crypto blog

Shanghai court affirms that Bitcoin is virtual property, subject to property rights

The Shanghai High People’s Court has issued a document in which it states that Bitcoin is subject to property rights laws and regulations. That finding was made in relation to a lawsuit filed in a district court in October 2020 involving the recovery of a loan of 1 Bitcoin (BTC). The lower court recognized Bitcoin as having value, scarcity and disposability, and therefore being subject to property rights and meeting the definition of virtual property. According to the Sina website, the Shanghai Baoshan District People’s Court ruled in favor of plaintiff Cheng Mou, ordering defendant Shi Moumou to return the Bitcoin. When the defendant failed to do so, the case was returned to the court, which held a mediation in May 2021. Since the defendant no longer had possession of the Bitcoin, t...

Crypto mining stocks crash as the market continues bleeding heavily

Bitcoin is down 13% in the last 24 hours, extending a bearish run that has wiped almost 30% of its value over the last seven days The massive-sell off has been felt by Bitcoin mining companies whose stock has registered declines Terra’s collapsing ecosystem has been the biggest headline in the crypto sector, but it isn’t the only crypto entity that has been affected by the market downturn. Its native token LUNA crumbled after continued losses totalling 98% in the last 24 hours. Its related stable coin, TerraUSD, has suffered a similar fate – down to $0.4711 against the dollar. Bitcoin is faring badly itself but is much better than Ethereum and many other altcoins. The flagship asset today fell below $28,000 – a low it hasn’t visited since December 2020. Notably, the latest b...

Best tokens you can buy during the market dip on May 12

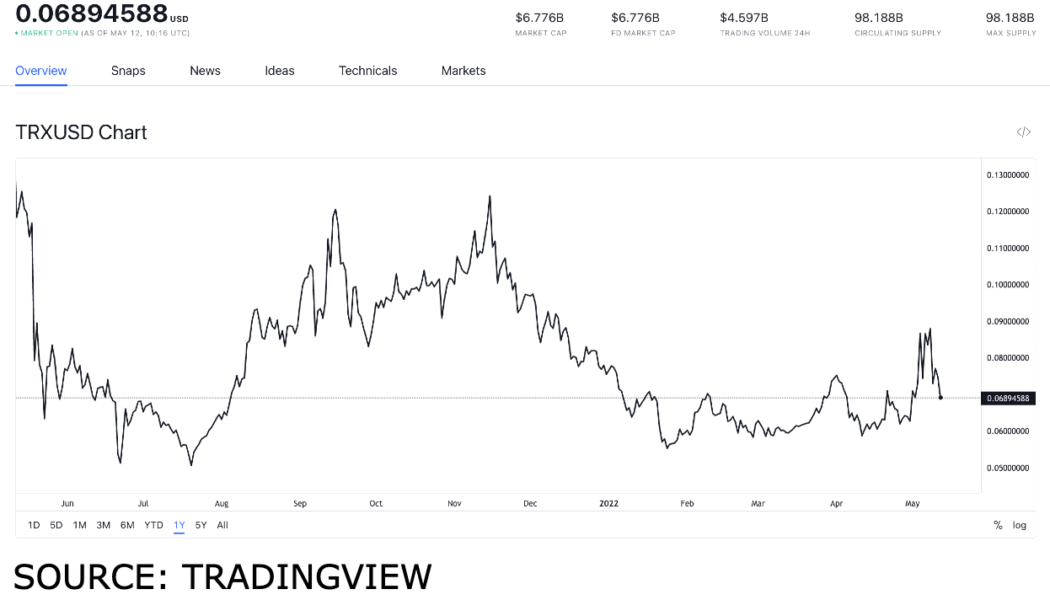

Brazil’s Nubank will allow customers to buy Ethereum (ETH). TRON DAO Deploys $2 billion to protect TRX FTX burns $7.6 million worth of FTT. Justin Sun, the founder of Tron (TRX), made an announcement on May 11 that the TRON DAO deployed $2 billion as a means of protecting TRX following the crash of the Terra (LUNA) cryptocurrency. On May 11, 2022, the Brazilian fintech and banking app, Nubank, started offering capabilities powered by Paxos. Specifically, it allowed cryptocurrencies such as Ethereum to be bought on the platform. FTX burned a total of 7.6 million USD worth of FTT on May 11, 2022, as well. Should you buy TRON (TRX)? On May 12, 2022, TRON (TRX) had a value of $0.06894. The all-time high of TRON (TRX) was on January 5, 2018, when it reached $0.231673. At its ATH, the token...

ApeCoin rebounds after APE price crashes 80% in two weeks: Dead cat bounce or bottom?

ApeCoin (APE) has undergone a sharp recovery after falling to its lowest level in two months. But its strong correlation with Bitcoin (BTC) and U.S. equities amid macro risks suggests more losses could be in store. APE rebounds after 80% losses in two weeks APE rebounded by nearly 45% to $7.30 on May 12. The upside retracement move came after APE dropped circa 81% to $5 on May 11, from its record high near $27.50, established on April 28. The seesaw price action mirrored similar volatile moves elsewhere in the crypto market, led by the chaos around TerraUSD (UST) — an “algorithmic stablecoin” whose value plunged to $0.23 earlier this week, and the Federal Reserve’s hawkish response to rising inflation. APE/USD versus USTUSD. Source: TradingView Meanwhile, the correla...

