crypto blog

Elon Musk’s support for Dogecoin grows stronger following $258B lawsuit

Not even a $258 billion class-action lawsuit alleging a crypto pyramid scheme could stop Elon Musk from publicly displaying his continued support for Dogecoin (DOGE). On June 16, a New York district court received a class action complaint against the world’s richest man Elon Musk and his companies, SpaceX and Tesla, for an alleged Ponzi scheme using DOGE tokens. The lawsuit demanded $258 billion in total monetary damages from Musk while requesting the court to rule DOGE trading as gambling in the United States. I will keep supporting Dogecoin — Elon Musk (@elonmusk) June 19, 2022 The lawsuit, however, did not resonate with the crypto community as entrepreneurs began to ridicule the move. Musk, too, was seemingly unshaken about the allegation as he doubled down on his love for the Dogecoin ...

US lawmakers urge EPA to consider the potential benefits of crypto mining

A group of 14 United States senators and House representatives have signed a letter to the Environmental Protection Agency extolling what they believe are the benefits of crypto mining. In a Thursday letter, many U.S. lawmakers including pro-Bitcoin Senator Cynthia Lummis and Representative Tom Emmer addressed EPA administrator Michael Regan, requesting the government agency analyze the potential impact of crypto mining in an effort to balance innovation with environmental concerns. The group of 14 senators and representatives claimed mining could have a “substantial stabilizing effect on energy grids” and cited examples of mining operations using flared gas and renewable energy sources. “Digital assets, and their related mining activities, are essential to the economic future of the Unite...

Crypto prices continue to tank, lawsuit takes aim at Binance.US, and Celsius moves $320M worth of digital assets: Hodler’s Digest, June 12-18

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Binance ends support for anonymous Litecoin transactions Binance has decided to ban Litecoin (LTC) transactions sent through the most recent MimbleWimble (MWEB) upgrade from its exchange, noting that such transactions would now result in the loss of the related LTC. Binance isn’t delisting LTC entirely, unlike other exchanges that have decided to remove the cryptocurrency. Among its changes, the latest Litecoin MWEB update ushered in privacy features. Binance’s decision to end support for these transactions co...

What is a bear trap in trading and how to avoid it?

As a difficult proposition for novice traders, a bear trap can be recognized by using charting tools available on most trading platforms and demands caution to be exercised. In most cases, identifying a bear trap requires the use of trading indicators and technical analysis tools such as RSI, Fibonacci levels, and volume indicators, and they are likely to confirm whether the trend reversal after a period of consistent upward price movement is genuine or merely meant to invite shorts. Any downtrend must be driven by high trading volumes to rule out the chances of a bear trap being set up. Generally speaking, a combination of factors, including the retracement of price just below a key support level, failure to close below critical Fibonacci levels and low volumes, are signs of a b...

Emerging Crypto Art Platform Outland Raises $5M Seed Round Led by OKG Ventures

Los Angeles, United States, 18th June, 2022, Chainwire Outland, an emerging crypto art platform based in Los Angeles, CA, has announced that it has raised $5 million in its first seed round in March 2022. Led by OKG Ventures, IMO Ventures, Dragon Roark, and JDAC Capital have all invested in the burgeoning Web3 cultural leader. Launched in February 2022, Outland has received widespread global attention from both crypto tech, and traditional art audiences. The platform’s debut project, Elemental, is a series of NFT works by renowned Chinese contemporary artist Fang Lijun. Regarded as one of the most highly anticipated NFT projects of 2022, Elemental has garnered over 4,000 ETH in primary and secondary sales with an unwavering position in OpenSea’s top charts since its launch. In April 2022, ...

