crypto blog

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy across the crypto market. Unfortunately, the bearish sentiment has not even spared stablecoins, so-called crypto equivalents of the U.S. dollar, which have been unable to stay as “stable” a...

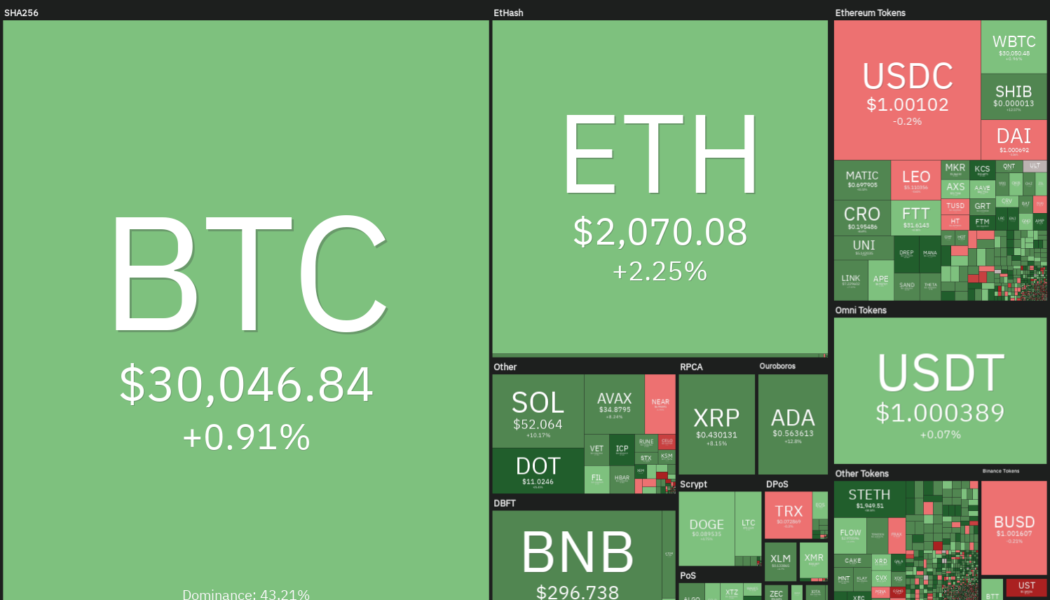

Price analysis 5/13: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

Bitcoin (BTC) rebounded sharply after dropping near its realized price of $24,000 on May 12, suggesting some bulls went against the herd and bought the dip. According to on-chain analytics platform CryptoQuant, the exchange balances declined by more than 24,335 Bitcoin on May 11 and 12, indicating that bulls may have started bottom fishing. However, macro investor Raoul Pal is not confident that a bottom has been made. In an exclusive interview with Cointelegraph, Pal said that if equity markets witness a capitulation phase, crypto markets are also likely to plunge before forming a bottom. He anticipates the current bear phase to end after the United States Federal Reserve stops hiking rates. Daily cryptocurrency market performance. Source: Coin360 Bear markets are known for sharp relief r...

Etherscan, CoinGecko warn against ongoing MetaMask phishing attacks

Popular crypto analytics platforms Etherscan and CoinGecko have parallelly issued an alert against an ongoing phishing attack on their platforms. The firms began investigating the attack after numerous users reported unusual MetaMask pop-ups prompting users to connect their crypto wallets to the website. Based on the information disclosed by the analytics firms, the latest phishing attack attempts to gain access to users’ funds by requesting to integrate their crypto wallets via MetaMask once they access the official websites. Security Alert: If you are on the CoinGecko website and you are being prompted by your Metamask to connect to this site, this is a SCAM. Don’t connect it. We are investigating the root cause of this issue. pic.twitter.com/7vPfTAjtiU — CoinGecko (@coingeck...

Terra ecosystem collapses, Sam Bankman-Fried buys Robinhood stock and crypto trader receives jail sentence for Ponzi scheme: Hodler’s Digest, May 8-14

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Breaking: Terra blockchain officially halted following LUNA price collapse This week, news about the Terra ecosystem dominated the headlines after algorithmic stablecoin TerraUSD (UST) lost its peg to the U.S. dollar — and continued to crash. At its lowest point during the week, UST fell to around $0.13, according to CoinMarketCap. The meltdown also affected LUNA due to its symbiotic relationship with its sister asset. After reaching a high of $120 in early April, LUNA’s value plummeted this week to basi...

