crypto blog

Harmony offers $1M bounty, but is it big enough?

The Harmony layer-1 blockchain project team has offered a bounty equal to just 1% of the $100 million in crypto stolen from the Horizon Bridge hack last week. Harmony tweeted on June 26 that the team had committed $1 million for the return of the funds that were stolen from the Horizon Bridge on June 23. It added, “Harmony will advocate for no criminal charges when funds are returned.” We commit to a $1M bounty for the return of Horizon bridge funds and sharing exploit information. Contact us at whitehat@harmony.one or ETH address 0xd6ddd996b2d5b7db22306654fd548ba2a58693ac. Harmony will advocate for no criminal charges when funds are returned. — Harmony (@harmonyprotocol) June 26, 2022 However, concerns have been raised that the modest bounty sum may not be enough to incentivize the ...

ANZ’s stablecoin used to buy tokenized carbon credits

ANZ’s stablecoin A$DC has been used to buy Australian tokenized carbon credits, marking another critical test of the asset’s use cases in the local economy. In March, the “Big Four” bank became the first major Australian financial institution to mint its own stablecoin after overseeing a pilot transaction worth 30 million AUD ($20.76 million) between Victor Smorgon Group and digital asset manager Zerocap. ANZ’s stablecoin is fully collateralized by Australian dollars (AUD) held in the bank’s managed reserved account. So far, A$DC transactions have primarily been conducted over the Ethereum blockchain. According to a June 27 report from the Australian Financial Review (AFR), the latest transaction saw its long-time institutional partner Victor Smorgon use A$DC to purchase Australian C...

What are Bitcoin covenants, and how do they work?

Various prominent Bitcoin experts, including Adam Back, Jimmy Song and Andreas Antonopoulos, have raised some concerns over the implementation of restrictive covenants, in particular with the BIP119. In particular, Antonopoulos has voiced concerns over “recursive covenants” that the new update could convey, thereby deteriorating the network. A recursive covenant occurs when a programmer restricts a transaction, but he does it in a way that restricts another transaction after that, starting a domino effect resulting in future limitless recursive covenants. Blacklisting and risks of censorship and confiscation While locking up where a Bitcoin can be spent is advantageous to ensure more security, it also provides grounds for censorship, and control by governments, which would hind...

BTC price tops 10-day highs as Bitcoin whale demand sees ‘huge spike’

Bitcoin (BTC) made the most of weekend volatility on June 26 as a squeeze saw BTC/USD reach its highest in over a week. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView “Unusual whale activity” flagged Data from Cointelegraph Markets Pro and TradingView followed the largest cryptocurrency as it hit $21,868 on Bitstamp. Just hours from the weekly close, a reversal then set in under $21,500, Bitcoin still in line to seal its first “green” weekly candle since May. The event followed warnings that volatile conditions both up and down could return during low-liquidity weekend trading. On-chain data nonetheless fixed what appeared to be buying by Bitcoin’s largest-volume investor cohort prior to the uptick. “Unusual whale activity detected in B...

Top 5 cryptocurrencies to watch this week: BTC, UNI, XLM, THETA, HNT

The United States equities markets witnessed a sharp comeback last week, led by the Nasdaq Composite which gained 7.5%. The S&P was up about 6.5% for the week while the Dow Jones Industrial Average managed a gain of 5.4%. Continuing its tight correlation with the equities market, the crypto markets are also attempting a relief rally. Bitcoin (BTC) has seen a modest recovery but some altcoins have risen sharply in the past week. This suggests that investors are taking advantage of the sharp fall in the price to accumulate altcoins at lower levels. Crypto market data daily view. Source: Coin360 Smaller-sized investors have been using the decline in Bitcoin to build their position to at least one Bitcoin. Glassnode data shows that the number of Bitcoin wallet addresses having more than on...

Crypto conspiracy theories abound, but prop traders are just doing their job

Alameda Research is a cryptocurrency trading firm and liquidity provider founded by crypto billionaire Sam Bankman-Fried (SBF). Before founding his firm in 2017, SBF spent three years as a trader at the quantitative proprietary trading giant Jane Street Capital, which specializes in equity and bonds. In 2019, SBF founded the crypto derivatives and exchange FTX, which has quickly grown to become the fifth-largest by open interest. The Bahamas-based exchange raised $400 million in January 2022 and was valued at $32 billion. FTX’s global derivatives exchange business is separate from FTX US, another entity controlled by SBF, which raised another $400 million from investors including the Ontario Teachers Pension and SoftBank. The self-made billionaire has big dreams, like purchasing ...

