crypto blog

Binance.US faces class-action lawsuit over LUNA and UST sale

Binance.US, the sister company of global cryptocurrency exchange Binance, is facing a class-action lawsuit from investors for the sale of LUNA and TerraUSD (UST). A group of investors filed a class-action lawsuit in the Northern District of California on Monday, alleging that Binance sold unregistered securities in the form of LUNA and UST to investors and mislead them into buying them. The lawsuit was filed by law firms Roche Freedman and Dontzin Nagy & Fleissig on behalf of several investors who lost their money during the recent LUNA and UST spiral collapse. The lawsuit alleged that Binance.US is not registered as a broker-dealer in the United States and thus clearly violates U.S. securities laws. The plaintiffs in the case accused the crypto exchange of knowingly promoting a f...

Binance suspends Bitcoin withdrawals: CZ says funds are ‘SAFU’

Crypto’s Black Monday continues to wreak havoc. Changpeng Zhao, the CEO of crypto exchange Binance, tweeted that there would be a temporary pause on Bitcoin (BTC) withdrawals. Temporary pause of $BTC withdrawals on #Binance due to a stuck transaction causing a backlog. Should be fixed in ~30 minutes. Will update. Funds are SAFU. — CZ Binance (@cz_binance) June 13, 2022 CZ, who often lends his opinion to projects and the market, regularly tweets on behalf of Binance to his 6.4 million followers. He quickly updated the tweet to show: This is only impacting the Bitcoin network. You can still withdraw Bitcoin on other networks like BEP-20. SAFU is a meme that plays on the word ‘safe,’ first appearing in a Youtube video three years ago, while it also refers to Binance’s ...

How to survive in a bear market? Tips for beginners

Usually, bear markets bring about a feeling of uncertainty in any investor. Even more so for a newcomer, for whom it can feel like the end of the world. It may even be common knowledge that during bull cycles, investors are sure of making gains. Whereas in bear markets such as this, an unimaginable amount of pessimism sets in. The co-founder and strategic lead at the Kylin Network, Dylan Dewdney, told Cointelegraph that the two major mistakes that investors make while feeling anxious are “One, over-investing and two, not investing with conviction.” “You need to find the sweetspot where you have enough conviction in your investments while managing the resources devoted to them such that you are 100% comfortable with being patient for a long time. Lastly, bear markets are where the magic rea...

Pennsylvania pharmacist feeds thousands of homeless using crypto

Pennsylvania-based pharmacist Kenneth Kim had always “wanted to do something with crypto” that could “make the world a better place”. In 2019, he founded what is known today as Crypto for the Homeless (CFTHL), a New Jersey registered non–profit organization, which has fed more than 5,000 homeless people around the world through the use of digital currencies. “I always had the desire to get involved with some kind of project in crypto… if it made the world better that would be the best possible scenario,” Kim told Cointelegraph. Whilst he was a pharmacy student at Temple University in Philadelphia between 2018 and 2021, Kim would walk past scores of homeless people just on his route between the campus and his home. It was also around this time that the new Blade Runner 2049 movie was ...

Celsius exodus: $320M in crypto sent to FTX, user withdrawals paused

Crypto staking and lending platform Celsius may be dealing with its rumored liquidity crisis by unstaking $247 million worth of Wrapped Bitcoin from Aave and sending it to FTX exchange. Speculations among the crypto community are now flaring as the project has been moving massive amounts of WBTC, ETH, and other crypto assets in addition to pausing withdrawals for users. Celsius users have criticized the platform for how they believe the project has mismanaged its funds following the collapse of the Anchor Protocol on the now-named Terra Classic blockchain. The project could be addressing those concerns with the recent moves to stabilize liquidity. Some think that if Celsius fails, it would sell its significant stack of staked ETH (stETH), which would cause it to depeg further from ETH. stE...

