crypto blog

Fashion brand Balenciaga follows Gucci in accepting crypto payments

Balenciaga is going after Gucci. The brand revealed that it now accepts payment in cryptocurrency. They are starting this in the US, and will then roll out this option to other countries. “Other regions will follow” Balenciaga will initially only accept crypto in its flagship stores, including on Madison Avenue in New York and Rodeo Drive in Beverly Hills. In addition, you may already be able to pay with crypto in the US on the website: balenciaga.com. Other regions and e-commerce will follow, the company said, according to WWD. The fashion house is going after Tag Heuer and Gucci, who recently also started accepting crypto for their products. The latter brand will also first start a pilot in the US, before focusing on other countries. The fashion house is still deciding which payment solu...

Central bank of Sweden won’t consider Bitcoin as a currency

Sweden’s central bank, otherwise known as Sveriges Riksbank, has recently delved deeper into Bitcoin (BTC) to determine whether the king’s coin can be classified as a currency. It stated that it must meet three criteria to be considered a currency, namely: store of value, means of payment and unit of account. No reliable store of value The central bank indicated that Bitcoin is not a reliable store of value due to its volatile nature. It said the following: “If an asset acts as a store of value, you have to be confident that you can buy about as much today for, say, 100 Swedish kronor as tomorrow. Bitcoin’s price has had a high level of volatility and so is a relatively poor protector.” The Riksbank also indicated that despite being accepted as a means of payment in a small number of place...

NAGAX introduces crypto staking feature

NAGAX, the decentralized social trading platform, has introduced a crypto staking feature for some of the biggest cryptocurrencies by market cap, including Bitcoin, Ethereum, and Polkadot, Coin Text learned from a press release. Stake native NAGA coin to generate high returns You can also stake the platform’s native NAGA Coin (NGC) for high returns on the crypto you hold. This is aimed at helping investors in the crypto space regardless of their level of experience earn passive income on their idle tokens. Competitive APR rates The staking feature will offer highly competitive APR staking rates and greater returns through the VIP program. Staking time ranges from 24 hours to an unlimited maximum term, which remains flexible. Investors and traders also benefit from zero s...

Finance tokens that should be in anyone’s cryptocurrency wallet in May

NEXO (NEXO), Kava (KAVA), and XDC Network (XDC) are the best finance tokens you can get in May. NEXO announced an investment in Enhanced Digital Group, Kava 10 launched, and the XDC dApp Summer hackathon was announced. Each token has showcased a high level of growth and will likely do so going forward. NEXO (NEXO), Kava (KAVA), and XDC Network (XDC) are some of the best finance tokens that you can get in April. Each token has showcased developments and has potential for growth moving forward. On May 25, 2022, NEXO made an announcement that they invested in Enhanced Digital Group. On the same day, Kava Network also announced that Kava 10 officially went live. When it comes to XinFin, they announced the XDC dApp Summer hackathon NEXO (NEXO), Kava (KAVA), and XDC Ne...

Cathie Wood’s Ark and 21Shares refile for spot Bitcoin ETF

ARK Investment Management, an investment firm founded by veteran investor Cathie Wood, is taking another try to launch a spot Bitcoin (BTC) exchange-traded fund (ETF) in the United States. ARK Invest submitted on May 13 yet another application for its physical Bitcoin ETF, the ARK 21Shares Bitcoin ETF, according to a filing with the U.S. Securities and Exchange Commission. The application includes a proposed rule change from the Chicago Board Options Exchange (CBOE) BZX Exchange. According to Bloomberg ETF analyst Henry Jim, the latest deadline for approval or disapproval of the ARK 21Shares Bitcoin ETF is January 24, 2023. Ark 21Shares decides to try again for a “Spot” Bitcoin ETF and files 19b-4 with SEC. Deadline for approval / disapproval: Jan 24, 2023 (latest). Deadlines:2...

Blockchain tech offers multiple paths to financial inclusion for unbanked

Financial inclusion, accessible services and the unbanked are standard talking points in many conversations about crypto. But, the details may remain somewhat fuzzy — the people who talk about crypto are generally those already inside the financial system. There are people who are actively working to increase financial inclusion and access to services for the vast number of people who are unbanked or underserved. CBDC for the people Central bank digital currencies (CBDC) will serve different purposes in different places. In economies where individuals have moved away from high levels of cash usage, like those of the United States and the United Kingdom, there will be relatively little retail demand for CBDC, but there are places where cash is in short supply and CBDC can serve to inc...

