crypto blog

Seoul authorities launch an official investigation on the TerraUSD crash

Terraform Labs employees have been summoned by South Korean prosecutors in a bid to establish the exact cause of the collapse of Terra assets The investigators have also tightened up scrutiny on exchanges to make sure investors are protected from the same fate that befell Terra and its native tokens South Korean authorities have reportedly launched a full-scale investigation to find the exact reason for the collapse of algorithmic stable coin UST and its sister token LUNA. The investigation is being conducted by the joint financial and securities crime investigation team from the Seoul Southern District Prosecutors Office. Investigators probing to determine if there was price manipulation The investigation team seeks to find from the Terra lab employees if the project’s founder, Do Kwon, i...

Luna Classic (LUNC) pricing error leads to Mirror Protocol exploit

A mismatch in the reported price of underlying assets on synthetic assets DeFi platform Mirror Protocol has caused an ongoing exploit that has the potential to drain all of its funds. The exploit was observed on May 29 by governance participant ‘Mirroruser’ on the protocol’s forum. As of the time of writing, the mBTC, mDOT, mETH, and mGLXY synthetic asset pools on the protocol have lost almost all of their assets valued at over $2 million. Mirror allows trading of synthetic assets, such as stocks and cryptocurrency on the Terra and Terra Classic layer-1 blockchains, BNB Chain (BNB), and Ethereum (ETH). A pricing error for Luna Classic (LUNC) made the exploit possible. The remaining validators on Terra Classic reported that the price of LUNC ($0.000122) was the same as the newly launched LU...

Aussie consumer group calls for better crypto regs due to ‘lagging laws’

Australian consumer advocacy group CHOICE has called on the federal government to provide better protection for crypto investors while submitting a proposed regulatory framework for cryptocurrency exchanges operating in the country. The regulatory framework was submitted in response to the federal Treasury’s consultation paper for “crypto asset secondary service providers” (CASSPs) defined as firms providing custodial crypto wallets and exchange services. CHOICE commented: “As it stands, enforceable protections in the unregulated cryptocurrency market are somewhere between negligible and non-existent.” Outlining four main areas in its framework, the group called for a single definition of crypto for better regulation, a license for exchanges in line with current financial licensing, ...

Ropsten Ethereum testnet ready for Merge ‘first dress rehearsal’

The Ropsten testnet on the Ethereum network is ready to set the stage for the “first dress rehearsal” of the Merge to adopt the Proof-of-Stake (PoS) consensus mechanism. Core Ethereum developer Tim Beiko announced on May 31 that a new Beacon Chain for Ropsten has been launched. It will serve as the precursor for the final test Merge, which is expected to be “around June 8th.” Ropsten Merge Announcement Ethereum’s longest lived PoW testnet is moving to Proof of Stake! A new beacon chain has been launched today, and The Merge is expected around June 8th on the network. Node Operators: this is the first dress rehearsalhttps://t.co/0fDHObLOmn — Tim Beiko | timbeiko.eth (@TimBeiko) May 30, 2022 The Ropsten testnet is one of many testing grounds for Ethereum clients. It mimics aspects of t...

Shiba Inu founder deletes social media posts, steps down from community

Pseudonymous Shiba Inu (SHIB) founder ‘Ryoshi’ has walked away from the community after deleting all of their Tweets and blog posts this week. Much like Bitcoin (BTC) founder Satoshi Nakamoto, Ryoshi’s identity has remained unknown since the project launched in August 2020. Additionally, they have also held a hands-off approach to the memecoin much like Dogecoin (DOGE) founders Billy Markus and Jackson Palmer. Lead developers such as ‘Shytoshi Kusama’ have stated that the project will carry on and continue to “actualize Ryoshi’s vision and plan for this grand experiment” of building a decentralized memecoin ecosystem. Ryoshi has hinted on several occasions that they would eventually walk away, as they often played down their significance and role in Shiba Inu. In a since-deleted Medium pos...

Price analysis 5/30: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

After creating the dubious record of nine successive red weekly closes, Bitcoin (BTC) is attempting to make amends by starting a price recovery to end the losing streak. Analysts have repeatedly said that investors should not fear a bear market because it is one of the best times to invest in fundamentally strong projects in preparation for the next bull phase. CryptoQuant CEO Ki Young Ju highlighted that unspent transaction outputs (UTXOs) that are older than six months reflect 62% of the realized cap, which is similar to the level seen during the March 2020 crash. Hence, Ki said that Bitcoin may be close to forming a cyclic bottom. Daily cryptocurrency market performance. Source: Coin360 In the current bearish environment, it is difficult to fathom a Bitcoin rally to $250,000 ...

