crypto blog

6 Questions for Alex Wilson of The Giving Block

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Alex Wilson, co-founder of The Giving Block — a crypto donation solution that provides an ecosystem for nonprofits and charities to fundraise Bitcoin and other cryptocurrencies. Alex is a co-founder of The Giving Block, a Shift4 company. The Giving Block is a leading crypto philanthropy platform that makes accepting and fundraising cryptocurrencies easy for nonprofits and empowers donors to give crypto to their favorite causes. Alex oversees The Giving Block’s growth in several areas, including technological innovation, crypto and financial partnerships, and institutional giving. Alex’...

Ethereum price enters ‘oversold’ zone for the first time since November 2018

Ethereum’s native token Ether (ETH) entered its “oversold” territory this June 12, for the first time since November 2018, according to its weekly relative strength index (RSI). This is the last time $ETH went oversold on the weekly (hasn’t confirmed here yet). I had no followers, but macro bottom ticked it. Note, you can push way lower on weekly rsi, not trying to catch a bottom. https://t.co/kLCynTKTcS — The Wolf Of All Streets (@scottmelker) June 12, 2022 ETH eyes oversold bounce Traditional analysts consider an asset to be excessively sold after its RSI reading fall below 30. Furthermore, they also see the drop as an opportunity to “buy the dip,” believing an oversold signal would lead to a trend reversal. Ether’s previous oversold reading appeared i...

What are Bitcoin improvement proposals (BIPs), and how do they work?

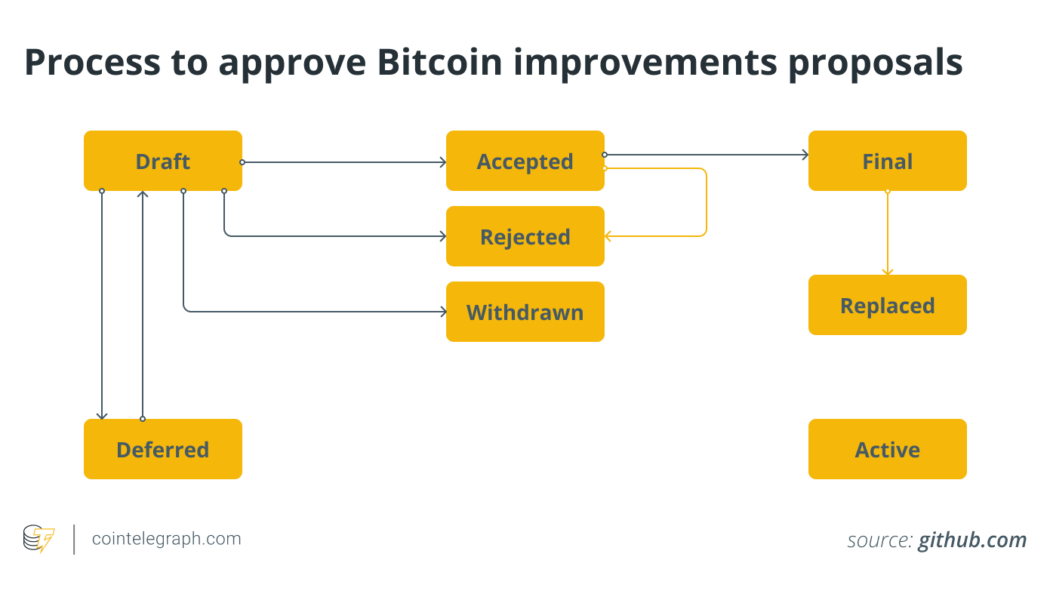

Gathering significant consensus within the community is the first step of the process. Sometimes, even the most valuable proposals can take years before they are approved or rejected because the community can’t find an agreement. Once a BIP is submitted as a draft to the BIP GitHub, the proposal gets reviewed and worked on transparently so that everyone can view its progress and consequent testing outcomes. As Bitcoin blockchain is based on code, protocol changes will have to be reflected in the code, and miners will have to add a reference to their hashed block to signal that they accept or reject their implementation. Because of the severe implications some changes might inflict on miners, a modification in the code requires acceptance by a vast majority of around 95% unless a ...