XRP price rally stalls near key level that last time triggered a 65% crash

Ripple’s (XRP) ongoing upside retracement risks exhaustion as its price tests a resistance level with a history of triggering a 65% price crash. XRP price rebounds 30% XRP’s price gained nearly 30%, rising to $0.36 on June 24, four days after rebounding from $0.28, its lowest level since January 2021. The token’s retracement rally could extend to $0.41 next, according to its cup-and-handle pattern shown in the chart below. XRP/USD four-hour price chart featuring “cup and handle” pattern. Source: TradingView Interestingly, the indicator’s profit target is the same as XRP’s 50-day exponential moving average (50-day EMA; the red wave). XRP/USD daily price chart featuring 50-day EMA upside target. Source: TradingView Major resistance hurdle The cup-and-handle bullis...

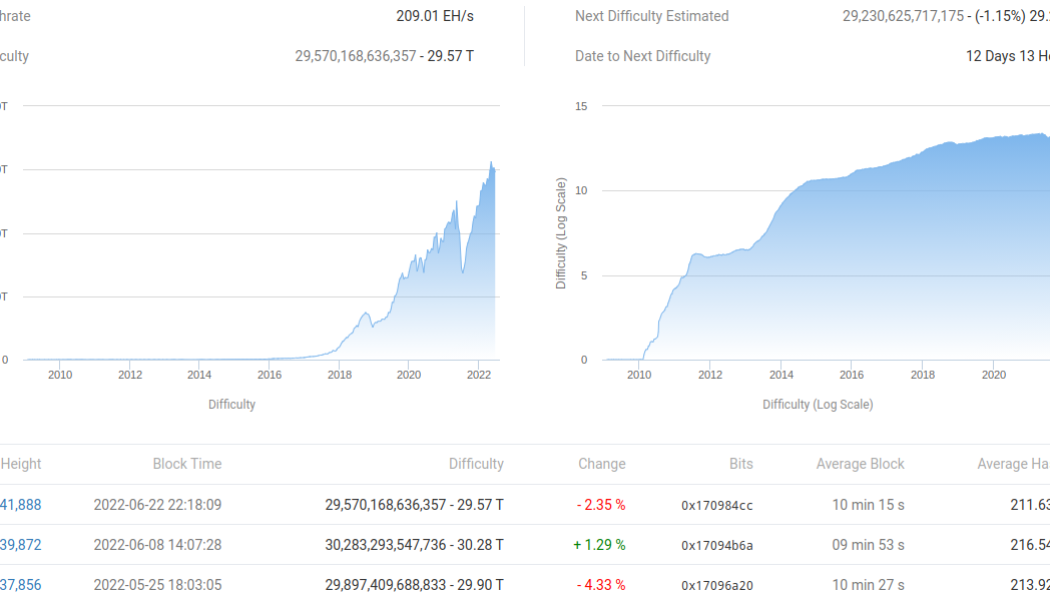

Bitcoin miner ‘capitulation event’ may have already happened — Research

Bitcoin (BTC) miners may have already sparked a “capitulation event,” fresh analysis has concluded. In an update on June 24, Julio Moreno, senior analyst at on-chain data firm CryptoQuant, hinted that the BTC price bottom could now be due. BTC price bottom “typically” follows miner capitulation Miners have seen a dramatic change in circumstances since March 2020, going from unprecedented profitability to seeing their margins squeezed. The dip to $17,600 — 70% below November’s all-time highs for BTC/USD — has hit some players hard, data now shows, with miner wallets sending large amounts of coins to exchanges. This, CryptoQuant suggests, precedes the final stages of the Bitcoin sell-off more broadly in line with historical precedent. “Our data demonstrate a miner capitulation event that has...