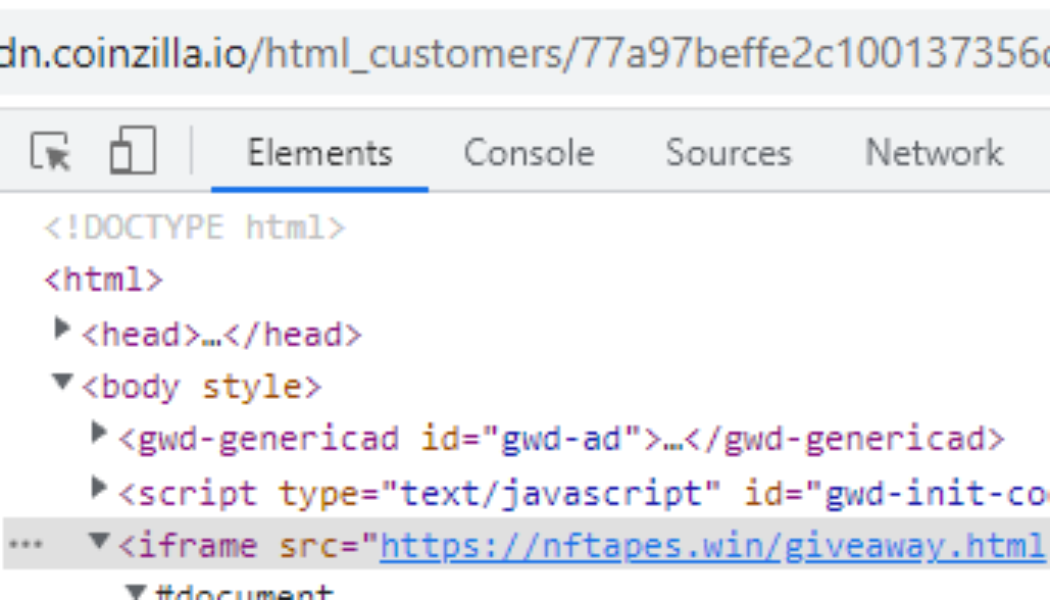

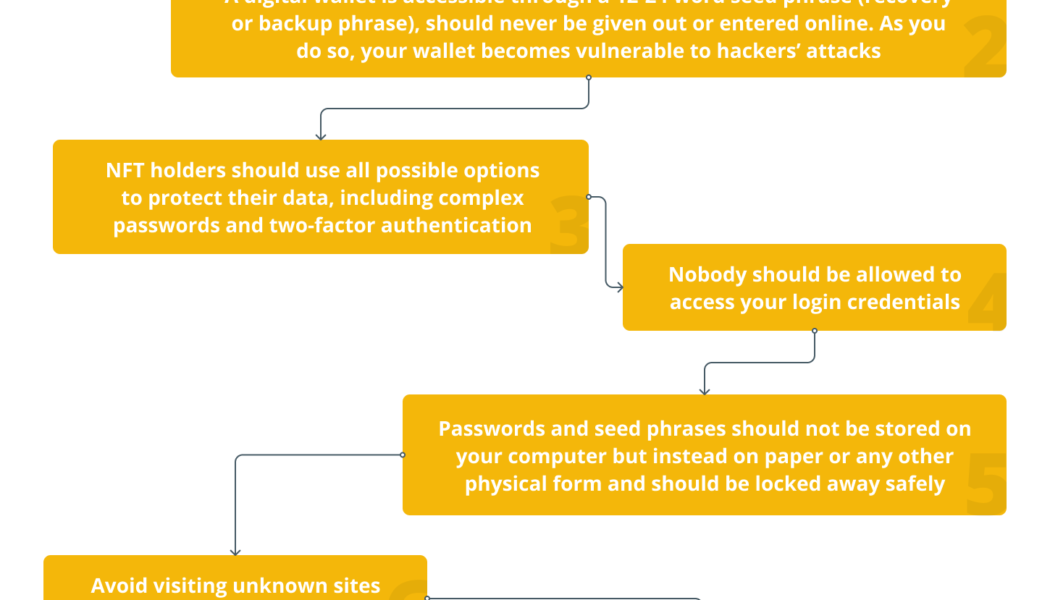

NFT scams: How to avoid becoming a victim

When you’re an active NFT trader, you can’t avoid all the scams in the world of nonfungible tokens. The most common NFT scams are phishing, counterfeit NFTs and pump-and-dumps. The year 2021 was a breakthrough for nonfungible tokens (NFTs). But when something gets popular like decentralized finance (DeFi) and the newest version of the Web called Web3, there are also risks involved. Follow the money is advice you don’t have to give hackers twice. Last year, hackers took home $14 billion from crypto-related hacks and still, cryptocurrency crime numbers have risen 79% — and the risk is not over yet. But how do NFT traders protect themselves from getting scammed? First of all, educate yourself. By understanding the most common NFT sca...