Ethereum price moves toward $2,000, but analysts say it’s just another ‘relief rally’

On May 30, the cryptocurrency market experienced a much-needed bounce that saw Bitcoin (BTC) climb above $30,900 and Ether (ETH) rally 5.84% to $1,930, but analysts warn that it could be too early to expect a reversal. ETH/USDT 1-day chart. Source: TradingView Here’s a look at what several analysts are saying about the outlook for Ether moving forward and the major support and resistance levels to keep an eye on. A bounce off of major support The May 30 bounce in Ether came as “no surprise” to market analyst and pseudonymous Twitter user Rekt Capital, who posted the following chart, stating that “It’s more about how much #ETH will move from here.” ETH/USD 1-month chart. Source: Twitter Rekt Capital said: “Technically, #Ethereum could rally to as high as ~$2269 to flip it into new res...

Argentines turn to Bitcoin amid inflation worries: Report

Since 2016, Argentina has been engaged in a war against inflation. Caused by multiple factors, like a lack of trust in the central bank or government overspending, the depreciation of the Argentinean peso has negatively impacted citizens’ purchasing power. This has brought 37.3% of the population under the poverty line, and many others have had their savings vanish into thin air. Against this backdrop, many Argentines have turned to Bitcoin (BTC) and crypto as a way to hedge against 60% inflation, despite the market being in the red for several months and the central bank forbidding financial institutions from operating with digital assets. Related: Argentina’s central bank steps in to block new crypto offerings from banks In an Americas Market Intelligence report cited by Reute...

On-chain data shows Bitcoin long-term holders continuing to ‘soak up supply’ around $30K

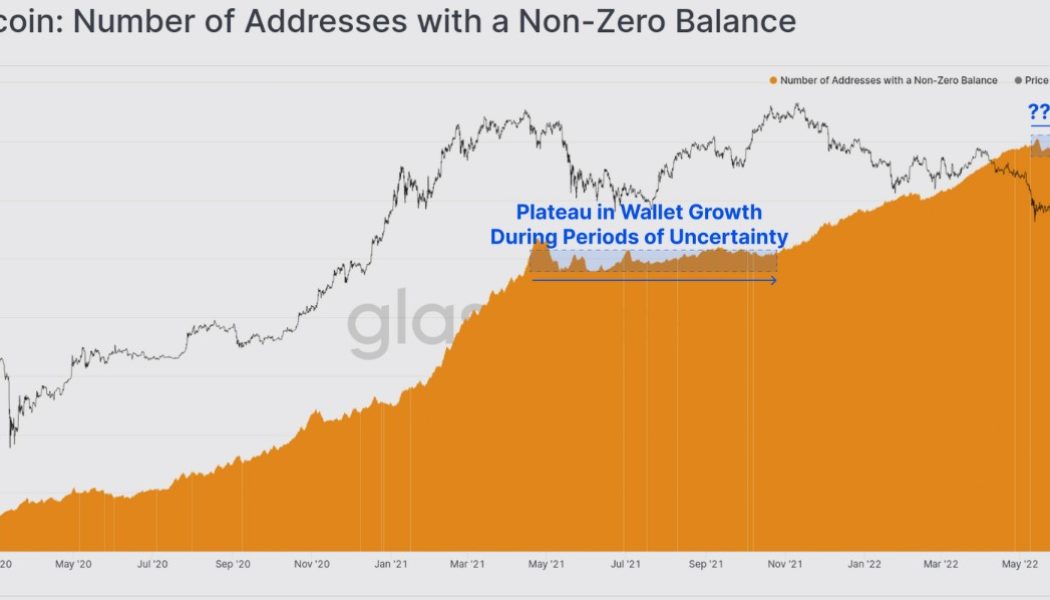

Bear markets are typically marked by a capitulation event where discouraged investors finally abandon their positions and asset prices either consolidate as inflows to the sector taper off or a bottoming process begins. According to a recent report from Glassnode, Bitcoin hodlers are now “the only ones left” and they appear to be “doubling down as prices correct below $30K.” Evidence of the lack of new buyers can be found looking at the number of wallets with non-zero balances, which has plateaued over the past month, a process that was seen after the crypto market sell-off in May of 2021. Number of Bitcoin addresses with a non-zero balance. Source: Glassnode Unlike the sell-offs that occurred in March 2020 and November 2018, which were followed by an upswing in on-chain activity tha...

