crypto blog

BTC price snaps its longest losing streak in history — 5 things to know in Bitcoin this week

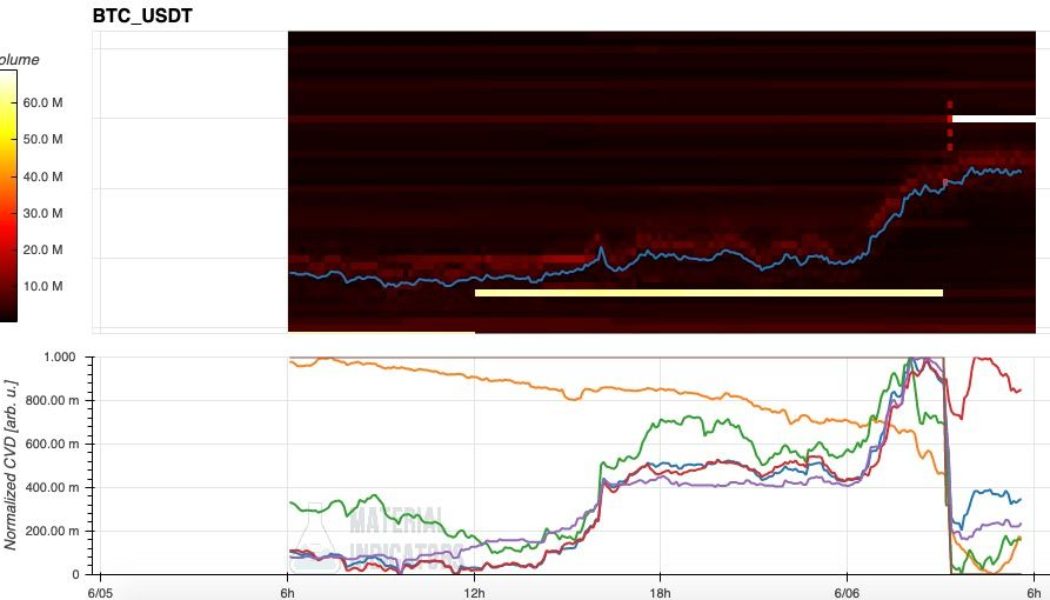

Bitcoin (BTC) starts a new week with some fresh hope for hodlers after halting what has been the longest weekly downtrend in its history. After battling for support throughout the weekend, BTC/USD ultimately found its footing to close out the week at $29,900 — $450 higher than last Sunday. The bullish momentum did not stop there, with the pair climbing through the night into June 6 to reach multi-day highs. The price action provides some long-awaited relief to bulls, but Bitcoin is far from out of the woods at the start of what promises to be an interesting trading week. The culmination will likely be United States inflation data, this itself a yardstick for the macroeconomic forces at world globally. As time goes on, the impact of anti-COVID policies, geopolitical tensions and supply shor...

Remote roles in blockchain offer flexibility for women: Alien Worlds co-founder

Saro McKenna, the co-founder of nonfungible token game Alien Worlds and CEO of blockchain consulting firm Dacoco, shared perspectives and personal experiences regarding inclusivity within the blockchain industry in an interview with Cointelegraph. Having experienced other male-dominated industries, McKenna shared how she believes that communities within the blockchain industry are “extremely diverse.” She explained that the people working in blockchain are from various backgrounds, and because of this, they offer “unique perspectives and interests.” She also noted that the space gives women who are primary caretakers of their children the opportunity to push their careers forward because of remote opportunities. She explained: “Given women still tend to be the primary caretakers when...

