crypto blog

Can you earn passive income running a Lightning node?

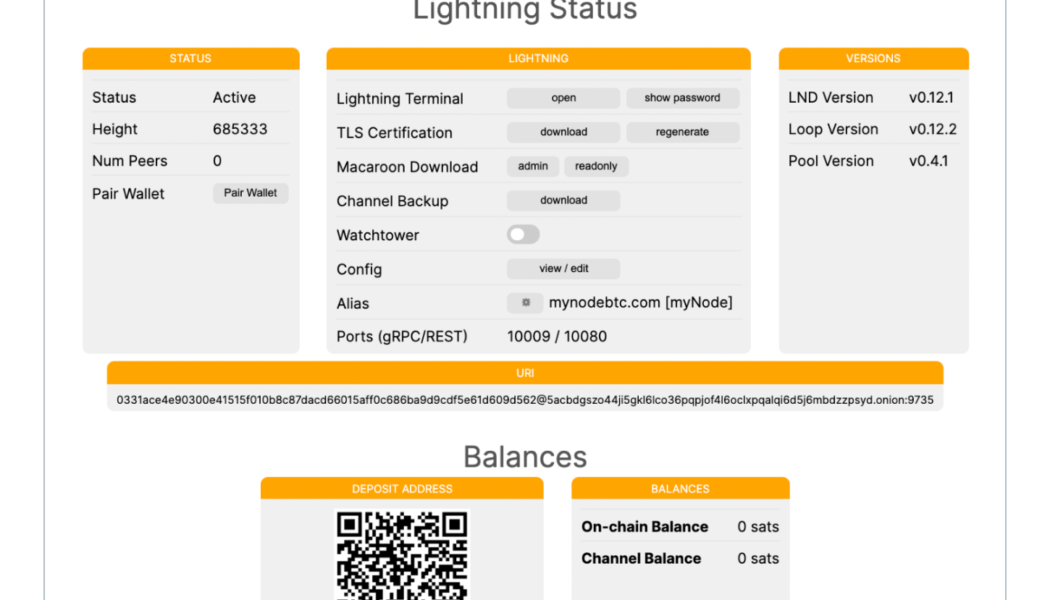

The prerequisites to run a Bitcoin Lightning node include an amount of Bitcoin to fund your Lightning channel, fiat money to buy the hardware equipment(s), and a Lightning-compatible wallet. Remember that Lightning nodes are non-mining nodes, which means you aren’t mining Bitcoin but are vital to validating Bitcoin blocks. Validation Nodes are the most common name for these. MyNode and Umbrel are two of the most popular specialized hardware options for validation nodes. In just a few simple steps, you can set up a new myNode device. To begin, download the myNode image for your device type and follow the instructions on the download page to flash it to an SD card. After that, turn on the device and connect an external SSD. You’ll be asked to type in your product key. You can sel...

