crypto blog

Two key takeaways from Nansen’s UST stablecoin depeg report

As the dust settles on the cataclysmic collapse of the Terra ecosystem, an on-chain deep-dive carried out by blockchain analytics firm Nansen highlights two major takeaways. The cryptocurrency ecosystem was awash with varying speculatory theories around the cause of Terra’s algorithmic stablecoin UST’s decoupling from its $1 peg. The who and why seemed a mystery but the outcome was catastrophic, with UST dropping well below $1 while the value of Terra’s stablecoin token plummeting in value as a result. Nansen undertook an investigation leveraging on-chain data from the Terra ecosystem to the Ethereum blockchain in an effort to chart the chain of events that led to the UST depeg. [embedded content] It is worth noting that the report does not include potential off-chain events that cou...

Partying in Davos with Cointelegraph: Crypto card payments accepted

With the World Economic Forum (WEF) Annual Meeting drawing to a close, attendees had the opportunity to join Cointelegraph for a farewell party at Ex Bar in Davos — where they could actually pay for food and drinks using cryptocurrency. The annual meeting of the World Economic Forum is scheduled to take place between May 22–26, with a slew of world leaders expected to attend. What role will blockchain have at the event? https://t.co/wEtEvuVK5I — Cointelegraph (@Cointelegraph) May 20, 2022 Early partygoers had the opportunity to win one of 20 cards loaded with up to 100 Davos Coins, which are pegged one-for-one with the Swiss franc. The winners enjoyed a seamless checkout experience using a new hardware wallet with the look and feel of a regular credit card. Powered by German crypto c...

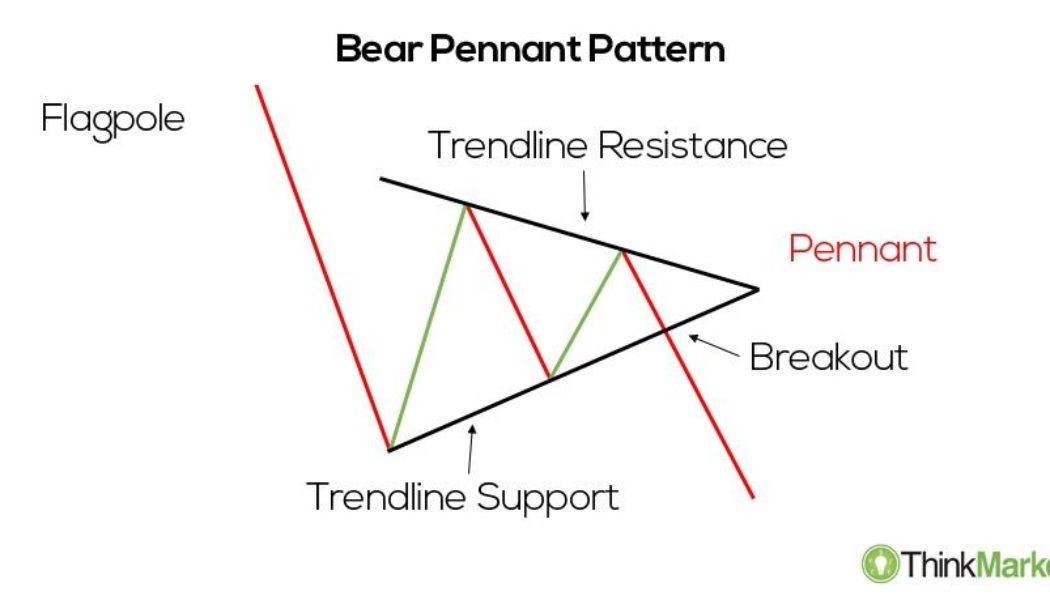

Spooky Solana breakdown begins with SOL price facing a potential 45% drop — Here’s why

Solana (SOL) dropped on May 26, continuing its decline from the previous day amid a broader retreat across the crypto market. SOL price pennant breakdown underway SOL price fell by over 13% to around $41.60, its lowest level in almost two weeks. Notably, the SOL/USD pair also broke out of what appears to be like a “bear pennant,” a classic technical pattern whose occurrences typically precede additional downside moves in a market. In detail, bear pennants appear when the price trades inside a range defined by a falling trendline resistance and rising trendline support. Bear pennant pattern. Source: ThinkMarkets These patterns resolve after the price breaks below the lower trendline, accompanied by higher volumes. As a rule of technical analysis, traders decide the pennant’...

