crypto blog

USD stablecoin premiums surge in Argentina following economy minister’s resignation

Argentina, a country with one of the highest crypto adoption rates in the world, saw the price of dollar-pegged stablecoins surge across exchanges on Saturday after the abrupt resignation of its Economy Minister, Martin Guzman. The minister’s shock exit, confirmed on his Twitter account on July 3 via a seven-page letter, threatens to further destabilize a struggling economy battling high inflation and a depreciating national currency. According to data from Criptoya, the cost of buying Tether (USDT) using Argentinian pesos (ARS) is currently 271.4 ARS through the Binance exchange, which is around a 12% premium from before the resignation announcement, and a 116.25% premium compared to the current fiat exchange rate of USD/ARS. The local crypto price tracking website has also revealed...

Haters to unite at the first conference for crypto skeptics

In the middle of crypto’s latest bear market, industry and asset class detractors have rallied together to share their skepticism and network with lawmakers at their own anti-crypto conference. Whereas most crypto conferences exist to promote the latest developments on the cutting edge of the industry, crypto critic journalist Amy Castor said in her July 3 blog post that the Crypto Policy Symposium promises a way for disgruntled nay-sayers to voice their negativity. Crypto skeptics step up lobbying efforts with their first conference – Amy Castor https://t.co/DdUjSfFPIQ — your #1 source for absurdist true crime (@davidgerard) July 3, 2022 Author and symposium organizer Stephen Diehl explained to Castor that this first major anti-crypto event aims to provide the community a way to speak dir...

Crypto’s ongoing crisis is an opportunity for realignment

It’s not a great day to be in crypto. Perhaps you’ve seen an article (or 20) about this. Perhaps you’ve been on Twitter, where our detractors are cackling gleefully over every headline, each one more harbinger-of-doom-esque than the next. To be fair, things are going badly. Crashed, collapsed, erased, plunged, obliterated and imploded are the operative verbs in most coverage, and they’re not being used incorrectly or in an exaggerated manner. There’s no putting a positive spin on a week where $400 billion in value just evaporated. Even for the most furiously determined buy-the-dippers and diamond-handed believers who feed off detractors and never say die, it’s dire out there. I’m not interested in making a case for buying the dip or for dipping out forever and getting into, say, stockpilin...

6 Questions for Alyssa Tsai of Panony

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Alyssa Tsai, founder and CEO of Panony — an incubator, investor and adviser for blockchain and Web3 business. My name is Alyssa Tsai, and I’m the founder and CEO of Panony. There are three pillars of businesses under our group umbrella. PANews is one of the earliest crypto media outlets in Greater China and South Korea. It has published over 20,000 articles, with an average of over 5 million page views per month. At Panony, we invest in blockchain projects worldwide and consult Fortune 500 companies for integration and expansion into the industry, spanning the entire spectrum of the blockcha...

Are expiring copyrights the next goldmine for NFTs?

Although non-fungible tokens (NFTs) are most commonly known in the form of digital art, they exist in many other forms and represent much more than just art. In the creative industry, NFTs have been used by musicians such as Kings of Leon to release their latest album. In the sports industry, NFTs are created to record the highlights of major sporting events such as the NBA. In the consumer product industry, Nike, Gucci and many others are selling their digital branded products in the form of NFTs. A lot more real-world applications of NFTs are still to be explored and one of them is the digital publishing industry. The game-changing implications of publishing and promoting books with NFTs have already been discussed extensively by many. For example, the Alliance of Independent Autho...

