crypto blog

Klever set to launch layer 1 blockchain mainnet, the KleverChain

Blockchain network Klever has announces it will launch its layer 1 blockchain mainnet duped KleverChain on July 1. The mainnet will enable the Klever ecosystem to gain full independence allowing it to bring more products and services to its ecosystem. Klever has positioned itself as a top-tier public blockchain infrastructure for the internet with a mission of making crypto easy for everyone to take part in. The launch of its mainnet will usher in a new era making a departure from the Tron Network which it was launched on. KleverChain While blockchain can prove to be difficult for newcomers, KleverChain aims at making it simple and easy for everyone. In essence, the mainnet will serve as a trusted and permissionless blockchain network for helping in the expansion of the emerging decentrali...

Infamous North Korean hacker group identified as suspect for $100M Harmony attack

The Lazarus Group, a well-known North Korean hacking syndicate, has been identified as the primary suspect in the recent attack that saw $100 million stolen from the Harmony protocol. According to a new report published Thursday by blockchain analysis firm Elliptic, the manner in which Harmony’s Horizon bridge was hacked and the way in which the stolen digital assets were consequently laundered bears a striking resemblance to other Lazarus Group attacks. “There are strong indications that North Korea’s Lazarus Group may be responsible for this theft, based on the nature of the hack and the subsequent laundering of the stolen funds.” Additionally, Elliptic outlined exactly how the heist was executed, noting that The Lazarus Group targeted the login credentials of Harmony employees in ...

Grayscale’s legal challenge to SEC sparks response from the community

After Grayscale’s application to convert its Grayscale Bitcoin Trust (GBTC) into a Bitcoin (BTC) exchange-traded fund (ETF) was denied, the firm launched a legal challenge against the United States Securities and Exchanges Commission. Following these events, the community responded with various reactions, from accusing the SEC of price manipulation to suggesting different solutions. Redditor u/ThatsMRcurmudgeon2u, who introduced themself as a securities lawyer, weighed in on the matter. According to the Redditor, many anticipated the lawsuit, as SEC Chair Gary Gensler has made it clear that he wants exchanges to register with the SEC. The Redditor also accused the SEC of “holding GBTC hostage.” Lawyer Jake Chervinsky tweeted that the ETF denial was “deeply disappointing” and defies f...

How to start a career in crypto? A beginner’s guide for 2022

The cryptocurrency industry is arguably one of the fastest-growing industries in the world. With its decentralized finance (DeFi) system and blockchain technology, crypto has become an attractive career path for those interested in technology and finance. As expected of any fast-growing sector, growth has also led to a corresponding increase in demand for talented individuals to build the space. According to a KoreanAITimes report, cryptocurrency and blockchain jobs grew by a whopping 118% between September 2020 and July 2021. Even in the correct market downturn, where some firms have paused hiring or cut staff from their rosters, others are actively searching for and onboarding staff. There are tons of career paths to choose from in the cryptocurrency industry. So whether you are simply l...

Thailand’s Crypto Utopia — ‘90% of a cult, without all the weird stuff’

The story of how a Bitcoin OG set up a Libertarian crypto community and commune for digital nomads on beautiful islands in Thailand three times — and why he hasn’t yet given up on the dream. It’s a wild tale involving “unchecked merrymaking,” crypto-influencers, police grillings, seasteading, a reported $20,000-a-month burn rate, rumors about shamans and drugs — and a major collision between idealism and reality. It was also, by all accounts, a whole lot of fun. Cryptopia became the House of DAO, and a new version is planned. The spectacular Cape Residences in Phuket, Thailand are a world away from the bohemian backpackers and Full Moon parties of Koh Pha-ngan where I’ve spent the past few weeks researching Part 1 about crypto digital nomads living in paradise. If you’ve ever imagined how ...

Nifty news: Sandbox LAND on Polygon, ETH gain a tax loss and more…

Popular Ethereum-based Metaverse gaming platform The Sandbox has unveiled a bridge that enables users to transfer their virtual NFT LAND and native SAND tokens over to Layer-2 network Polygon (MATIC). While The Sandbox will live on Ethereum for the most part, the platform has emphasized that conducting SAND and LAND transactions on Polygon will result in lower gas fees, faster transaction speeds and greener interactions on the blockchain. The firm stated via Twitter on June 29 that it is now ready to start deploying LAND on Polygon, and users will be able to receive a 10 mSAND cashback worth roughly ($10.60) on LAND ported over to the Layer 2. We are ready to deploy LAND to @0xPolygon Each LAND bridged grants a 10 mSAND cashback!LAND multipliers on both mSAND staking programs are back!LAND...

