crypto blog

NEAR Foundation partners with Kenyan blockchain community Sankore to build a regional hub

The regional hub will focus on blockchain innovation, talent development and community education in Africa NEAR Foundation CEO Marieke Flament said the collaboration presents an opportunity to work with local talent NEAR Foundation has announced the launch of a regional hub in partnership with Kenyan blockchain community Sankore. The Swiss non-profit organisation is responsible for managing the evolution and governance of the NEAR protocol, a smart contract-capable blockchain launched in 2020. The hub would be backed by a core team of four people and led by Sankore founder Kevin Imani. It would support blockchain innovation, educate the communities, and enhance talent development in the larger continent of Africa. The hub will also feature the Sankore Bounty ecosystem, have an incubation p...

Binance suspends LUNA and UST withdrawals

Binance, a crypto exchange, has announced that it has suspended the withdrawal of UST and LUNA stablecoins temporarily due to bottleneck processes. This comes after the TerraUSD (UST) stablecoin de-pegged from the US dollar causing its price and that of LUNA to drop drastically. LUNA, for instance, has dropped by more than 85% today. In an official announcement issued yesterday, Binance said: ‘’Withdrawals for LUNA and UST tokens on the Terra (LUNA) network were temporarily suspended on 2022-05-10 at 02:20 AM (UTC) due to a high volume of pending withdrawal transactions. This is caused by network slowness and congestion. Binance will reopen withdrawals for these tokens once we deem the network to be stable and the volume of pending withdrawals has reduced. We will not notify users in a fur...

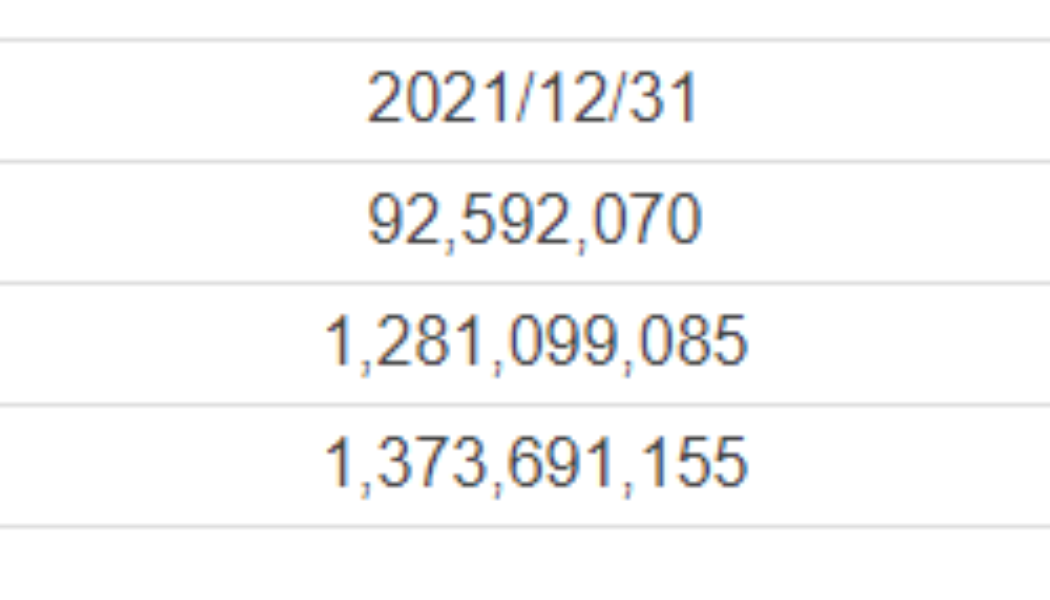

VeChain Foundation reports $1.2B crypto treasury… but spent just $4M in Q1

The VeChain Foundation has released its financial report for Q1 2022 showing that the project amassed an impressive $1.2 billion war chest but only spent about $4.1 million in the quarter. VeChain (VET) is a blockchain project designed to enhance supply chain management.. The Foundation’s May 10 financial report for Q1 2022 outlines its balance sheet as of March 31 and how it spent funds through the quarter. Although the treasury opened the year with $1.37 billion in assets between stablecoins, Bitcoin (BTC), Ether (ETH), and VET, it ended with $1.2 billion. The report states that most of the losses were incurred “due to crypto market fluctuations and other VeChain Foundation outgoings.” The BTC price has fallen 34% since, ETH has fallen 36%, and VET has fallen 54% since Dec. 31, 2021 when...

Nifty News: Azuki founder under fire, CryptoPunk sells for a major loss…

The founder of the $723.5 million Azuki NFT project who goes by “Zagabond” online caused a sh*tstorm yesterday after revealing that they had previously worked on three noabandoned NFT projects. After facing strong backlash from the NFT community, they have since apologized for their “shortcomings.” The three projects in question are Tendies and CryptoPunks copycats CryptoPhunks and Cryptozunks. Zagabond suggested all three had failed due to a lack of community support , and other factors such as team members leaving or high gas fees on Ethereum (ETH). After releasing the blog via Twitter, most replies were in support of Zagabond’s honesty on the trial and error path that led to Azuki NFTs, however other sections of the NFT community weren’t as pleased. Really don’t understand all the...

Indian central bank’s ‘informal pressure’ disrupted payments: Coinbase CEO

Just three days after debuting in the Indian market, United States-based crypto exchange Coinbase abruptly stopped using United Payments Interface (UPI), the most popular payment service in the region. Coinbase CEO Brian Armstrong later revealed that the service disruption was due to an “informal pressure” from India’s central bank. During Coinbase’s 2022 Quarterly Earnings call, Armstrong spoke about the company’s global expansion plans while acknowledging Coinbase’s role in starting the conversation with regulators related to crypto adoption. When asked about the impact of the recent disruption related to offering payment services in India, Armstrong stated: “So a few days after launching, we ended up disabling UPI because of some informal pressure from the Reserve Bank of Indi...