Central authorities have demonized privacy — Crypto projects must fight back

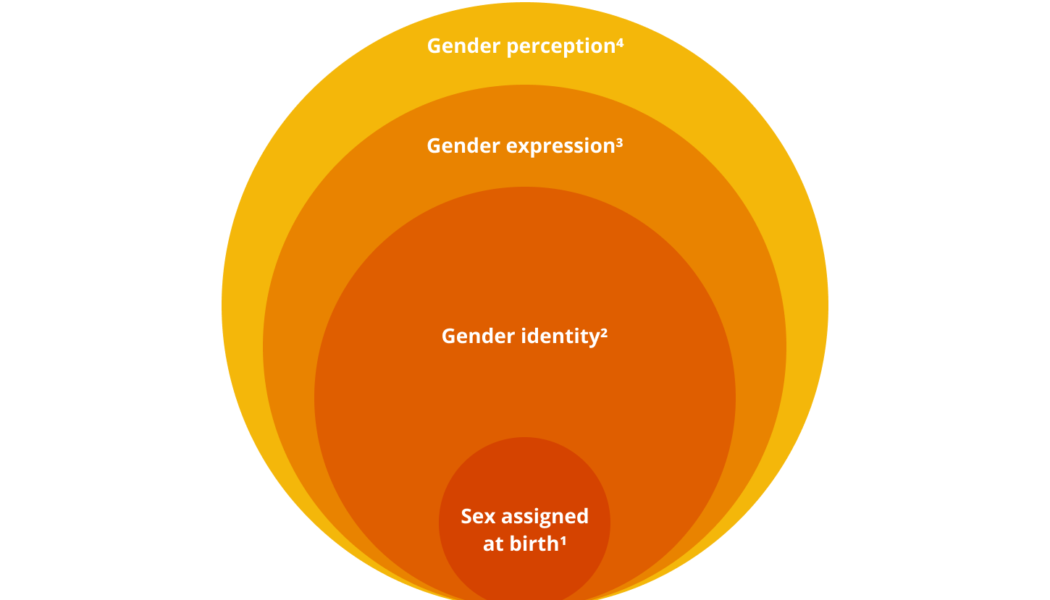

Zcash (ZEC), a privacy coin that launched in 2016, unveiled an upgrade to its system on May 31 that will allow users to more easily make private, trustless digital cash payments on mobile phones. Not everyone would view this as a good development. The unfamiliarity, uncertainty and public intrigue surrounding privacy — including its complexity, misuse and speculative activity — presents a number of challenges and reputational issues for innovating crypto projects. While a core tenet and source of pride among crypto projects such as Zcash, privacy has been demonized by those in power, including lawmakers, regulators, banks and academics. Yet, frequent hacks and data breaches show that the need to protect individuals’ privacy is more essential than ever. It’s here where crypto firms can ente...

Do Kwon dismisses allegation of cashing out $2.7B from Terra (LUNA), UST

Do Kwon, the CEO and co-founder of the infamous Terra (LUNA) and TerraUSD (UST) ecosystems, refuted the claims of cashing out $80 million every month for nearly three years. Numerous unconfirmed reports surfaced on June 11, claiming Kwon’s participation in draining liquidity out of LUNA and UST before the crash to purchase US dollar-pegged stablecoin such as Tether (USDT). Rumors about Kwon cashing out LUNA and UST reserves surfaced after a Twitter thread by @FatManTerra shared the alleged details on how Kwon, along with Terra influencers, managed to drain funds while artificially maintaining the liquidity. Some of you thought $80m per month was bad. That’s nothing. Here’s how Do Kwon cashed out $2.7 billion (33 x $80m!) over the span of mere months thanks to Degenbox: th...

What can other algorithmic stablecoins learn from Terra’s crash?