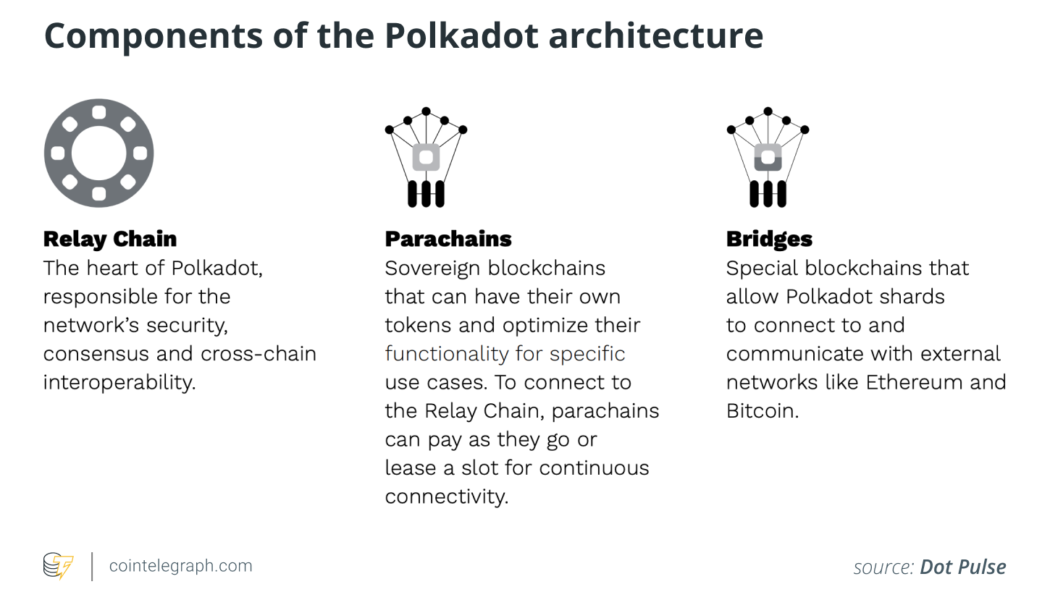

Polkadot vs. Ethereum: Two equal chances to dominate the Web3 world

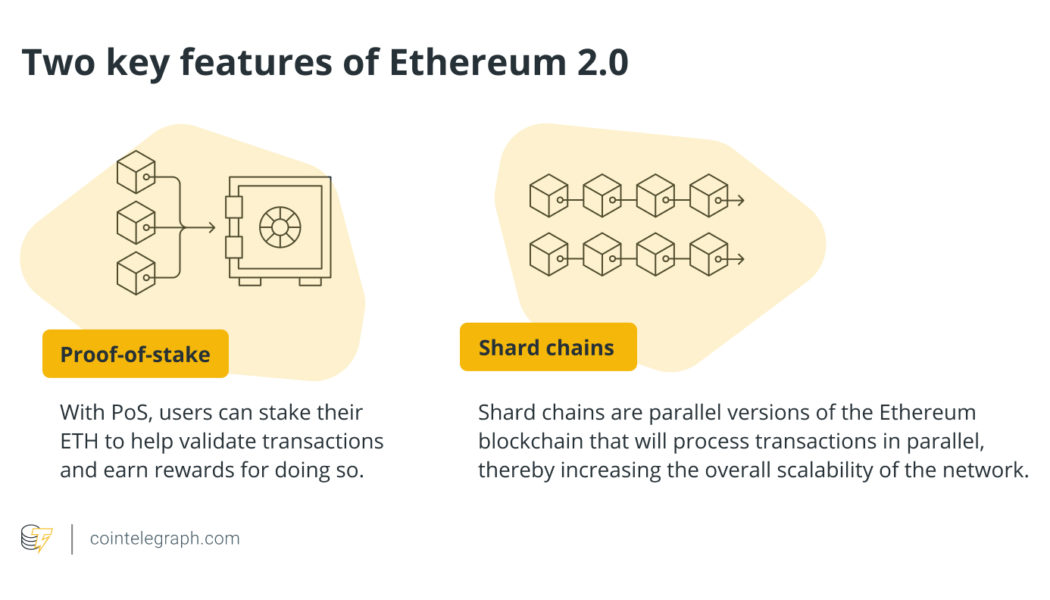

For most casual digital asset investors, the Ethereum 2.0 upgrade promises to be a game-changing event that will improve efficiency, reduce network costs and propel the entire blockchain and crypto space closer to a Web3 reality. Ethereum has been struggling with a lack of scalability and skyrocketing gas fees, and since it serves as the largest smart contract and DApp development platform, the move to a more reliable and scalable proof-of-stake (PoS) blockchain will be a welcome reprieve. Unbeknownst to most casual investors, however, Polkadot’s Substrate platform has been making massive inroads in the development of a parallel decentralized internet infrastructure that many believe will eventually eclipse Ethereum’s. Related: The Polkadot architecture and introduction to the ...

