crypto blog

Bitcoin price: June close barely beats 2017 high as Coinbase Premium flips positive

Bitcoin (BTC) finished June 2022 just below $20,000 after a last-minute pump saw bulls escape 40% monthly losses. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst: Bitcoin could stay “boring” for months Data from Cointelegraph Markets Pro and TradingView showed BTC/USD spiking higher into the monthly close, which came in at $19,924 on Bitstamp. With that, the pair narrowly avoided its first-ever monthly close below a previous halving cycle’s all-time high. On Bitstamp in November 2017, Bitcoin reached approximately $19,770. Right on time. #BTC pic.twitter.com/KxZiOF0kF8 — Material Indicators (@MI_Algos) June 30, 2022 The success was, at best, touch-and-go for a market that nonetheless sealed its worst monthly losses since September 2011, these coming in at around 37.3%. ...

Not giving up: VanEck refiles with SEC for spot Bitcoin ETF

VanEck, one of the first firms in the world to ever file for a Bitcoin (BTC) exchange-traded fund (ETF), is not giving up on its plans to launch a spot Bitcoin ETF in the United States. The firm has refiled an application for a physically-backed Bitcoin ETF with the U.S. Securities and Exchange Commission (SEC). Filed on June 24, VanEck’s latest Bitcoin ETF application comes months after the SEC rejected its previous spot Bitcoin ETF request on November 12, 2021. The securities regulator based its decision on the ETF on its alleged inability to meet standards to protect investors and the public interest as well as to “prevent fraudulent and manipulative acts and practices.” In the latest filing, VanEck provided a wide number of reasons for the SEC to approve a Bitcoin ETF this time. T...

Coinbase denies reports of selling customer data to the US government

Crypto exchange platform Coinbase denied reports alleging that the company is selling its customer information to the United States Immigration and Customs Enforcement (ICE), an agency that works under the country’s Department of Homeland Security. On Thursday, news that Coinbase has been providing geolocation data to ICE has circulated online. Because of this, Twitter users like Solobase Mac were shocked and noted that they “didn’t sign up for that.” They tweeted: Now why would they be doing that? So basically invasion of privacy. Sells with out knowledge? They will be owing me 10 million for that one. I didn’t sign up for that. What the hell could this be real or false. Man so much running through my head right now. — Solobase Mac (@Blacktalizman) June 30, 2022 In a statement...

Deutsche Bank analysts see Bitcoin recovering to $28K by December

Analysts from Deutsche Bank forecast Bitcoin (BTC) rebounding to $28,000 by December 2022 as the cryptocurrency market continues to grapple with gloomy times. Bitcoin and the wider cryptocurrency markets have endured a tough six months, with the value of BTC, in particular, enduring its worst quarter in 10 years. Macroeconomic conditions around the world have played a role, with stagnating markets and fears of inflation driving conventional stock markets and their crypto-counterparts down to painful lows. A report from Deutsche Bank analysts Marion Laboure and Galina Pozdnyakova provides an interesting perspective on the medium-term outlook for BTC. Their insights suggest that cryptocurrency markets have mirrored movements of the Nasdaq 100 and S&P 500 since late 2021. The pair believe...

BnkToTheFuture unveils 3 proposals to rescue Celsius from oblivion

Celsius’ lead investor BnkToTheFuture has outlined three proposals to save Celsius from bankruptcy while finding a good outcome for shareholders and depositors with funds stuck on the platform. Shared on Twitter by BnkToTheFuture CEO Simon Dixon on June 30, the three distinct proposals include either two options of restructuring and relaunching Celsius, or potentially co-investing in the platform alongside wealthy Bitcoin Whales. “Proposal #1: A restructuring to relaunch Celsius and allow depositors to benefit from any recovery through financial engineering. Proposal #2: A pool of the most influential whales in Bitcoin to co-invest with the community. Proposal #3: An operational plan that allows a new entity and team to rebuild and make depositors whole.” Dixon previously referred to...

