crypto blog

Cointelegraph Store: Introducing Bitcoin Pizza Day merch for crypto OGs

Twelve years ago today, on May 22, 2010, programmer and early Bitcoin (BTC) miner Laszlo Hanyecz made history when he traded 10,000 BTC for two large pizzas. It was the first real-world cryptocurrency transaction, and media attention from the act legitimized Bitcoin in a big way. Inspired by that delicious turning point in decentralized finance, the Cointelegraph Store has created a fresh new line of merchandise. And you won’t even have to tip your driver when it arrives. Bitcoin Pizza apron The Bitcoin Pizza Organic Cotton Apron will cook up a slice of fashion for the crypto chef in your life. Shield yourself against food mishaps, heat and more kitchen conundrums with this 100% organic cotton apron, complete with adjustable straps and a large front pocket with two compartments. ...

Cointelegraph Store: Introducing Bitcoin Pizza Day merch for crypto OGs

Twelve years ago today, on May 22, 2010, programmer and early Bitcoin (BTC) miner Laszlo Hanyecz made history when he traded 10,000 BTC for two large pizzas. It was the first real-world cryptocurrency transaction, and media attention from the act legitimized Bitcoin in a big way. Inspired by that delicious turning point in decentralized finance, the Cointelegraph Store has created a fresh new line of merchandise. And you won’t even have to tip your driver when it arrives. Bitcoin Pizza apron The Bitcoin Pizza Organic Cotton Apron will cook up a slice of fashion for the crypto chef in your life. Shield yourself against food mishaps, heat and more kitchen conundrums with this 100% organic cotton apron, complete with adjustable straps and a large front pocket with two compartments. ...

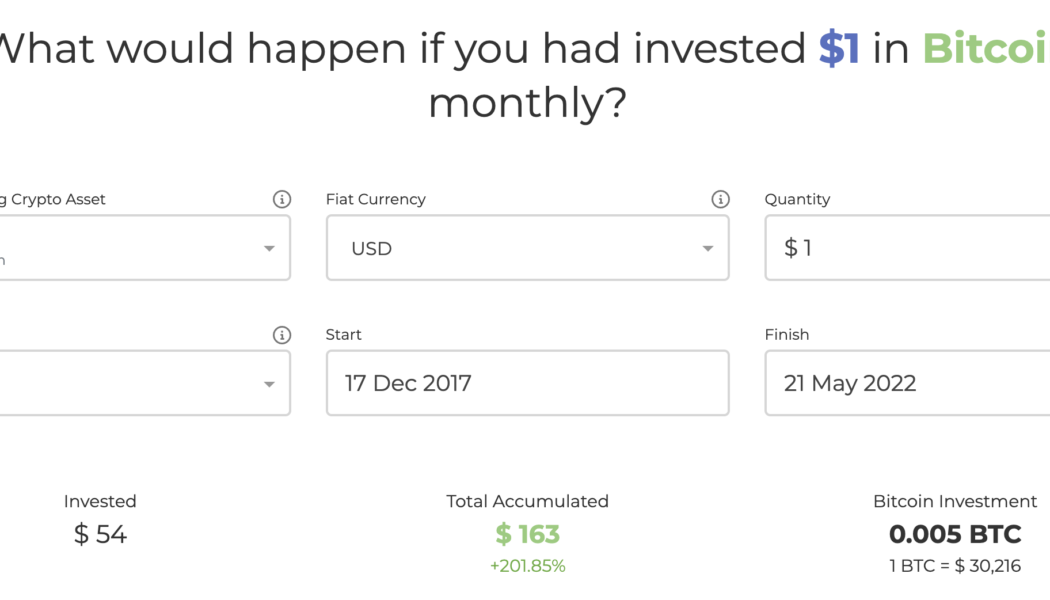

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

Dollar Cost Averaging or Lump-sum: Which Bitcoin strategy works best regardless of price?

