crypto blog

US lawmakers ask about EPA, DOE monitoring of crypto mining emissions, energy consumption

Democratic legislators from both houses of the United States Congress have sent a letter to the Environmental Protection Agency (EPA) and Energy Department (DOE) to inform them of their findings on the energy consumption of cryptocurrency mining and asking the agencies to require mining to report their emissions and energy use. Meanwhile, the Paraguayan Senate, the upper house of that country’s legislature, has passed a comprehensive bill to regulate cryptocurrency and allow miners to use excess electricity generated in the country. The six U.S. lawmakers, led by crypto cynic Elizabeth Warren, noted in their July 15 letter that crypto mining in the United States has been increasing since it was banned by China last year. The seven crypto mining companies that responded to the legisla...

SEC commissioner Allison Lee departs, readying financial regulator for Jaime Lizárraga

Allison Herren Lee, one of five members of the United States Securities and Exchange Commission’s board, has officially left the regulatory body after more than three years as a commissioner. In a Friday announcement, chair Gary Gensler and commissioners Hester Peirce, Mark Uyeda, and Caroline Crenshaw said Lee had left the SEC, where in 2005 she started as a staff attorney at the agency’s enforcement division at a regional office in Denver. She moved on to be appointed a commissioner in 2019 under the former presidential administration, and later served as acting chair to the regulatory body for three months, until Gensler’s confirmation in April 2021. “Commissioner Lee has been a stalwart advocate for strong and stable markets, including by emphasizing the need for market participants to...

Crypto Biz: 3AC’s founders are nowhere to be found

In the world of crypto, there’s no such thing as “too big to fail.” Three Arrows Capital, once the most recognizable hedge fund in the industry, has essentially gone belly-up after its founders believed their own hype and decided to go full-degen mode during the worst macro climate of a generation. Since the proverbial shit hit the fan last month, founders Kyle Davies and Su Zhu have kept a very low profile. So low, in fact, that their whereabouts remain a mystery, according to court documents. This week’s Crypto Biz chronicles the latest developments surrounding Three Arrows Capital and explores Grayscale’s legal proceedings against the United States Securities and Exchange Commission (SEC). Liquidators can subpoena 3AC founders despite ‘tricky issues’ with crypto assets We may not ...

You can transform the world with blockchain: Dr. Jane Thomason

Jane Thomason is an Australian academic who spent 15 years running hospitals and doing development work abroad followed by a 20-year stint building a $250-million revenue company. Thomason — now a blockchain adviser to the World Health Organization — says she “had an epiphany” while thinking about the 2004 Tsunami in Indonesia, in which the lives of over 200,000 people were washed away. “No one knew the identities of the people coming to the hospitals — all the identity documents were gone, all the bank records were gone, all the health records were gone. People wanted to send money to the people who were alive, but no one could send money directly.” Dr Jane Thomason believes in the power of blockchain to help make the world a better place. Thomason believes that if this data had bee...

DeFi token AAVE faces major correction after soaring 100% in a month

The price of Aave (AAVE) has more than doubled in a month, but its bullish momentum could be reaching a point of exhaustion. AAVE price tests key inflection level Notably, AAVE has surged by over 103% after bottoming out locally at $45.60 on June 18, hitting almost $95.50 this July 15. Nevertheless, the token’s sharp upside retracement move has brought its price closer to the level that triggered equally sharp pullbacks since early June. In other words, AAVE has been testing an ascending trendline resistance that constitutes a “bear flag,” a bearish continuation pattern. For example, the trendline’s previous test on July 9 ended up in a 20% downside move. Similarly, a similar attempt on June 24 pushed AAVE price lower by nearly 30%. AAVE/USD daily price chart. ...