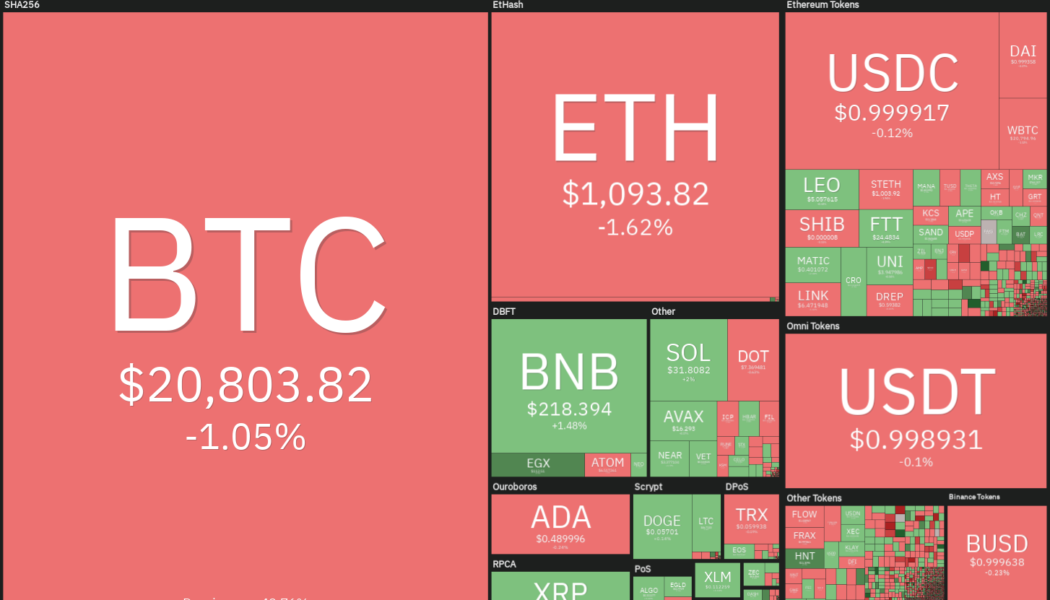

Price analysis 6/17: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The sharp fall in cryptocurrencies has pulled the total crypto market capitalization below $900 billion. According to CoinGoLive, 72 out of the top 100 tokens have declined in excess of 90% from their all-time highs. In comparison, the top-10 coins have outperformed during the fall, dropping an average of 79% from their all-time high. Bitcoin (BTC) is down more than 70% from its all-time high but the bulls are struggling to arrest the decline. Jurrien Timmer, director of global macro of Fidelity, highlighted that Bitcoin could be “cheaper than it looks” considering the metric of price-to-network ratio, which is similar to the price-to-earnings ratio used in the equities market to value a stock. Daily cryptocurrency market performance. Source: Coin360 Billionaire investor Mark Cuban s...

