crypto blog

6 Questions for Andrew Levine of Koinos Group

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Andrew Levine, CEO of Koinos Group, which is focused on accelerating the transition to a more decentralized future by helping entrepreneurial developers, entrepreneurs and enterprises build disruptive blockchain-based solutions. Andrew leads a team of industry veterans accelerating decentralization through accessible blockchain technology. Their foundational product is Koinos, a feeless blockchain with infinite upgradeability and a proof-of-burn consensus. 1 — What kind of consolidation do you expect to see in the crypto industry in 2022? There are too many general-purpose blockchains that a...

What is chain reorganization in blockchain technology?

A blockchain reorganization attack refers to a chain split in which nodes receive blocks from a new chain while the old chain continues to exist. On May 25, the Ethereum Beacon chain suffered a seven-block reorg and was exposed to a high-level security risk called chain organization. Validators on the Eth2 (now consensus layer upgrade) Beacon Chain became out of sync after a client update elevated specific clients. However, during the process, validators on the blockchain network were confused and didn’t update their clients. Seven-block reorganization means that seven blocks of transactions were added to the eventually discarded fork before the network figured out it wasn’t the canonical chain. Therefore, blockchain reorganization happens if some node operators are faster than...

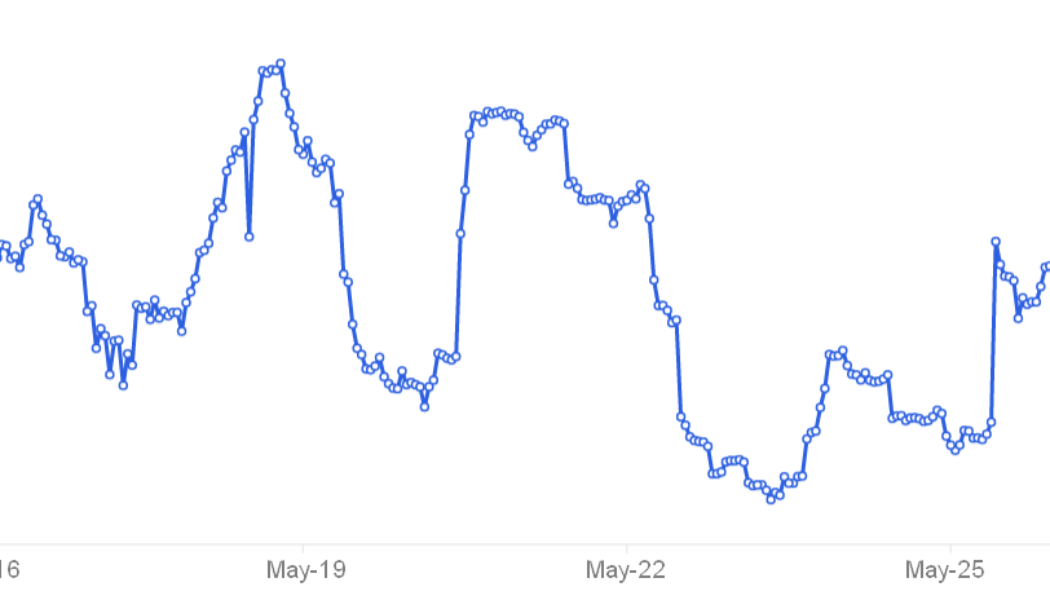

Bitcoin to set a new record 9-week losing streak with BTC price down 22% in May

Bitcoin (BTC) threatened to continue an unprecedented losing streak on May 29 as BTC/USD stayed in a right intraday range. BTC/USD 1-day candle chart (Bitstamp). Source: TradingView Stocks correlation offers no comfort to BTC bulls Data from Cointelegraph Markets Pro and TradingView flagged the largest cryptocurrency heading for nine weeks of downtrend in a row — the most in history. Already at a dubious record, Bitcoin’s weekly chart closes provided the backdrop to weakness that continued to disappoint analysts over the weekend. Even stock markets, troubled by central bank tightening, managed to put in gains over the week, while Bitcoin and the majority of altcoins added to losses. “Most concerning has been the divergence between Equities and Crypto. S&P and NASDAQ ha...

