crypto blog

Almost $100M exits US crypto funds in anticipation of hawkish monetary policy

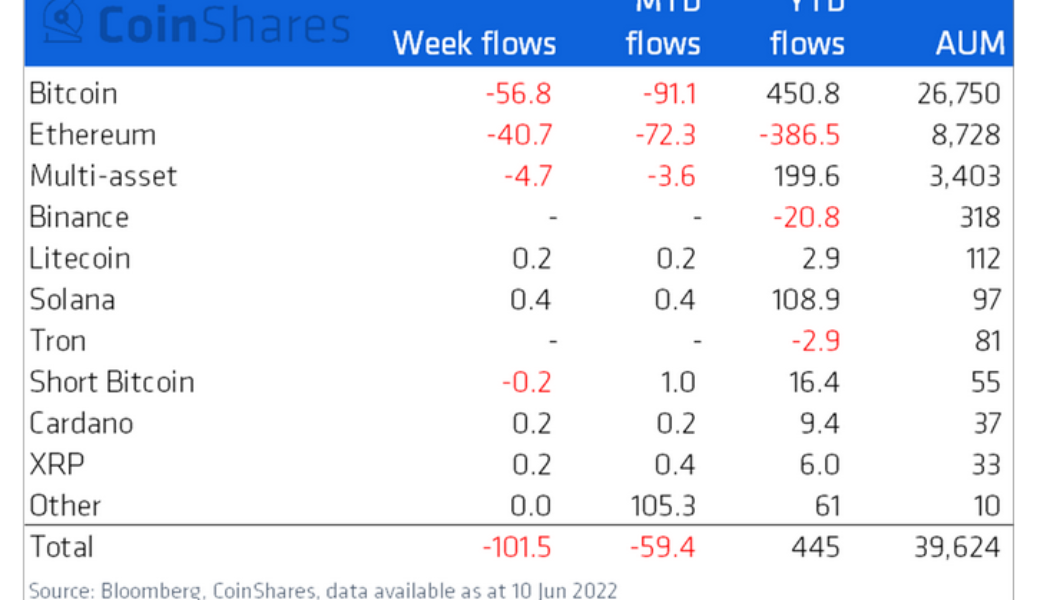

Institutional investors offloaded $101.5 million worth of digital asset products last week in ‘anticipation of hawkish monetary policy’ from the U.S. Federal Reserve according to CoinShares. U.S. inflation rates hit 8.6% year-on-year at the end of May, marking a return to levels not seen since 1981. As a result, the market is expecting the Fed to take considerable action to reel in inflation, with some traders pricing in three more 0.5% rate hikes by October. According to the latest edition of CoinShares’ weekly Digital Asset Fund Flows report, the outflows between June 6 and June 10 were primarily led by investors from the Americas at $98 million, while Europe accounted for just $2 million. Products offering exposure to crypto’s top two assets, Bitcoin (BTC) and Ethereum (ETH), accounted ...

