crypto blog

Hacker drains $1.08M from Audius following passing of malicious proposal

Proposals in crypto help communities make consensus-based decisions. However, for decentralized music platform Auduis, the passing of a malicious governance proposal resulted in the transfer of tokens worth $5.9 million, with the hacker making away with $1 million. On July 24, a malicious proposal (Proposal #85) requesting the transfer of 18 million Audius’ in-house AUDIO tokens was approved by community voting. First pointed out on Crypto Twitter by @spreekaway, the attacker created the malicious proposal wherein they were “able to call initialize() and set himself as the sole guardian of the governance contract.” Hello everyone – our team is aware of reports of an unauthorized transfer of AUDIO tokens from the community treasury. We are actively investigating and will report ...

California again allows crypto contributions to state, local political campaigns

Candidates for state and local offices in California will once again be allowed to accept donations in cryptocurrency after a ban was lifted by the state’s Fair Political Practices Commission (FPPC) on Thursday. The ban was imposed in 2018. California was one of nine states that had banned political contributions in crypto due to perceived transparency and Know Your Customer (KYC) issues. The question of contributions in crypto was revived in March when the commission issued an opinion on the sale of nonfungible tokens (NFTs) for campaign fundraising. In May, a report was prepared by the FPPC that examined three options for its crypto policy. Those were to maintain the ban or treat crypto like cash, with a $100 contribution cap, as is done in several states. The third option was to t...

Price analysis 7/22: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, MATIC, AVAX

In a downtrend, when markets do not respond negatively to bearish news, it is a sign that the selling may have reached exhaustion. Reports of electric vehicle maker Tesla dumping 75% of its Bitcoin (BTC) holdings in the second quarter only caused a minor blip as lower levels attracted strong buying from the bulls. Tesla was not the only institution that sold its Bitcoin. Arcane Research analyst Vetle Lunde highlighted in a Twitter thread that large institutions have sold 236,237 BTC since May 10. It is encouraging to note that even after huge selling by institutions and the unfavorable macro environment, Bitcoin has held up quite well. Daily cryptocurrency market performance. Source: Coin360 The current bear market allows an opportunity for new traders to enter at lower levels. A repo...

Ethereum price ‘cup and handle’ pattern hints at potential breakout versus Bitcoin

Ethereum’s native token Ether (ETH) has rebounded 40% against Bitcoin (BTC) after bottoming out locally at 0.049 on June 13. Now, the ETH/BTC pair is at two-month highs and can extend its rally in the coming weeks, according to a classic technical pattern. ETH paints cup and handle pattern Specifically, ETH/BTC has been forming a “cup and handle” on its lower-timeframe charts since July 18. A cup and handle setup typically appears when the price falls and then rebounds in what appears to be a U-shaped recovery, which looks like a “cup.” Meanwhile, the recovery leads to a pullback move, wherein the price trends lower inside a descending channel called the “handle.” The pattern resolves after the price rallies to an approximately equal size to ...

NFTs banned in Minecraft, SEC lists 9 tokens as securities and 3AC founder blames cockiness for company meltdown: Hodler’s Digest, July 17-23

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week 3AC founders reveal ties to Terra founder, blame overconfidence for collapse After five weeks of being AWOL, the founders of defunct crypto hedge fund Three Arrows Capital (3AC), Su Zhu and Kyle Davies, resurfaced via an interview with Bloomberg. The duo admitted to operating the firm with overconfidence as a result of the multi-year bull market. They also noted that they were very close with Terra founder Do Kwon and, despite running a major hedge fund, were shocked that the project’s extremely risky algorith...

Crypto Biz: The 3AC saga takes another bizarre twist

About eight months ago, I vouched pretty strongly for Su Zhu to be included in the prestigious Cointelegraph Top 100. My reasoning was pretty straightforward: Zhu was not only an influential figure on social media, but he ran arguably the most revered hedge fund in crypto — Three Arrows Capital, also known as 3AC. Then, the bear market of 2022 exposed 3AC as a house of cards run by founders who believed their own hype — and made reckless business decisions along the way. With the 3AC saga still unfolding, we received privileged information this week about the company’s remaining assets. The revelations aren’t good if you’re a 3AC creditor looking to be made whole again. Source claims 3AC’s Deribit exposure is worth much less than reported An anonymous source close to the 3AC debacle ...