Bitcoin (BTC) has declined by more than 55% six months after it reached its record high of $69,000 in November 2021. The massive drop has left investors in a predicament about whether they should buy Bitcoin when it is cheaper, around $30,000, or wait for another market selloff. The more you look at prior $BTC price history the more one can think it’s not the bottom After 190 days from the all-time high, Bitcoin still had another 150 to 200 days until it hit bottom last couple of cycles (red box) If time is any indicator, could be another 6 to 8 months pic.twitter.com/C1YHnfOzxC — Rager (@Rager) May 20, 2022 This is primarily because interest rates are lower despite Federal Reserve’s recent 0.5% rate hike. Meanwhile, cash holdings among the global fund managers have surged ...

What is total value locked (TVL) in crypto and why does it matter?

In 2022, Ethereum appeared as the largest network by DeFi TVL, accounting for over half of the total DeFi volume worldwide. To give some perspective, the Ethereum DeFi network includes just under 500 protocols. It has a TVL of approximately $73 billion, with 64% of the market share, compared with BNB Smart Chain, which is the second-highest TVL at $8.74 billion in value at 7.7% of the market share, Avalanche with $5.21 billion and 4.5% of the market share and Solana with $4.19 billion and 3.68% of the market share. It’s very easy to read a TVL crypto chart. It represents the TVL for the entire DeFi market is expressed in USD, with the percentage of movement in the last 24 hours and the crypto with higher dominance. The total value locked metric across all chains clearly indicates...

What is total value locked (TVL) in crypto and why does it matter?

In 2022, Ethereum appeared as the largest network by DeFi TVL, accounting for over half of the total DeFi volume worldwide. To give some perspective, the Ethereum DeFi network includes just under 500 protocols. It has a TVL of approximately $73 billion, with 64% of the market share, compared with BNB Smart Chain, which is the second-highest TVL at $8.74 billion in value at 7.7% of the market share, Avalanche with $5.21 billion and 4.5% of the market share and Solana with $4.19 billion and 3.68% of the market share. It’s very easy to read a TVL crypto chart. It represents the TVL for the entire DeFi market is expressed in USD, with the percentage of movement in the last 24 hours and the crypto with higher dominance. The total value locked metric across all chains clearly indicates...

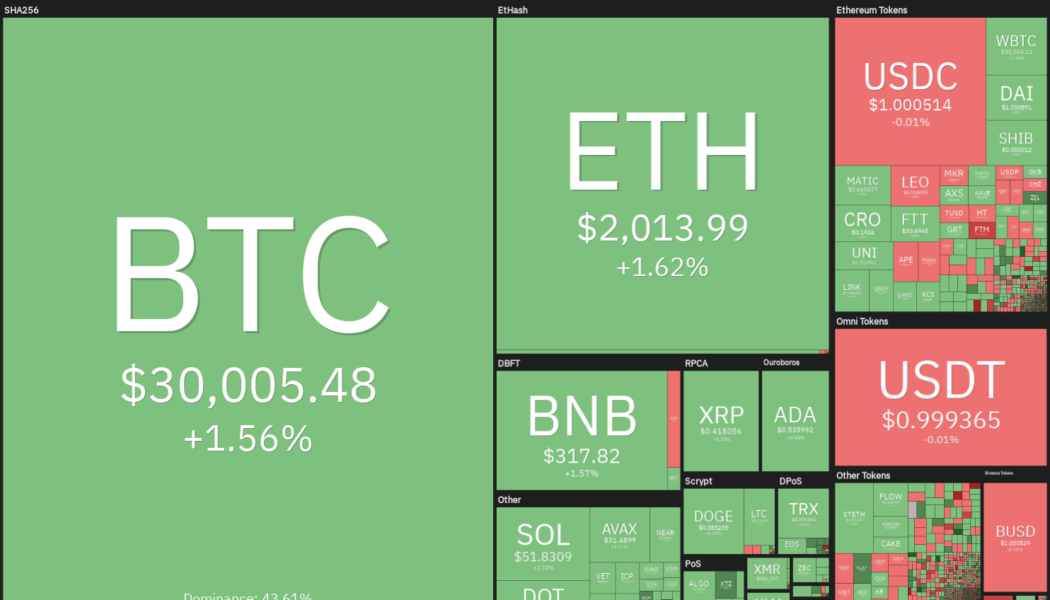

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Top 5 cryptocurrencies to watch this week: BTC, BNB, XMR, ETC, MANA