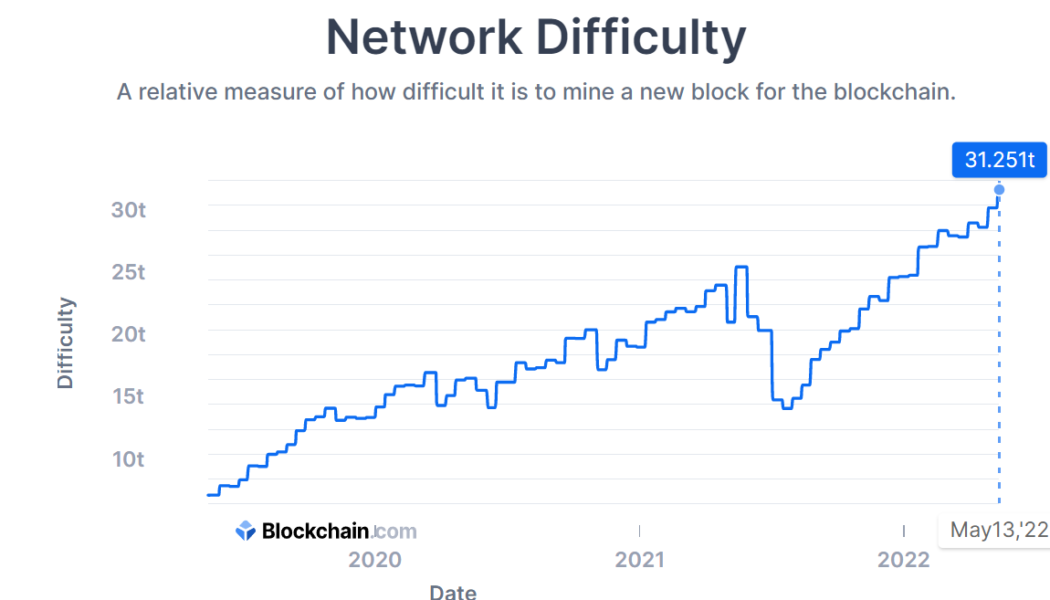

Bitcoin network fortifies as mining difficulty records ATH of 31.251T

Further distancing itself from any concerns of planned attacks on the blockchain, the Bitcoin (BTC) network established a new mining difficulty all-time high of 31.251 trillion — exceeding the 30-trillion mark for the first time in history. The creator of Bitcoin, Satoshi Nakamoto, warranted the security of the BTC network through a decentralized network of BTC miners who are tasked with confirming the legitimacy of transactions and minting new blocks. Given the extensive community support — from developers to hodlers to traders to miners — that spans over 13 years, the BTC network was witness to a historic 10-month-long rally as it achieved mining difficulty of 31.251 trillion. Bitcoin network difficulty. Source: Blockchain.com Mining difficulty safeguards the BTC ecosystem against networ...

