crypto blog

Bitcoin fights to hold $29K as fear of regulation and Terra’s UST implosion hit crypto hard

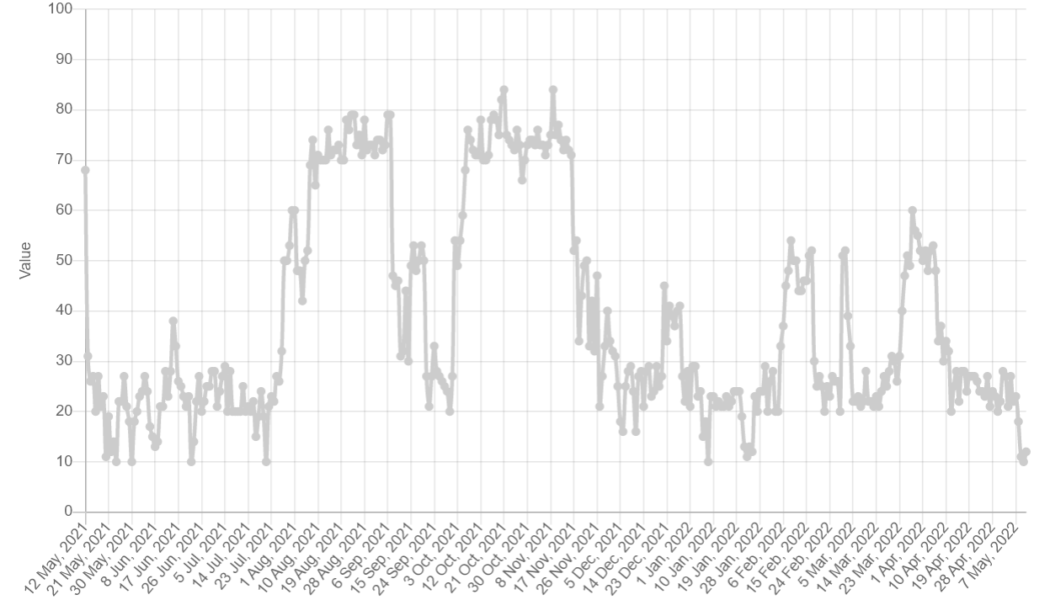

Bitcoin (BTC) price initially bounced from its recent low at $29,000 but the overall market sentiment after a 25% price drop in five days is still largely negative. Currently, the crypto “Fear and Greed Index,” which uses volatility, volume, social metrics, Bitcoin dominance and Google trends data, has plunged to its lowest level since March 2020 and at the moment, there appears to be little protecting the market against further downside. Crypto “Fear and Greed index”. Source: Alternative.me Regulation continues to weigh down the markets Regulation is still the main threat weighing on markets and it’s clear that investors are taking a risk-off approach to high volatility assets. Earlier this week, during a hearing of the Senate Banking Committee, United S...

Chairmen from the SEC and CFTC talk crypto regulation at ISDA meeting

The annual meeting of the International Swaps and Derivatives Association (ISDA) began Wednesday in Madrid. United States Securities and Exchange Commission (SEC) chairman Gary Gensler and U.S. Commodity Futures Trading Commission (CFTC) chairman Rostin Behnam were both featured as keynote speakers at the event, with Behnam speaking at the morning session, and Gensler in the afternoon. Behnam spoke at length about “a request for an amended order of registration as a derivatives clearing organization (DCO) by an entity seeking to offer non-intermediated clearing of margined products to retail participants,” which was transparently a reference to FTX US’s request. “As other registered entities have expressed interest in exploring similar models, and given the potential impact on clear...

