crypto blog

Bitcoin price target now $29K, trader warns after Terra weathers $285M ‘FUD’ attack

Bitcoin (BTC) prepared for a rare bear feature to return on May 8 after an overnight sell-off took the market ever closer to January lows. BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView BTC circles $34,400 lows Data from Cointelegraph Markets Pro and TradingView showed BTC/USD dipping to $34,200 on Bitstamp, recovering to trade around $500 higher at the time of writing. The pair had seen brief support around the $36,000 mark, but this gave way as thin weekend liquidity added to the volatility. Bitcoin liquidations themselves were limited, however, as market sentiment had long expected a deeper pullback after a tumultuous week on stock markets. Data from on-chain monitoring resource Coinglass countered 24-hour liquidations for both Bitcoin and Ether (ETH), running at aroun...

6 Questions for Ming Duan of Umee

We ask the buidlers in the blockchain and cryptocurrency sector for their thoughts on the industry… and throw in a few random zingers to keep them on their toes! This week, our 6 Questions go to Ming Duan, the co-founder and chief operating officer of Umee, a cross-chain DeFi hub that allows decentralized interactions between different blockchains. Ming Duan’s knowledge of the crypto and blockchain world goes back to 2014 when she initially learned about the emerging industry through the first-ever blockchain course taught at a business school. Since then, she has developed extensive crypto investment knowledge through hands-on practice. Duan brings unique insight to Umee, having experience as both a crypto investor and builder in the ecosystem. Her goal for Umee is to build a platf...

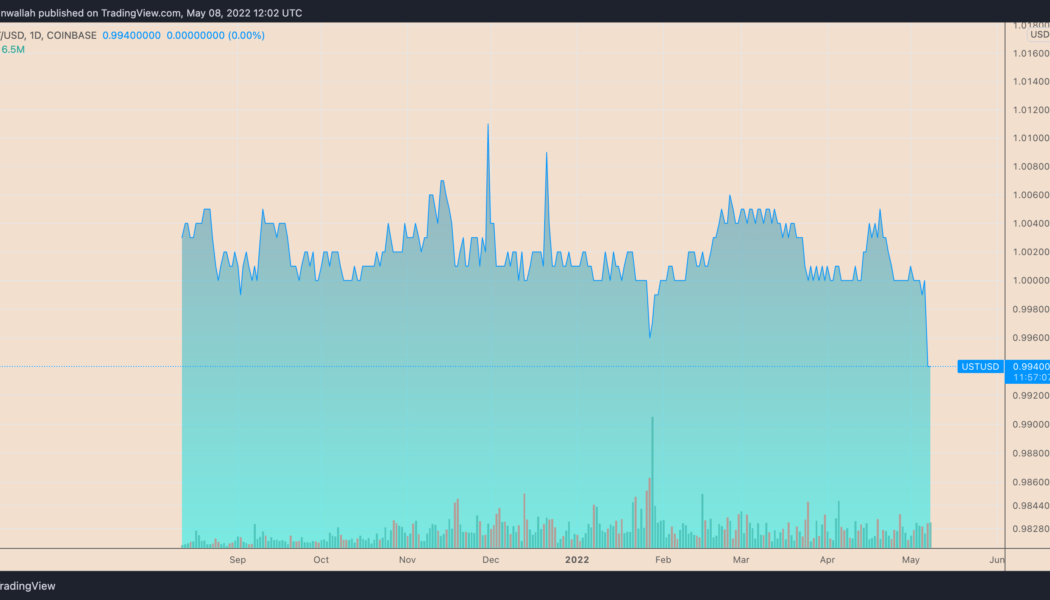

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

Terra (LUNA) has plunged significantly after witnessing a FUD attack on its native stablecoin TerraUSD (UST). The LUNA/USD pair dropped 20% between May 7 and May 8, hitting $61, its worst level in three months, after a whale mass-dumped $285 million worth of UST. As a result of this selloff, UST briefly lost its U.S. dollar peg, falling to as low as $0.98. UST daily price chart. Source: TradingView Excessive LUNA supply LUNA serves as a collateral asset to maintain UST’s dollar peg, according to Terra’s elastic monetary policy. Therefore, when the value of UST is above $1, the Terra protocol incentivizes users to burn LUNA and mint UST. Conversely, when UST’s price drops below $1, the protocol rewards users for burning UST and minting LUNA. Therefore, during UST supp...