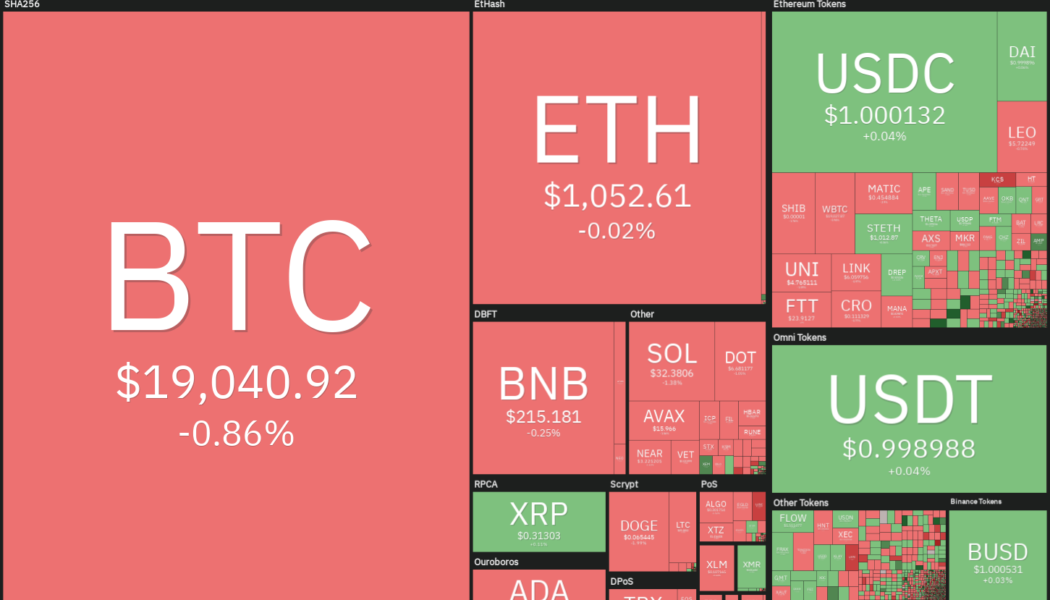

Top 5 cryptocurrencies to watch this week: BTC, SHIB, MATIC, ATOM, APE

The bears are attempting to sink Bitcoin (BTC) below $19,000 to further cement their advantage over the crypto market. Analysts watching Bitcoin’s MVRV-Z Score, a metric which measures how high or low Bitcoin’s price is relative to “fair value,” expect an even deeper fall before the bottom is finally reached. However, economist, trader and entrepreneur Alex Krueger pointed out that Bitcoin’s volume hit an all-time high in June. Usually, the highest volume in a downtrend is indicative of capitulation and that “creates major bottoms.” If Bitcoin follows the historical pattern of the 2018 bear market, Krueger expects the bottom to form in July. Crypto market data daily view. Source: Coin360 Due to the tight correlation between Bitcoin and the S&P 500, crypto traders will have to keep a cl...

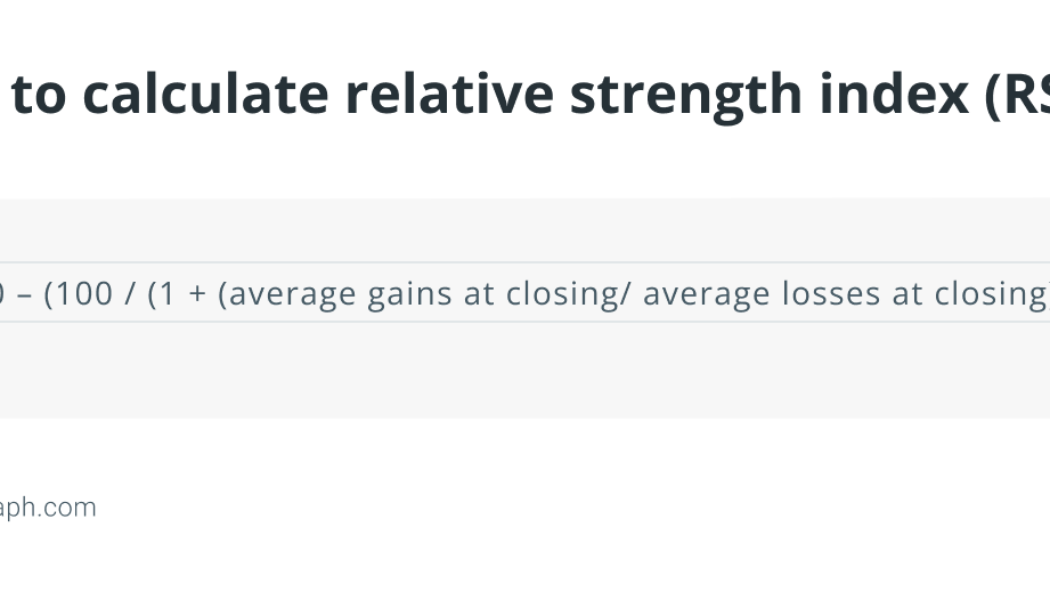

What is a bull trap, and how to identify it?

Here’s how to spot a bull trap with some tell-tale indicators that one is on the way: RSI divergence A high RSI might be an indication of a potential bull or bear trap. A relative strength index (RSI) calculation may be used to identify a possible bull or bear trap. The RSI is a technical indicator, which can help determine whether a stock or cryptocurrency asset is overbought, underbought or neither. The RSI follows this formula: The calculation generally covers 14-days, although it may also be applied to other timeframes. The period has no consequence in the calculation since it is removed in the formula. In the instance of a probable bull trap, a high RSI and overbought circumstances suggest that selling pressure is increasing. Traders are eager to pocket their gains and will ...

The crypto industry needs a crypto capital market structure

The past few weeks have been interesting and have surfaced what we in the financial services industry call matters requiring attention, or MRAs. An MRA describes a practice that deviates from sound governance, internal controls and risk management principles. These matters that require attention have the potential to adversely affect the industry and increase the risk profile. I have always focused on technology and innovation-led business models — systems and interconnected elements of blockchain-powered business networks — redefining the transaction systems that power many industries, including financial services. A growing number of naysayers have become vocal about recent events, which have revealed extensive mismanagement, ill-defined and misgoverned systems, and general misrepr...

