crypto blog

BTC Markets becomes first Australian crypto firm to get a financial services license

Australian-based cryptocurrency exchange BTC Markets has become the first crypto company in the country to gain a financial services license. The license was issued by the country’s financial regulator, the Australian Securities and Investments Commission (ASIC), to BTC Markets’ sister company BTCM Payments. We have an exciting announcement to make: BTC Markets is the first Australian crypto exchange to successfully go through the full AFSL application process via our sister company, BTCM Payments! ✅AFSL attained✅ISO Certified✅SOC 2 on the way!#crypto #bitcoin #finance — BTC Markets (@BTCMarkets) June 21, 2022 An Australian Financial Services (AFS) license allows the holder to give advice, deal in, and create a market for a financial product. It also permits the provis...

Price analysis 6/20: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

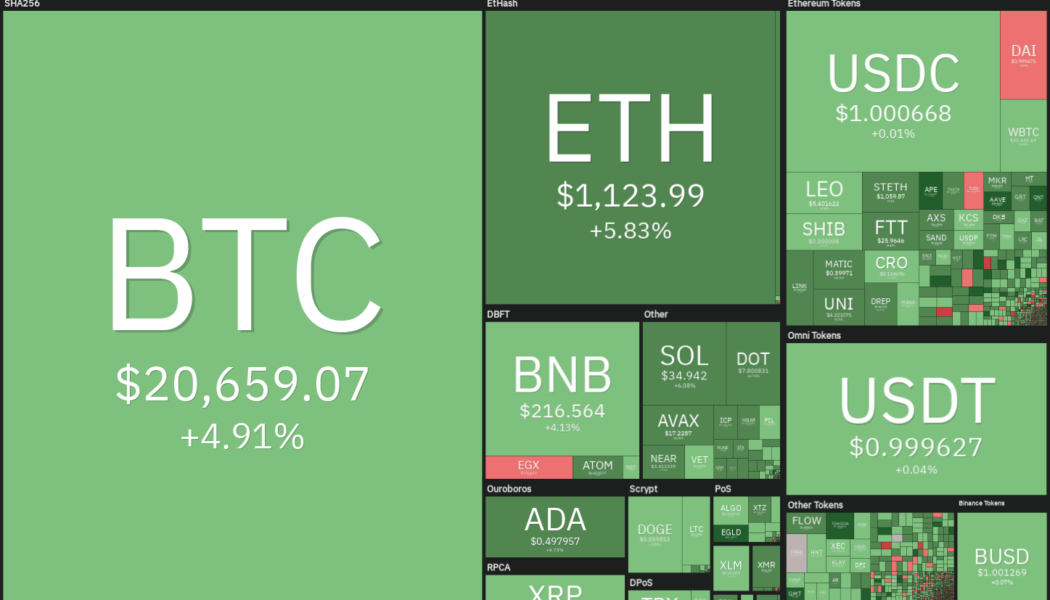

The crypto markets have been in a strong bear phase for the past several months but JPMorgan Chase analysts expect that to change and they have projected a significant upside from the current levels. The analysts cited the rising share of all stablecoins in the total crypto market for their bullish outlook. Unperturbed by the current fall, retail traders have been adding Bitcoin (BTC) to their portfolios. The number of wallet addresses holding one Bitcoin surged by 13,091 to a record high of 865,254. Similarly, the number of addresses holding about 0.1 Bitcoin has also witnessed a sharp rise in the past 10 days, according to data from Glassnode. Daily cryptocurrency market performance. Source: Coin360 Bitcoin’s sharp recovery from the June 18 fall shows strong buying at lower levels&n...

HM Treasury changes course on collecting data around unhosted crypto wallets

The government of the United Kingdom said it intends to modify a proposal that would have required crypto firms to collect personal data from individuals holding unhosted wallets that were the recipients of digital asset transfers. In its Amendments to the Money Laundering, Terrorist Financing and Transfer of Funds updated on Wene, HM Treasury said it will be scaling back its requirements for gathering data from both the senders and recipients of crypto sent to unhosted wallets, unless the transaction poses “an elevated risk of illicit finance.” The U.K. government added that unhosted wallets could be used for a variety of legitimate purposes, including asan additional layer of protection as is sometimes the case for cold wallets. “There is not good evidence that unhosted wallets present a...

