing companies in the nonprofit sector, with thousands of nonprofit clients and the world’s largest crypto donor community. 1 — What is the main hurdle to mass adoption of blockchain tech...

Axie Infinity is painting a giant bearish pattern — will AXS price crash another 95%?

Axie Infinity (AXS) has been forming a giant bearish reversal pattern since July last year, which could send its prices down by another 95% in 2022. AXS risks one big breakdown Dubbed the “inverted cup and handle,” the pattern is identified by its large crescent shape followed by a modest upward retracement. It typically resolves after the price breaks out of the rising channel, followed by another break below the cup-and-handle’s neckline support. Meanwhile, as a rule of technical analysis, an inverted cup and handle breakout leads the price to the level at length equal to the maximum distance between the structure’s top and support. AXS’s price rally during the second half of 2021, followed by its complete wipeout in 2022, makes a crescent shape trend, which...

Bitcoin wobbles on Wall Street open as Ethereum hits $1.6K in 6-week high

Bitcoin (BTC) took a step back as Wall Street trading began on July 22 after recovering most of its previous losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC bulls fail to sustain assault on multi-week high Data from Cointelegraph Markets Pro and TradingView confirmed BTC/USD encountering fresh resistance near $24,000. The pair had spent the past 24 hours slowly clawing back lost ground after news that Tesla had sold most of its BTC holdings. With the pre-announcement high of $24,280 still in force, bulls saw something of a setback as Wall Street opened on the day, with BTC/USD losing around $400. Analyzing the current order book structure on major exchange Binance, on-chain monitoring resource Material Indicators warned that the overall bear market structure re...

Ethereum Classic soars 100% in nine days outperforming ETH as ‘the Merge’ approaches

Ethereum Classic (ETC) has been outperforming its arch-rival Ethereum’s native token Ether (ETH) during the current crypto market rebound with the ETC/ETH pairs at 10-month highs. Why is ETC beating ETH? ETC’s price has risen to $27 on July 22, amounting to a 100% gain in nine days after bottoming out at $13.35. Comparatively, ETH’s price has seen a 64% rally in U.S. dollar terms. ETC/USD versus ETH/USD daily price chart. Source: TradingView Ethereum’s rebound has been among the sharpest among the top cryptocurrencies, primarily due to the euphoria surrounding its potential network upgrade in September. Dubbed “the Merge,” the long-awaited technical update will switch Ethereum from proof-of-work (PoW) to proof-of-stake (PoS). Anyone who believes the #Eth...

A short-term BTC rally or trend reversal? Find out now on ‘Market Talks’ with Crypto Jebb

The latest episode of Market Talks welcomes Nicholas Merten, the founder of DataDash, one of the largest cryptocurrency YouTube channels. Merten is an international speaker, thought leader and crypto analyst. He has utilized his 10-plus years of experience in traditional markets to understand the potential of cryptocurrencies and help his 515,000 YouTube subscribers make better investment decisions. One of the topics up for discussion with Merten isthe recent Bitcoin (BTC) price rally. Are the markets finally out of the sideways trend it’s been stuck in for months, or is this just another bull trap forming, with BTC to head back down below $20,000? With all seasoned traders and experts eyeing the BTC 200-week moving average, Merten is asked the significance of this indicator and why many c...