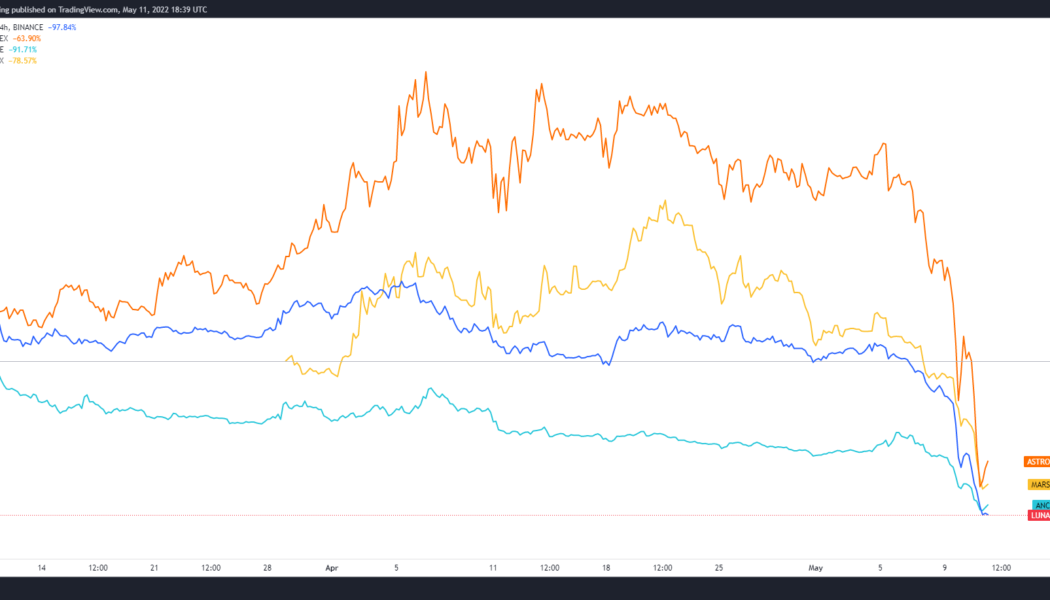

Terra contagion leads to 80%+ decline in DeFi protocols associated with UST

The knock-on effect of the collapse of Terra (LUNA) and its TerraUSD (UST) stablecoin have spread wide across the cryptocurrency market on May 11 as projects with any kind of association with the DeFi ecosystem have seen their prices hammered. The forced selling of the Bitcoin (BTC) holdings backing a portion of UST also influenced BTC’s current drop to $29,000 and analysts fear that DeFi platforms that have liquidity pools primarily comprised of UST and LUNA will collapse. LUNA, ANC, ASTRO and MARS in USDT pairings. 4-hour chart. Source: TradingView Terra-based protocols suffer Projects with the direst of outlooks are those that are hosted on the Terra protocol including Anchor Protocol (ANC), Astroport (ASTRO) and Mars Protocol (MARS). As shown in the chart above, ...

De-pegged UST sends LUNA tumbling: Token price down almost 95% in the last 24 hours

LUNA has seen an extended downturn as investors rush to sell off The token has lost more than 90% on the day, sinking below $2.00 Crypto markets are seeing the worst of volatility caused by their correlation with stock markets, which are, on the other hand reacting to the US Federal Reserve’s aggressive monetary policy against inflation. However, some are feeling the pinch more than others, and the Terra ecosystem is one such network as it is barely holding on for survival in this bear market. Terra’s LUNA token has seen a large-scale sell-offs as holders rush to cut their losses and dump the asset. This comes after the LUNA/USD pair plunged to single-digit figures – a month after hitting as high as $120 in early April. CoinMarketCap data shows that LUNA is trading below at $2.0...

Crypto Crisis: Over $1 billion liquid in 24 hours

The crypto market has witnessed a massive sell-off in the past 24 hours, triggered by the recent crash of Bitcoin (BTC) below $30,000. As a result, the positions of hundreds of thousands of crypto traders were liquidated. For example, data from Coinglass shows that more than $1 billion in trading positions has been wiped out in the past 24 hours. Multi-million dollar wipe out Traders expecting a bounce were hit the hardest by the correction, as nearly $750 million in long positions were liquidated over the past day. The volatility also took a toll on those betting crypto will fall in a straight line, as nearly $200 million in short positions were wiped out over the same period. With bearish momentum taking over the crypto markets, traders trying to time Ethereum (ETH) suffered its biggest ...