Chinese court invalidates 2019 car sale made using now worthless crypto token

Last week, a WeChat post published by the Shanghai Fengxian Court began circulating in crypto circles with regards to its recent ruling on a car sale in May 2019 made using digital currency. At the time, the buyer, identified only as Mr. Huang, signed a sales contract to purchase a 2019 Audi AL6 for CNY 409,800 ($59.477) in exchange for the consideration of 1,281 Unihash (UNIH) tokens with an undisclosed car dealership in Shanghai. Per the original contract, the seller was to deliver the car to Huang within three months’ time. According to the Shanghai Fengxian Court, Mr. Huang paid 1,281 UNIH on the date of the contract signing but did not receive the car within the specified duration nor afterwards. As a result, Mr. Huang took the seller to court, demanding the delivery of the vehi...

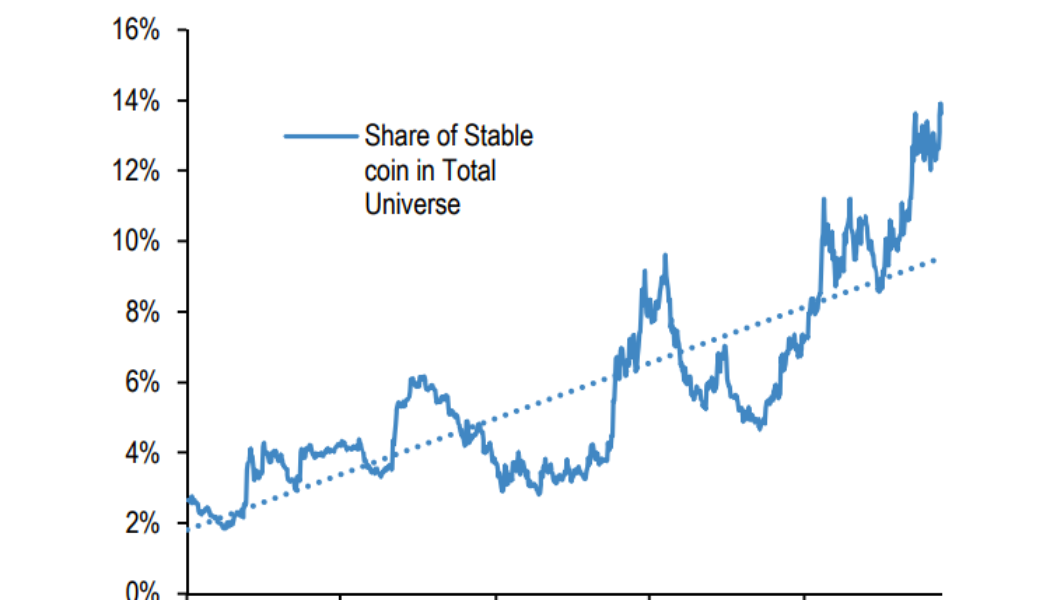

Record stablecoin market share points to crypto upside: JPMorgan

The rapid surge in share of stablecoins like Tether (USDT) in the cryptocurrency market may point to an upcoming crypto upside, according to analysts at the American investment bank JPMorgan Chase. The percentage of stablecoins in the total crypto market value has been on the rise, reaching new historical highs in mid-June, JPMorgan strategists believe. Led by JPMorgan crypto market analyst Nikolaos Panigirtzoglou, the analysts provided their industry insights in the bank’s new investor note shared with Cointelegraph. Released on June 15, the investor note reads that the share of all stablecoins rose to above 14%, or a “new historical high, which brings it to well above its trend since 2020.” “The share of stablecoins in total crypto market cap looks excessively high, pointing to ove...

Scams in GameFi: How to identify toxic NFT gaming projects

Over the last couple of years, games using blockchain technology have been actively developing and attracting new players, and the decentralized games market — broadly referred to as GameFi — has gained great popularity. The GameFi industry started back in 2013, and since then, the sphere has been slowly developing, but in 2021 the popularity of decentralized games exploded along with the boom in nonfungible tokens (NFT). According to the DappRadar analytical service, the total value of one of the most popular blockchain-based games, Axie Infinity, exceeds $550 million. But the GameFi industry has its issues. Many projects often “launch” regardless of the game’s development stage. And while Bitcoin’s (BTC) price trend can enhance or weaken the success of GameFi projects, there isn’t ...