The Dow Jones Industrial Average has declined for eight consecutive weeks, the first such losing streak since 1923. On May 20, the S&P 500 briefly fell into bear market territory, indicating that traders continue to sell risky assets in fear of a recession. Due to its tight correlation with US equities markets, Bitcoin (BTC) has remained under pressure for many weeks. The bulls are attempting to push Bitcoin higher during the weekend and avert an even longer losing streak. Crypto market data daily view. Source: Coin360 Bitcoin’s performance in the first five months has been the worst since 2018, indicating that sellers are in control. However, after several weeks of weakness, the crypto markets may be on the cusp of a bear market rally. What are the critical levels that may signa...

Bitcoin targets record 8th weekly red candle while BTC price limits weekend losses

Bitcoin (BTC) gave bears little joy over the weekend as the May 22 weekly close looked set to revolve around $30,000. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Waiting for Bitcoin to “make a decision” Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it held a narrow range after the Wall Street trading week. With volatility absent, traders hoped for a move to larger areas of support or resistance next. “Still wedged between the supply and demand zone .. Hoping for a break today so we have some juicy action to play with,” popular trader Crypto Tony summarized, noting upside and downside targets were around $27,900 and $31,000, respectively. Time for #Bitcoin to make a decision? pic.twitter.com/DEfNhuvnYa — Matthew Hyland (@MatthewHyland_) ...

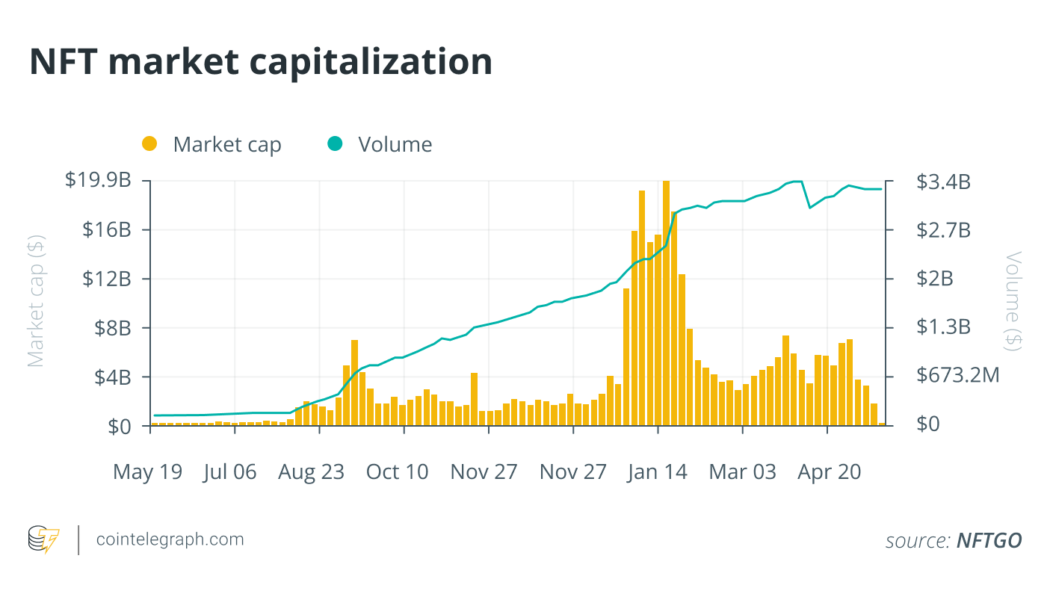

NFTs: Empowering artists and charities to embrace the digital movement

Depending who you ask, NFTs are either a new and exciting way to invest, or a bearish, overhyped sector. Regardless, journalists, investors and collectors have paid significant attention to the growing NFT market in the past year. NFTs continue to be one of the most popular Web3 entry points, an opportunity for everyone from casual art fans to crypto billionaires to own a unique asset stored on the blockchain. As NFT visionaries have recently pointed out, NFTs also have the potential to be used for incredible causes beyond digital asset collection. In the past six months, communities have launched NFTs to raise support for causes like testicular cancer, human trafficking and the war in Ukraine. While many believe the NFT trend is finally on the path to sustainable growth, its potenti...