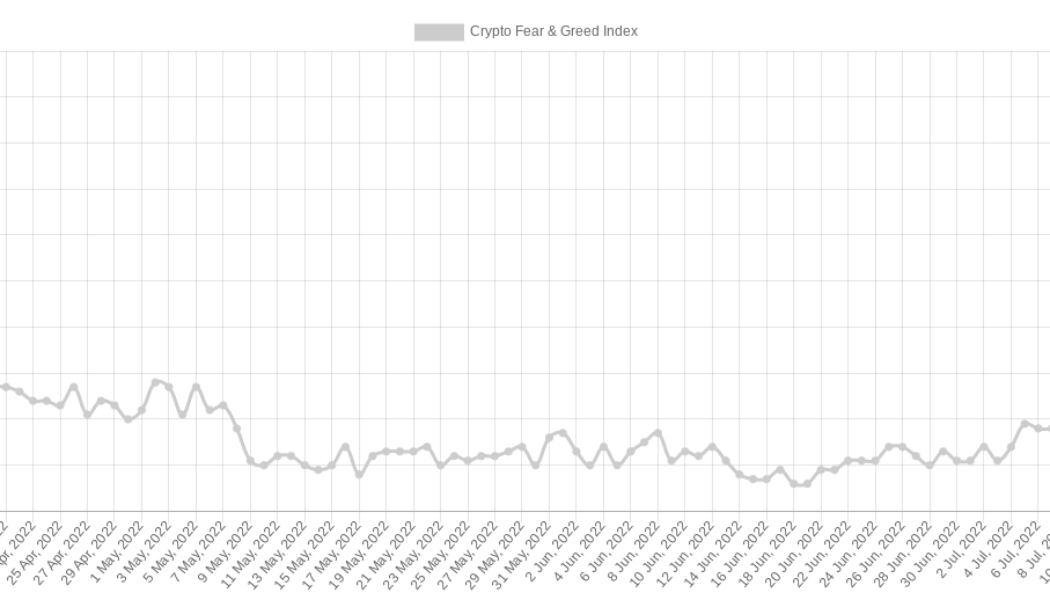

Bitcoin is now in its longest-ever ‘extreme fear’ period

Bitcoin (BTC) may have avoided fresh losses since falling to $17,600 last month, but the sentiment is on the floor. Now, one classic crypto market mood gauge is showing just how long and hard the average investor has suffered. 70 days of “extreme fear” While crypto market sentiment was already “comparable to funeral” before the start of 2022, the subsequent price drawdown in Bitcoin and altcoins produced cold feet like never before. This has now been quantified by the Crypto Fear & Greed Index, a tool that takes multiple sources into account to create an overall score of how the markets are feeling. As of July 15, Fear & Greed has spent 70 days in its lowest bracket — “extreme fear” — marking of a new bearish record. The Index consists of f...

Bitwells Exchange Launches 777 BTC Giveaway for Derivatives Traders

Victoria, Seychelles, 15th July, 2022, Chainwire Bitwells, the leading crypto derivatives exchange, has launched a 100% deposit match for new signups. The programme will reward traders who deposit up to 10 BTC with a corresponding bonus amount. A total of 777 BTC has been set aside in a funding pool and allocated for the promotion. A user who deposits 1 BTC, for example, will receive a total of 2 BTC credited to their account, while a trader who deposits the maximum 10 BTC will receive 20 BTC. The offer by Bitwells exchange is the most generous promotion of its kind within the industry. Bitcoin’s high volatility has made it an attractive proposition for traders looking to profit from the intraday swings. Adroit traders who take advantage of these opportunities often report impressive ROI f...

Nifty News: Old Navy’s BAYC shirts, expensive whisky NFTs, Sandbox publishing

A bottle of 52-year-old whisky made at Japan’s famous defunct Karuizawa distillery is being auctioned off as a nonfungible token (NFT). The starting price for the NFT and bottle of whisky is a dizzying $75,000, or about 62 Ether (ETH). Direct-to-Customer NFT wine and spirits marketplace BlockBar is handling the auction. To whisky collectors, the ultra-rare bottle of whisky from “The Last Masterpiece” cask made in 1970 is attractive, as there are now only 211 bottles of it left, according to a Tuesday report by Finbold. Now, an NFT collector can bolster their collection with a token that verifies authentic ownership of a bottle. NFT authenticating a bottle of “The Last Masterpiece” from Kurizawa. The auction began on Tuesday and will continue until July 18. The artwork for the NFT and ...