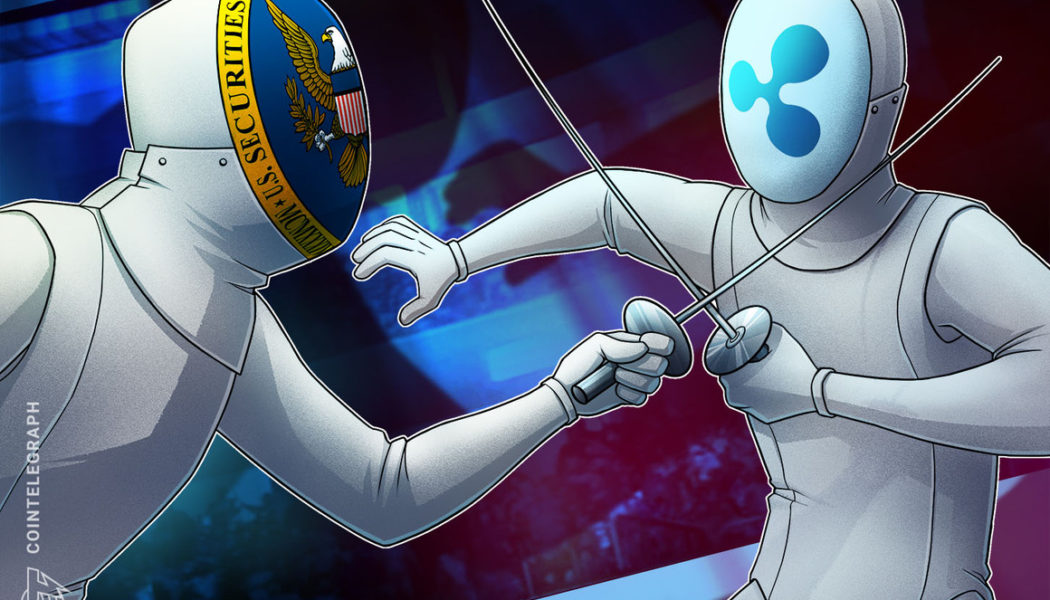

Ripple counsel slams SEC for trying to bulldoze and bankrupt crypto

Ripple general counsel Stu Alderoty has slammed the United States Securities and Exchange Commission (SEC) for trying to “bully, bulldoze, and bankrupt” crypto innovation in the U.S. in the name of expanding its own regulatory territory. “By bringing enforcement actions–or threats of potential enforcement–the SEC intends to bully, bulldoze, and bankrupt crypto innovation in the U.S., all in the name of impermissibly expanding its own jurisdictional limits.” Alderoty shared his views on June 13 amidst an ongoing lawsuit between Ripple and the regulator, which he says is part of the “SEC’s assault on all crypto in the U.S.” by treating every cryptocurrency as a security. “Like a hammer wanting everything to be a nail, the SEC is keeping everything murky so it can argue every crypto is ...

Binance Australia CEO: regulations will establish higher standards in crypto

As the struggle for regulatory clarity down under rages on, Binance Australia’s CEO Leigh Travers thinks that such a framework will prove the crypto industry “holds itself to a higher standard” than many believe. Travers spoke with Cointelegraph on June 14 about the current state of local crypto regulatory efforts and how the opportunities available in the industry are restricted by the lack of clarity. That lack of clarity was cited as the reason why the Commonwealth Bank of Australia (CBA) has indefinitely postponed a pilot program for its crypto trading services last month. Although there are no rules on the books directly prohibiting CBA’s new service, Australian financial regulators pushed for a pause on the services because of absent consumer protections. Without the regulations in p...

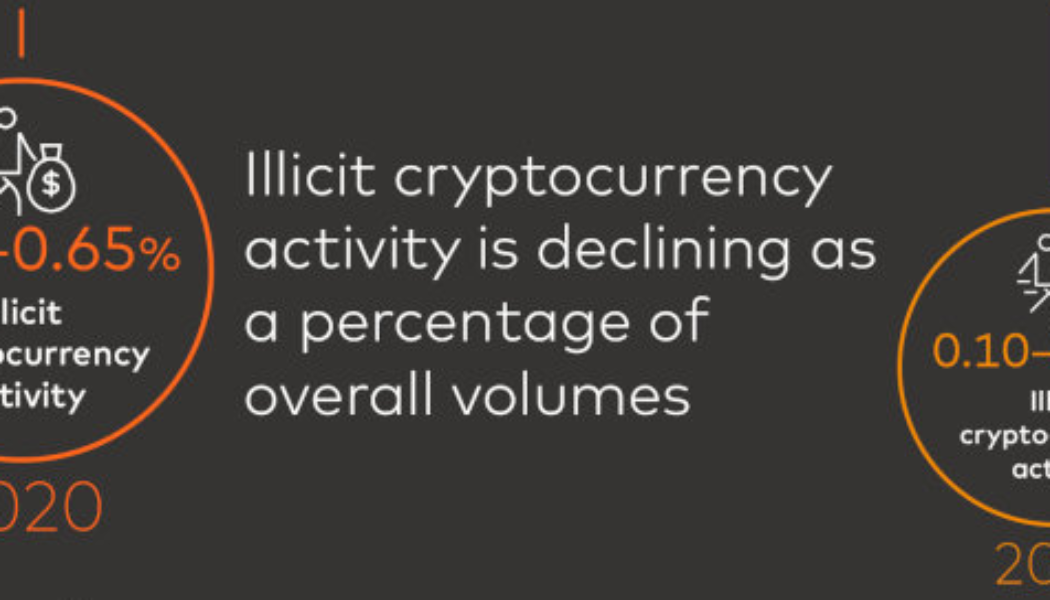

Illicit crypto usage as a percent of total usage has fallen: Report

Illicit cryptocurrency activity in 2021 and the first quarter of 2022 has declined as a percentage of overall crypto activity, according to blockchain forensics firm CipherTrace. The cryptocurrency industry has long held a reputation in some jurisdictions as a haven for illegal activity. However, CipherTrace estimates that illicit activity was between 0.62% and 0.65% of overall cryptocurrency activity in 2020. The firm reported that it has now fallen to between 0.10% and 0.15% of overall activity in 2021. Source: CipherTrace In its Cryptocurrency Crime and Anti-Money Laundering Report released June 13, CipherTrace outlined that the top ten decentralized finance (DeFi) hacks in 2021 and Q1 2022 netted attackers $2.4 billion. Over half of that figure came from just two events, the largest be...