Worst quarter in 11 years as Bitcoin price and activity plunges

Bitcoin (BTC) has seen its worst quarterly loss in 11 years with price and activity on the blockchain both plunging over the last three months. The second quarter ending June 30 saw Bitcoin’s price fall from around $45,000 at the start of the quarter to trade at $19,884 before midnight ET on June 30 according to CoinGecko, representing a 56.2% loss according to crypto analytics platform Coinglass. It’s the steepest price fall since the third quarter of 2011, when BTC fell from $15.40 to $5.03, a loss of over 67% and worse than the bear markets of 2014 and 2018, when Bitcoin’s price slumped 39.7% and 49.7% in their worst quarters respectively. The past quarter saw eight weekly red candles in a row for Bitcoin and the month of June saw a draw down of over 37%, the heaviest monthly losses sin...

Ethereum fork a success as Sepolia testnet gears up to trial the Merge

The difficulty bomb-delaying Gray Glacier hard fork went live on Ethereum on Thursday without a hitch according to the network’s core devs including Ethereum Foundation’s Tim Beiko. The Sepolia testnet is also set to run through its Merge trial over the next few days and is the second last testnet to go through the trial before the official Merge. According to Etherscan, the Gray Glacier hard fork was initiated on block number 15050000 at roughly 6:54 am ET, June 30. The hard fork will now delay the difficulty bomb by roughly 700,000 blocks or 100 days, giving devs until mid-October to complete the long-awaited Merge. Ethereum Foundation community manager Tim Beiko promptly went to note on Twitter later that day that at 20 blocks past the fork, all monitored notes remained in sync, st...

Better days ahead with crypto deleveraging coming to an end: JPMorgan

The historic deleveraging of the cryptocurrency market could be coming to an end, which could signal the close of the worst of the bear market, according to a JPMorgan analyst. In a Wednesday note, JPMorgan strategist Nikolaos Panigirtzoglou highlighted increased willingness of firms to bail out companies, and a healthy pace of venture capital funding in May and June as the basis for his optimism. He said key indicators support the assessment: “Indicators like our Net Leverage metric suggest that deleveraging is already well advanced.” The deleveraging of major crypto firms, where their assets have been sold either willingly, in a rush, or via liquidation, began largely in May when the Terra ecosystem collapsed and wiped out tens of billions of dollars. Since then, crypto lende...

Analysts identify 3 critical flaws that brought DeFi down

The cryptocurrency market has had a rough go this year and the collapse of multiple projects and funds sparked a contagion effect that has affected just about everyone in the space. The dust has yet to settle, but a steady flow of details is allowing investors to piece together a picture that highlights the systemic risks of decentralized finance and poor risk management. Here’s a look at what several experts are saying about the reasons behind the DeFi crash and their perspectives on what needs to be done for the sector to make a comeback. Failure to generate sustainable revenue One of the most frequently cited reasons for DeFi protocols struggling is their inability to generate sustainable income that adds meaningful value to the platform’s ecosystem. Fundamental Design Princ...