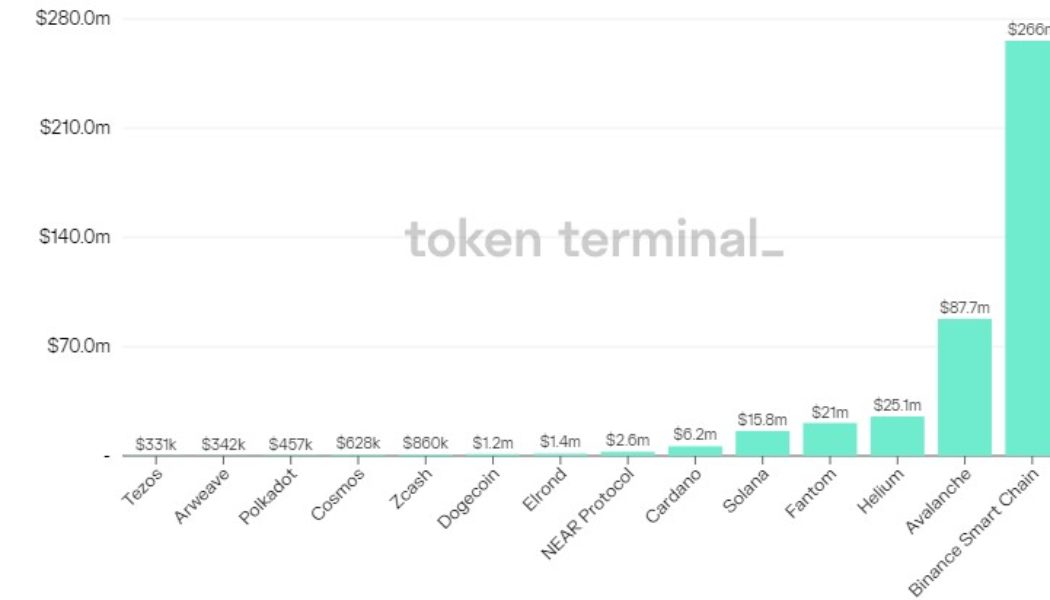

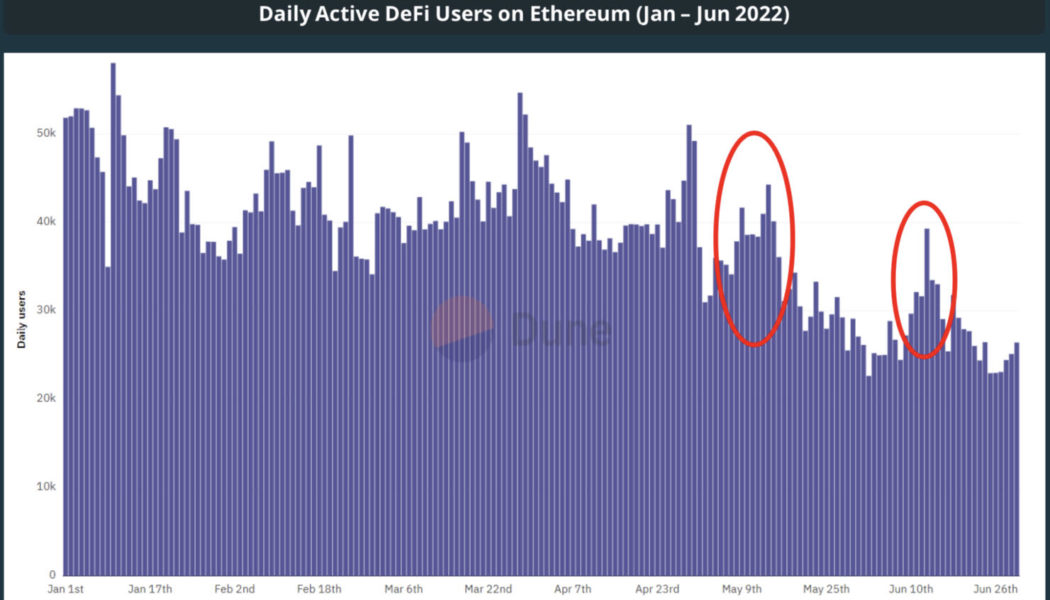

DeFi market fell off cliff in Q2 but users haven’t given up hope: Report

Despite the decentralized finance (DeFi) market suffering a 74.6% market cap decline in Q2, user activity has remained relatively resilient, says CoinGecko. In a report published by the crypto data aggregator on Wednesday, CoinGecko reported that the overall DeFi market cap fell from $142 million to $36 million over the second quarter, due mainly to the collapse of Terra and its stablecoin TerraUSD Classic (USTC) in May. CoinGecko also noted a rise in DeFi exploits in the quarter contributed to the fall, including Inverse Finance and Rari, which suffered hacks of $1.2 million and $11 million, respectively: “These attacks have negatively impacted token prices as investors lose faith in these hacked protocols.” However, CoinGecko also noted that while on-chain activity slowed down, the...

