crypto blog

UK Treasury en route to legalizing stablecoins amid Terra’s UST crash

United Kingdom’s Department of Treasury, or Her Majesty’s Treasury, has reportedly decided to go ahead with regulating stablecoins as legal tender. While welcomed by the crypto community, the decision comes as a shocker due to its proximity to the recent fall of one of the most popular algorithmic stablecoin, TerraUSD (UST). A local report from The Telegraph highlighted the Treasury’s intent to regulate stablecoins across Britain, which was revealed during the Queen’s Speech. During the speech, Prince Charles announced the introductions of new legislation across various sectors, including measures to drive economic growth to improve living standards in the region, adding: “A bill will be brought forward to further strengthen powers to tackle illicit finance, reduce economic crim...

Accessibility is the main barrier to crypto adoption — Here are the solutions

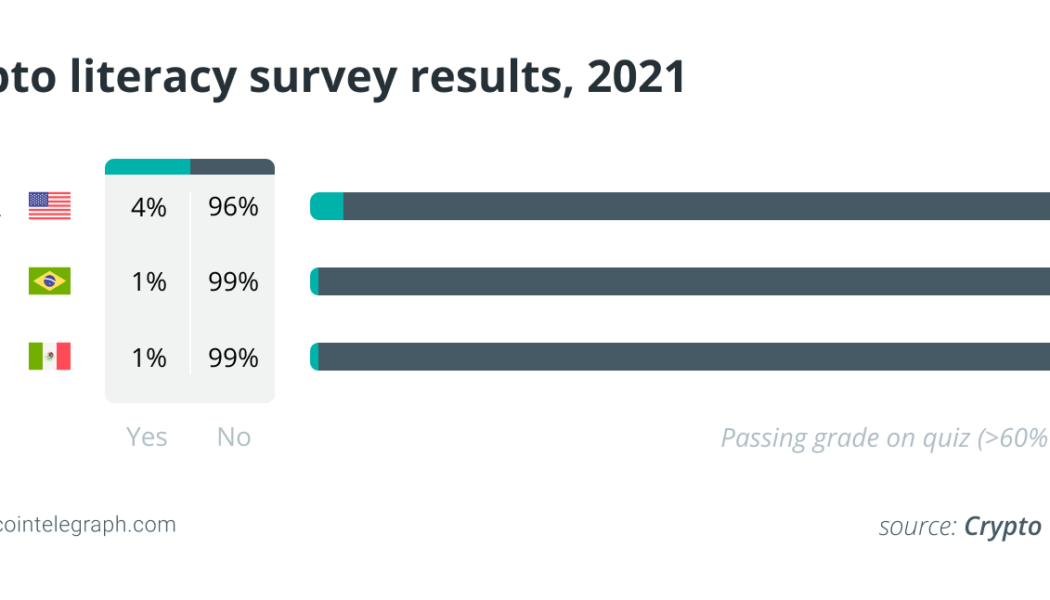

Accessibility is a pain point for cryptocurrency adoption that has been discussed for years, yet still, it is pertinent as ever. This issue was most recently recognized by the United States government as we’ve seen Treasury Secretary Janet Yellen discuss during her remarks on digital assets policy and regulation. There are barriers that are limiting accessibility to cryptocurrencies, such as financial education and technological resources, and it is our duty as developers and leaders in this revolutionary industry to address them. Studies have shown that only 33% of adults across the globe are financially literate. With many projects in the decentralized finance (DeFi) space focusing on providing individuals without access to traditional financial institutions and tools for earning, ...