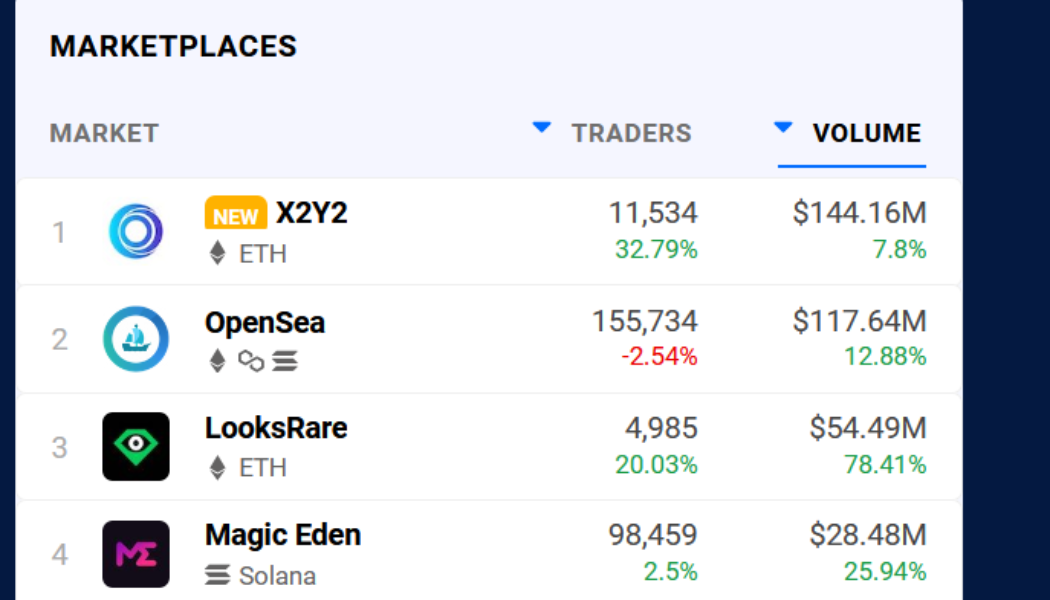

Nifty News: Yuga Labs breaks silence, X2Y2 outpaces OpenSea and more…

Yuga Labs has finally broken its silence over the conspiracy theory that alleges the team embedded alt-right and Nazi memes/imagery into the artwork and branding behind the Bored Ape Yacht Club (BAYC). As Cointelegraph previously reported, the BAYC conspiracy theory was once again brought into the limelight on June 20 after YouTuber Philion published a video exploring the supposed evidence that artist Ryder Ripps initially compiled at the start of this year. In a Medium blog post shared via Twitter on June 25, Yuga Labs co-founder Gordon Goner said that the team finally decided to clear the air after the theory had gotten so much attention that one of their favorite podcasters was talking about it. “We’ve not responded in further detail to these allegations because frankly they are insanel...

Bitcoin payments make a lot of sense for SMEs but the risks still remain

While Bitcoin payments can be processed quite easily by businesses these days there are still some tangible issues that need to be ironed out. The last six odd months has seen the cryptocurrency market witness an unparalleled amount of financial volatility, so much so that the total capitalization of this fast-maturing space has dropped from $3 trillion to approximately $1 trillion. This comes after the industry hit all-time highs across the board last November, with Bitcoin (BTC) reaching a price point of $69,000. Despite the previously stated volatility, a recent report shows that small to medium-sized enterprises (SMEs) across nine separate countries, Brazil, Canada, Germany, Hong Kong, Ireland, Russia, Singapore, United Arab Emirates and the United States, are extremely open to the ide...

Price analysis 6/24: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, SHIB, LEO

