crypto blog

MiCA and ToFR: The EU moves to regulate the crypto-asset market

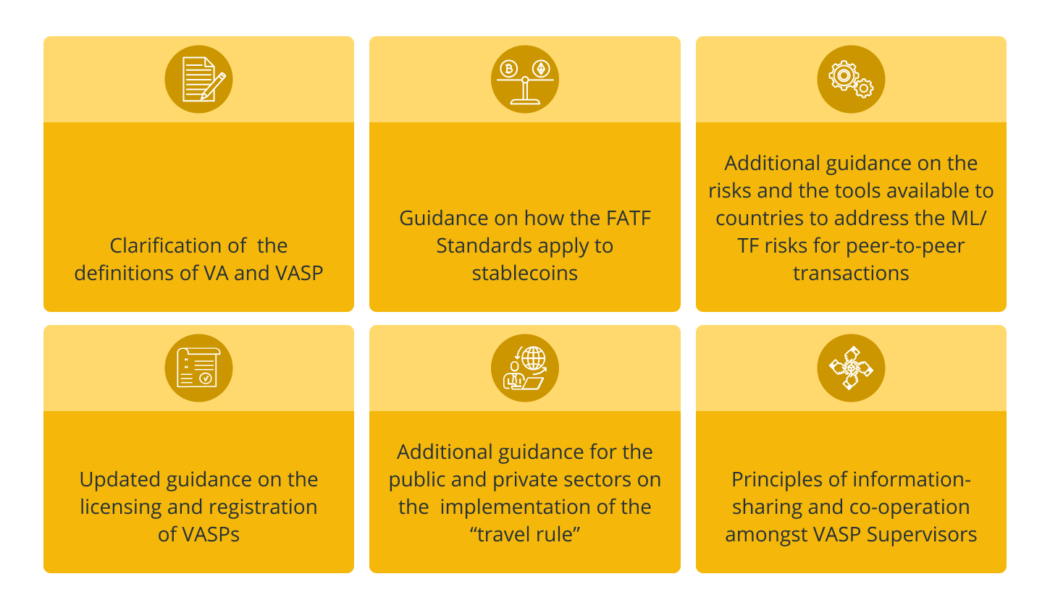

On the last day of June, the European Union reached an agreement on how to regulate the crypto-asset industry, giving the green light to Markets in Crypto-Assets (MiCA), the EU’s main legislative proposal to oversee the industry in its 27 member countries. A day earlier, on June 29, lawmakers in the member states of the European Parliament had already passed the Transfer of Funds Regulation (ToFR), which imposes compliance standards on crypto assets to crack down on money laundering risks in the sector. Given this scenario, today we will further explore these two legislations that, due to their broad scope, can serve as a parameter for the other Financial Action Task Force (FATF) members outside of the 27 countries of the EU. As it’s always good to understand not only the resul...

How to identify and avoid a crypto pump-and-dump scheme?