Crypto lender Celsius freezes withdrawals; rival Nexo offers a ‘helping hand’

Celsius halted withdrawals on Monday, noting that said the process back to normalcy could see delays Fellow crypto lending Nexo tabled an offer to ‘bail’ Celsius by taking up its qualifying assets Crypto lending platform Celsius is seeing the worst of the crypto markets and, in effect, announced on Monday morning that it paused redemptions citing severe “market conditions.” In what it termed a very important message to the community, Celsius justified that it took the decision in order to remain ‘fit’ to honor its withdrawal obligations to customers over time. “Acting in the interest of our community is our top priority. In service of that commitment and to adhere to our risk management framework, we have activated a clause in our Terms of Use that will allow for this process to take place...

Binance resumes withdrawals as many retail crypto investors monitor exchanges

Major crypto exchange Binance has announced that it had resumed Bitcoin withdrawals after more than three hours amid extreme market volatility. In an update during what many are calling cryptocurrency’s “Black Monday,” Binance said on its website the exchange would be processing Bitcoin (BTC) network withdrawals within “the next couple of hours” following the resumption of activity. The platform announced Monday that it had temporarily paused BTC withdrawals, with CEO Changpeng Zhao saying on Twitter that all user funds were “SAFU.” #Bitcoin network withdrawals have now resumed on #Binance.https://t.co/FhxXi3LeBg — Binance (@binance) June 13, 2022 While BTC trading activity on Binance seems to have been restored, withdrawals for users on Celsius have remained frozen since...

Floor price of popular NFT collections collapse due to bear market

It appears there is no respite anywhere in the crypto realm in the face of Monday’s extraordinary market sell-off. Based on data from NFT Price Floor, the floor prices for Bored Ape Yacht Club (BAYC) and CryptoPunks, two of the most popular nonfungible token, or NFT, collections on the market, have fallen to 74 ETH ($92,223) and 48 ETH ($69,473), respectively. In comparison, pieces in the BAYC collection had an all-time high floor price of 153.70 ETH, while the same metric amounted to 123 ETH for CryptoPunks. The data aggregator tracks 380 collections with a total market cap of $5.58 billion at the time of publication. The sell-off among NFTs was partly exacerbated by a warning just a day prior, where Gordon Goner, co-founder of Yuga Labs — the firm owning both BAYC and CryptoP...

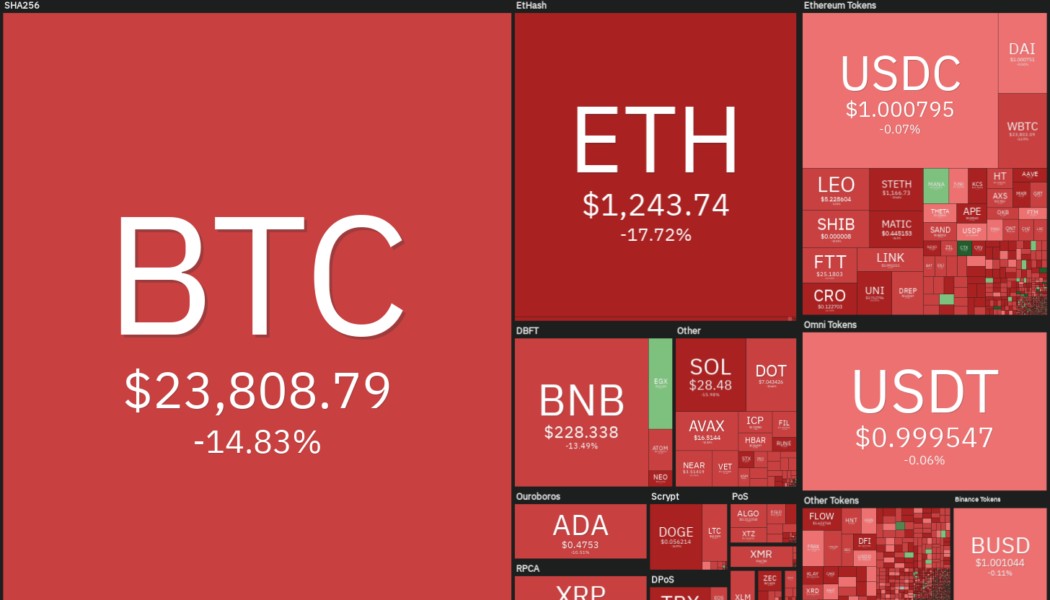

Price analysis 6/13: BTC, ETH, BNB, ADA, XRP, SOL, DOGE, DOT, LEO, AVAX

The United States equities markets extended their decline to start the week on June 13. The S&P 500 hit a new year-to-date low and dipped into bear market territory, falling more than 20% from its all-time high made on Jan. 4. The cryptocurrency markets are tracking the equities markets lower and the selling pressure further intensified due to the rumored liquidity crisis of major lending platform Celsius and traders possibly selling positions to meet margin calls. This pulled the total crypto market capitalization below $1 trillion. Daily cryptocurrency market performance. Source: Coin360 The sharp declines have led some analysts to project extremely bearish targets. While anything is possible in the markets and it is difficult to call a bottom, capitulations usually tend to sta...

