crypto blog

Roger Ver denies CoinFLEX CEO’s claims he owes firm $47M USDC

Roger Ver, an early Bitcoin investor and Bitcoin Cash proponent, has pushed against claims from crypto investment platform CoinFLEX regarding an alleged $47-million debt. In a Tuesday tweet, Ver — not mentioning CoinFLEX by name — said he had not “defaulted on a debt to a counter-party,” and alleged the crypto firm owed him “a substantial sum of money.” The denial followed rumors on social media that the BCH proponent was involved in the platform halting withdrawals due to “a high-networth client who has holdings in many large crypto firms” not covering their debts. CoinFLEX CEO Mark Lamb took to Twitter shortly after the statement to claim the company had a written contract with Ver “obligating him to personally guarantee any negative equity on his CoinFLEX account and top up margin regul...

INX And SICPA Sign A Groundbreaking Memorandum of Understanding To Establish a Joint Venture to Develop An Innovative Central Bank Digital Currency Ecosystem To Support Monetary Sovereignty

Toronto, Canada, 28th June, 2022, Chainwire The proposed joint venture will lead the development of blockchain-based technology solutions to create a central bank digital currency ecosystem to help governments digitize their monetary systems The INX Digital Company, Inc. (INXS ATS: INX)(NEO: INXD) (“INX” or the “Company”), a broker-dealer, inter-dealer broker, and owner of a digital asset trading platform, announced today that it has signed a non-binding memorandum of understanding (“MOU”) with SICPA, a global Swiss company, leading provider of security inks and identification, traceability and authentication technologies, to help governments digitize their monetary systems. The Company believes that today, more than ever, governments and central banks around the globe are searching for a ...

Can Cardano’s July hard fork prevent ADA price from plunging 60%?

Cardano (ADA) has started painting a bearish continuation pattern on its longer-timeframe charts, raising its likelihood of undergoing a major price crash by August. ADA price in danger of a 60% plunge Dubbed the “bear pennant,” the pattern forms when the price consolidates inside a range defined by a falling trendline resistance and rising trendline support after a strong move downside. Additionally, the consolidation moves accompany a decrease in trading volumes. Bear pennants typically resolve after the price breaks below their trendline support and, as a rule, could fall by as much as the height of the previous big downtrend, called a “flagpole,” as illustrated in the chart below. ADA/USD three-day price chart featuring “bear pennant'”setup. So...

How crypto is attracting some institutional investors — Huobi Global sales head

James Hume, head of sales at Huobi Global, said that while some institutional investors have gotten “cold feet” over crypto, many with billions of dollars are exploring the space. Speaking to Cointelegraph at the European Blockchain Convention on Tuesday, Hume said that the crypto exchange had observed increasing interest from institutional investors within the last one to two years in entering the digital asset space. According to Hume, it took a long time for certain firms and hedge funds to “build teams, raise capital and understand the infrastructure” to participate in crypto, estimating that 20–30 firms with more than $1 billion could start trading within the year. “I think it’s a pretty exciting time,” said Hume. “A lot of the more speculative bets in crypto… Some have got a bit of c...