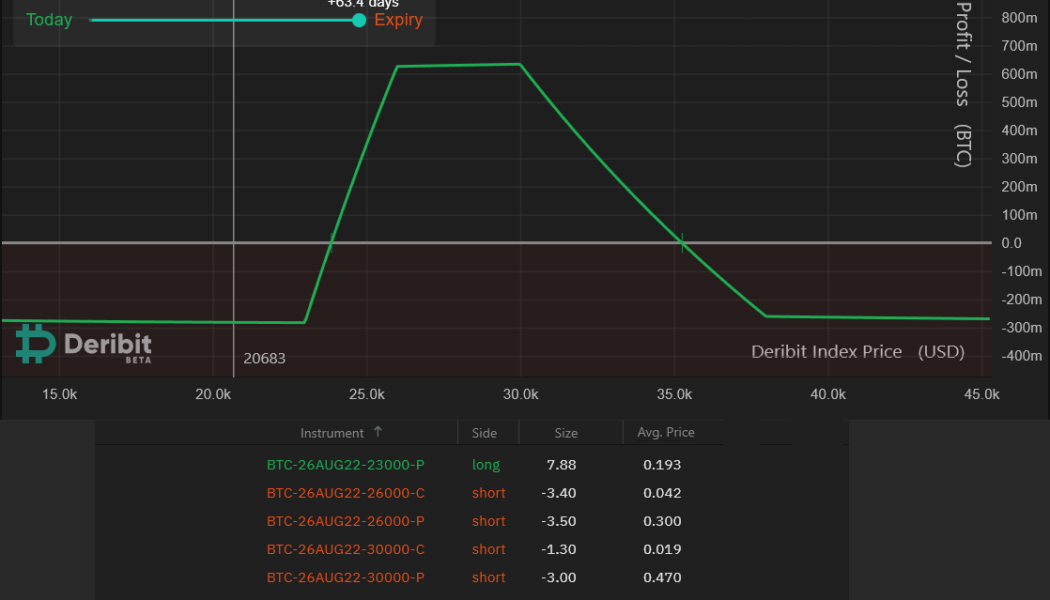

A handful of on-chain metrics suggest that Bitcoin could be close to bottoming, and if true, the eventual relief rally could induce sharp gains from altcoins. The United States equity markets and the cryptocurrency space are witnessing a relief rally this week. Supporting the rise in risky assets is the U.S. dollar index (DXY), which retreated from its multi-year high. Generally, cryptocurrencies move inverse to the price of the U.S. dollar, but this week’s bounce does not necessarily mean that bulls’ grip over the market has come to an end. Citing on-chain data, CryptoQuant senior analyst Julio Moreno, said that Bitcoin (BTC) miners may have already capitulated. Historical data suggests that miner capitulation usually precedes market bottoms. Daily cryptocurrency market perfor...

Bitcoin may still see ‘wild’ weekend as BTC price avoids key $22K zone

Bitcoin (BTC) focused on $21,000 into the weekend amid warnings that volatility could still consume the market before Monday. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView S&P 500 sees second best week of 2022 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD broadly higher in its recent trading range after U.S. stocks ended the week strong. As noted by markets commentators Holger Zschaepitz, the S&P 500 sealed its second best week of 2022, indicative of modest relief across risk assets. In case you missed it: S&P 500 has gained >6% in 2nd-best week of 2022 as disinflationary forces gather steam & #Fed tightening expectations recede. Investors now see the key interest rate at only 3.4% at the end of 2022, a full 35bps lower than at the...

Sam Bankman-Fried provides bailouts, ‘Bitcoin dead’ searches soar, and debate over hidden themes behind BAYC continues: Hodlers Digest, June 19–25

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week SBF and Alameda step in to prevent crypto collapse contagion Sam Bankman-Fried stated on June 20 that his firms Alameda Research and FTX would be “stepping in” to help companies with liquidity troubles amid the current bear market. Over the course of the week, Alameda dished out a loan of roughly $500 million to Voyager Digital, which is suffering from exposure to the potentially insolvent Three Arrows Capital, while FTX supplied BlockFi with $250 million worth of credit. New video revives debate over Bored Ap...

FTX may be planning to purchase a stake in BlockFi: Report

Crypto exchange FTX is reportedly in talks to acquire a stake in BlockFi after the company issued a $250 million credit to the lending firm. According to a Friday report from the Wall Street Journal, FTX is currently in discussions with BlockFi regarding the crypto exchange purchasing a stake in the firm, but no equity agreement has been reached. The reported ongoing talks followed BlockFi signing a term sheet with FTX to secure a $250 million revolving credit facility on Tuesday. “BlockFi does not comment on market rumors,” a BlockFi spokesperson told Cointelegraph. “We are still negotiating the terms of the deal and cannot share more information at this time. We anticipate sharing more on the terms of the deal with the public at a later date. FTX founder and CEO Sam Ban...

Bitpanda announces layoffs citing no compromise on product quality

Austrian crypto and stock trading platform Bitpanda joins the growing list of companies to announce a mass layoff as it aims to “get out of it financially healthy” amid an unforgiving bear market. Over the past several weeks, the bear market resulted in numerous catastrophic outcomes for many ecosystems such as Terra’s (LUNA) and Abracadabra’s Magic Internet Money (MIM) de-pegging fiasco. Witnessing the crashes from a front-row seat, Bitpanda made the “tough decision” of cutting down its employee headcount to roughly 730 people. While the exact number of employees intimated to stop working for Bitpanda remains undisclosed, data from LinkedIn indicates that the company is in the process of laying off approximately 277 full-time and part-time employees. In the announcement, named ‘The Way Fo...