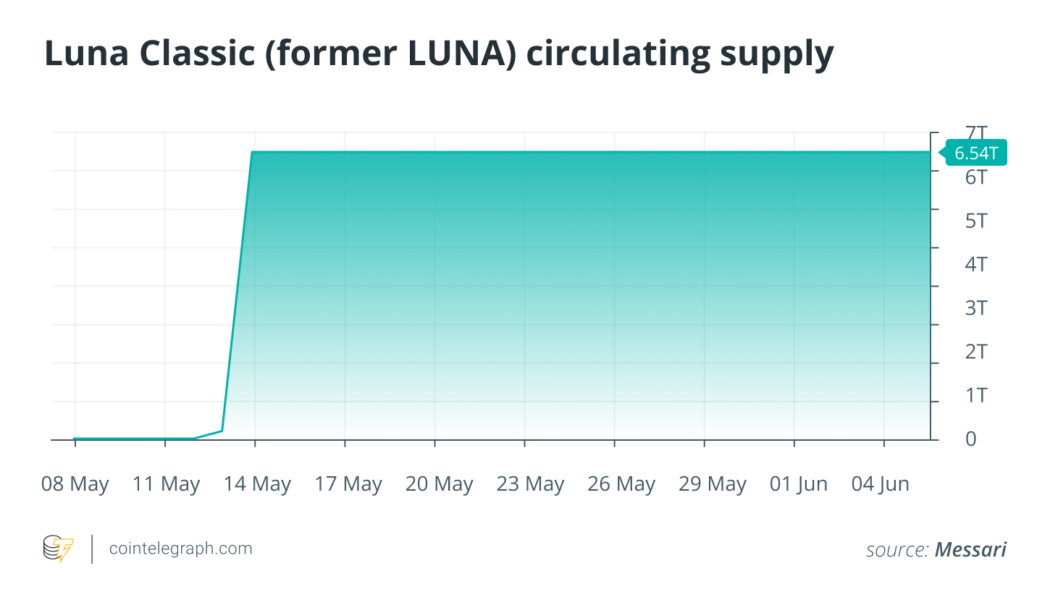

The spectacular implosion of the Terra ecosystem in mid-May left the crypto industry scarred. Though there were some brave critics who understood just how thin the razor’s edge was for TerraUSD (UST) — now TerraUSD Classic (USTC) — I think it’s safe to say that most people didn’t expect Terra to fail so fast, so dramatically and so completely irrevocably. [embedded content] I’m writing this as the Terra community is voting on a plan to restart some kind of Terra 2.0 — a plan to salvage the layer-1 ecosystem without the UST stablecoin. The old Terra, now to be known as Terra Classic, is completely dead. An ill-fated attempt to backstop UST holders printed trillions of LUNA tokens, destroying their value and ultimately jeopardizing the safety of the network itself. The complete wipeout of $5...

Bitcoin price threatens lowest weekly close since 2020 as inflation spooks markets

Bitcoin (BTC) dropped to two-week lows on June 11 as the week’s Wall Street trading ended with bears in control. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView U.S. inflation print proves setback Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it reached $28,528 on Bitstamp, its lowest since May 28. The pair had fallen in step with stock markets on June 10, these finishing the week noticeably down — the S&P 500 and Nasdaq Composite lost 2.9% and 3.5% respectively. This was on the back of surprisingly high inflation data from the United States, which took a turn for the worst in stark contrast to expectations. As Cointelegraph reported, at 8.6%, annual inflation came in at the highest since December 1981. Reacting, market commentators were thus firml...

Innovation in fiat on-ramps can overcome crypto’s expensive card fees

Being in crypto is all about taking an intelligent view towards money. We know that Bitcoin (BTC) is the future, both as a store of value and also as a means of payment, as layer 2 solutions such as the Lightning Network begin to flourish. It is, therefore, vital that every cryptocurrency user makes sure that they always obtain the most competitive price for every service. While millions of crypto users convert fiat to crypto using a debit or credit card, this is by no means a low-cost choice. Paying the overhead: Converting fiat to crypto According to The Motley Fool, people who are using credit cards to pay for crypto purchases may be subject to at least 7% in extra fees. For example, if you were to purchase $1,000 in Bitcoin using a credit card, you could pay up to $70 in fees if your c...

The total crypto market cap drops under $1.2T, but data show traders are less inclined to sell

An improving Tether discount in Asian markets and positive futures premiums for BTC and ETH suggest a slight recovery is in the making. The total crypto market capitalization has been trading in a descending channel for the past 29 days and currently displays support at the $1.17 trillion level. In the past 7 days, Bitcoin (BTC) presented a modest 2% drop and Ether (ETH) faced a 5% correction. Total crypto market cap, USD billion. Source: TradingView The June 10 consumer price index (CPI) report showed an 8.6% year-on-year increase and crypto and stock markets immediately felt the impact, but it’s not certain whether the figure will convince the U.S. Federal Reserve to hesitate in future interest rate hikes. Mid-cap altcoins dropped further, sentiment is still bearish The generalized beari...

US SEC investigates Binance’s ICO, metaverse crypto assets up 400% YoY, and STEPN faces DDoS attacks: Hodler’s Digest, June 5-11

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Anonymous hacker served with restraining order via NFT In what’s perhaps an industry first, an anonymous defendant in an exchange-hacking legal case has received a temporary restraining order via NFT. The defendant is part of legal proceedings surrounding the January 2022 LCX exchange hack. Two legal firms served the “service token” NFT to the defendant as a restraining order, with the event touted as the first official NFT usage in the legal world. FTX will not freeze hiring amid layoffs at other crypto firms...

Centralized vs. decentralized digital networks: Key differences

A decentralized digital network is not controlled by a central authority. Instead, control is distributed among its users. There is no single server or point of command. Rather, the network is run on a peer-to-peer basis, with each user wielding equal power and responsibility. A great example of a decentralized network is the internet, itself, which is not controlled by one authority. Rather, it is distributed among its users. However, some argue that the internet is moving toward centralization due to the monopoly of big names within the space—Google, Facebook, WordPress and the like. How so? Data is concentrated within these big players’ servers. As such, everything one needs to access online goes through any one of them. So to answer the question, “Is the internet ...