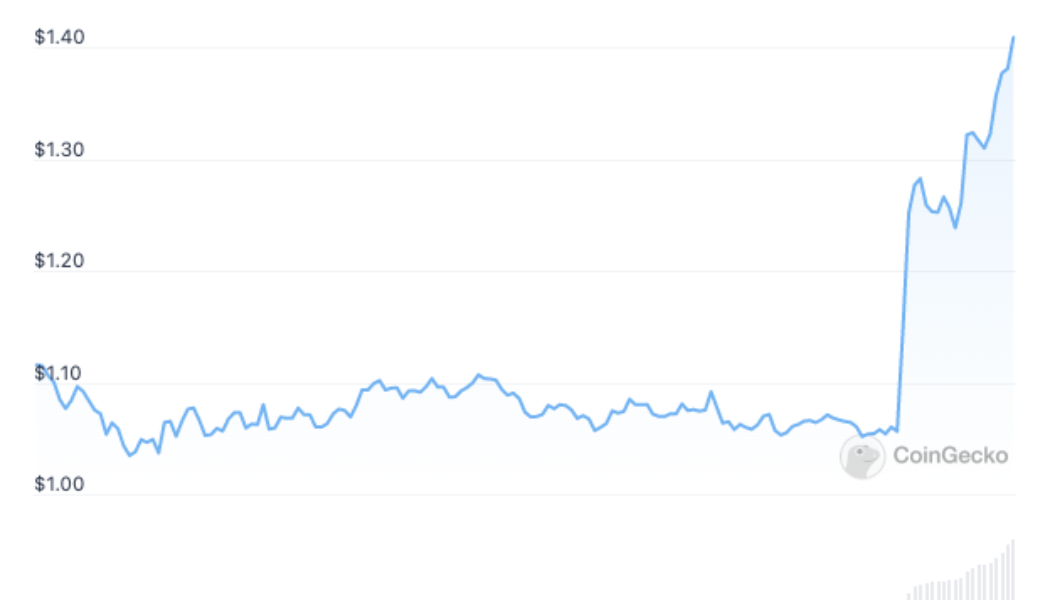

‘Unique phenomenon’: All 5B toncoins mined on PoS TON blockchain

The TON Foundation, an organization developing the Telegram-initiated blockchain project, the TON blockchain, on Tuesday officially announced that TON miners have mined the final toncoin. “Tens of thousands of miners have mined the entire issuance of toncoins, which was about 5 billion tokens,” TON Foundation founding member and core developer Anatoly Makosov said in a statement to Cointelegraph. The last toncoin was mined on June 28, he noted. The end of toncoin mining marks a major milestone in TON’s distribution, starting its new era as an entirely PoS blockchain. From now on, new toncoins will only enter circulation via PoS validation, the TON Foundation said. That will result in a cut in the total influx of new toncoins into the network by around 75% to the existing l...

Bitcoin’s bottom might not be in, but miners say it ‘has always made gains over any 4-year period’

Your favorite trader is saying Bitcoin (BTC) bottomed. At the same time, the top on-chain indicators and analysts are citing the current price range as a “generational buy” opportunity. Meanwhile, various crypto and finance media recently reported that Bitcoin miners sending a mass of coins to exchanges are a sign that $17,600 was the capitulation move that pins the market bottom. There’s so much assurity from various anon and doxed analysts on Crypto Twitter, yet Bitcoin price is still in a clear downtrend, and the metrics don’t fully reflect that traders are buying every dip. A critical component of BTC price that many investors often overlook is the condition and sentiment of Bitcoin miners, which is exactly why Cointelegraph had a chat with Rich Ferolo of Blockware Solutions and ...

Celsius denies allegations on Alex Mashinsky trying to flee US

Troubled crypto lending firm Celsius is putting their best foot forward to recover operations alongside CEO Alex Mashinsky, who currently stays in the United States, the company has claimed. A spokesperson for Celsius has denied rumors that the company’s CEO tried to flee the U.S. last week amid the ongoing liquidity crisis of the Celsius Network. The representative told Cointelegraph on Monday that the firm continues working on restoring liquidity, stating: “All Celsius employees — including our CEO — are focused and hard at work in an effort to stabilize liquidity and operations. To that end, any reports that the Celsius CEO has attempted to leave the U.S. are false.” Celsius’ statement came shortly after Mike Alfred, co-founder of the crypto analytics firm Digital Assets Data, took to T...