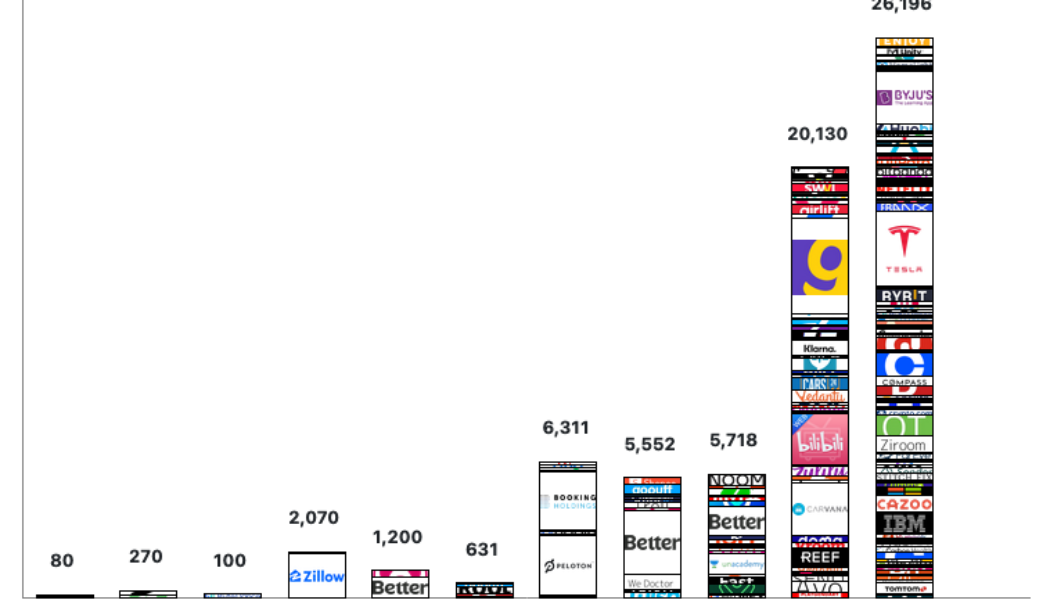

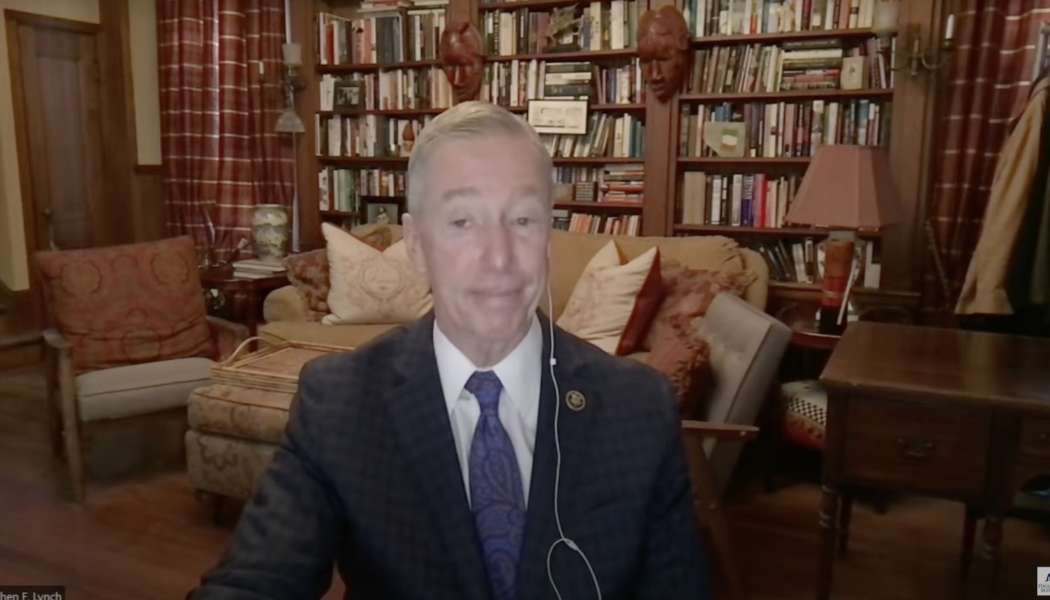

US lawmakers say crypto industry has a ‘tech bro’ problem hurting innovation

According to some United States lawmakers in the House Financial Services Committee, the lack of diversity in the financial technology space could be hurting many companies’ bottom lines. In a Thursday virtual hearing on “Combatting Tech Bro Culture,” U.S. lawmakers and witnesses discussed how women and people of color were underrepresented in leadership positions in the financial technology industry, including crypto firms. Massachusetts Representative Stephen Lynch cited data that only 2% of venture capital funding went to firms in which the founders were women, while only 1% went to those with black founders, and 1.8% for Latinx. According to Lynch and some on the committee, this trend suggested an “old boys club” culture in companies including those involved with cryptocurrencies, in w...

Former Monero maintainer Riccardo ‘Fluffypony’ Spagni to surrender for South Africa extradition

Riccardo Spagni, the former maintainer of the privacy coin Monero also known as Fluffypony, faces extradition to South Africa months after his arrest by U.S. authorities. In a Thursday court filing for the Middle District of Tennessee, Magistrate Judge Alistair Newbern ordered Spagni to surrender to U.S. Marshals on July 5 for extradition to South Africa. He will reportedly face 378 charges related to allegations of fraud and forgery between 2009 and 2011 at a company called Cape Cookies. U.S. authorities arrested Spagni in Nashville in July 2021 at the request of the South African government, holding him in custody until September. The court filings hint at allowing Spagni to be in the United States for the Independence Day holiday weekend before being taken to Africa early on Tuesday. No...