JPMorgan trials blockchain for collateral settlement in after-hours trading

Multinational investment bank JPMorgan Chase & Co is reportedly trialing the use of its own private blockchain for collateral settlements. According to Bloomberg JPMorgan conducted a pilot transaction last Friday which saw two of its entities transfer a tokenized representation of Black Rock Inc. money market fund shares A money market fund is a type of mutual fund that is considered as a low risk investment as it offers exposure to liquid and short term assets such as cash, cash equivalents and debt-securities with high credit ratings. In terms of JPMorgan’s broader vision for its private blockchain, the bank said that it intends to enable investors to put forward a wide range of assets as collateral that can also be used outside of regular market hours. It pointed to equities and fix...

Billionaire Bill Miller calls Bitcoin ‘insurance’ against financial catastrophe

Bill Miller the billionaire founder and Chief Investment Officer of investment firm Miller Value Partners, has said he considers Bitcoin (BTC) an “insurance policy against financial catastrophe.” Appearing on an episode of the “Richer, Wiser, Happier” podcast on May 24 Miller backed the cryptocurrency as a means for those caught in conflict to still access financial products. He used the collapse of financial infrastructure in Afghanistan after the US withdrawal in August 2021 as an example. “When the US pulled out of Afghanistan, Western Union stopped sending remittances there or taking them from Afghanistan, but if you had Bitcoin, you were fine. Your Bitcoin is there. You can send it to anybody in the world if you have a phone.” Miller said examples of how the crypto can function as ins...

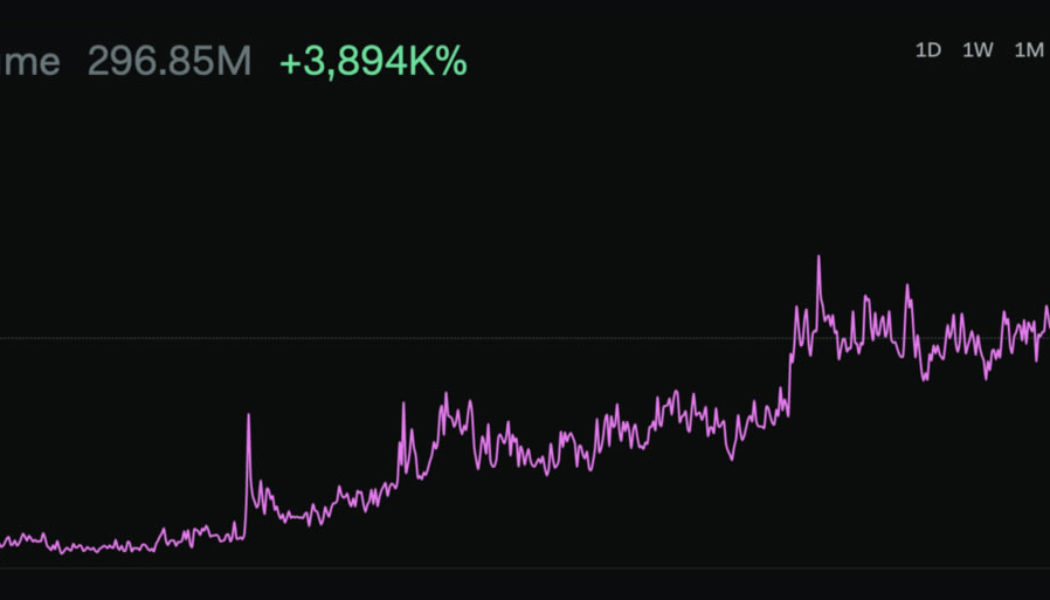

Crypto spam increases 4000% in two years: LunarCrush

Spam and bots have been the bane of anyone that uses the internet for years, but recently this digital scourge has ramped up activity in the crypto sector in a big way. Crypto intelligence provider LunarCrush has revealed spam in the cryptosphere has increased by an astonishing 3,894%. The firm has been collecting crypto-specific social data since 2019, and says not only is spam at an all-time high, it’s also “the fastest growing metric on social media.” The findings were published in a May 25 report, stating that “more spam accounts than you would think are actually people.” For this reason, it is often a challenge for software to detect and flag spam. Spam Volume collected by LunarCrush over the previous 2 years Twitter is the social media platform of choice for the crypto industry...