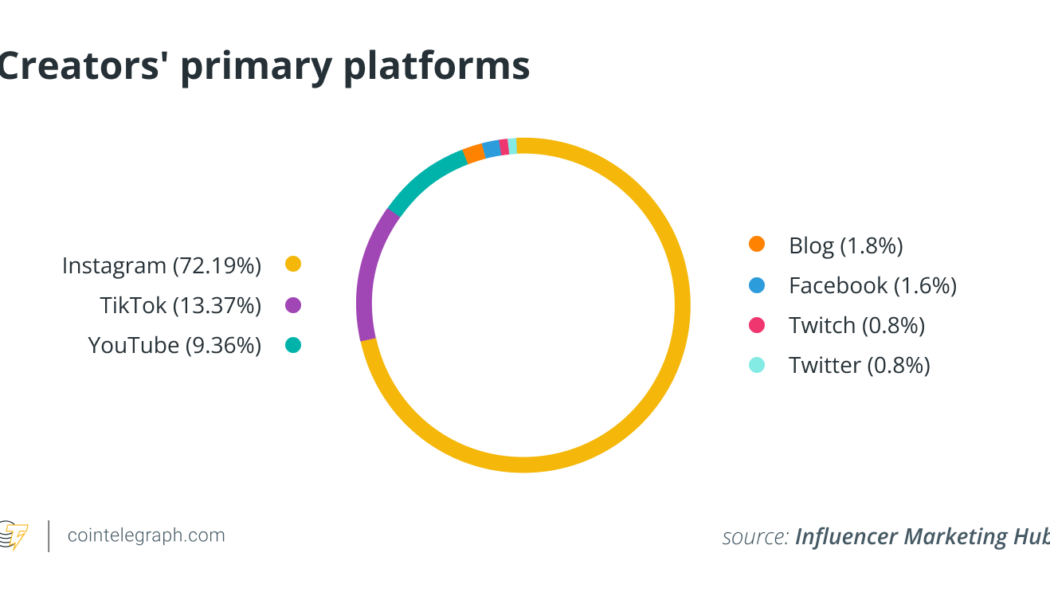

Educating oneself about the crypto ecosystem is crucial for investors to pursue during a bear market while awaiting a bull cycle. That being said, having a good understanding of crypto investment entails keeping an eye out for fraudulent projects that threaten to drain assets overnight, a.k.a. pump-and-dump schemes. Pump-and-dump in crypto is an orchestrated fraud that involves misleading investors into purchasing artificially inflated tokens — typically marketed and hyped by paying celebrities and social influencers. SafeMoon token is one of the most prominent examples of an alleged pump-and-dump scheme involving A-list celebrities, including Nick Carter, Soulja Boy, Lil Yachty and YouTubers Jake Paul and Ben Phillips. Once the investors have purchased tokens at inflated prices, the peopl...

Bitcoin ready to attack key trendline, says data as BTC price holds $20K

Bitcoin (BTC) consolidated higher on July 16 after the Wall Street trading week finished with modest gains for United States equities. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Can Bitcoin bulls reclaim the 200-week moving average? Data from Cointelegraph Markets Pro and TradingView showed BTC/USD ranging between $20,500 and $21,000 into the weekend. The pair thus preserved the majority of its comeback from the week’s lows, these following shock U.S. inflation data and sparking weakness across risk assets. Now, out-of-hours trading meant that the classic scenario of breakouts and fakeouts on thin liquidity could accompany Bitcoin into the weekly close. Eyeing order book data from Binance, the largest global exchange by volume, showed key resistance clustered ar...

Celsius is bankrupt with $1.2B balance sheet hole, Su Zhu returns to Twitter and OpenSea purges 20% of employees: Hodler’s Digest, July 10-16

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week OpenSea lays off 20% of its staff, citing ‘crypto winter’ Leading NFT marketplace OpenSea plans to lay off around 20% of its staff, with co-founder and CEO Devin Finzer citing “an unprecedented combination of crypto winter and broad macroeconomic instability” as the reasons behind the move. He also added, “The changes we’re making today put us in a position to maintain multiple years of runway under various crypto winter scenarios (5 years at the current volume), and give us high confidence that we will only h...

SEC dismisses claims against John McAfee, fines accomplice for ICO promo

The United States Securities and Exchange Commission (SEC) obtained the final judgment for an initial coin offering (ICO) promotion scheme against late entrepreneur John McAfee and accomplice Jimmy Gale Watson, Jr., filed on October 5, 2020. In the original complaint, the SEC alleged that McAfee and Watson promoted ICO investments on Twitter without disclosing that they were paid for them. Watson allegedly assisted McAfee in negotiating promotional deals with ICO issuers and cashing out the crypto payments, among other pump-and-dump charges. The U.S. District Court for the Southern District of New York found Watson guilty of violating the law and imposed a cumulative fine of $375,934.86. In addition, Watson has been barred from participating in ICO-related issuance, purchase, offer o...

Rethinking approaches to regulation of the Fourth Industrial Revolution

Mass adoption of technologies of the Fourth Industrial Revolution (4IR) potentially could trigger an even larger than projected transition to a new taxonomy of regulation concerning various fields of human life, including that of finance and the market itself. New technologies are enabling new concepts, systems and frameworks, such as driverless cars, drone postal deliveries and central bank digital currencies (CBDC). In the foreseeable future, the role of technology in our society would be exceeding the boundaries of an elementary subsystem, where its regulation would be designated to the stakeholders or the market itself. A persistent theme of this short submission is the currently changing approaches to the regulation of technological risks following a rapid transition to the whol...

Andorra green lights Bitcoin and Blockchain with Digital Assets Act

A small light of progress shines from Andorra, a tiny European country nestled between France and Spain. The country’s government, the General Council of Andorra, recently approved the Digital Assets Act, a regulatory framework for digital currencies and blockchain technology. The act is split into two parts. The first regards the creation of digital money, or “programmable digital sovereign money,” which can be exchanged in a closed system. In effect, this would allow the Andorran state to create its own token. The second half of the act refers to digital assets as financial instruments and intends to create an environment in which blockchain and distributed ledger technologies can be regulated. For Paul (who withheld his surname), CEO of local Bitcoin business 21Million, the new la...

Lido DAO most ‘overbought’ since April as LDO price rallies 150% in two weeks — what’s next?

The price of Lido DAO (LDO) dropped heavily a day after its key momentum oscillator crossed into “overbought” territory. LDO undergoes overbought correction LDO’s price plunged to as low as $1.04 on July 16 from $1.32 on July 15, amounting to a 20%-plus decline. The token’s sharp downside move took its cues from multiple bearish technical indicators, including its daily relative strength index (RSI) and its 100-day exponential moving average (EMA). LDO’s latest plunge came after it rallied over 150% in just two weeks, a move that simultaneously pushed its daily RSI above 70 on July 15, thus turning it overbought. An overbought RSI signals that the rally may be nearing an end while readying for a short-term pullback. Meanwhile, more downside cues for the ...