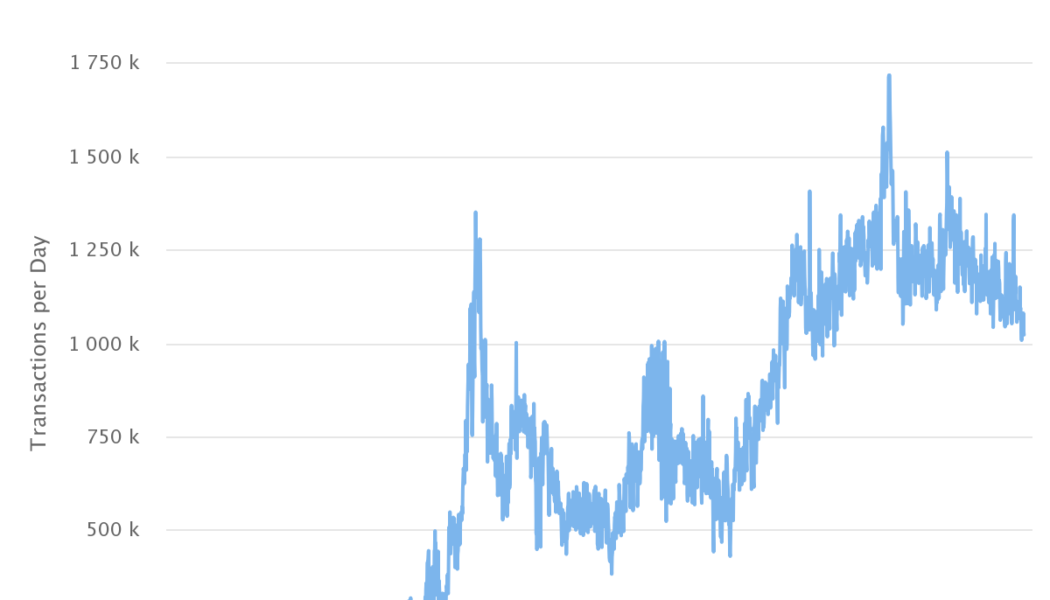

Ethereum difficulty bomb delayed but network adoption still growing

Ethereum network developers have decided to delay the difficulty bomb, a major step leading up to the highly anticipated Merge upgrade for the layer-1 blockchain. They set the delay to two months in order to “be sure that we sanity check all the numbers before selecting an exact delay and deployment time” according to core developer Tim Beiko in a June 11 tweet. In short, we agreed to the bomb delay. We were already over time, and want to be sure that we sanity check all the numbers before selecting an exact delay and deployment time, but we are aiming for a ~2 month delay, and for the upgrade to go live late June. — Tim Beiko | timbeiko.eth (@TimBeiko) June 10, 2022 The difficulty bomb will be a measure to disincentivize ETH mining operations from keeping their physical mining devices run...

The CFTC’s action against Gemini is bad news for Bitcoin ETFs

On June 2, 2022, the United States Commodity Futures Trading Commission (CFTC) initiated an action against Gemini, the crypto exchange founded by billionaire twins Tyler and Cameron Winklevoss. Among other things, the complaint alleges that Gemini made a number of false and misleading statements to the CFTC in connection with the potential self-certification of a Bitcoin futures contract, the prices for which were to be settled daily by an auction (the “Gemini Bitcoin Auction”). In the complaint, the CFTC specifically articulated the position that these statements were designed to mislead the commission as to whether the proposed Bitcoin futures contract would be susceptible to manipulation. While the Winklevoss brothers were not named in the suit, the complaint alleges that “Gemini office...

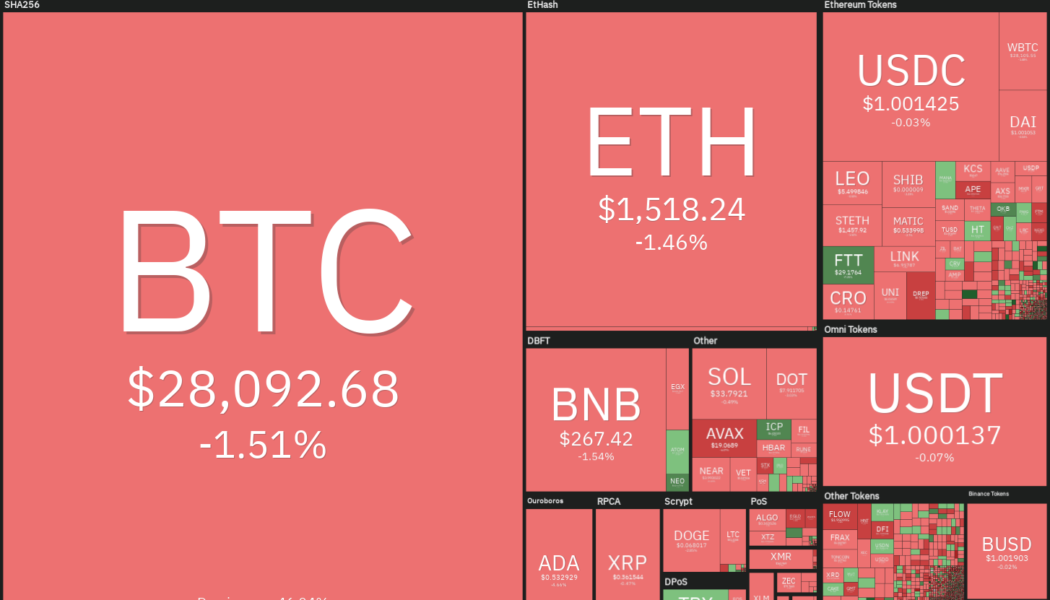

Top 5 cryptocurrencies to watch this week: BTC, FTT, XTZ, KCS, HNT

Bitcoin (BTC) is threatening to drop to its worst weekly close since December of 2020. The crypto markets are in are held firmly in a vice grip and the selling accelerated following a higher-than-expected inflation report from the United States on June 10. It is not only the crypto markets that are facing the brunt, even U.S. equities markets finished the week ending June 10 with sharp losses. Risky assets may remain volatile in the near term as traders await the outcome of the U.S. Federal Open Market Committee meeting on June 14 and June 15. Crypto market data daily view. Source: Coin360 Bloomberg Intelligence senior commodities strategist Mike McGlone warned that if the stock markets continue to drop, then it will signal that most assets may have seen their peak exuberance in the ...

DeFi pulls the curtain on financial magic, says EU Blockchain Observatory expert

As decentralized finance continues its victorious march — although the road is sometimes bumpy — some significant questions on its nature remain. How can DeFi applications be protected from becoming nonoperational under extreme stress? Is it really decentralized if some individuals have way more governance tokens than others? Does the anonymous culture compromise its transparency? A recent report from the EU Blockchain Observatory and Forum elaborates on these questions and many others around DeFi. It contains eight sections and covers a range of topics, from the fundamental definition of DeFi to its technical, financial and procedural risks. Conducted by an international team of researchers, the report formulates some important conclusions that will hopefully make their way to the eyes an...

Bitcoin price drops to lowest since May as Ethereum market trades at 18.4% loss

Bitcoin (BTC) saw further losses on June 12 as thin weekend trading volumes fueled an ongoing sell-off. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Analyst likens risk asset ‘pump’ to 1929 Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hitting lows of $27,150 on its sixth straight day of downside. With hours to go until the weekly close, the pair was in danger of resuming the losing streak, which had previously seen a record nine weeks of red candles in a row. To avoid that outcome and put in a second “green” close, BTC/USD needed to gain over $2,000 from current spot price, which at the time of writing was $27,400. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView With support levels failing to change the mood thanks to the thinner...