crypto blog

Further downside is expected, but multiple data points suggest Bitcoin is undervalued

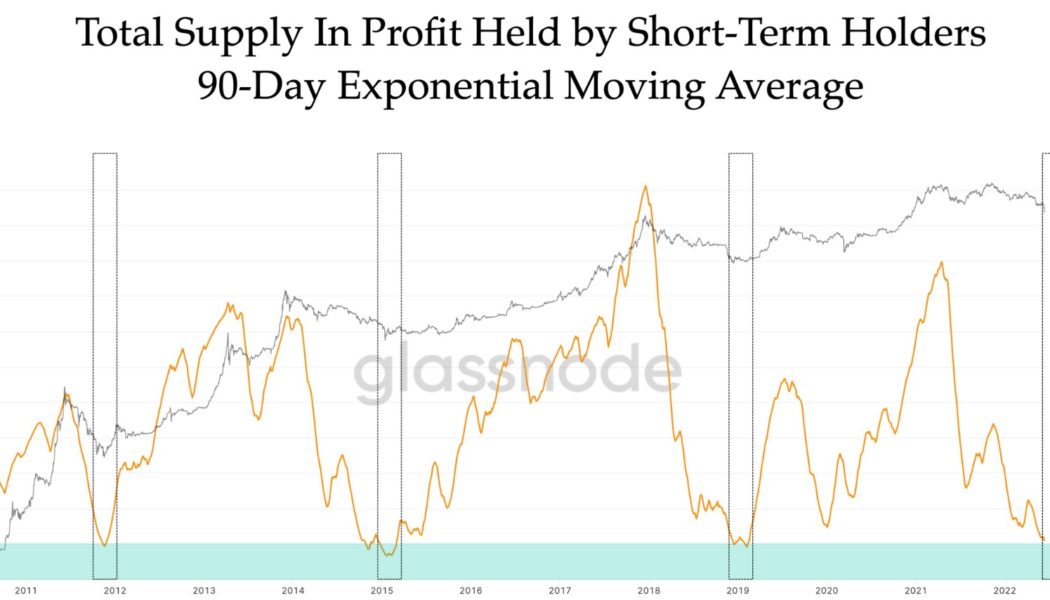

The outlook across the cryptocurrency ecosystem continue to dim as the sharp downtrend that was initially sparked by the collapse of Terra now appears to have claimed the Singapore-based crypto venture capital firm Three Arrows Capital (3AC) as its next victim. As large crypto projects and investment firms begin to collapse on a weekly basis, the prospect of a long, drawn out bear market is a reality investors are beginning to accept. Based on a recent Twitter poll conducted by market analyst and pseudonymous Twitter user Plan C, 41.6% of respondents indicated that they thought the Bitcoin (BTC) bottom will fall between the $17,000 to $20,000 range. Total Bitcoin supply in profit held by short-term holders. Source: Twitter Addresses holding at least 1 BTC hits a new ...

Three Arrows Capital has failed to meet margin calls: Report

Venture firm Three Arrows Capital (3AC) has reportedly failed to meet margin calls from its lenders, raising the spectre of insolvency after this week’s crypto market collapse triggered unforeseen liquidations for the Singapore-based company. Crypto lender BlockFi was among the firms to liquidate at least some of 3AC’s positions, according to the Financial Times. Citing people familiar with the matter, FT reported that 3AC had borrowed Bitcoin (BTC) from the lender but was unable to meet a margin call after the market turned sour earlier this week. The issues surrounding 3AC appear to have impacted Finblox, a Hong Kong-based platform that allows investors to earn yield on their digital assets. Finblox said it was forced to reduce its withdrawal limits on Thursday due to concerns surroundin...

How Ankr transformed the scalability of the BNB Chain

Cryptocurrency’s tussle with scalability is well known. Ethereum suffers from sky-high gas fees making it unusable for a lot of customers, leading to a lot of alternative Layer-1’s popping up. Binance, one of the world’s leading exchanges, was one such firm to develop its very own blockchain. While some criticise the BNB Smart Chain for being centralised, one cannot argue against the basement-level fees and impressive scalability that it offers. Its impressive performance is partially due to Ankr, the Web3 infrastructure provider. Consulting with the Binance team, Ankr implemented several open-source performance improvements which transformed the network. There was a 10x increase in RPC request throughput, 75% reduction in storage requirements, a sync process that is 100x faste...