The meaningful shift from Bitcoin maximalism to Bitcoin realism

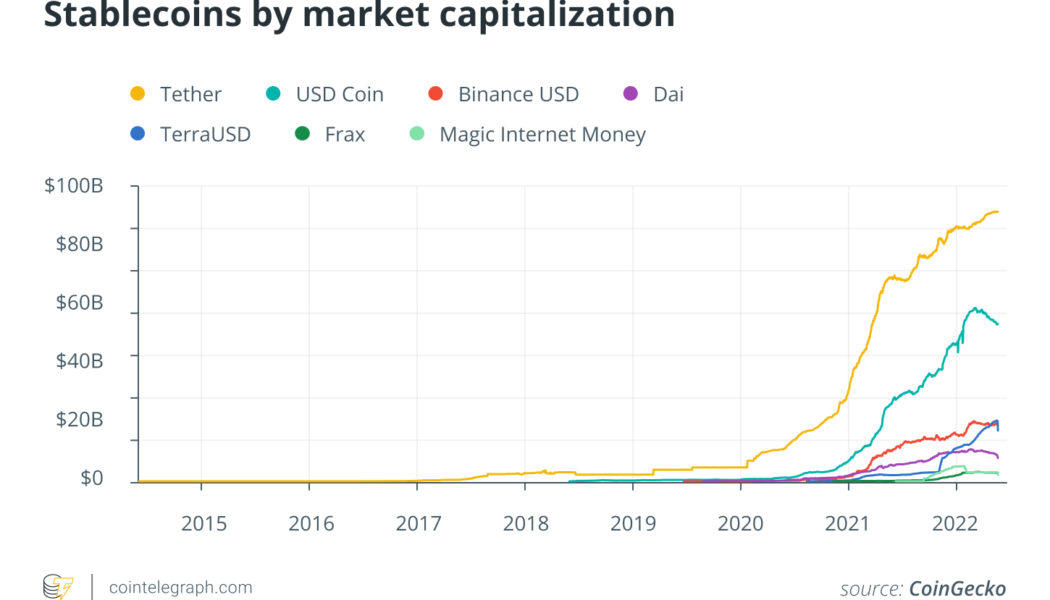

There was a time when all cryptocurrencies traded against Bitcoin (BTC). Speculators ventured into other coins when they saw assuring tokenomics or promising hype, but Bitcoin was their settlement coin of choice. Things have changed. Stablecoins now constitute a critical $150 billion pillar in the cryptocurrency market. Perpetual futures over-amplify market sentiment and, more often than not, dominate price action. Much more capital, including from institutional funds, has come into the market lately with only a moderate impact on Bitcoin’s price. So, some former bulls now dismiss Bitcoin as boring. Is this the end of Bitcoin maximalism? Probably not. But, perhaps, it’s time for more realism. Related: Gold, Bitcoin or DeFi: How can investors hedge against inflation? Bitcoin in a sea of mem...

Binance CEO CZ to support Terra community but expects more transparency

Changpeng “CZ” Zhao, the CEO of crypto exchange Binance, recently questioned the idea of hard forking the Terra blockchain as a means to revive the once-thriving LUNA and UST ecosystems. Following up on the same, CZ revealed his perspective on the appropriate course of action for falling projects across the crypto community. “This won’t work,” said CZ while dismissing the validators’ idea of a hard forking to TERRA2, which would involve providing a new version of LUNA to all holders based on a snapshot of the holdings before the market collapsed. CZ suggested: “Reducing supply should be done via burn, not fork at an old date, and abandon everyone who tried to rescue the coin. I don’t own any LUNA or UST either. Just commenting.” Instead, he suggested that the Terra community should f...

Utility tokens vs. equity tokens: Key differences explained

Investors familiar with the concept of equity investing will find equity tokens to be an extension of the same thought process as initial public offerings while those with a riskier appetite can venture into plonking their capital on the utility tokens in which they believe. One glaring difference between utility and equity tokens is the fact that the former is not regulated as they provide access to a service rather than a specific investment in an asset or company as do equity tokens. However, for those asking the question of whether utility tokens can be traded, the answer is that they are similar to equity tokens in this aspect and are available for trading on various exchanges. To answer whether utility tokens are good investments though, any money put into a utili...

