crypto blog

Community reacts after SEC’s Gensler affirms BTC’s commodity status

Securities and Exchange Commission Chairman Gary Gensler riled up Crypto Twitter on Monday after affirming that Bitcoin (BTC) is a commodity. Questions were raised about its impact on Grayscales’ proposed Bitcoin ETF and why Ethereum wasn’t mentioned. Speaking to Jim Cramer on CNBC’s Squawk Box on Monday, June 27, the SEC chair said while many crypto-financial assets have the key attribute of a security, Bitcoin is the “only one” that he was comfortable publicly labeling as a commodity. “Some, like Bitcoin — and that’s the only one I’m going to say because I’m not going to talk about any one of these tokens, but my predecessors and others have said they’re a commodity.” Grayscale Bitcoin ETF The remarks kicked up chatter about Grayscale’s application to convert its Bitcoi...

Unizen ‘CeDeFi’ smart exchange secures $200M investment from GEM

Cryptocurrency exchange Unizen has scored a $200 million investment from private equity group Global Emerging Markets (GEM) which it will use to expand its business and its ecosystem. Rather than receiving the $200 million in funding all at once, Unizen noted on June 27 that the investment will come in the form of a “capital commitment’, with part of the funding released upfront and the rest will be provided later based on achieved milestones. Unizen did not disclose what particular criteria it had to achieve to receive the funding. Unizen calls itself a “CeDeFi” exchange mixing features of both centralized exchanges (CEXs) and decentralized exchanges (DEXs), it runs on the BNB Chain, formerly called the Binance Smart Chain. It aims to attract both retail and institutional investors by fin...

Terra’s LUNA2 skyrockets 70% in nine days despite persistent sell-off risks

The price of Terra (LUNA2) has recovered sharply nine days after falling to its historic lows of $1.62. On June 27, LUNA2’s rate reached $2.77 per token, thus chalking up a 70% recovery when measured from the said low. Still, the token traded 77.35% lower than its record high of $12.24, set on May 30. LUNA2’s recovery mirrored similar retracement moves elsewhere in the crypto industry with top crypto assets Bitcoin (BTC) and Ether (ETH) rising by approximately 25% and 45% in the same period. LUNA2/USD four-hour price chart versus BTC/USD. Source: TradingView LUNA2 price rally could trap bulls The recent bout of buying in the LUNA2 market could trap bulls, given it has come as a part of a broader correction trend. In detail, LUNA2 appears to be forming a “bear flag&#...

Price analysis 6/27: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, AVAX

Bitcoin’s (BTC) current bear market is one of the worst, according to a report by on-chain analytics firm Glassnode. This was the first time in history that the Mayer Multiple slipped below the previous cycle’s low. Bitcoin’s fall below $20,000 on June 18 also marked the biggest loss ever booked by investors in a single day at $4.23 billion. Considering the above factors and a few other events, Glassnode believes that the capitulation in Bitcoin may have started. Bitcoin whales seem to have started their purchasing, suggesting that the bottom may be close and on June 25, analytics resource “Game of Trades” highlighted that demand from whales holding 1,000 to 10,000 Bitcoin witnessed a sharp spike in demand. Daily cryptocurrency market performance. Source: Coin360 Another sign t...

Grayscale reports 99% of SEC comment letters support spot Bitcoin ETF

Digital asset manager Grayscale reported overwhelming support in public comments for its application to launch a spot Bitcoin exchange-traded fund. In a Monday letter to investors, Grayscale said that of the more than 11,400 letters the United States Securities and Exchange Commission, or SEC, had received in regards to its proposed Bitcoin (BTC) investment vehicle, “99.96 percent of those comment letters were supportive of Grayscale’s case” as of June 9. According to Grayscale, roughly 33% of the letters questioned the lack of a spot BTC ETF in the U.S., given the SEC had already approved investment vehicles linked to Bitcoin futures, as was the case for ProShares and Valkyrie. “The SEC’s actions over the past eight months […] have signaled an increased recognition of and comfort wi...

Metaverse fractional ownership to form similarly to property loans: Casper exec

As metaverse land assets become more expensive, ownership becomes harder for normal users. Because of this, Ralf Kubli, Board Member at the Casper Association, argues that fractional ownership, similar to property loans in the real world, may gain traction within the virtual space through nonfungible tokens (NFTs). Kubli told Cointelegraph that understanding fractional ownership within the metaverse is very similar to the legacy property system. As prices soar, many cannot afford to buy and own properties. This leads to people renting or leasing property, giving a form of fractional ownership. He explained that: “Instead of the typical renter-buyer relationship and processes inherent to the legacy system, smart contracts and virtual assets such as NFTs are what powers this fractional...

Swiss National Bank exec: Regulators may favor centralized stablecoins after Terra crisis

Swiss National Bank (SNB) deputy head Thomas Muser talked to Cointelegraph editor Aaron Wood and discussed the ongoing trends in central bank digital currencies (CBDCs), stablecoins, and regulations, during the recently concluded European Blockchain Convention (EBC) 2022. Talking about the innovation and adoption of private stablecoins and plans of central banks regarding the CBDC launch, Moser said both could co-exist. He said that CBDC’s function would be very basic and private stablecoin issuers can add services on top of them to meet retail customers’ needs. When asked about the recent collapse of the Terra’s UST and its subsequent impact on regulations, Moser said that the recent spiral crash of the Terra and its decentralized algorithmic stablecoin UST could have a lastin...