US Air Force taps SIMBA Chain to develop budgeting and accounting system

For many years, the United States Military has been experimenting with blockchain in a number of settings to enhance its operations. Now, the U.S. Air Force (USAF) is adopting blockchain into its budgeting and accounting processes. According to a Thursday press release, the USAF has enlisted SIMBA Chain, a blockchain-as-a-service platform, to develop a blockchain-based system for tracking and monitoring the military’s cash flow and supply chain quality and management. The goal of the project, dubbed Digital Blockchain Budgeting Accountability and Tracking (DiBaT), is to tokenize all dollars within the USAF supply chain budget, as well as track fund movement across billing centers, purchasing teams and suppliers. DiBaT, as per the release, uses SIMBA Blocks to track and audit funds in...

BTC price rejects at $23K as US dollar declines from fresh 20-year highs

Bitcoin (BTC) ran out of steam near $23,000 on June 16 after the biggest United States key rate hike in nearly thirty years. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Dollar strength wobbles after rate hike news Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reaching highs of $22,957 on Bitstamp after the Federal Reserve confirmed a 0.75% hike in June — its largest since 1994. Momentum did not last long, however, and at the time of writing, the pair had shed $2,000 to return to $21,000 at the new Wall Street open. $BTC Did indeed fail to hold the mid range and fell back to the range low which it has held so far. This range low is my line in the sand if BTC doesn’t want to revisit the lows and possibly test sub $20K levels. Holding here and w...

Blockchain’s potential: How AI can change the decentralized ledger

One reason is that blockchain’s use of a decentralized ledger offers insight into the workings of AI systems and the provenance of the data these platforms may be using. As a result, transactions can be facilitated with a high level of trust while maintaining solid data integrity. Not only that, but the use of blockchain systems to store and distribute AI-centric operational models can help in the creation of an audit trail, which in turn allows for enhanced data security. Furthermore, the combination of AI and blockchain, at least on paper, seems to be extremely potent, one that is capable of improving virtually every industry within which it is implemented. For example, the combination has the potential to enhance today’s existing food supply chain logistics, healthcare record-sharing ec...

This oracle data provider platform has surpassed 4 million nodes since inception

Can a fully-functional oracle network ecosystem that anonymously collects and validates geospatial (location-specific) data exist? One blockchain firm seems to have gotten the gist of the idea. Founded in 2012, XY Labs and its namesake protocol XYO, which is built on the Ethereum blockchain, seek to reward participants for the genesis, interpretation, analysis, and storage of data to be called upon for specific problems. There are currently over 4 million nodes worldwide on the XYO network. In a recent ask-me-anything (AMA) session with Cointelegraph Markets Pro, Arie Trouw, founder of XY Labs, explained that fundamental to the XYO system is a special type of payload called BoundWitnesses. It contains a list of user-input data points that are signed by one or more nodes in the XYO ne...

CEL overtook LINK as the most-traded token from whales, which one to buy?

CEL has overtaken LINK as the most traded cryptocurrency among the top 100 ETH whales. The value of each of these tokens has increased in the last 24 hours, CEL by 4% and LINK by 11%. Learn which option is more suitable for your specific investment goals and expectations. Celsius (CEL) is a popular financial services platform specifically catered toward cryptocurrency users. Its main purpose is to allow the users to receive regular payouts and interest on their holdings, and its native cryptocurrency is known as CEL. Chainlink (LINK), on the other hand, is a blockchain abstraction layer, and its main goal is to enable universally connected smart contracts. It has a decentralized oracle network that let’s blockchain have data from external data feeds, which means that smart contracts ...