Gate.io Announces Launch of Mirror World NFTs on NFT Box

Majuro, Marshall Islands, 30th May, 2022, Chainwire Gate.io, one of the world’s leading cryptocurrency exchanges with over 10 million users worldwide and a wide range of tradable assets has announced the upcoming listing of Mirror World NFTs, on its NFT marketplace, set to launch in June 1st, 2022. About Mirror World Mirror World is a game matrix with AI-powered virtual beings (the Mirrors), fighting along with the players in the game universe. Mirrors are fully interoperable with all the Play-to-Earn games in our matrix. This means that anyone with a pass can use it to access any of them. Among the existing game world designs, Mirror World includes [Mirrama], an ARPG that combines Roguelike gameplay, [Brawl of Mirror], a casual PVP-based arena dueling game; and [Beacon], an SLG-base...

Crypto’s youngest investors hold firm against headwinds — and headlines

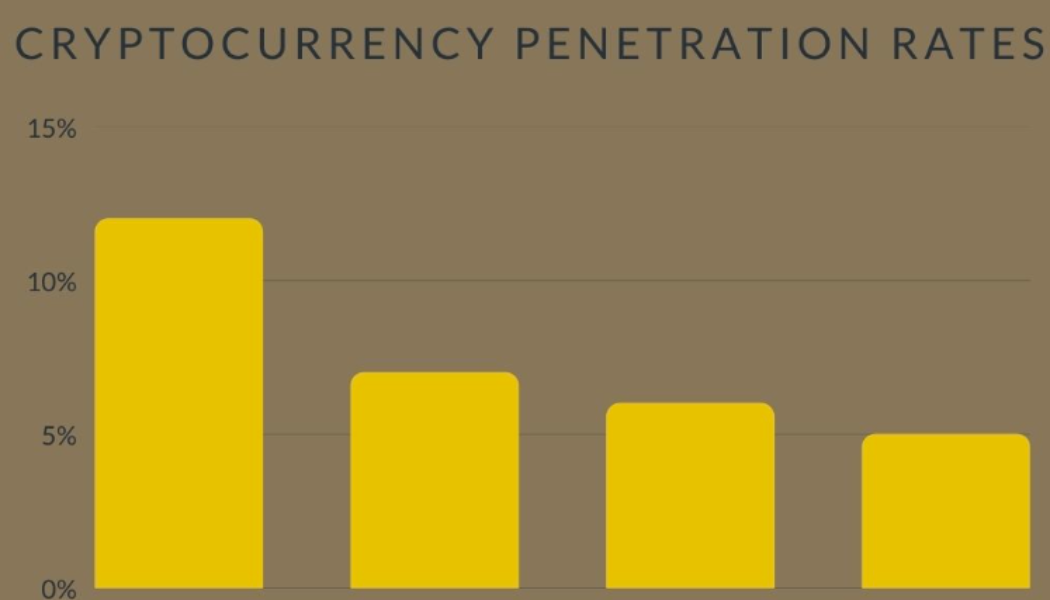

These can be anxious times for holders of cryptocurrencies, especially those who entered the market in late 2021 when prices were cresting. Bitcoin (BTC), Ether (ETH) and especially altcoins now appear to be undergoing a major reset, down 50% or more from November highs. Some worry that a whole generation of crypto adopters could be lost if things crumble further. “If the market decline continues, it will become too painful and retail investors will bail,” Eben Burr, president of Toews Asset Management, told Reuters earlier this month. “Everyone has a breaking point.” But, all the gloom and doom could be overdone. It’s “unnerving,” acknowledged Callie Cox, United States investment analyst at eToro, but it’s only par for the course for a market that scarcely existed a decade ago. Bitcoin, a...

Here’s how much Kazakh gov’t made off crypto mining in Q1 2022

The government of Kazakhstan, one of the world’s largest countries by the Bitcoin (BTC) mining hash rate distribution, has reported budget earnings derived from cryptocurrency mining. On May 30, Kazakhstan’s state revenue committee of the Ministry of Finance released a report on the amount of total energy fees paid by local crypto miners in the first quarter of 2022. According to the report, Kazakhstan’s budget added 652 million Kazakhstani tenge ($1.5 million) in energy fees from crypto mining in Q1 2022 after the government introduced a digital mining fee on Jan. 1, 2022. The committee stressed that a significant amount of the expected sum of fees has not been received by the budget as the government has shut down a wide number of crypto mining firms in order to “ensure energy security.”...