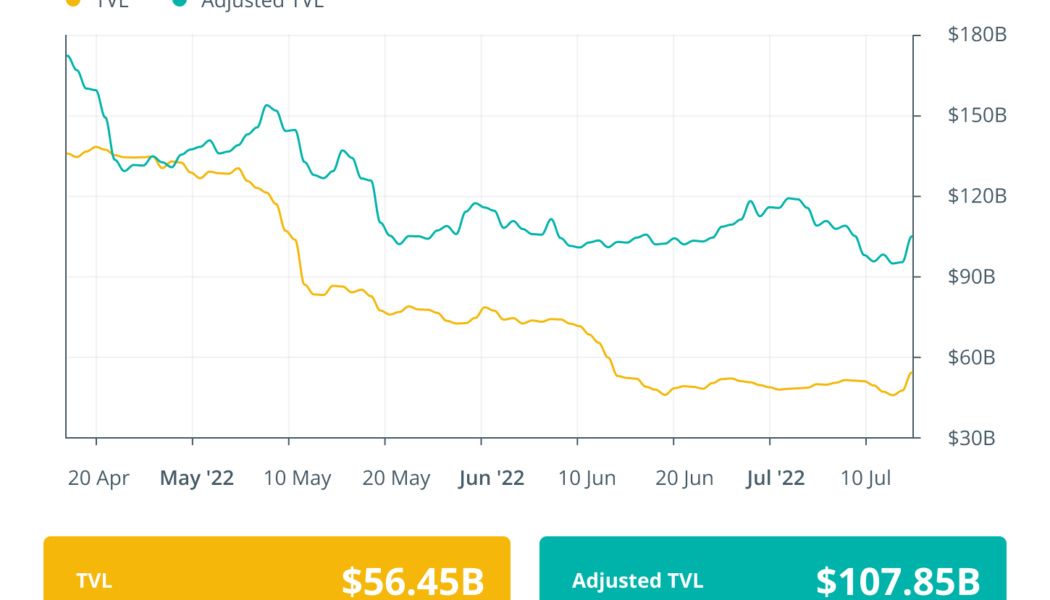

Finance Redefined: DeFi market fell off the cliff in Q2, but there’s hope

Welcome to Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a newsletter crafted to bring you some of the major developments over the last week. This past week, the DeFi ecosystem saw several new developments despite a bearish phase brought on by the lending crisis in the crypto market. Another crypto lender, Celsius, with high stakes in DeFi protocols, filed for bankruptcy. The overall DeFi market fell to new lows in the second quarter. However, a new report indicates users haven’t given up hope. BNB Chain launched a new decentralized application (DApp) platform with an alarm feature. Vermont state regulator opened an investigation into troubled crypto lender Celsius, deeming it deeply insolvent. A DeFi researcher has predicted that Ethereum proof-of-stake...

The creator economy: How we arrived there and why we need its Web3 upgrade

Does the term “creator economy” make you think of some idealistic environment where creativity, authenticity and passion are key values? Where true Michelangelos and da Vincis drive progress through their talents without struggling for food and proving themselves all their lives to get a chance to be recognized posthumously? If so, I’m with you. Though creativity has existed as long as humanity, we started to discuss it as the new economic paradigm not so long ago. What’s more, now we even talk about it in the Web3 dimension. To better understand what it is, first, let’s walk through the backstory of the creator economy. How did we actually arrive here? Often, looking back at the past is a great way to get real insights into what is happening today. It won’t make you yawn, I promise. The b...

The new philanthropic frontier: How Web3 could democratize donations

A merge between crypto and philanthropy is already underway as decentralized autonomous organizations (DAO) and nonfungible token artists alike fundraise and donate crypto to nonprofits. But what does the age-old institution of philanthropy have to learn from emerging technologies in the crypto space? Additionally, what does crypto have to offer philanthropy that could improve the sector generally? Crypto offers the potential for nonprofits to be governed in a decentralized fashion, creating conditions that maximize the influence of communities most impacted by these organizations. Despite its meme-based reputation at times, the crypto industry is actually in the midst of a major push toward true democracy. This effort begins by leveraging blockchain technology that has created the conditi...

Bit2Me to onboard 100k blocked crypto investors from 2gether exchange

Following a recent agreement between the two crypto exchanges, Bit2Me announced plans to onboard 2gether’s 100,000 crypto investors, who were recently blocked from trading due to the exchange’s inability to operate amid unfavorable market conditions. On July 10, Spanish cryptocurrency trading platform 2gether shut down its free trading services, citing its inability to justify its related operational costs due to crypto winter. Instead, the users were being charged 20 euros as maintenance fees. Providing relief to the recently displaced crypto investors, Bit2Me reached an agreement with 2gether to onboard its users without imposing any fees — allowing users to move over their holdings and resume their trading activities. In addition, Bit2Me decided to reimburse the 20 euros back to the use...