DeFi attacks are on the rise — Will the industry be able to stem the tide?

The decentralized finance (DeFi) industry has lost over a billion dollars to hackers in the past couple of months, and the situation seems to be spiraling out of control. According to the latest statistics, approximately $1.6 billion in cryptocurrencies was stolen from DeFi platforms in the first quarter of 2022. Furthermore, over 90% of all pilfered crypto is from hacked DeFi protocols. These figures highlight a dire situation that is likely to persist over the long term if ignored. Why hackers prefer DeFi platforms In recent years, hackers have ramped up operations targeting DeFi systems. One primary reason as to why these groups are drawn to the sector is the sheer amount of funds that decentralized finance platforms hold. Top DeFi platforms process billions of dollars in transactions e...

Will the Ethereum 2.0 update reduce high gas fees?

Purpose of Ethereum 2.0 The primary goal of the Ethereum 2.0 update is to improve scalability so that the network can handle more transactions without delays or high fees. While the full effects of the update will not be felt until it is fully rolled out, some of the possible use cases for Ethereum 2.0 include: Supporting the large-scale enterprise adoption of blockchain technology in private corporations and businesses; Creating more decentralized autonomous organizations (DAOs) and governance models based on smart contracts and trustless interactions; Ethereum token launches that will allow new projects to fundraise and launch their own tokens on the Ethereum network; The further expansion of nonfungible tokens (NFTs) and other digital assets that can be stored on the...

On-chain privacy is key to the wider mass adoption of crypto

Innovations in the crypto space appear daily. Whether through decentralized applications or new ways to implement and use nonfungible tokens (NFTs) within decentralized finance, blockchain technology is innovating at the speed of light. The only thing missing? Widespread adoption. One thing holding this back is the very public nature of the blockchain. DeFi, as it operates now, lacks meaningful privacy. In order to catalyze broad adoption for businesses, governments and individuals, those executing blockchain transactions should expect regular, consistent privacy. First, we need to define what privacy means. It does not mean pseudonymity, which cryptocurrency purports to have now. Meaningful privacy means that a personal financial account will not be traced and an individual’s wealth will ...

Bitcoin stays under $30K as LUNA gains 600% during ‘insane volatility’

Bitcoin (BTC) failed to reclaim $30,000 into May 14 as traders looked forward to a relatively stable weekend. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Bitfinex longs gather strength Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it lingered below the $30,000 mark, now rapidly becoming resistance. The pair had reached just shy of $31,000 before retracing, while the end of the traditional market trading week had been accompanied by fresh warnings of a new macro low still to come. #Bitcoin – Looks like we might get the inverse H & S before going into the weekend. Hoping to see this 4h candle hold and see it push up. Then I’ll move stops in profit and let it ride during the weekend. 2% risk, 2% stop loss. pic.twitter.com/lxRuk3M43G — ...

Crypto.com unblocks users, reverses glitched LUNA trades that made 30-40x

Crypto.com was one of the few crypto exchanges to keep LUNA trades open as Terra’s death spiral saw an unrecoverable price crash of LUNA and stablecoin UST. However, a technical glitch on Crypto.com’s mobile application allowed users to get away with a 30-40x profit on LUNA trades momentarily. On Friday, Crypto.com abruptly barred users from trading after an internal tool detected the system quoting incorrect prices for LUNA due to some error. Just when Crypto Twitter started raising concerns about trade reversals on the exchange, Kris Marszalek, CEO of Crypto.com, revealed details about a glitch that allowed users to make away with massive profits. There was a lot of customers who were buying at wrong prices and of course some also jumped onto the opportunity to exploit the glitch to the ...