Top tokens under $1 not to miss on May 11

TRX, MATIC, and CRO are some of the best tokens you can get under $1. Each project has undergone numerous updates and developments to make it stand out. They are all currently at an affordable price point and can climb much further in value going forward. On March 9, 2022, the Bitrue cryptocurrency exchange added the USDC cryptocurrency. What this means is that users can deposit and withdraw USDC on the TRON blockchain and mix and match ERC-20, TRC-20, and SPL USDC. On the same day, Meta (formerly Facebook) launched their digital collectibles powered by the Polygon blockchain. Select creators and collectors can now showcase their non-fungible tokens (NFTs) to a wider audience. On May 10, 2022, Cronos successfully upgraded its mainnet. Specifically, it upgraded to v0.7.0 “Huy...

Sculptor aims to use the Fearless Girl statue to empower women in crypto

The creator of the Fearless Girl statue in New York, which stands for the empowerment of women, has brought the emblem into the crypto space by dropping a nonfungible token (NFT) counterpart for the symbolic art piece. In an interview with Cointelegraph, sculptor Kristen Visbal told the story behind the artwork’s significance and how she aims to use it to empower women in crypto. According to Visbal, the piece is a symbol that fights for equality, the need for gender collaboration and parity. She explained that: “Fearless Girl legally stands for the empowerment of women, equality, equal pay, supporting women in leadership positions, the education of women, education in the workplace for the prevention of prejudice, and the general well-being of women.” Now, with the advent of NFTs, V...

Rising global adoption positions crypto perfectly for use in retail

Even though the cryptocurrency market seems to be going through a bit of a lull at the moment, there’s no denying the fact that the industry has grown from strength to strength over the last few years, especially from an adoption perspective. To this point, a recent study revealed that the number of adults in the United States using digital assets for everyday purchases will increase by 70% by the end of the year when compared to 2021, with the metric rising from 1.08 million to 3.6 million users. The study’s chief author suggests that as the crypto market’s volatility continues to reduce — thanks to the growing use of stablecoins and central bank digital currencies (CBDCs) — more and more people will look at these offerings as a legitimate means of payment. In fact, by the end of 20...

Bitcoin 2022 — Will the real maximalists please stand up?

As I go about the Miami conference, I wonder, Aside from some of the conference speakers, where are these Bitcoin maximalists I keep hearing so much about? When I tell the customs official I’m going to Miami for the Bitcoin 2022 conference, there seems to be a light in the man’s eyes. He peppers me with questions, even though I’d gotten up at 5 am that day to fly, and my smartwatch is telling me that my energy levels are only at 70%. The customs official has way more interest in the subject than I can handle. Why am I going to the conference? The philosophy of the event fascinates me — it’s a Bitcoin-only conference — with the divide between Bitcoin and the rest of the cryptocurrency world growing year by year. I don’t go into that much detail with the customs official, though. Sometimes, ...

Bank of Israel claims ‘public support’ for its CBDC project

Despite the fact that it still hasn’t made a final decision on the launch of the “digital shekel,” Israel’s central bank reported that the public feedback on the project is mainly positive. According to Reuters, on Monday, The Bank of Israel summarized the results of the public consultation on its central bank digital currency (CBDC) plans. It has received 33 responses from different sectors, with half of them coming from abroad and 17 from the domestic fintech community. While specifying that the final decision on the project’s fate is yet to be made, it claimed: “All of the responses to the public consultation indicate support for continued research regarding the various implications on the payments market, financial and monetary stability, legal and technological issues, and more....

Delayed crypto ETFs expected to launch on Cboe Australia this Thursday

Cboe Australia said that the downstream issues that had caused the delay have been resolved EFT Securities, in collaboration with 21Shares, will launch a Bitcoin and ETH spot ETF Cosmos Asset Management will debut a Bitcoin ETF Late last month, it was expected that Australia would debut three crypto exchange-traded funds (ETFs) that were set for listing on Cboe Global Market’s Cboe Australia. Two of the three ETFs were a Bitcoin and Ether spot ETF by 21Shares (in collaboration with ETF Securities), and the third was a Bitcoin EFT offered by Cosmos Asset Management. However, cutting it late, near the day of launch set for April 27, the Cboe exchange announced that the three ETFs had been delayed. Back on this Thursday Cboe Australia has now provided an update and says the three ETPs w...