Top 5 cryptocurrencies to watch this week: BTC, ADA, XLM, XMR, MANA

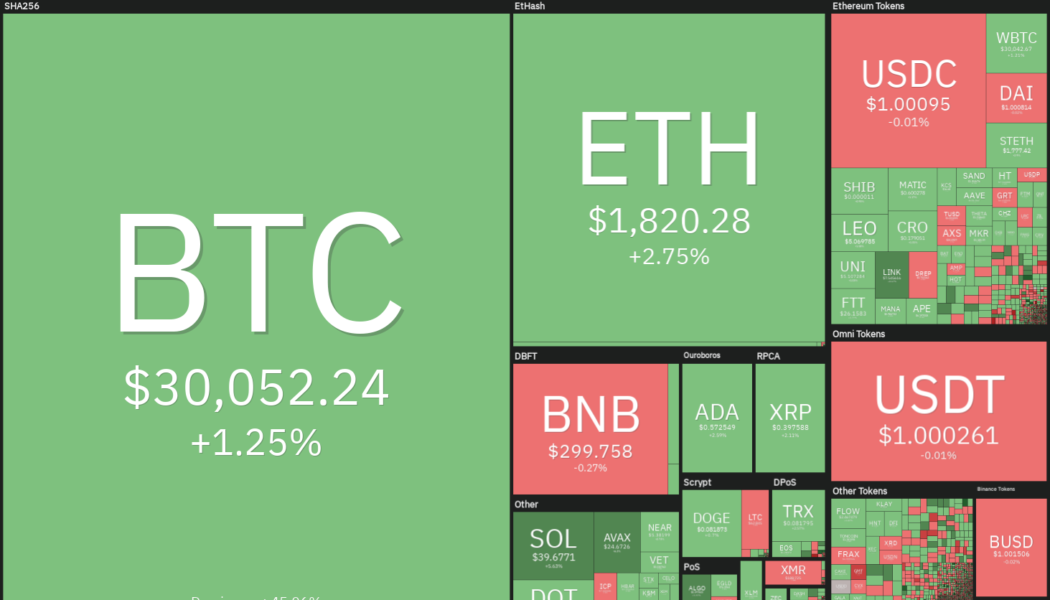

The bears are trying to extend Bitcoin’s (BTC) record of nine consecutive red weekly candles to ten weeks, but the bulls are trying to avert this negative occurrence. Although sentiment remains negative, Arthur Hayes, former CEO of derivatives giant BitMEX, anticipates Bitcoin to bottom out in the range of $25,000 to $27,000. On-chain data from Glassnode shows that smart money may have started accumulating Bitcoin. The net outflows from major cryptocurrency exchanges reached 23,286 Bitcoin on June 3, the highest since May 14. Crypto market data daily view. Source: Coin360 Another positive sign of accumulation is that investment into Bitcoin exchange-traded products (ETPs) was strong in May and has only risen further in the first two days of June, according to an Arcane Research report. The...

A life after crime: What happens to crypto seized in criminal investigations?

Earlier this year, during the annual Queen’s Speech in the United Kingdom, Prince Charles informed the Parliament about two bills. One of them — the Economic Crime and Corporate Transparency Bill — would expand the government’s powers to seize and recover crypto assets. Meanwhile, the United States Internal Revenue Service (IRS) seized more than $3 billion worth of crypto in 2021. As digital currencies’ monetary stock grows and enforcers’ scrutiny over the maturing industry tightens, the amount of seized funds will inevitably increase. But where do these funds go, assuming they aren’t returned to the victims of scams and fraud? Are there auctions, like there are for forfeited property? Or are these coins destined to be stored on some kind of special wallet, which might end up as a perfect ...

6 Questions for Nikki Farb of Headline

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Nikki Farb — an active investor and advisor to technology companies who is currently a venture partner at Headline, a venture capital firm. I invest in consumer tech (with a real love for marketplaces) and Web3. I’ve invested in Consensys (MetaMask), AfterParty, Fractal, Aloft, Wander, MarketerHire, SudShare and a few others I can’t share just yet. Before investing, I co-founded Darby — a video shopping app that connected creators and their fans. It was such a journey. We built Darby up to 50,000 creators making videos for 5 million viewers. Working with the team at Darby was one of my...

Who accepts Bitcoin as payment?

This is a list of some of the biggest places that accept Bitcoin, such as Microsoft and Whole Foods. First, we’re going to take a look at businesses that accept Bitcoin. There are some early adopters, but most of them recently started to accept payments using this digital currency. These major companies are the ones where you can pay via Bitcoin: Microsoft Microsoft is one of the early adopters of BTC, as they started accepting payments with Bitcoin in 2014. Users could buy games and applications with digital currencies, but digital coins were far from usual back then, so Microsoft stopped accepting BTC in 2016 and once again in 2018 due to high volatility. We’re eight years into the future, and now it’s way more usual and trustworthy to pay with dig...

Bitcoin price needs to close above $29,450 for its first green weekly candle since March

Bitcoin (BTC) kept traders guessing into the June 5 weekly close as BTC price action closely mimicked last weekend. BTC/USD 1-week candle chart (Bitstamp). Source: TradingView BTC price traders $300 in the gree Data from Cointelegraph Markets Pro and TradingView showed BTC/USD circling its May 30 opening level at the time of writing, just $300 higher than seven days ago. With hours to go before the weekly candle closed, the pair thus retained the threat of sealing yet another lower low. This would take Bitcoin to a new record in terms of consecutive “red” weeks. Discussing the potential outcomes, traders had mixed opinions. Very hard to tell, again all about daily trend and the recent highs put @ 32k. Gaps above big enough to be interesting to play even > 32. A close li...