6 Questions for Sonali Giovino of Defiyield

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Sonali Giovino, head of communications at Defiyield, a cross-chain asset management protocol that empowers users to be a part of the DeFi ecosystem. Sonali Giovino has been working in the crypto space since 2017 when she began holding weekly educational workshops, which lead to public speaking events on cryptocurrency and blockchain and her production of Vancouver’s first Blockchain Yacht Cruise Conference. She brings 20+ years of experience as a technical communicator to her position at Defiyield, previously holding roles in marketing, project management, business development and event coor...

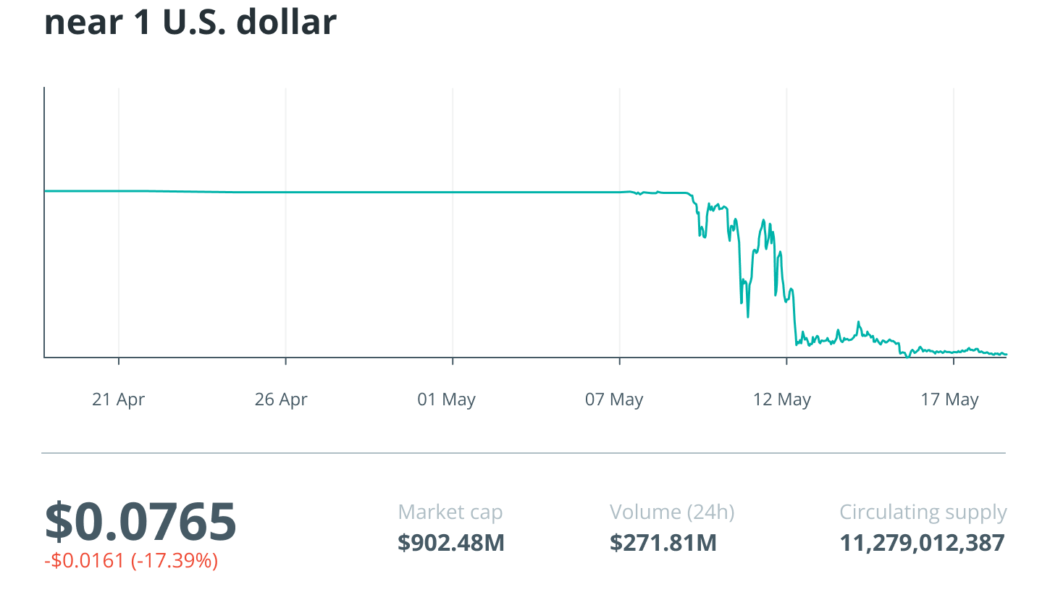

Terra’s meltdown highlights benefits of CEX risk-management systems

The collapse of Terra’s ecosystem — namely, native coin LUNA and algorithmic stablecoin TerraUSD (UST) — rocked the wider blockchain and cryptocurrency ecosystem. Not only did Terra-ecosystem tokens (such as Anchor’s ANC) collapse in value, but the widespread fear, uncertainty and doubt sent market-leading cryptocurrencies Bitcoin (BTC) and Ether (ETH) below $27,000 and $1,800, respectively, on some exchanges. As of the time that I’m writing this article, the cryptocurrency market still hasn’t recovered — even if Terra’s contagion has been mostly contained. Related: What happened? Terra debacle exposes flaws plaguing the crypto industry A huge blow to industry confidence Crypto market participants — and especially those involved with LUNA and UST — were wiped out in the collapse of the two...