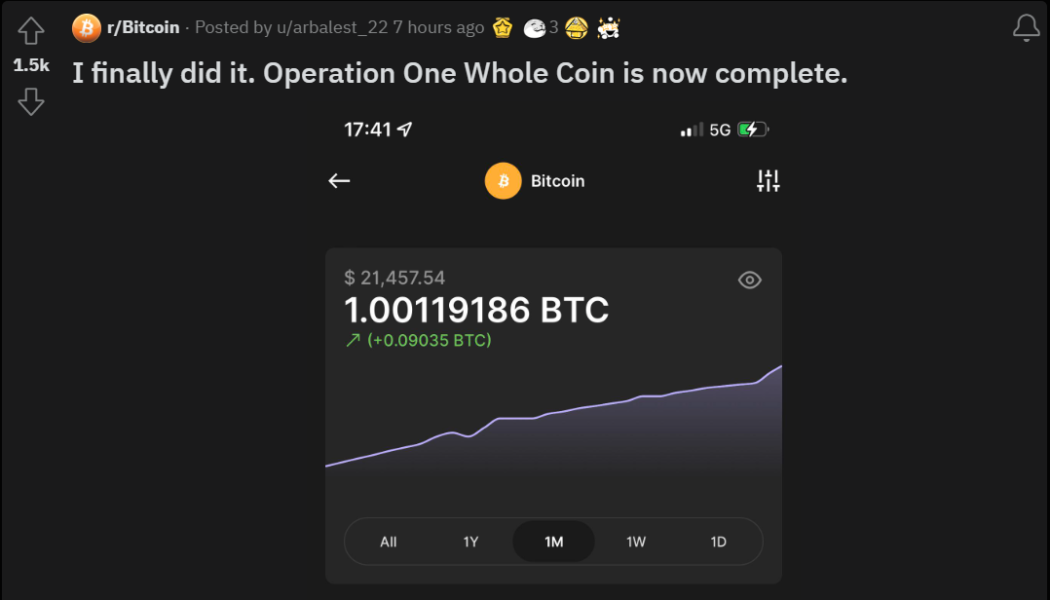

Small-time investors achieve the 1 BTC dream as Bitcoin holds $20k range

Ever since early Bitcoin (BTC) investors woke up millionaires as the ecosystem gained tremendous popularity alongside the mainstreaming of the internet, investors across the globe have been in the rush to accumulate as many of the 21 million BTC — one Satoshi at a time. With BTC recently trading at the $20,000 range for the first time since 2020, small-time investors found a small window of opportunity to achieve their dream of owning at least 1 BTC. On June 20, Cointelegraph reported that the number of Bitcoin wallet addresses containing one BTC or more increased by 13,091 in just 7 days. While the total number of addresses holding 1 BTC saw an immediate reduction in days to come, the crypto community on Reddit continues to welcome new crypto investors that hodled their way into becoming ...

6 Questions for Daniel Yan of Matrixport

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Daniel Yan, founding partner and chief operating officer at Matrixport — a digital assets financial services platform where users can invest, trade and leverage crypto assets. Hey guys, this is Dan — I am a founding partner at Matrixport. I have been COO of the company since 2019 overseeing the day-to-day operation of the company. Late last year, I started to spend most of my time building Matrixport Ventures — the venture investment arm of the company. It has been a great experience for me both personally and professionally. There has not been a boring day since I dipped my toes into crypto, let’s...

CBDC may threaten stablecoins, not Bitcoin: ARK36 exec

Central bank digital currencies (CBDCs) do not pose any direct threat to cryptocurrencies like Bitcoin (BTC) but are still associated with risks in relation to stablecoins, one industry executive believes. According to Mikkel Morch, executive director at the digital asset hedge fund ARK36, a state-backed digital currency like the U.S. dollar doesn’t necessarily have to be a competitor to a private or a decentralized cryptocurrency. That’s because the use cases and value proposition of the decentralized digital assets “often go beyond the realm of simple transactions,” Morch said in a statement to Cointelegraph on Thursday. The exec referred to Federal Reserve Chair Jerome Powell who earlier this year hinted that the United States government would not stop a “well regulated, privately issue...

Bitcoin gives ‘encouraging signs’ — Watch these BTC price levels next

Bitcoin (BTC) headed toward the upper end of its trading range on June 24 as optimism crept back into traders’ forecasts. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitcoin price “ready for $23,000” Data from Cointelegraph Markets Pro and TradingView tracked a broadly stable BTC/USD as it hit local highs of $21,425 on Bitstamp. The pair had shifted higher since wicking below the $20,000 on June 22, with United States equities similarly cool going into the weekend. “Bitcoin ready for $23,000,” Cointelegraph contributor Michaël van de Poppe announced to Twitter followers on the day. At just above the crucial 200-week moving average (WMA), $23,000 formed a popular upside target for commentators — and sellers. As noted by trading suite Decentrader, whales on exchan...