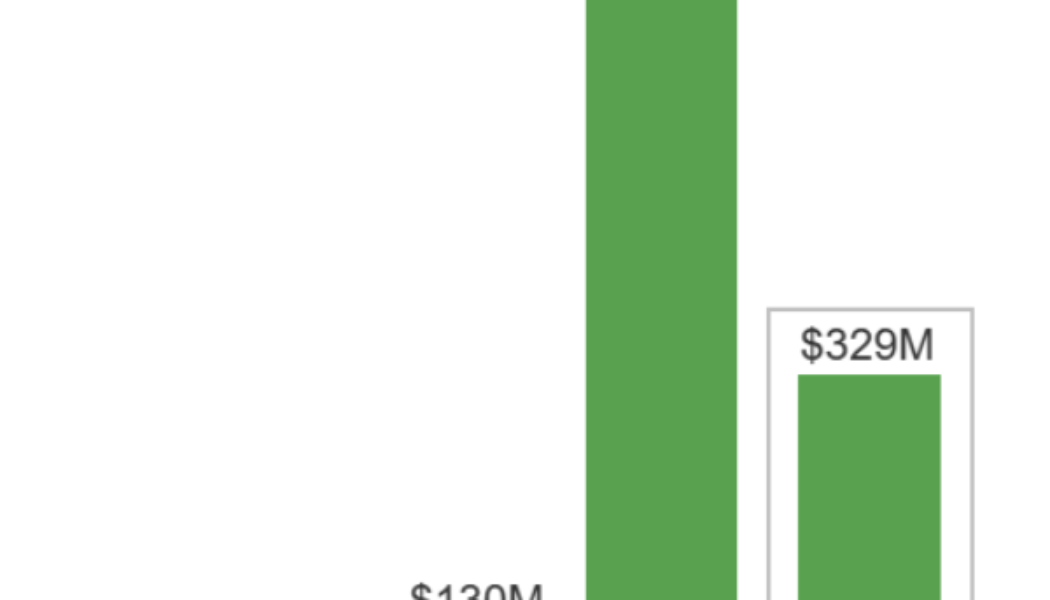

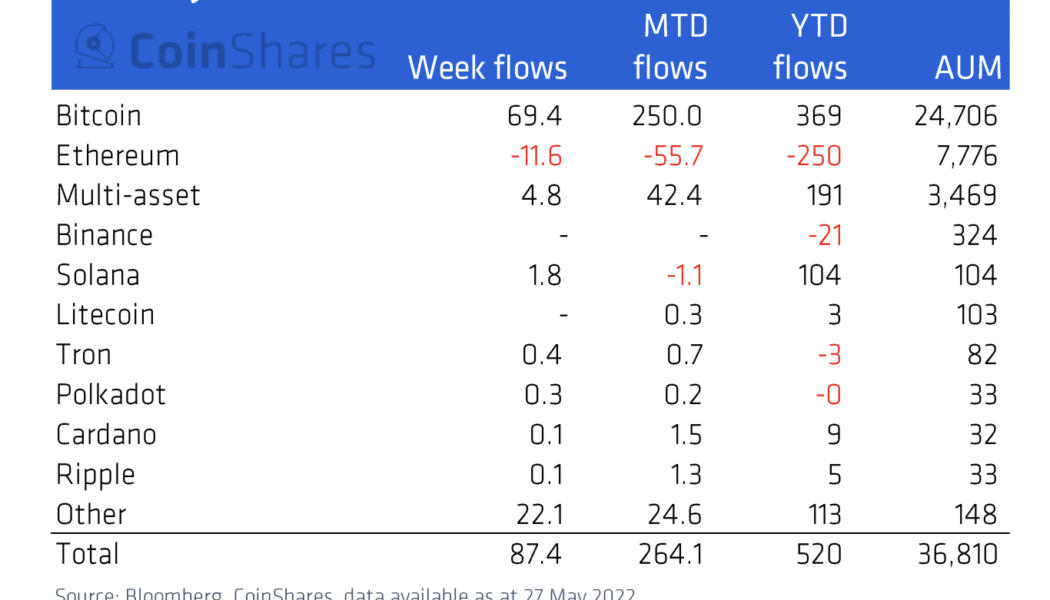

3 reasons Ethereum price risks 25% downside in June

Ethereum’s native token Ether (ETH) has dropped more than half of its value in 2022 in dollar terms, while also losing value against Bitcoin (BTC) and now remains pinned below $2,000 for several reasons. What’s more, ETH price could face even bigger losses in June due to another slew of factors, which will be discussed below. Ethereum funds lose capital en masse Investors have withdrawn $250 million out of Ethereum-based investment funds in 2022, according to CoinShares’ weekly market report published May 31. The massive outflow appears in contrast to other coins. For instance, investors have poured $369 million into Bitcoin-based investment funds in 2022. Meanwhile, Solana and Cardano, layer-one blockchain protocols competing with Ethereum, have attracted $104 million and ...

Weekly Report: New York passes bill limiting Bitcoin mining, El Salvador delays Bitcoin bonds again, Japan limits stablecoin issuance, and more

Here are this week’s most intriguing stories in the cryptocurrency sector: Not yet Bitcoin bonds, El Salvador’s Finance minister says When El Salvador adopted Bitcoin for use as an official tender in September last year, it also set out on several Bitcoin ambitions. Among them; are building a Bitcoin city