Terra ‘rescue plan’ still at large as LUNA falls below $5, Bitcoin spikes to ‘$138K’ in UST

Panic appeared to set in on crypto markets overnight on May 11 as Blockchain protocol Terra failed to steady its bleeding cryptoassets. Data from Cointelegraph Markets Pro and TradingView showed both the firm’s in-house token, LUNA and stablecoin, TerraUSD (UST) seeing fresh heavy losses on the day. A dubious new “all-time high” for Bitcoin After a mass sell-off which some argued was “coordinated” to destroy the Terra ecosystem, UST lost its peg to the U.S. dollar. Attempts to shore up the peg with both LUNA and Bitcoin (BTC) reserves failed, and as uncertainty gripped the market, both UST and LUNA dived to levels unimaginable just days previously. Getting close … stay strong, lunatics — Do Kwon (@stablekwon) May 10, 2022 Co-founder Do Kwon said that a “recove...

The Fed cites its concern about stablecoins in its latest Financial Stability Report

The United States Federal Reserve Board released its semiannual Financial Stability Report on Monday. The report points to the volatility on commodities markets brought on by the Russian invasion of Ukraine, the spread of the omicron variant of COVID-19 and “higher and more persistent than expected” inflation as sources of instability. Stablecoins and some types of money market funds were singled out in the report and noted to be prone to runs. According to the Fed, stablecoins have an aggregate value of $180 billion, with 80% of that amount represented by Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). They are backed by assets that may lose value or become illiquid during stress, leading to redemption risks, and those risks may be exacerbated by a lack of transparency, the centra...

Michael Saylor assuages investors after market slumps hurts MSTR, BTC

MicroStrategy’s CEO and Bitcoin proponent Michael Saylor is confident his firm’s BTC holdings will more than cover a potential margin call on Bitcoin-backed loans. The American business intelligence and software giant made headlines in 2021 with a number of major investments into Bitcoin. Saylor was a driving force behind MicroStrategy’s decision to convert its treasury reserve into BTC holdings. Global markets have suffered major losses in early May and Microstrategy’s stock has not been spared. MSTR has seen its value drop by 24% and the value of Bitcoin has also slumped considerably along with the wider cryptocurrency markets. This is cause for concern as the company’s subsidiary MacroStrategy took out a $205 million loan from Silvergate Bank in March 2022, with a portion of MicroStrate...

Altcoins stage a relief rally while Bitcoin traders decide whether to buy the dip

The similarity in price action between the crypto and traditional financial markets remains quite strong on May 10 as traders enjoyed a relief bounce across asset classes following the May 9 rout, which saw Bitcoin (BTC) briefly dip to $29,730. Market downturns typically translate to heavier losses in altcoins due to a variety of factors, including thinly traded assets and low liquidity, but this also translates into larger bounces once a recovery ensues. Daily cryptocurrency market performance. Source: Coin360 Several projects notched double-digit gains on May 10, including a 15.75% gain for Maker (MKR), the protocol responsible for issuing the DAI (DAI) stablecoin, which likely benefited from the fallout from Terra (LUNA) and its TerraUSD (UST) stablecoin. Other notable gainers incl...

Environmental groups urge US government to take action on crypto miners

A group of eight organizations focused on the environment have called on different government agencies under the Biden administration to implement new approaches in response to Proof-of-Work and other crypto mining operations. In a letter to the United States Office of Science and Technology Policy on Monday, the Environmental Working Group, Earthjustice, Greenpeace, the League of Conservation Voters, the Sierra Club, Friends of the Earth, the Seneca Lake Guardian, and the Milwaukee Riverkeeper urged the White House to enact policies aimed at curbing “the electricity use and climate pollution associated with digital currencies that rely on [PoW].” Specifically, the organizations alleged crypto mining in the United States harmed communities by creating increasing demand for electricity sour...

Bitcoin falls below $30k to retouch a ten-month low: Here is what is happening?

Crypto and traditional markets continue seeing wide-scale sell-offs in response to the Fed’s tighter monetary policy Glassnode says the rush to de-risk from assets such as Bitcoin pushed the token’s network transaction costs 15% higher than average Cryptocurrency markets have been in the red since the value of the largest crypto-token, Bitcoin, plunged below the $40k on April 28. Since last Thursday, the fall has been even more intense. Yesterday, the price of Bitcoin fell below $30k for the first time since July 2021, as markets – traditional and cryptocurrency – saw increased sell-offs in reaction to the US Federal Reserve’s renewed aggressive monetary policy. The price of the flagship crypto was spotted as low as $29,944 on CoinMarketCap during yesterday’s session. Though it...

Silence from Do Kwon says it all amid UST crisis

Do Kwon is the founder of Terra and the face of the ecosystem. He is also extremely active on Twitter, frequently discussing Luna, UST and the merits of the algorithmic peg. Tone Well, I say discussing, but it’s normally far from a discussion. He often takes a very aggressive line with accounts enquiring about the sustainability of the peg, the long-term viability of Anchor and many other (valid) questions about the experiment that is UST. 6/ On depeg risk – I’ve grown quite tired of arguing with idiots on Twitter on whether UST can remain stable in bear. So soon I will propose creating multi billion dollar reserves in decentralized assets (BTC and others) in an attempt to save myself time. More to follow. — Do Kwon 🌕 (@stablekwon) November 20, 2021 Yesterday, his UST stablec...