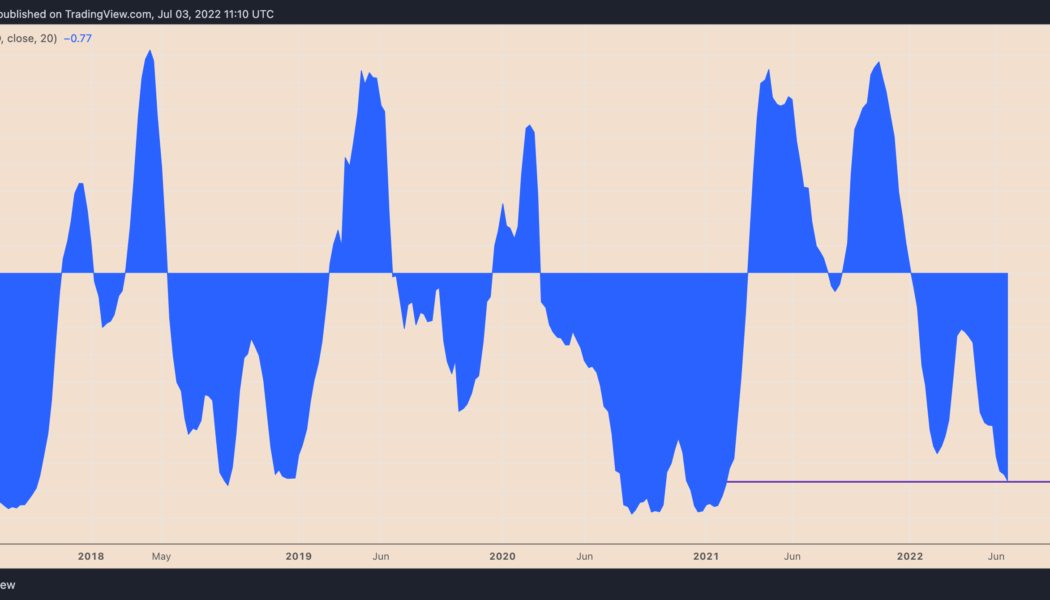

Bitcoin’s inverse correlation with US dollar hits 17-month highs — what’s next for BTC?

Bitcoin (BTC) has been moving in the opposite direction of the U.S. dollar since the beginning of 2022 — and now that inverse relationship is more extreme than ever. Bitcoin and the dollar go in opposite ways Notably, the weekly correlation coefficient between BTC and the dollar dropped to 0.77 below zero in the week ending July 3, its lowest in seventeen months. Meanwhile, Bitcoin’s correlation with the tech-heavy Nasdaq Composite reached 0.78 above zero in the same weekly session, data from TradingView shows. BTC/USD and U.S. dollar correlation coefficient. Source: TradingView That is primarily because of these markets’ year-to-date performances amid the fears of recession, led by the Federal Reserve’s benchmark rate hikes to curb rising inflation. Bitcoin, for example,...

Bitcoin addresses in loss hit all-time high amid $18K BTC price target

Bitcoin (BTC) meandered into the weekly close on July 3 after weekend trading produced a brief wick below $18,800. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bollinger bands signal volatility due Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it stuck to $19,000 rigidly for a third day running. The pair had gone light on volatility overall at the weekend, but at the time of writing was still on track for the first weekly close below its prior halving cycle’s all-time high since December 2020. The previous weekend’s action had produced a late surge which saved bulls from a close below $20,000. Momentum remained weak throughout the following week’s Wall Street trading, however, and traders were unconvinced about the potential for a significant relief...