Madonna’s nude NFT launch triggers a mix of emotions from the community

The queen of pop has collaborated with record-setting artist Beeple to create a series called Mother of Creation, which includes three nonfungible tokens (NFTs) titled Mother of Technology, Mother of Nature and Mother of Evolution. The NFTs show a 3D likeness of Madonna giving birth to robot centipedes, butterflies and trees. As the markets went crazy over stablecoins showing instability, Madonna and Beeple decided that it was the right time to show the community something even crazier — NFTs showing a 3D model of the 63-year-old singer-songwriter’s vagina. Following the drop, the community reacted with various perspectives, with some being inspired and some criticizing various aspects of the artwork. Twitter user Emiko Inoue wrote that the artwork is “the most inspiring” ...

Untethered: Here’s everything you need to know about TerraUSD, Tether and other stablecoins

The crypto winter could be claiming more casualties among the stablecoin camp. The de-pegging of TerraUSD (UST) on Tuesday triggered market sell-offs, and now Tether (USDT) appears to be losing its footing, having slipped against the U.S. dollar. The algorithmic stablecoin UST is, as the name implies, algorithmically backed. LUNA, the ecosystem’s corresponding token, has sunk over 95% since Tuesday, while UST continues to languish around the $0.50 mark. Cointelegraph’s resident experts shared their explanations for why UST crashed in a special edition of “The Market Report” yesterday. The plan for Terraform Labs’ algorithmic stablecoin continues to roll out, but UST is still struggling. [embedded content] Data from Cointelegraph Markets Pro confirmed that various stable...

How blockchain archives can change how we record history in wartime

Decentralized blockchain technology has been around for a relatively short period of time, in the grand scheme of things, but its decentralized nature has the power to keep data and information out of the hands of censors looking to create a “safe” and “faultless” version of history. Blockchain is permissionless and literally owned by no one. So, while we can’t save the Alexandria libraries of the past, we can make sure the future is well equipped with the tools necessary to preserve historical records. Here we’ll look at some of the ways nonfungible tokens (NFT) and blockchain technology have been used for keeping archives, the potential downfalls of such technology, and what the future holds for blockchain-based storage systems. NFTs and archives While many current use cases ...

Coinbase CEO cites ‘informal pressure’ for withdrawing UPI payments in India

Coinbase CEO Brian Armstrong says the exchange faced informal pressure from the RBI to retract its UPI option in India Armstrong holds an even more bullish stance, notwithstanding Coinbase’s reported $430M net loss in Q1 Last month, Coinbase launched UPI payments for Indian crypto users, but before the product could even take off, it was withdrawn as an option, with the crypto exchange offering users no explanation for the rollback. UPI is a widely-used payments infrastructure built by an internetwork of banks. The decision to withdraw the offering had been preceded by a caution by the National Payments Corporation of India (NPCI), which manages the UPI. The organisation denied being aware of “any crypto exchange” using UPI payments. Informal pressure from the RBI Addressing th...

Aussie crypto ETFs see $1.3M volume so far on difficult launch day

With crypto markets tanking, three crypto-focused exchange-traded funds (ETFs) picked a difficult day to commence trading on local exchange Cboe Australia today. The trio’s launch marks the first crypto ETFs to go live in Australia, with two of them focused on offering exposure to Bitcoin (BTC) and the other focused on Ethereum (ETH). So far the three ETFs have generated more than $1.3 million between them, and it has been estimated that they could see around $1 billion worth of inflows moving forward. The Cosmos Purpose Bitcoin Access ETF (CBTC) from Sydney-based crypto investment firm Cosmos Asset Management offers a relatively indirect route to BTC, as it “approximately tracks the performance of the USD denominated ETF non-currency hedged units (Purpose ETF Units) in the Purpose Bitcoin...

Terrible crypto trader gets 42 months for fraud, claiming he was a total gun

A crypto trader who defrauded over 170 people was sentenced to 42 months in prison on May 11 for operating a series of cryptocurrency funds claiming to make big returns but in reality were losing money and instead operated as a Ponzi scheme. The DOJ said that 25 year old Jeremy Spence had solicited millions through false representations, “including that Spence’s crypto trading had been extremely profitable when, in fact, Spence’s trading had been consistently unprofitable.” Spence, who operated the social media channels for a crypto investment scheme called “Coin Signals” was handed the decision by United Stated District Judge Lewis Kaplan for the U.S. District Court for the Southern District of New York. Spence was also sentenced to three years of supervised release and ordered to p...

Bitcoin falls below $27K to December 2020 lows as Tether stablecoin peg slips under 99 cents

Bitcoin (BTC) fell out of its long-term trading range on May 12 as ongoing sell pressure reduced markets to 2020 levels. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView Tether wobbles as UST stays under $0.60 Data from Cointelegraph Markets Pro and TradingView followed BTC/USD as it exited the range in which it had traded since the start of 2021. At the time of writing, the pair circled $26,700 on Bitstamp, marking its lowest since Dec 28, 2020. The weakness came as fallout from the Terra stablecoin meltdown continued to ricochet around crypto and beyond, with rumors claiming that even professional funds were experiencing solvency issues due to losses on LUNA and UST. “People are still processing this but this is the Lehman moment for crypto” Hearing about a lo...