Tips to claim tax losses with the US Internal Revenue Service

Crypto volatility is nerve-wracking, and it may not be over yet. The turmoil may make crypto investors and crypto-related businesses less enthusiastic than when prices seemed ever to be climbing. With the market falling off a cliff, there will be big losses to claim on your taxes, right? Not necessarily. As your United States dollars shake out in the digital world, it is worth asking whether there is any lemonade you can make by claiming losses on your taxes. First, ask what happened from a tax viewpoint. If you’ve been trading and triggering big taxable gains, but then the floor drops out, first consider whether you can pay your taxes for the gains you have already triggered this year. Taxes are annual and generally based on a calendar year unless you have properly elected otherwise. Star...

Hodler’s guide to travel: Which platforms accept cryptocurrency?

The global economy is becoming increasingly digital, and it’s no surprise that cryptocurrencies and blockchain technology are starting to have an impact on the travel industry. Many travel agencies now accept Bitcoin (BTC) and other digital currencies as payment, with some even providing discounts to customers who pay in cryptocurrency. Here is a list of popular travel booking platforms that take BTC, as well as embrace blockchain technology. 1INCH Network to bring crypto payments to the travel industry The decentralized exchange aggregator 1inch Network on Thursday announced a partnership with the travel booking platform Travala.com, which will allow users to pay for their hotel bookings with cryptocurrency. Users of Travala.com can now use their favorite cryptocurrency to purchase ...

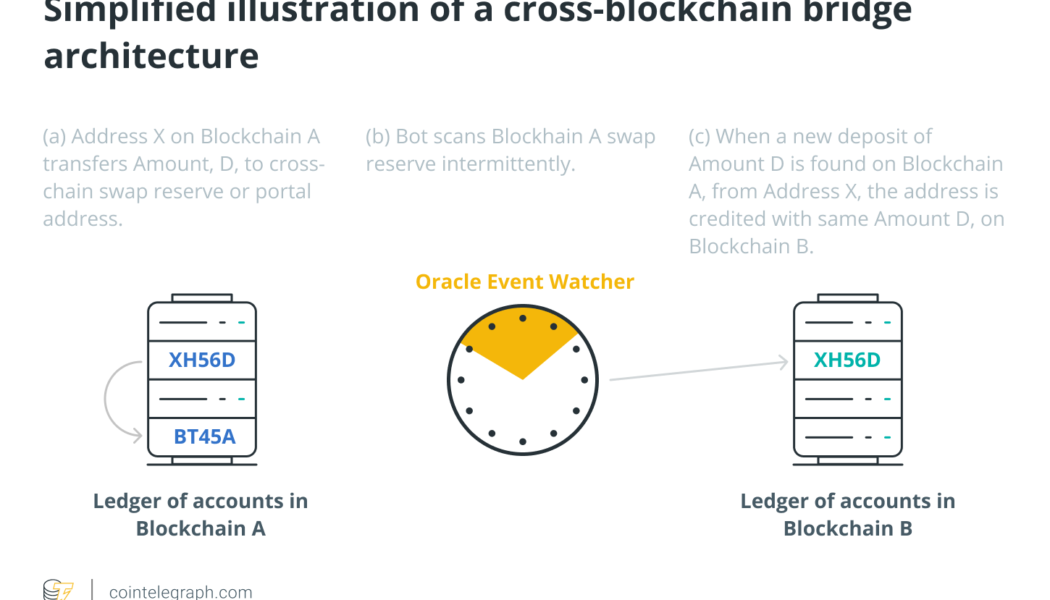

Is there a secure future for cross-chain bridges?