BitMEX co-founder Benjamin Delo avoids jail, receives 30 months probation

Benjamin Delo the co-founder of cryptocurrency exchange BitMEX has been sentenced to 30 months probation for violating the Bank Secrecy Act (BSA), which is an anti-money laundering law. The sentence, handed down at a federal court in New York on June 15th, follows his guilty plea to charges in February of “willfully failing to establish, implement and maintain an Anti-Money Laundering (AML) program” in his role at BitMEX. Prosecutors had argued Delo should serve a year in prison or at least receive a two-year probation along with six months of home detention, as was given to former CEO Arthur Hayes in May. For Delo, his lesser sentence closes the legal saga which started in October 2020 which also saw co-founders Hayes and Samuel Reed along with BitMEX’s first official employee Gregory (Gr...

BitBoy founder threatens class action lawsuit against Celsius

Just two weeks after appearing in an ask me anything (AMA) with Celsius founder Alex Mashinsky, crypto Youtuber Ben Armstrong has announced he intends to file a class action lawsuit against the lending platform and its chief executive. Armstrong made legal threats via Twitter on June 15, and has since provided more detail in multiple threads. His issue is centered on being unable to pay down loans with existing funds on the platform, and instead having to deposit new funds to pay the loans off: “[Our account rep] told us we had enough money in our account to pay off a loan. But we can’t use money in our account. We HAVE TO SEND CELSIUS MORE MONEY TO PAY IT OFF.” “Imagine an insolvent company that you can’t withdraw your money from ASKING YOU TO SEND THEM MORE MONEY,” he added. Armstrong st...

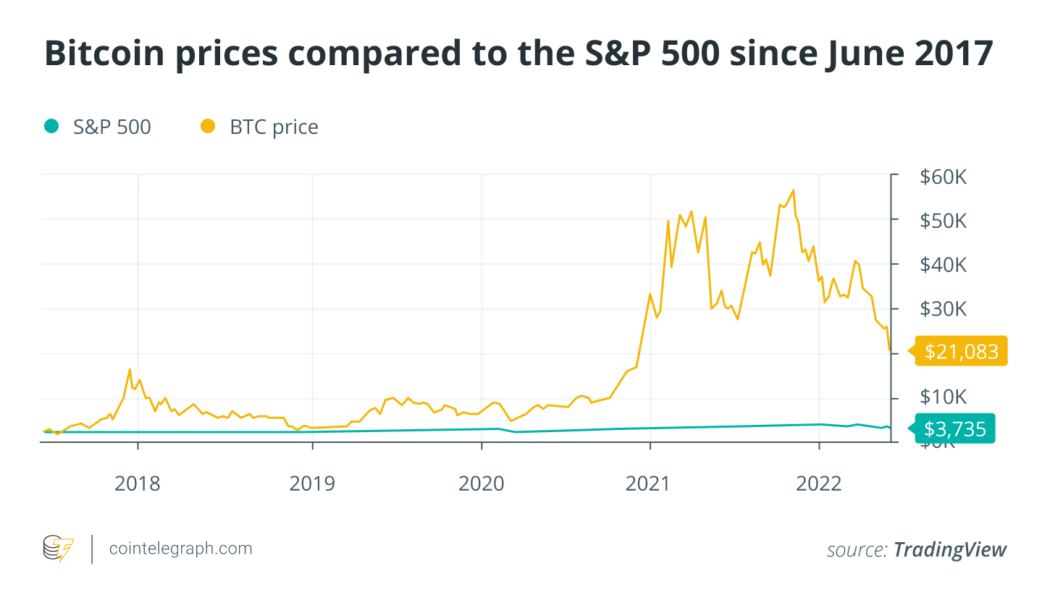

‘Buy Bitcoin, plant a tree, lower your time preference’: a Sequoia story

When the market falls faster than a tree in the forest, the phrases “zoom out,” and “lower your time preference,” take root. “Zoom out” refers to taking a break from the omnipresent price charts that populate news feeds and Twitter threads. Consider looking at the price of Bitcoin (BTC) over the past five years–as opposed to over the past 6,12 or 18 months. HODLing Bitcoin has far outperformed HODLing stocks over the past five years. But what does “lower your time preference,”–popular parlance among Bitcoiners, actually mean? Commonly attributed to Saifedean Ammous, the polarizing author who penned The Bitcoin Standard, lowering one’s time preference translates to thinking long-term, and to valuing the future over the present. In contrast to a fiat standard, where money loses va...