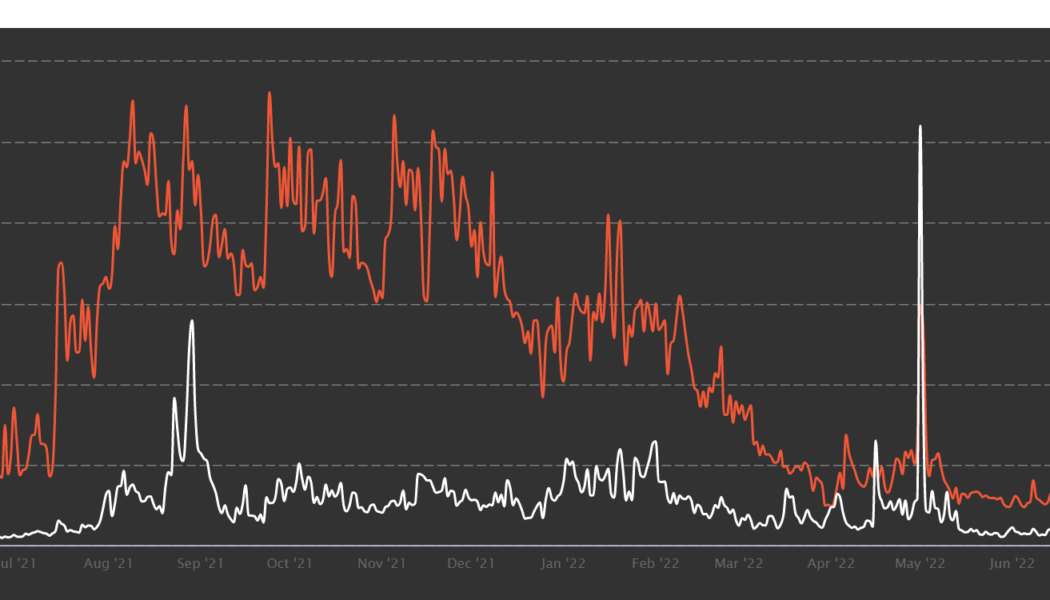

Fans seek trust and better understanding of sports NFT market: Research

The heavy involvement of the sports ecosystem is what expedited nonfungible tokens’ (NFT) mainstream adoption as the teams and players leveraged the technology for fan engagement. However, sports fans revealed their interest in moving beyond the hype and making investments based on knowledge about NFTs and trust in the issuers. The prolonged crypto winter razed off the inflated floor prices across the NFT ecosystem, inadvertently changing investor sentiment and forcing users to rethink their long-term investment strategies. A study released by the National Research Group (NRG) revealed an openness among sports fans to learn about NFTs as they await a greener market. Number of daily NFT sales between June 2021-June 2022. Source: NonFungible In June 2022, NFT sales plummeted to one-year lows...

Proof-of-time vs proof-of-stake: How the two algorithms compare

Consensus algorithms are processes where validators (also known as nodes or miners) within a blockchain network agree on the current state of the network. This mainly entails agreeing on whether a transaction submitted by a validator is authentic. Fraudulent or inaccurate transactions are rejected by the network assuming all validators are acting fairly with no malicious intent. Validators are rewarded with cryptocurrency for submitting accurate and authentic transactions, whilst malicious actors are penalized depending on the consensus protocol. For example, in proof-of-work (PoW) networks like Bitcoin (BTC), validators have to spend energy via expensive hardware to validate transactions, and if successful, they gain new tokens. If they act maliciously they gain nothing and the loss...