The plane touches down and comes to a halt. Heading to passport control, one of the passengers stops at a vending machine to buy a bottle of soda — but the device is absolutely indifferent to all of their credit cards, cash, coins and everything else. All of that is part of a foreign economy as far as the machine is concerned, and as such, they can’t buy even a droplet of Coke. In the real world, the machine would have been quite happy with a Mastercard or a Visa. And the cash exchange desk at the airport would have been just as happy to come to the rescue (with a hefty markup, of course). In the blockchain world, though, the above scenario hits the spot with some commentators, as long as we swap traveling abroad for moving assets from one chain to another. While blockchains as decentraliz...

SpaceX to follow Tesla in accepting DOGE payments for merch: Elon Musk

Just four months after EV manufacturer Tesla started accepting Dogecoin (DOGE) for merchandise purchases, Elon Musk announced his plan to extend the payment option for his space exploration company, SpaceX. Musk, the CEO of SpaceX and Tesla, has been a staunch supporter of the DOGE ecosystem since 2019 and has since publicly revealed interest in accepting meme coin payments across his multibillion-dollar enterprises. Tesla merch can be bought with Doge, soon SpaceX merch too — Elon Musk (@elonmusk) May 27, 2022 Historically, Musk’s pro-Dogecoin tweets have had an immediate and positive impact on DOGE’s market prices as investors try to cash in on the hype. However, the recent revelation about SpaceX’s plan to accept DOGE payments for merchandise had no significant effect on the price...

Identity is the antidote for DEXs’ regulation problem

Regulators from Europe, the United States and elsewhere are busily hammering out details on how to designate decentralized exchanges (DEXs) as “brokers,” transaction agents or similar entities that affect a transfer and cooperate with each other. The U.S. called for multinational cooperation in its executive order on responsible digital asset development, as did the European Union with its recent Financial Stability and Integration Review. And that is just what’s publicly accessible. Behind the scenes, the whisper of regulation is getting louder. Did anyone notice that all the Know Your Customer (KYC) requirements have been laid on smaller centralized exchanges in exotic locations over the past two months? That was the canary in the coal mine. With the aforementioned designation and ...

India to roll out CBDC using a graded approach: RBI Annual Report

Further cementing India’s decision to introduce an in-house central bank digital currency (CBDC) in 2022-23, the Reserve Bank of India (RBI) proposed a three-step graded approach for rolling out CBDC “with little or no disruption” to the traditional financial system. In February, while discussing the budget for 2022, Indian finance minister Nirmala Sitharaman spoke about the launch of a digital rupee to provide a “big boost” to the digital economy. In the annual report released Friday by India’s central bank, RBI revealed exploring the pros and cons of introducing a CBDC. In the report, RBI stressed the need for India’s CBDC to conform to India’s objectives related to “monetary policy, financial stability and efficient operations of currency and payment systems.” Based on this need, RBI is...

Identity and the Metaverse: Decentralized control

“The Metaverse” and “Web3” are the buzzwords of the moment, with their concepts permeating across the worlds of fintech, blockchain, and now even mainstream media. With decentralization thought to be at the core of the Web3 Metaverse, the promise of a better user experience, security and control for consumers is what’s driving its growth. But with users’ identities at the heart of the Metaverse, coupled with unprecedented amounts of data online, there are concerns over data security, privacy and interoperability. This has the potential to hinder the development of the Metaverse, but both regulated and self-sovereign identities could play an important role in ensuring that we truly own our identity and data within this new space. Related: Digital sovereignty: Reclaiming your private data in...

JPMorgan sees higher BTC price potential, a16z unveils $4.5 billion crypto fund and PayPal hints at more crypto involvement: Hodler’s Digest, May 22-28

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Andreessen Horowitz closes $4.5 billion crypto fund amid market turmoil Venture capital player Andreessen Horowitz, or a16z, has unveiled a new $4.5 billion cryptocurrency fund. The a16z fund is the fourth of its kind and more than double the amount of its third crypto investment fund. With $3 billion earmarked for venture investments and $1.5 billion for early-seed projects, the fund will look to invest in companies at various stages in their life cycle. Andreessen’s new fund provides a strong indicator that ...