Uzbekistan warms up to Bitcoin mining, but there’s a catch

The National Agency of Prospective Projects (NAPP) in Uzbekistan announced its demands toward crypto mining operators. It would only allow the companies that use solar energy to mine Bitcoin (BTC) or other cryptocurrencies. The normative act on the government page, dated June 24, describes the confirmation of “Guidelines on the registration of the crypto assets mining,” and sets the finalization date on July 9. The second article of the document offers an uncompromising wording: “Mining is being carried out only by the legal entity with the use of electric energy, provided by a solar photovoltaic power plant.” As a further complication, the miners should own the solar photovoltaic power plant that they will use for energy. The executive order also obliges any mining operator to obtai...

Not the best week for crypto lending: Law Decoded, June 20-27

Due to Celsius Network’s withdrawal suspension in mid-June, the very topic of crypto lending made its entryway to the acute issues list for the regulators. Last week, lawmakers and officials continued to raise the question of necessary action, with significant utterance belonging to one of the key European crypto skeptics, Christine Lagard. European Central Bank president got so impressed with the Celsius crisis that she coined the term “MiCa II,” referring to the main regulatory package for crypto in the European Union. Lagarde believes the new MiCa should include separate crypto-asset staking and lending guidelines. It’s not necessary to be a civil servant to discern the flaws of the current lending model, though. A hardcore Bitcoin (BTC) maximalist and Swan Bitcoin CEO...

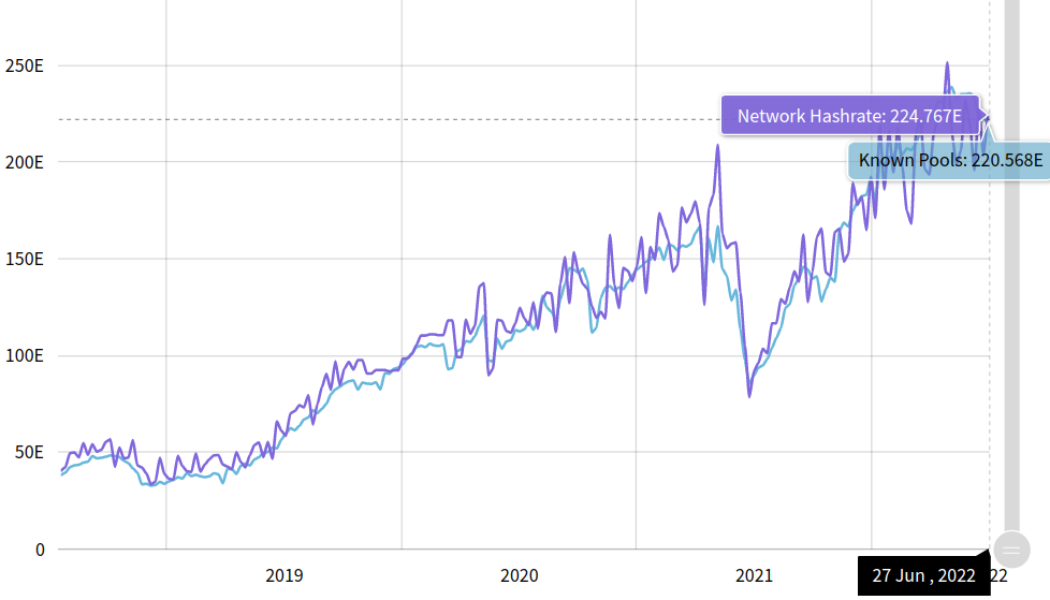

3 charts showing this Bitcoin price drop is unlike summer 2021

Bitcoin (BTC) bear markets come in many shapes and sizes, but this one has given many reason to panic. BTC has been described as facing “a bear of historic proportions” in 2022, but just one year ago, a similar feeling of doom swept crypto markets as Bitcoin saw a 50% drawdown in weeks. Beyond price, however, 2022 on-chain data looks wildly different. Cointelegraph takes a look at three key metrics demonstrating how this Bitcoin bear market is not like the last. Hash rate Everyone remembers the Bitcoin miner exodus from China, which effectively banned the practice in one of its most prolific areas. While the extent of the ban has since come under suspicion, the move at the time saw huge numbers of network participants relocate — mostly to the United States — in a matter of week...