Welcome to Mars: I own everything, have total privacy and life has never been better

This is a parody of the article published by the World Economic Forum titled “Welcome to 2030. I Own Nothing, Have No Privacy And Life Has Never Been Better.” Welcome to Mars. Welcome to my city, or should I say “our city” because I, like every other inhabitant, is a stakeholder in it. No, I don’t mean “shareholder,” as this isn’t a dystopian future run by private companies. My city on Mars has a decentralized governance structure just like the greater Mars. It is not a corporation nor is it a militarized state. It is a set of institutions governed directly by The People. As a result of this system, we have police that spread peace instead of violence. We have financial systems that spread wealth instead of creating poverty. We have institutions that are open instead of closed and transpar...

Ethereum in danger of 25% crash as ETH price forms classic bearish technical pattern

Ethereum’s native token Ether (ETH) looks ready to undergo a breakdown move in May as it forms a convincing “bear pennant” structure. ETH price to $1,500? ETH’s price has been consolidating since May 11 inside a range defined by two converging trendlines. Its sideways move coincides with a drop in trading volumes, underscoring the possibility that ETH/USD is painting a bear pennant. Bear pennants are bearish continuation patterns, meaning they resolve after the price breaks below the structure’s lower trendline and then falls by as much as the height of the previous move downside (called the flagpole). ETH/USD two-hour price chart. Source: TradingView As a result of this technical rule, Ether risks closing below its pennant structure, followed by additional mo...

6 Questions for Dominik Schiener of the Iota Foundation

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Dominik Schiener, a co-founder of the Iota Foundation, a nonprofit organization, and the creator of the Tangle, a permissionless, multi-dimensional distributed ledger designed as a foundation of a global protocol for all things connected. Dominik Schiener is a co-founder and the chairman of the Iota Foundation, one of the largest and greenest cryptocurrency ecosystems in the world. The Iota Foundation’s mission is to support the research and development of new distributed ledger technologies, including the Iota Tangle. Raised in Italy, Dominik oversees partnerships and the overall real...

Terra (LUNA) trading volume surge 200% as market adjusts to death spiral

It took just seven days for the Terra (LUNA) ecosystem to spiral down as prices came crashing from $85 on May 5 to nearly $0 on May 12. As the market slowly gained clarity on what transpired, the trading volume of LUNA saw a steep recovery of over 200% over the weekend. As a result of UST de-pegging, which crashed the LUNA market, LUNA investors mirrored the price dip as CoinGecko recorded the decline of trading volumes to $178.6 million on May 13 — a number that was last seen in February 2021. Falling trading volume of LUNA. Source: CoinGecko Terraform Labs CEO and co-founder Do Kwon sought damage control on the same day as he proposed a revival plan for Terra’s comeback, which involves compensating UST and LUNA holders for holding the tokens during the crash. Despite the risks...

UK Court recognizes NFTs as ‘private property’ — What now?

At the beginning of May, the British Web3 community celebrated an important legal precedent — the High Court of Justice in London, the closest analog to the United States Supreme Court, has ruled that nonfungible tokens (NFT) represent “private property.” There is a caveat, though: In the court’s ruling, this private property status does not extend to the actual underlying content that NFT represents. Cointelegraph reached out to legal experts to understand what this decision could possibly change in the British legal landscape. The theft of Boss Beauties In February 2022, Lavinia D. Osbourne, founder of Women in Blockchain Talks, wrote on Twitter that two digital works had been stolen from the Boss Beauties — a 10,000-NFT collection of empowered women that was created by “Gen Z chan...

NFT visionaries are doubling down on community ethos amid a bearish cycle

The fever-pitch euphoria of nonfungible tokens (NFT) reached its proverbial all-time highs in the hours preceding the calamitous gas wars of the Otherside metaverse land sale. But by most reputable accounts, following almost a year of frantic exponential growth, rife speculation and cultural spotlighting, the market was long overdue a respite. A hiatus from minting drama. It has now subsided and officially entered its inaugural bearish cycle. Statistical data from OpenSea paints a sorrowful assessment of the market’s financial fortunes, with the floor prices of some highly popular collections more than halving since peak highs. The eminent Bored Ape Yacht Club is down from its peak floor price of 156 Ether (ETH) from the beginning of May to 98.8 ETH at the time of wri...