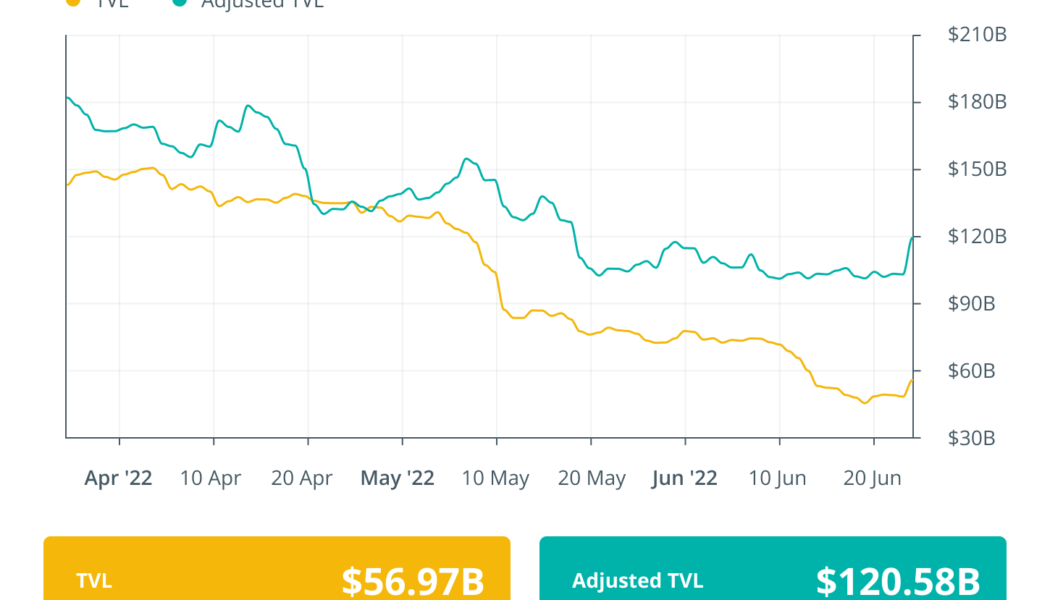

Finance Redefined: Uniswap goes against the bearish trends, overtakes Ethereum

This past week, the decentralized finance (DeFi) ecosystem tried gaining some momentum amid the bear market crash. Uniswap saw a trend reversal and overtook Ethereum regarding network fees paid. However, not all DeFi protocols were as lucky, as Bancor had to pause its “impermanent loss protection” in the wake of a hostile market. DappRadar’s report shows that the GameFi ecosystem continues to thrive despite the current downturn in the market. Solend invalidates Solana whale wallet takeover plan with second governance vote. The top 100 DeFi tokens showed signs of recovery after last week’s mayhem, and several of the tokens registered double-digit gains. DeFi Summer 3.0? Uniswap overtakes Ethereum on fees, DeFi outperforms Decentralized exchange (DEX) Uniswap has overtaken its host blockchai...

Gensler appeals for ‘one rule book’ in negotiations with CFTC over crypto regulation

United States Securities and Exchange Commission (SEC) chair Gary Gensler is in talks with Commodity Futures Trading Commission (CFTC) officials on a “memorandum of understanding” on the regulation of digital assets. Together, the agencies can assure market integrity, Gensler told The Financial Times in an interview published Thursday. “I’m talking about one rule book on the exchange that protects all trading regardless of the pair — [be it] a security token versus security token, security token versus commodity token, commodity token versus commodity token,” Gensler told the newspaper. Gensler’s desire to be collaborative comes as a variety of legislative initiatives have been introduced to create a more comprehensive regulatory framework for digital assets. The Digital Commodity Ex...