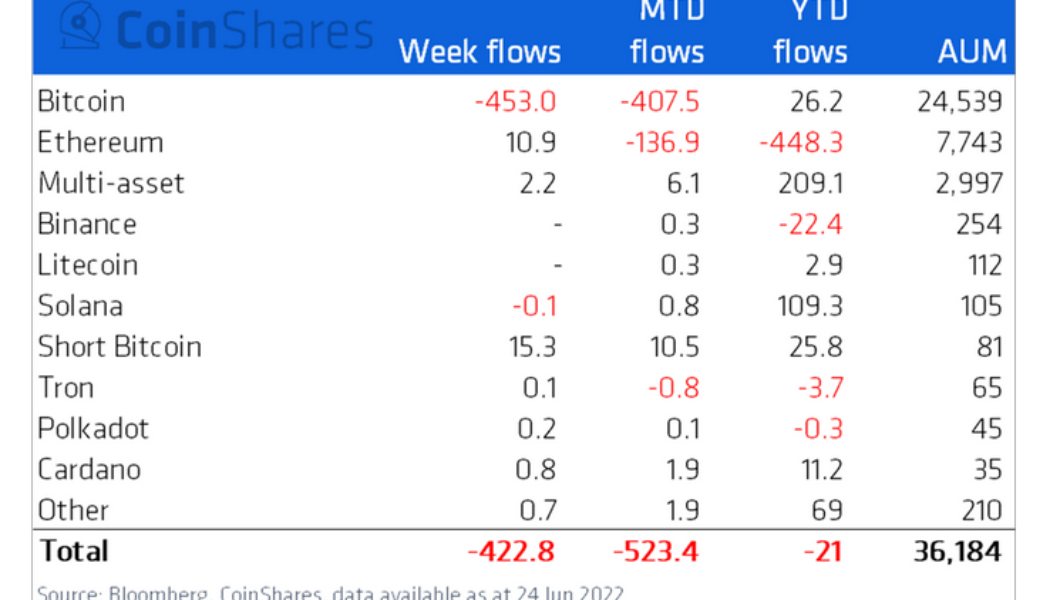

Institutional crypto asset products saw record weekly outflows of $423M

Digital asset investment products saw record outflows totaling $423 million last week, with institutional investors from Canada representing nearly all of the carnage. According to the latest edition of CoinShares’ weekly “Digital Asset Fund Flows” report, Canadian investors offloaded a whopping $487.5 worth of digital asset products between June 20 and June 24. The total outflows for the week were partially offset by $70 million worth of inflows from other countries, with U.S.-based investors accounting for more than half of the inflows with $41 million. Outside of the U.S., investors from Germany and Switzerland accounted for inflows totaling $11 million and $10.4 million apiece. In comparison, Brazilians and Australians also pitched in with minor inflows of $1.6 million and $1.4 million...

Harmony hacker sends stolen funds to Tornado Cash mixer

The funds from Harmony’s Horizon Bridge have begun to move into the Tornado Cash Ethererum mixer, signaling that the attacker has no intention of accepting the $1 million bounty offered. The decision to obfuscate the ill-gotten gains answers questions about whether the Harmony team’s offer of just 1% of the $100 million in crypto funds stolen on June 24 would be enough to convince the exploiter to return them. #PeckShieldAlert ~6k $ETH (~$7.1m) into @TornadoCash from @harmonyprotocol exploiters Intermediary address: 0x432…47ae pic.twitter.com/AR9dmJRQet — PeckShieldAlert (@PeckShieldAlert) June 27, 2022 A total of 18,036.3 ETH worth about $21 million was moved out of the Horizon Bridge exploiter’s primary wallet at 03:10 am ET on June 28. These funds were then divided equally three w...