crypto blog

Ethereum co-founder responds to PoS critics amid upcoming Merge

While some believe that Ethereum’s upcoming shift to proof-of-stake (PoS) may push the platform to eventually surpass Bitcoin (BTC), others take this opportunity to make snarky remarks on Twitter, triggering a rebuttal from Vitalik Buterin, a co-founder of Ethereum. In a tweet, Bitcoiner Nick Payton called out “Proof-of-Stakers” and argued that voting to change the properties on PoS platforms proves that the PoS assets are securities. Dear Proof of Stakers, The fact that you can vote on something to change its properties is proof that it’s a security. Love, Bitcoin — Nick (@NickDPayton) July 11, 2022 Buterin responded to the post, describing Payton’s notions as an “unmitigated bare-faced lie.” According to the Ethereum Buterin...

Bitcoin miner prices will continue to fall, F2Pool exec predicts

The price of cryptocurrency mining hardware is likely to continue falling in the near future amid the ongoing crypto winter, according to an executive at major Bitcoin (BTC) mining pool F2Pool. Supporting 14.3% of the BTC network, F2Pool is one of the world’s biggest Bitcoin mining pools. On Tuesday, F2Pool released its latest mining industry update. Focusing on June 2022 BTC mining results, F2Pool’s report noted that the majority of Bitcoin mining companies like Core Scientific have opted to sell their self-mined Bitcoin recently. Bitfarms, a major Canadian BTC mining firm, sold 3,000 Bitcoin, or almost 50% of its entire BTC stake for $62 million ito reduce its credit facility in June. “I have studied almost 10 publicly traded industrial miners and found that they are...

Bitcoin price indicator that marked 2015 and 2018 bottoms is flashing

Bitcoin (BTC) could undergo a massive price recovery in the coming months, based on an indicator that marked the 2015 and 2018 bear market bottoms. What’s the Bitcoin Pi Cycle bottom indicator? Dubbed “Pi Cycle bottom,” the indicator comprises a 471-day simple moving average (SMA) and a 150-period exponential moving average (EMA). Furthermore, the 471-day SMA is multiplied by 0.745; the outcome is pitted against the 150-day EMA to predict the underlying market’s bottom. Notably, each time the 150-period EMA has fallen below the 471-period SMA, it has marked the end of a Bitcoin bear market. For instance, in 2015, the crossover coincided with Bitcoin bottoming out near $160 in January 2015, followed by an almost 12,000% bull run toward $20,000 in December 2017....

Vleppo and Tokel make NFT rights legally enforceable in the real world leveraging Komodo technology

Kongens Lyngby, Denmark, 12th July, 2022, Chainwire A long-standing problem confronting the blockchain world and NFT owners is the distinct lack of contractual clarity and legal rights in the enforcement of digital asset transactions. Today, Vleppo and Tokel have successfully conducted a breakthrough digital procedure that will pave the way for the blockchain industry and NFT owners to establish and enable their legal rights embodied in the NFTs and digital transactions to be made legally enforceable in the courts of law around the world. In June 2022, Vleppo developed a Blockchain Contract Management System (“CMS”) that enables NFT owners to create a digital contract by embedding their NFT’s on-chain ID directly into the Blockchain record of the same digital contract. [embedded content] T...