and establishing Bitcoin bonds worth $1 billion. The bonds, having been postponed earlier in the year, seem set for another delay as Finance Minister Alejandro Zelaya confirmed that the nation would not venture into offering them in the current bear market. Speaking during a recent interview with a local news outlet, the finance minister was queried on the state of the $1 billion bonds that were not issued in mid-March as initially planned. No official date when the ...

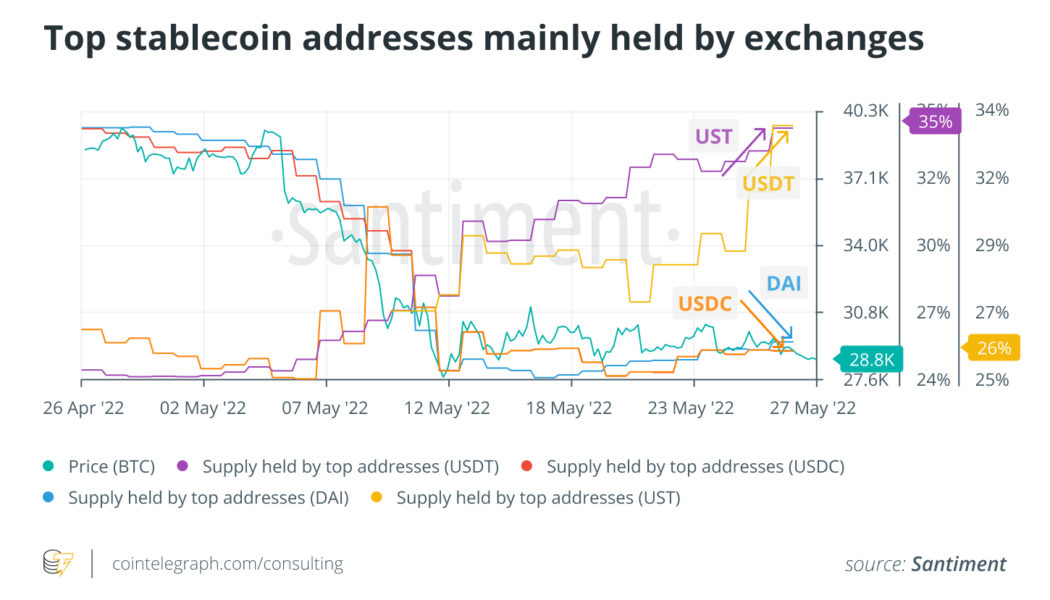

The crypto market dropped in May, but June has a silver lining

May 2022 was not for the faint-hearted. Even the most embattled and experienced crypto traders were tested in the first two weeks of the month on a brutal drop following the United States Federal Reserve’s announcement that interest rates would be rising by 0.5%. Crypto used to exhibit a lower correlation with real-world events and was generally unaffected by capitalistic successes and failures. However, a very steady approximate peg between Bitcoin (BTC) and the S&P 500 index was seen throughout the first five months of 2022. Inflation and war fears have not been kind to both markets either. Crypto mimicking the equity market could be due to the massive market capitalization growth in 2020 and 2021. At unprecedented rates, retail investors from equities have flocked to cryptocurrencie...