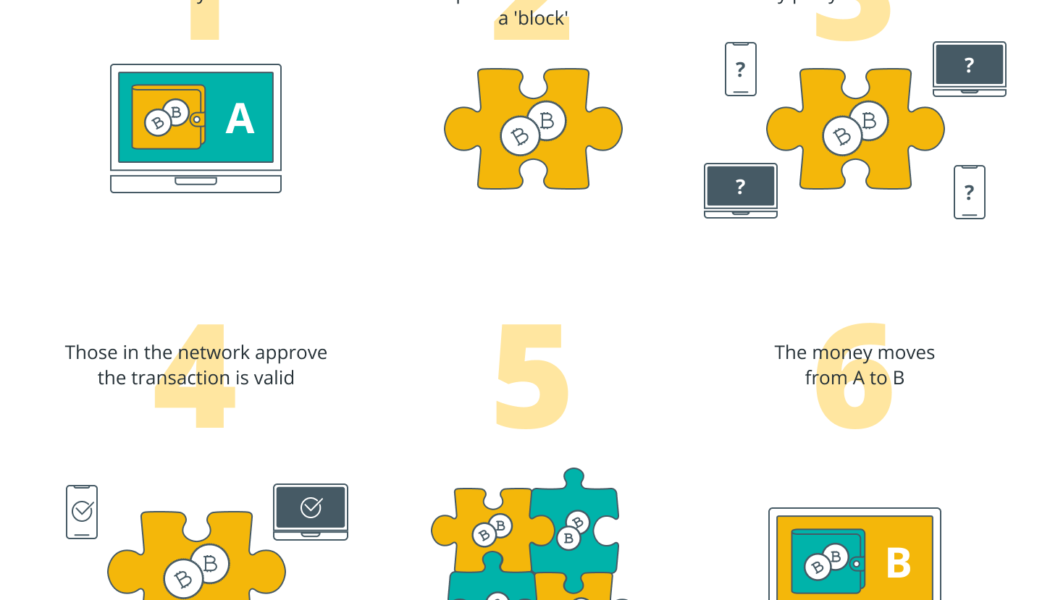

Fintech-Ideas brings blockchain functionality to its range of platforms

Berlin, Germany, 3rd July, 2022, Chainwire Enterprise software developer Fintech-Ideas has integrated a suite of blockchain tools to its SaaS offerings. The provision will enable businesses to utilize powerful web3 features such as tokenization, NFTs, and distributed storage. The integration of blockchain functionality into the company’s fintech and marketing platforms will deliver web3 services on demand. Customers will be able to gain exposure to crypto-based technologies, including blockchain, with minimal setup costs and lead time. Flagship Fintech-Ideas products such as Pushnoti, LiberSave, and ITTechAV are relied on by millions of customers for payments and marketing. The incorporation of web3 features will further extend their functionality and unlock new revenue streams for forward...

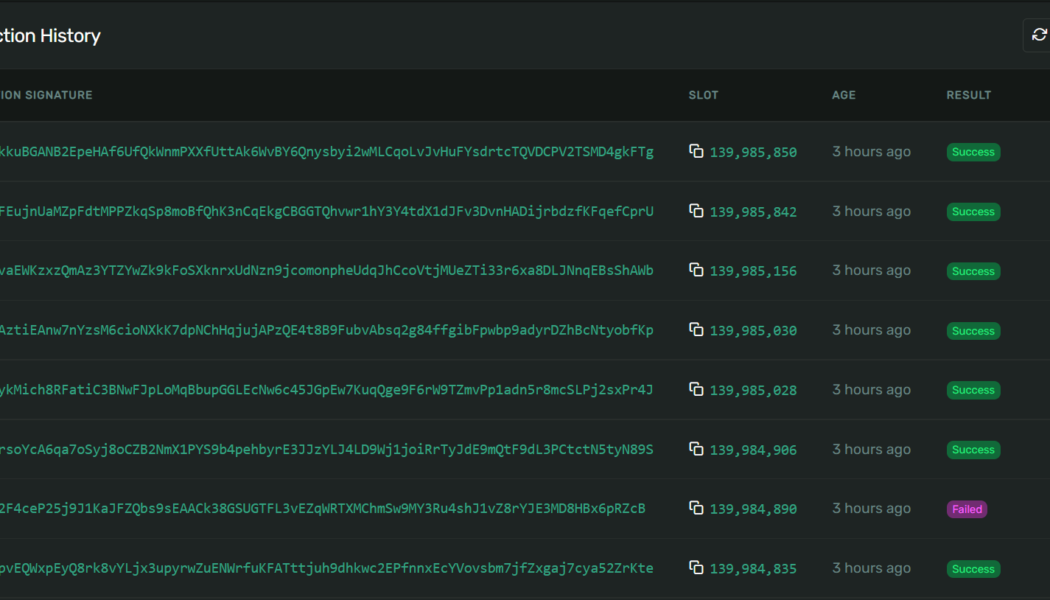

Crema Finance shuts liquidity protocol on Solana amid hack investigation

Crema Finance, a concentrated liquidity protocol over the Solana blockchain, announced the temporary suspension of its services owing to a successful exploit that has drained a substantial but undisclosed amount of funds. Soon after realizing the hack on its protocol, Crema Finance suspended the liquidity services to refrain the hacker from draining out its liquidity reserves — which include the funds of the service provider and investors. Attention! Our protocol seems to have just experienced a hacking. We temporarily suspended the program and are investigating it. Updates will be shared here ASAP. — CremaFinance (@Crema_Finance) July 3, 2022 Speaking to Cointelegraph about the matter, Henry Du, the co-founder of Crema Finance confirmed the commencement of the investigation. He state...