BTC price recovers to 3-day highs as new whale support forms at $19.2K

Bitcoin (BTC) held steady at the June 20 Wall Street open as nervous traders waited for a short-term trend decision. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Trader flags Bitcoin “macro bottoming period” Data from Cointelegraph Markets Pro and TradingView showed BTC/USD climbing to just shy of $21,000 at the time of writing, a three-day high. The weekend had spooked the majority of the market and liquidated speculators with a trip to $17,600, marking Bitcoin’s lowest levels since November 2020. Now, with United States equities cool at the start of the week, comparative calm characterized the largest cryptocurrency. “Nice reaction off of the bottom of our 16K–20K demand zone,” popular trading account Credible Crypto commented on the weekend’s price action. “12...

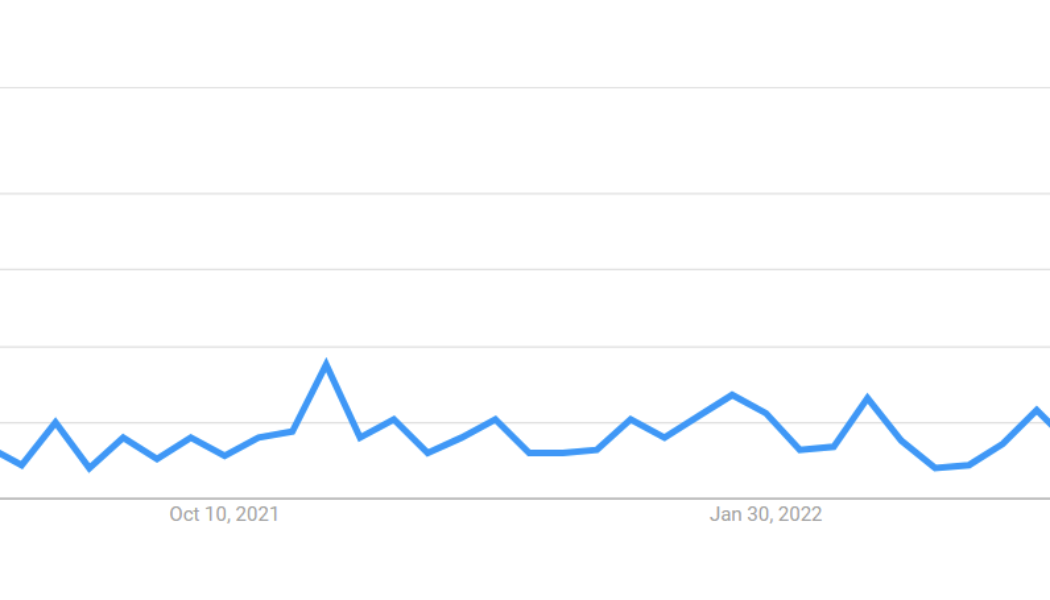

‘Bitcoin dead’ Google searches hit new all-time high

Collapsing Bitcoin (BTC) prices are reviving renewed speculation about the demise of the leading cryptocurrency, according to Google search trends. Google searches for “Bitcoin dead” spiked in the week ending Friday, June 18, and likely reached the highest level on record. Google Trends tracks interest in search terms over time, assigning scores of 1 to 100 based on the total number of user queries. The data are anonymized, categorized by topic and aggregated based on location. Google searches for “bitcoin dead” hit all time highs over the weekend. pic.twitter.com/oDXNqGEeIL — Alex Krüger (@krugermacro) June 20, 2022 “Bitcoin dead” achieved a score of 100 for the period between June 12–18 based on preliminary data that is reflected by the dotted line. The last time the se...