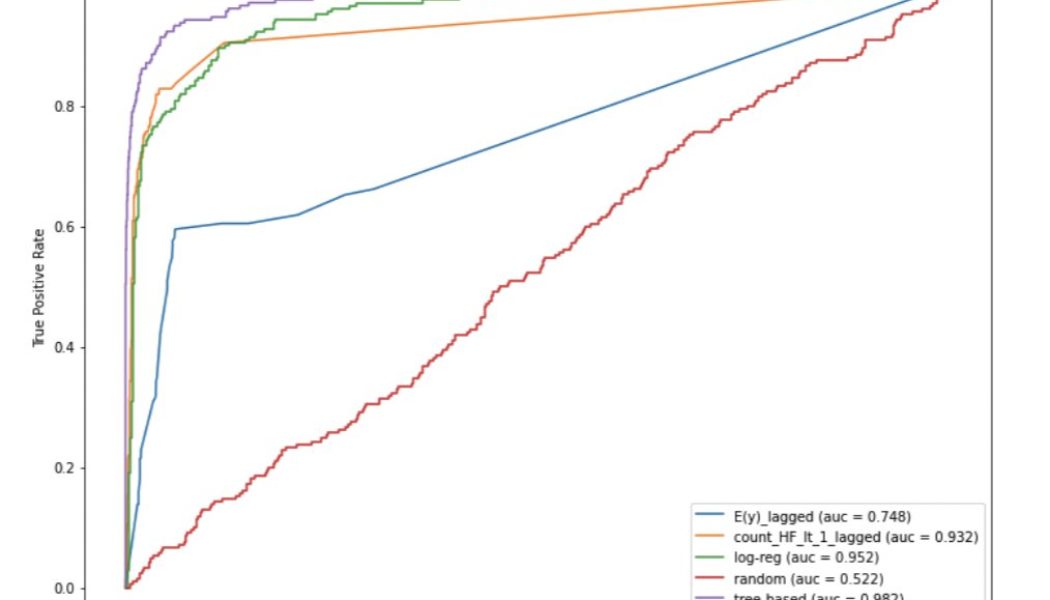

Cred Protocol unveils its first decentralized credit scores

Cred Protocol, a decentralized credit scoring startup has unveiled the results of its first automated credit scoring system for users of decentralized finance (DeFi). Cred Protocol CEO Julian Gay outlined the results in a Twitter thread, which showed how Cred successfully utilized past transaction behavior on the Aave protocol to assess the creditworthiness of future borrowers based on on-chain behavior in the DeFi space. 1/ Over the last few months, we’ve been working to build one of the first credit scores for DeFi. Today, we’re excited to share the results of our first credit score with the world! Read more below — Julian Gay (@juliangay) July 14, 2022 By using machine learning to assess time-based account attributes and analyze the user’s past transaction behavior, Cred Pro...