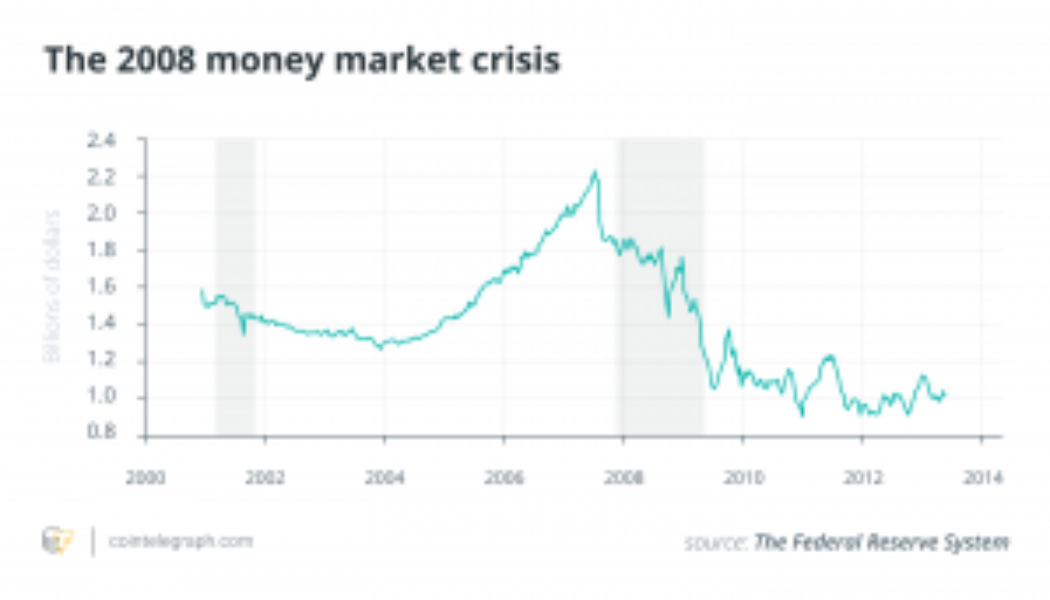

Powers On… When will we learn from recent history to protect our crypto and ourselves?

Stablecoins provide a false sense of security. They give the impression to the uninitiated and/or uncaring that a particular coin is pegged to the U.S. dollar, or an equivalent of the dollar in terms of value and stability, and that if you want to convert your stablecoin to dollars, you can do so easily and instantaneously. Yet, they do no such thing, as demonstrated by the recent collapse of Terra and its TerraUSD stablecoin and LUNA token and also made clear in September 2008 by the collapse of the Reserve Primary Fund money market fund during the height of the global financial crisis. Powers On… is a monthly opinion column from Marc Powers, who spent much of his 40-year legal career working with complex securities-related cases in the United States after a stint with the SEC. He is now ...

Tether launches stablecoin pegged to pesos on Ethereum, Tron and Polygon

Amid market issues surrounding stablecoins, Tether (USDT) launched a new digital asset that will be pegged to the Mexican peso on Ethereum, Tron and Polygon networks. In an announcement sent to Cointelegraph on Thursday, Tether mentioned that the token will have the MXNT ticker and will join Tether’s roster of fiat-pegged stablecoins that includes dollar-pegged USDT, Euro-pegged EURT and Chinese Yuan-pegged CNHT. Citing data that reports blockchain and crypto demand among Mexican companies, the stablecoin issuer believes that there’s a unique opportunity to provide a cheaper option for asset transfer within the region. According to Tether’s chief technology officer, Paolo Ardoino said that the rise in crypto usage in the Latin America region pushed their decision to...

Ethereum Beacon Chain experiences 7 block reorg: What’s going on?

Ahead of the Merge tentatively penciled in for August, Ethereum’s Beacon Chain experienced a seven-block reorganization (reorg) yesterday. According to data from Beacon Scan, on May 25 seven blocks from number 3,887,075 to 3,887,081 were knocked out of the Beacon Chain between 08:55:23 to 08:56:35 AM UTC. The term reorg refers to an event in which a block that was part of the canonical chain, such as the Beacon Chain, gets knocked off the chain due to a competing block beating it out. It can be the result of a malicious attack from a miner with high resources or a bug. Such incidents see the chain unintentionally fork or duplicate. On this occasion, developers believe that the issue is due to circumstance rather than something serious such as a security issue or fundamental flaw, with a “p...

World Bank won’t support Central African Republic’s Sango crypto hub

The World Bank has signalled its concerns over the Central African Republic (CAR) adopting Bitcoin (BTC) as a legal currency and says it won’t support the newly announced “Sango” crypto hub. At the end of April CAR president Faustin-Archange Touadéra established a regulatory framework for cryptocurrency in the country and adopted Bitcoin as a legal tender. On May 24 he announced a plan to launch the country’s first crypto hub called “Sango”. Sango is described as the country’s first “Crypto Initiative” — a legal hub for crypto related businesses encompassing economic policies including no corporate or income tax and thecreation of a virtual and physical “Crypto Island.” An official document outlining the Sango project states that the country “received approval for a $35 million development...

InsurAce says it will pay millions to claimants after Terra’s collapse

DeFi insurance protocol InsurAce says it was well within its rights to reduce the claims period for people affected by the Terra USD (UST) depeg event from 15 days to seven — but added it has already processed nearly all 173 submitted claims and will pay out $11 million. InsurAce (INSUR) is the third largest insurance provider for decentralized finance (DeFi) protocols, with a market cap of $15 million. On May 13, InsurAce caused a stir when it announced it had shortened the claims window for those with cover related to Anchor (ANC), Mirror (MIR), and stablecoin Terra USD (UST) following the collapse of the Terra (LUNA) layer-1 blockchain. But CMO Dan Thomson told Cointelegraph on Thursday that its move to shorten the claims window for the 234 covers of Terra portfolios was necessary to pr...

Injective partners with Wormhole to bring 10 new blockchains to the platform

Decentralized finance (DeFi) protocol Injective (INJ) has partnered with Wormhole to integrate “10 new blockchains” to its network. Injective is a Cosmos layer-2 decentralized exchange (DEX) that offers derivatives, token swaps and sports betting prediction markets. It is also focused on interoperability via cross-chain bridging, and currently supports digital assets from Ethereum, Polkadot and IBC-enabled chains such as Cosmos. Injective Labs, the protocol’s developers, noted in a May 25 announcement that the partnership will enable users to transfer and trade assets across any chain that is integrated with Wormhole. “The Wormhole integration will vastly enhance Injective’s capabilities with respect to interoperability. Users will soon find Wormhole integrated into the backend of the Inje...