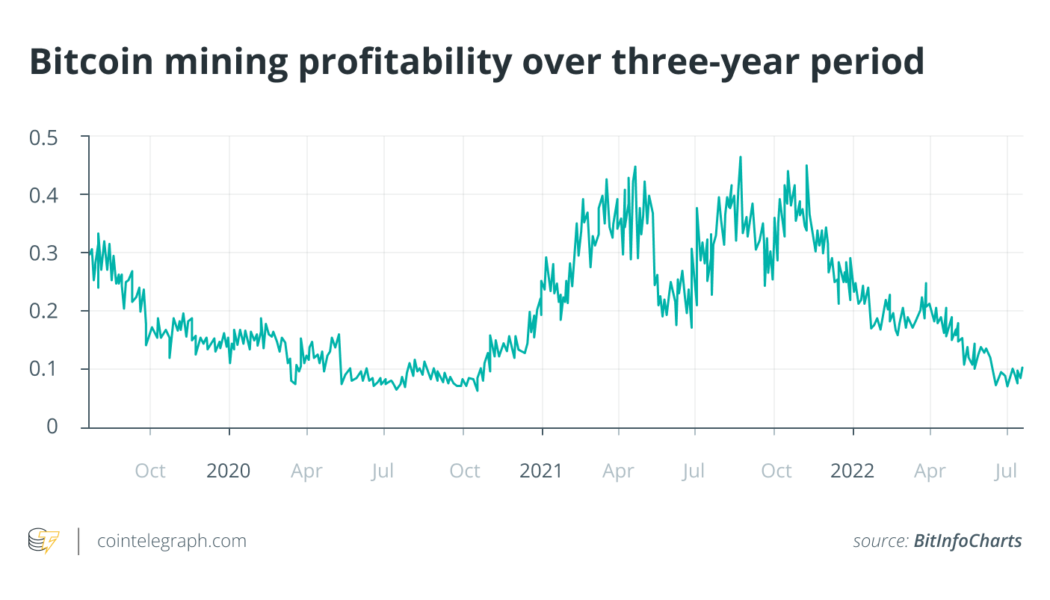

Not just Bitcoin price: Factors affecting BTC miner profitability

The ongoing cryptocurrency bear market has triggered a massive decline in Bitcoin (BTC) mining profitability as BTC mining expenses outpace the price of Bitcoin. Closely tied to the drop in the BTC price, Bitcoin mining profitability has been tanking since late 2021 and reached its lowest multi-month levels in early July 2022. According to data from crypto tracking website Bitinfocharts, BTC mining profitability tumbled to as low as $0.07 per day per 1 terahash per second (THash/s) on July 1, 2022, touching the lowest level since October 2020. The decline in BTC mining profitability has caused some big changes in the crypto mining industry. Lower Bitcoin prices fueled selling pressure as miners were pushed to sell their BTC to continue mining and pay for electricity. The majority of big cr...

Inflation got you down? 5 ways to accumulate crypto with little to no cost

Experienced crypto traders know that bull markets are for selling and bear markets are for accumulation, but the latter can be difficult amid a backdrop of surging inflation that saps the purchasing power of fiat currencies. As the crypto market heads deeper into crypto winter, with prices in the gutter and developers focused on creating the next popular protocol or breakout token, some crypto fans have begun to explore new ways of increasing their stack in preparation for the next bull market. Here’s a look at the top five ways hodlers can increase the size of their crypto portfolio without breaking the bank so that the money they earn can go toward combating the rising cost of living. Staking Staking is perhaps the most tested and proven way to increase the number of tokens held, a...

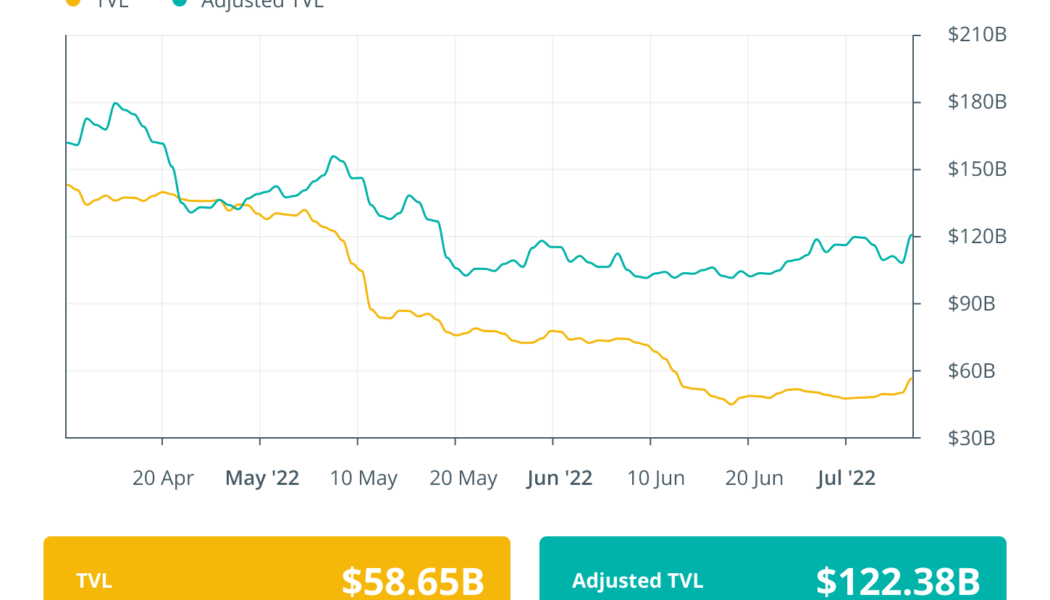

Finance Redefined: DeFi’s downturn deepens, but protocols with revenue could thrive

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights — a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments related to the DeFi lending crisis as Celsius filed for bankruptcy. At a time when bears are more dominant in the current market, DeFi protocols with a revenue system can thrive. Lido Finance has announced plans to offer its Ether (ETH) staking services across the entire L2 system. Aave plans to leverage Pocket’s distributed network of 44,000 nodes to access on-chain data from various blockchains, and gamers are plugging in DeFi through the Razer reward partnership. The majority of the top 100 DeFi tokens traded in green, with many registering double-...

Bitcoin network difficulty drops to 27.693T as hash rate eyes recovery

The difficulty in mining a block of Bitcoin (BTC) was reduced further by 5% to 27.693 trillion as network difficulty maintains its three-month-long downward streak ever since reaching an all-time high of 31.251 trillion back in May 2022. Network difficulty is a means devised by Bitcoin creator Satoshi Nakamoto to ensure the legitimacy of all transactions using raw computing power. The reduced difficulty allows Bitcoin miners to confirm transactions using lower resources, enabling smaller miners a fighting chance to earn the mining rewards. Despite the minor setback, zooming out on blockchain.com’s data reveals that Bitcoin continues to operate as the most resilient and immutable blockchain network. While the difficulty adjustment is directly proportional to the hashing power of miner...