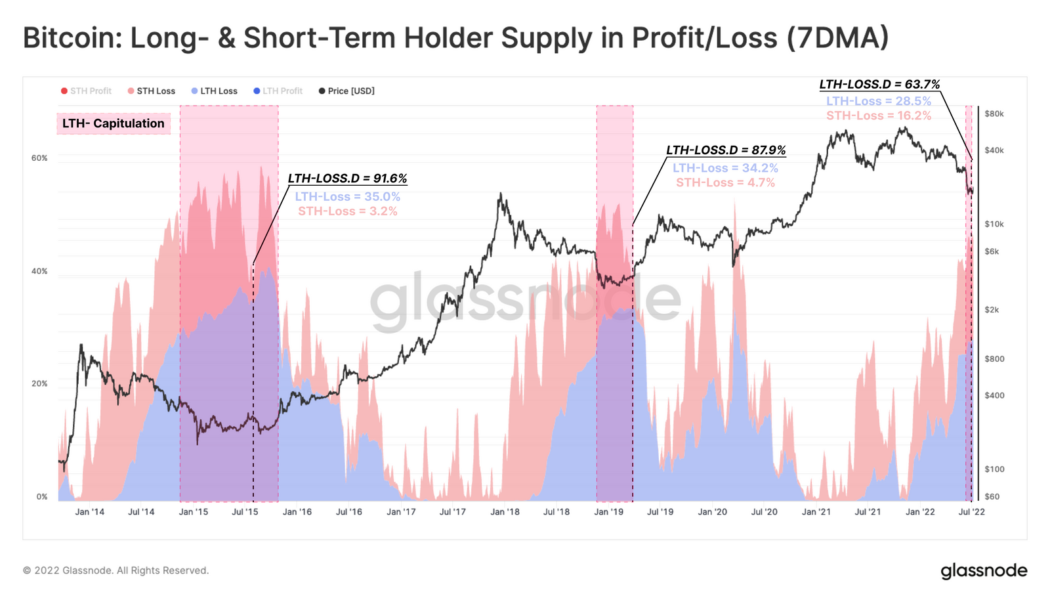

Capitulation ongoing but markets not at the bottom yet: Glassnode

Bitcoin wealth is being distributed from weak hands to strong hands due to ongoing capitulation from retail investors and miners, signaling that the bottom may be close. The latest ‘The Week On-Chain’ report from blockchain analysis firm Glassnode on July 11 explains that market capitulations have been ongoing for about a month and that several other signals suggest bottom formations in Bitcoin prices. However, Glassnode analysts wrote that the bear market “still requires an element of duration” as Long-Term Holders (LTH), who tend to have greater confidence in Bitcoin as a technology, increasingly bear the greatest unrealized losses. “For a bear market to reach an ultimate floor, the share of coins held at a loss should transfer primarily to those who are the least sensitive to price, and...

More than $4.7M stolen in Uniswap fake token phishing attack

A sophisticated phishing campaign targeting liquidity providers (LPs) of the Uniswap v3 protocol has seen attackers make off with at least $4.7 million worth of Ethereum (ETH). However, the community is reporting the losses could be even greater. Metamask security researcher Harry Denley was one of the first to raise the alarm bells of the attack, telling his 13,000 Twitter followers on July 11 that 73,399 addresses had been sent malicious ERC-20 tokens to steal their assets. ⚠️ As of block 151,223,32, there has been 73,399 address that have been sent a malicious token to target their assets, under the false impression of a $UNI airdrop based on their LP’s Activity started ~2H ago0xcf39b7793512f03f2893c16459fd72e65d2ed00c cc: @Uniswap @etherscan pic.twitter.com/5W...

More than $4.7M stolen in Uniswap fake token phishing attack

A sophisticated phishing campaign targeting liquidity providers (LPs) of the Uniswap v3 protocol has seen attackers make off with at least $4.7 million worth of Ethereum (ETH). However, the community is reporting the losses could be even greater. Metamask security researcher Harry Denley was one of the first to raise the alarm bells of the attack, telling his 13,000 Twitter followers on July 11 that 73,399 addresses had been sent malicious ERC-20 tokens to steal their assets. ⚠️ As of block 151,223,32, there has been 73,399 address that have been sent a malicious token to target their assets, under the false impression of a $UNI airdrop based on their LP’s Activity started ~2H ago0xcf39b7793512f03f2893c16459fd72e65d2ed00c cc: @Uniswap @etherscan pic.twitter.com/5W...

Helium network team resolves consensus error after 4-hour outage

The Internet of Things (IoT) blockchain Helium shut down for about 4 hours on July 11 due to validator outages from a software update, causing delayed transaction finality. During the outage, devices transferring data over the network were not affected, but miner rewards and token transfers were left pending. The team resolved the issue by skipping the blockchain forward by one block and resuming normal functions. At 10:20 am EDT, the Consensus Group stopped producing blocks at block height 1435692 on the Helium (HNT) blockchain, according to a status update. Lacking network consensus, token transfers could not be completed, and new blocks were not being produced. We’re back folks. The chain just processed block 1,435,693. We’ll continue to monitor the chain throughout the day....

Helium network team resolves consensus error after 4-hour outage

The Internet of Things (IoT) blockchain Helium shut down for about 4 hours on July 11 due to validator outages from a software update, causing delayed transaction finality. During the outage, devices transferring data over the network were not affected, but miner rewards and token transfers were left pending. The team resolved the issue by skipping the blockchain forward by one block and resuming normal functions. At 10:20 am EDT, the Consensus Group stopped producing blocks at block height 1435692 on the Helium (HNT) blockchain, according to a status update. Lacking network consensus, token transfers could not be completed, and new blocks were not being produced. We’re back folks. The chain just processed block 1,435,693. We’ll continue to monitor the chain throughout the day....

Dutch bank ING sells digital asset tool Pyctor to GMEX

ING Group, a Dutch multinational banking and financial services corporation, has spun out its digital asset business Pyctor to multi-asset trading infrastructure firm GMEX. GMEX has acquired ING’s institutional-grade digital asset custody solution Pyctor in a multi-million dollar deal, the companies said in a joint announcement on Monday. The Pyctor offering compliments GMEX’s MultiHub service, an institutional cross-platform business launched last year with the mission to bridge the gap between centralized finance (CeFi) and decentralized finance (DeFi), GMEX CEO Hirander Misra told Cointelegraph. Pyctor expands MultiHub with a number of digital asset-focused capabilities, including smart contract features, post-trade custodial and institutional network capabilities like the fragmentation...