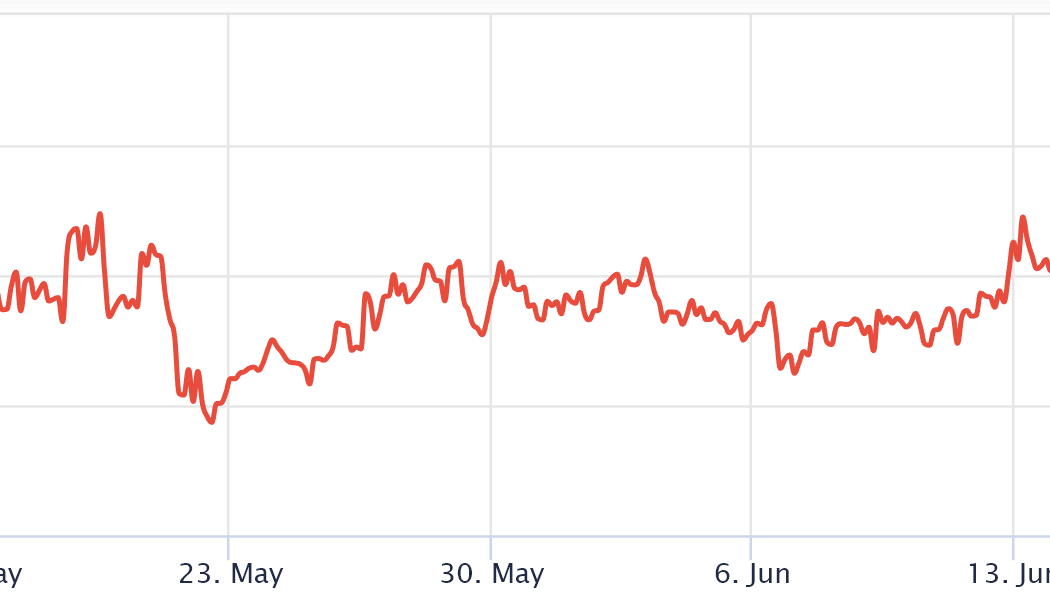

Ethereum risks another 60% drop after breaking below $1K to 18-month lows

The price of Ethereum’s native token, Ether (ETH), careened below $1,000 on June 18 as the ongoing sell-off in the crypto market continued despite the weekend. Ether reached $975, its lowest level since January 2021, losing 80% of its value from its record high in November 2021. The decline appeared amid concerns about the Federal Reserve’s 75 basis points rate hike, a move that pushed both cryptocurrencies and stocks into a strong bear market. “The Federal Reserve has barely started raising rates, and for the record, they haven’t sold anything on their balance sheet either,” noted Nick, an analyst at data resource Ecoinometrics, warnings that “there is bound to be more downside coming.” ETH/USD weekly price chart. Source: TradingView Ethereum...

What is an Iceberg order and how to use it?

An iceberg trade is most often executed by large institutional investors. Iceberg orders, also known as reverse orders, are mostly used by market makers, which is another word for an individual or firm who is providing offers and bids. When it comes to such big crypto transactions, we mostly talk about institutional crypto investors. They often trade in big amounts of cryptocurrencies, which may have a huge impact on the market. As a watcher, it’s possible to look up the order in the order books, but only a small part of the market maker iceberg orders is visible on level-2 order books. Level-2 order books, in the crypto world, contain all bids and asks on an exchange including price, volume and timestamp — real-time data collection it is. They call ...

Bitcoin critics say BTC price is going to $0 this time, but these 3 signals suggest otherwise

Like clockwork, the onset of a crypto bear market has brought out the “Bitcoin is dead” crowd who gleefully proclaim the end of the largest cryptocurrency by market capitalization. If #Bitcoin can collapse by 70% from $69,000 to under $21,000, it can just as easily fall another 70% down to $6,000. Given the excessive leverage in #crypto, imagine the forced sales that would take place during a sell-off of this magnitude. $3,000 is a more likely price target. — Peter Schiff (@PeterSchiff) June 14, 2022 The past few months have indeed been painful for investors, and the price of Bitcoin (BTC) has fallen to a new 2022 low at $20,100, but the latest calls for the asset’s demise are likely to suffer the same fate as the previous 452 predictions calling for its death. Bitcoin obitu...

Weekly Report: The latest on Panama’s crypto bill, Huobi to exit Thailand market, Circle launches a Euro-backed stablecoin, and more

Here are all the interesting headlines you missed outside the crypto market this week: Panama’s President vetoes crypto bill over money-laundering concerns Panama President Laurentino Cortizo on Thursday shot down a crypto bill introduced in September 2021 with a scope covering several cryptocurrencies, unlike El Salvador’s that major in Bitcoin. Cortizo partially vetoed the bill, citing non-compliance with the recent FAFT recommendation on fiscal transparency and prevention of money laundering. If the bill were to be approved, it would allow Panamanian natives to buy everyday goods and services using digital assets like Bitcoin, Ethereum, and Litecoin among other crypto coins. The bill would also make digital assets mainstream for settling taxes or any fee owed by the state. Additionally,...

Magic Internet Money token depegs as Terra (LUNA) domino effect persists

Magic Internet Money (MIM), a US dollar-pegged stablecoin of the Abracadabra ecosystem, joins the growing list of tokens losing their $1 value amid an untimely crypto winter. The sudden de-pegging of the MIM token commenced roughly on June 17, 7:40 pm ET, which saw the token’s price drop to $0.926 in just three hours. Terra’s LUNA and TerraUSD (UST) death spiral not only affected the investors but also had a negative impact on numerous crypto projects, including Abracadabra’s MIM token ecosystem — as alleged by Twitter handle @AutismCapital. Depegging of Magic Internet Money (MIM) token price chart. Source: CoinMarketCap Citing an insider scoop, AutismCapital claimed that Abracadabra accrued $12 million in bad debt as a direct result of Terra’s sudden downfall “because liquidations couldn&...