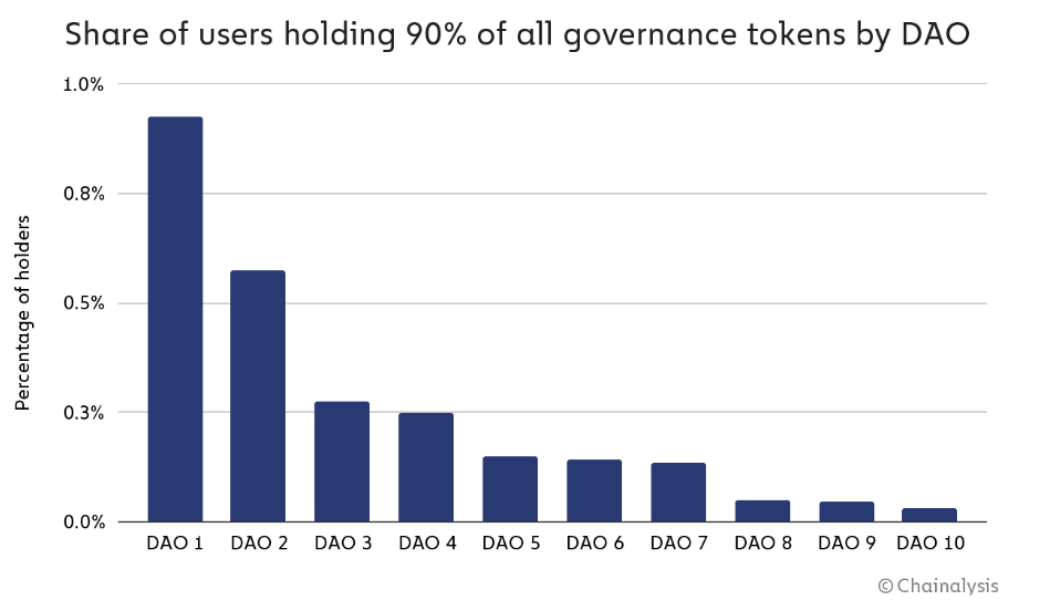

Less than 1% of all holders have 90% of the voting power in DAOs: report

Decentralized autonomous organizations (DAOs) have become a rage in the ever-expanding crypto ecosystem and are often seen as the future of decentralized corporate governance. DAOs are organizations without a centralized hierarchy, intended to work in a bottom-up manner, where the community collectively owns and contributes to an organization’s decision-making process. However, recent research data suggests that these DAOs are not as decentralized as it was intended to be. A recent report from Chainalysis analyzed the workings of ten major DAO projects and found that on average, less than 1% of all holders have 90% of the voting power. The finding highlights a high concentration of decision-making power in the hands of a selected few, an issue DAOs were created to resolve. This...

Educating regulators will help mitigate risks, says Figment exec

Cointelegraph’s managing editor Alex Cohen interviewed Figment’s staking marketing director Robert Ellison at the European Blockchain Convention (EBC) 2022. The duo discussed topics like educating regulators on blockchain and crypto, how businesses navigate uncertain regulatory landscapes and regulating staking. According to Ellision, it’s very important to educate regulators in the space to mitigate the risks of them going overboard without understanding the basics. The Figment executive mentioned that clear understanding is very important because of the complicated nature of the space. He explained that: “This is the battle we’re fighting, and it’s interesting to see that balance geopolitically to some countries versus others, and we hope that they jus...

How low can Ethereum price drop versus Bitcoin amid the DeFi contagion?

Ethereum’s native token Ether (ETH) has declined by more than 35% against Bitcoin (BTC) since December 2021 with a potential to decline further in the coming months. ETH/BTC weekly price chart. Source: TradingView ETH/BTC dynamics The ETH/BTC pair’s bullish trends typically suggest an increasing risk appetite among crypto traders, where speculation is more focused on Ether’s future valuations versus keeping their capital long-term in BTC. Conversely, a bearish ETH/BTC cycle is typically accompanied by a plunge in altcoins and Ethereum’s decline in market share. As a result, traders seek safety in BTC, showcasing their risk-off sentiment within the crypto industry. Ethereum TVL wipe-out Interest in the Ethereum blockchain soared during the pandemic as developer...

Anonymous vows to bring Do Kwon’s ‘crimes’ to light

Hacktivist group Anonymous has pledged to “make sure” Terra co-founder Do Kwon is “brought to justice as soon as possible” in regards to the collapse of the Terra (LUNA) and TerraUSD (UST) ecosystems in May. On Sunday, a video purportedly coming from the Anonymous hacker group rehashed a laundry list of Kwon’s alleged wrongdoings, including cashing out $80 million each month from Luna and TerraUSD prior to its collapse as well as his role in the fall of stable coin Basis Cash, for which Do Kwon allegedly co-created under the pseudonym “Rick Sanchez” in late 2020. “Do Kwon, if you are listening, sadly, there is nothing that can be done to reverse the damage that you have done. At this point, the only thing that we can do is hold you accountable and make sure that you are brought to ju...