‘Other flavors of Tether’ will bridge users to USDT: Paolo Ardoino

Tether’s decision to launch a new digital asset pegged to the Mexican peso will be a boon to crypto adoption in the Latin American country by providing more onramps to the USDT stablecoin, according to Paolo Ardoino. In an exclusive interview with Cointelegraph on the sidelines of the World Economic Forum summit, the Tether and Bitfinex chief technology officer said the reason he came to Davos was to showcase the utility of cryptocurrencies. “I didn’t participate in Davos to meet CEOs of big banks,” he said. “We are here to send our message [that] there is a big world out there that needs crypto in a safe way.” Tether CTO Paolo Ardoino said that the increase in crypto demand in the Latin America region pushed their decision to expand. https://t.co/Ig7Y524VT2 — Cointelegraph (@Cointel...

Brainard tells House committee about potential role of CBDC, future of stablecoins

United States Federal Reserve vice chair Lael Brainard submitted a written statement in advance to the Financial Services Committee’s virtual hearing, “On the Benefits and Risks of a U.S. Central Bank Digital Currency (CBDC),” that took place Thursday. That was a sound strategic move, considering that more than 25 legislators lined up to ask questions. Brainard’s appearance before the committee came just after the close of the comment period for the Fed’s discussion paper, “Money and Payments: The U.S. Dollar in the Age of Digital Transformation.” However, recent events on the stablecoin market played a preemptive role in the framing of her statement. Brainard acknowledged the position of stablecoins in the economy, saying in her written statement. She said: “In som...

Falling wedge pattern points to eventual Ethereum price reversal, but traders expect more pain first

The cryptocurrency market was hit with another round of selling on May 26 as Bitcoin (BTC) price dropped to $28,000 and Ether (ETH) briefly fell under $1,800. The ETH/BTC pair also dropped below what traders deem to be an important ascending trendline, a move that traders say could result in Ether price correcting to new lows. ETH/USDT 1-day chart. Source: TradingView Here’s a rundown of what several analysts in the market are saying about the move lower for Ethereum and what it could mean for its price in the near term. Price consolidation will eventually result in a sharp move A brief check-in on what levels of support and resistance to keep an eye on was provided by independent market analyst Michaël van de Poppe, who posted the following chart showing Ether trading near its range ...

Play-to-Earn (P2E) tokens worth your time on May 26

Gala Games is giving away 4 million in prizes, which sparked hype surrounding the project. Immutable X announced a $40 million developer fund with Kongregate. Illuvium also made an announcement that they included Chainlink Price feeds. Gala (GALA), Immutable X (IMX), and Illuvium (ILV) are some of the best Play-to-Earn (P2E) tokens that you can get on May 26. On May 25, 2022, Gala Games announced week 3 of MayMayhem. Throughout this event, Gala Games is giving away 4 million in prizes. On May 26, 2022, Immutable X announced a launch of a $40 million developer fund with Kongregate. Illuvium also announced that they had expanded their Chainlink integration to include Chainlink Price feeds. Should you buy Gala (GALA)? On May 26, 2022, Gala (GALA) had a value of $0.0743. When we look at its al...

Ankr and Pocket Network partner to promote full decentralization

Ankr, one of the most dynamically growing Web3 infrastructure providers, and Web3 blockchain data ecosystem Pocket Network have partnered to promote a fully decentralized infrastructure and improve the whole Web3 ecosystem, Coin Text learned from a press release. Pocket Network is now a node provider on Ankr Pocket Network enables node runners to generate income by supplying Ankr protocol with nodes. By combining their strengths, Ankr and Pocket Network will enable thousands of wallets, builders, and dApps interacting through RPC services with blockchains to benefit from a top-performance, fully decentralized node pool. Whitelisted providers can supply Ankr Protocol with nodes, with Pocket Network being the biggest and most decentralized provider ever added to the ecosystem. Gr...