Law Decoded, June 7–13: Lummis-Gillibrand bill is finally here

One can hardly name a document more long-hoped-for as the crypto bill, co-sponsored by United States Senators Cynthia Lummis of Wyoming and Kirsten Gillibrand of New York, was for the crypto community. And, it’s finally here. Last week, Lummis and Gillibrand introduced a 69-page bill in the U.S. Senate. What’s inside? The projects of study on the environmental impact of digital assets and advisory committee on innovation, a tax structure, a mandate for analysis of the use of digital assets in retirement savings and much more. Should it become law, the bill would undoubtedly implement major changes to the current regulatory landscape. Kirsten Gillibrand and Cynthia Lummis have confirmed that Bitcoin (BTC) and Ether (ETH) will be classified as commodities and regulated by the Commodity ...

Nexo looking to bail out Celsius as the network freezes withdrawals

Earlier today, the Celsius network halted all withdrawals, swaps and transfers between its users’ accounts, citing extreme market conditions. Now, rival crypto lending firm Nexo is extending a letter of intent to buy all the company’s eligible assets. Trouble in paradise One of the leading cryptocurrency lenders – Celsius Network – is facing major problems. Citing “extreme market conditions”, the company halted all withdrawals, swaps and transfers between its users’ accounts, causing a stir within the crypto community. Shortly thereafter, a rival company – Nexo – sent a letter of intent to “purchase residual qualifying assets” from Celsius Network. Nexo, its partners and affiliates could easily acquire some or all of the eligible outstanding loan receivables secured by the...

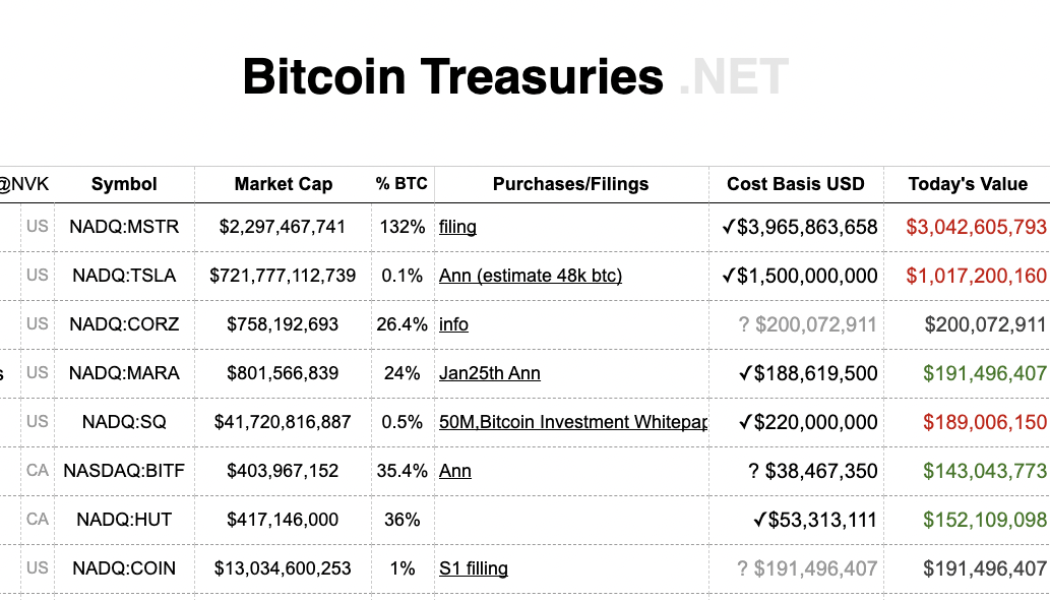

In this together: Musk and Saylor down a combined $1.5B on Bitcoin buys

As the bear market bites, holding crypto investments can be a tough pill to swallow. Consider two of the largest bag holders of publicly traded companies. They are down by almost $2 billion dollars on their Bitcoin buys. According to Bitcointreasuries.net, the 130,000 and 43,00 Bitcoin (BTC) held by Microstrategy and Tesla respectively are worth considerable sums less. The top “Hodlers” of Bitcoin according to Bitcointreasuries.net For Microstrategy, Michael Saylor splashed out almost $4 billion ($3,965,863,658) on 129,218 BTC, approximately 0.615% of the 21 million total supply. The Bitcoin price nosedive has ripped away earlier gains: the investment is worth $3.1 billion ($3,074,987,824), a loss of $900 million. Plus, in premarket trading on June 13, Microstrategy ...