Best decentralized finance tokens to get on June 20

Synthetix Network (SNX)and Convex Finance (CVX) are some of the best tokens to get on June 20. In the last 24 hours, SNX increased by 74% and CVX increased by 23%. Each of these tokens has a solid potential for growth in the near future. If you are looking to diversify your portfolio with some of the best decentralized finance (DeFi) tokens, Synthetix Network (SNX) and Convex Finance (CVX) are solid picks. On June 19, 2022, Synthetix announced that they hit 200 million in daily volume due to the Atomic Swaps on 1ich and CurveFinance and due to the Optimism Futures among other things. Convex Finance is a platform for CRV token holders and Curve liquidity providers to earn additional interest rewards, alongside Curve Trading fees. Its recent growth can be attributed to the fact t...

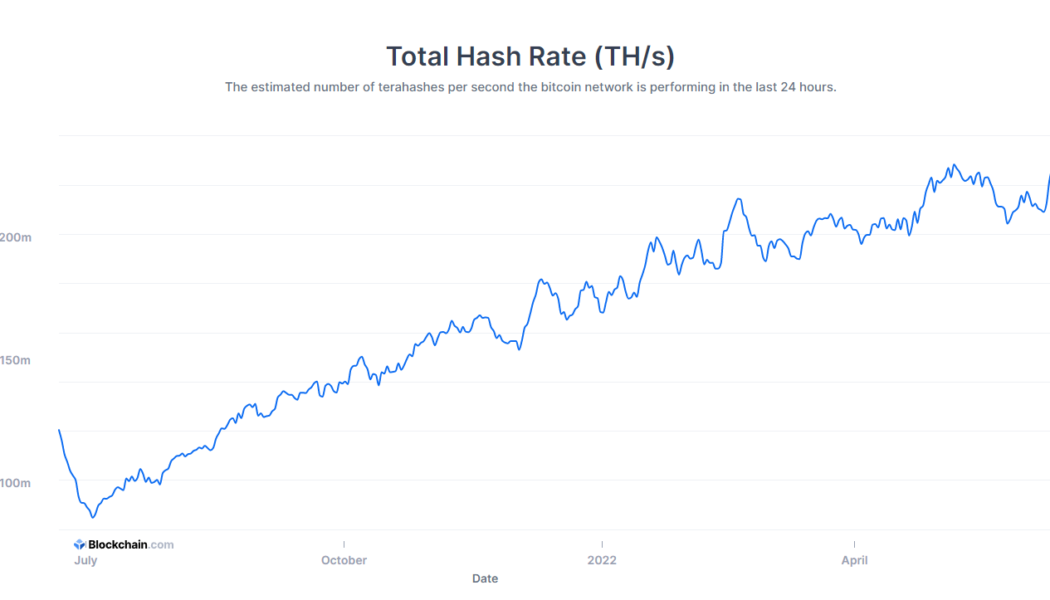

Marathon Digital keeps on mining despite BTC price slump

Despite data showing that the Bitcoin (BTC) price may have fallen to the point of being unprofitable for the average miner, Marathon Digital Holdings says it will continue working to accumulate the leading crypto asset. Charlie Schumacher, vice president of corporate communications at Marathon Digital, told Cointelegraph on Wednesday that while the company “isn’t immune to the macro environment,” it is “fairly well insulated and well-positioned” to weather the current downturn, due to the low cost of operations and fixed pricing for power “For reference, in Q1 2022, our cost to produce a Bitcoin was approximately $6,200. We also have fixed pricing for power, so we are not subject to changes in the energy markets.” Schumacher added that the company has been more focused on its Bitcoin...

Solend invalidates Solana whale wallet takeover plan with second governance vote

Solana-based decentralized finance (DeFi) lending protocol Solend has created another governance vote to invalidate the recently-approved proposal that gives Solend Labs “emergency powers” to access a whale’s wallet to avoid liquidation. On Sunday, the crypto lending platform launched a governance vote titled “SLND1 : Mitigate Risk From Whale.” This allows Solend to reduce the risk that the whale’s liquidation poses to the market by letting the lending platform access the whale’s wallet and letting the liquidations happen over-the-counter (OTC). According to Solend, if Solana (SOL) drops in price and the whale gets liquidated, the lending platform may “end up with bad debt” and strain the Solana network. The proposal was approved, triggering criticism from members of the community. A...