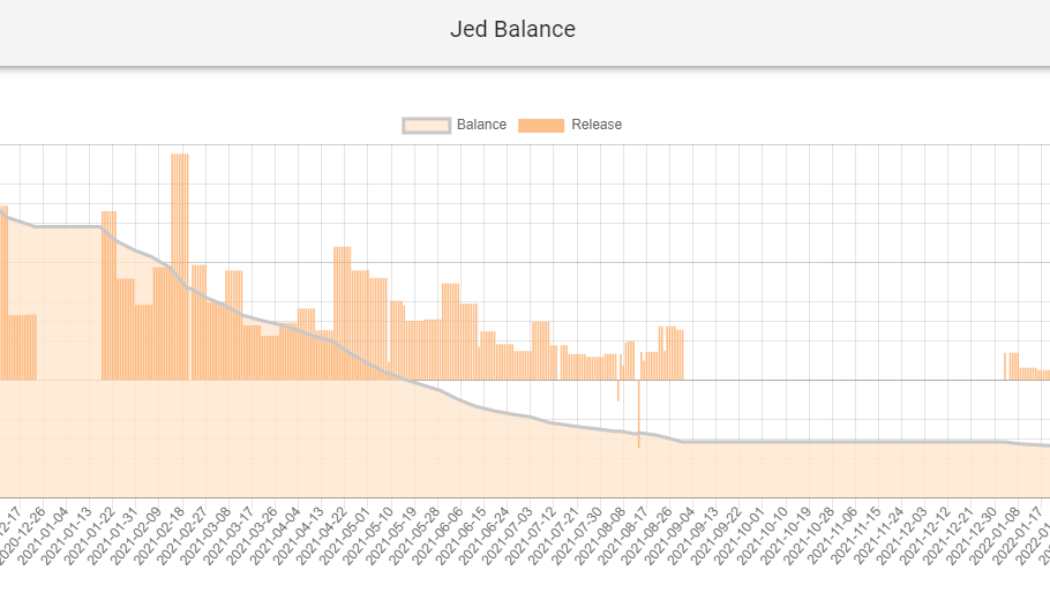

After 8 years dumping billions of XRP, Jed McCaleb’s stack runs out in weeks

Former Ripple Labs founder Jed McCaleb is nearing the end of his eight-year XRP dump marathon, with only 81.53 million XRP (worth $26.55 million), remaining in his wallet’s balance. According to Jed Balance, a website tracking his XRP holdings, McCaleb’s wallet name “tacostand” has been shedding an average of 4.06 million XRP over the last month but has ramped up daily transfers to 7.34 million XRP (worth $2.39 million), since Sunday, June 26. At the current rate of selling his wallet may be depleted within the next two to three weeks to the delight of the crypto community. On Wednesday, Mason Versluis, a tik tok influencer and youtuber known as Crypto Mason shared the news to his 115,000 followers on Twitter, highlighting that 22 million of XRP has been released in the past three days. Je...

CoinFlex CEO says withdrawals unlikely to resume on Thursday

Crypto exchange CoinFlex is “unlikely” to resume withdrawals on Thursday, June 30 as it had originally hoped, according to its CEO Mark Lamb, as the company continues to search for buyers of its $47 million bad debt. Speaking to CNBC on Wednesday, Lamb said more time was needed before it could reopen the platform for withdrawals, stating: “We will need more time. And it’s unlikely that withdrawals will be re-enabled tomorrow.” The crypto exchange had been banking on a $47 million token offering launched on Tuesday, June 28 which is known as Recovery Value USD (rvUSD). The token offering was created in an attempt to sell off its bad debt after one of its accounts went into negative equity. In a statement on Tuesday, the company said it hoped withdrawals could restart as previously pla...

Contagion: Genesis faces huge losses, BlockFi’s $1B loan, Celsius’s risky model

It’s been another day of watching the ripples of contagion spread through the crypto market. With Three Arrows Capital being ordered into liquidation by a British court, details have also emerged today of BlockFi liquidating a $1B loan to 3AC, and the fallout from the insolvency was partly to blame for lending firm and market maker Genesis Trading facing losses of “a few hundred million dollars.” Withdrawals remain suspended at the possibly insolvent lending and borrowing platform Celsius, which was revealed to have had a highly risky 19 to 1 assets-to-equity ratio before it ran into liquidity troubles this year. Celsius’ risky business According to documents reviewed and reported on by the Wall Street Journal (WSJ) on June 29, Celsius was operating on very fine and risky margins as ...

NYDIG study calculates the value of regulation worldwide in terms of BTC price gains

The need for regulation is a common theme in discussions about cryptocurrency, and the claim is often taken to be self-evident. Now, financial services company New York Digital Investment Group (NYDIG) has done some number crunching to prove the point. In a new study, NYDIG quantifies the effect of regulation on the price of Bitcoin (BTC) worldwide. NYDIG studied Bitcoin prices at regular intervals following regulatory events affecting digital asset taxation, accounting and payments, as well as decisions on the legality of service providers and the digital assets themselves. The research looked at the Americas, Europe, China and Asia except for China, and confined itself to the period between September 30, 2011, and March 31, 2022. The number of regulatory events considered in the study va...

US govt delays enforcement of crypto broker reporting requirements: Report

The provision in the U.S. infrastructure bill signed into law in November, which will require financial institutions and crypto brokers to report additional information, could reportedly be delayed. According to a Wednesday report from Bloomberg, the United States Department of the Treasury and Internal Revenue Service may not be willing to enforce crypto brokers collecting information on certain transactions starting in January 2023, citing people familiar with the matter. The potential delay could reportedly affect billions of dollars related to capital gains taxes — the Biden administration’s budget for the government for the 2023 fiscal year previously estimated modifying the crypto tax rules could reduce the deficit by roughly $11 billion. Under the current infrastructure bill, Sectio...