Nvidia to pay $5.5M as part of SEC case concerning ‘inadequate disclosures’ around crypto mining

The United States Securities and Exchange Commission, or SEC, has announced that it has settled charges against Nvidia — the company behind graphics cards used by many crypto miners — in regards to “inadequate disclosures.” In a Friday announcement, the SEC said that Nvidia failed to disclose that mining cryptocurrencies was “a significant element of its material revenue growth” based on sales of its graphics processing units, or GPUs, during the 2018 fiscal year. The company has agreed to pay a $5.5 million penalty and will be subject to a cease-and-desist order based on violations of the Securities Act of 1933 and disclosures required by the Securities Exchange Act of 1934. According to the SEC, Nvidia reported growth in revenue around its gaming business in 2018, but also had informatio...

90% of surveyed central banks are exploring CBDCs — BIS

A survey conducted by the Bank for International Settlements, or BIS, suggested that many central banks around the world are looking into rolling out a central bank digital currency, or CBDC. In a paper released on Friday, the BIS Monetary and Economic Department said 90% of 81 central banks surveyed from October to December 2021 were “engaged in some form of CBDC work,” with 26% running pilots on CBDCs and more than 60% doing experiments or proofs-of-concept related to a digital currency. According to the BIS, the increase in interest around CBDCs — up from roughly 83% in 2020 — may have been driven by a shift to digital solutions amid the COVID-19 pandemic as well as the growth in stablecoins and other cryptocurrencies. “Globally, more than two-thirds of central banks consider that they ...

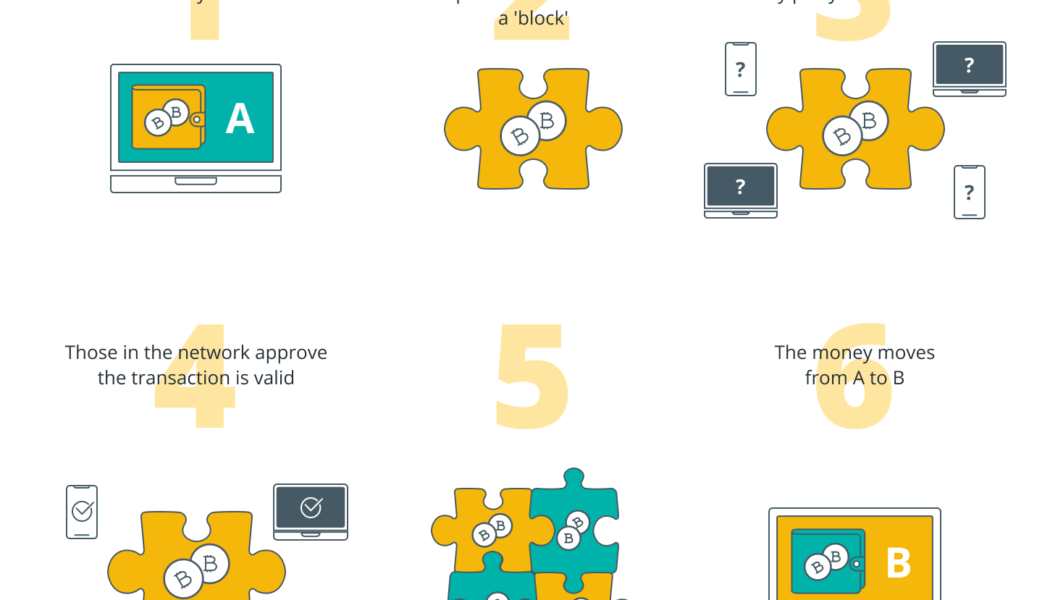

Crypto, like railways, is among the world’s top innovations of the millennium

You are about to read a half-fiction witty story based on Stuart Hylton’s review of “the making of Modern Britain” and my interpretation of the blockchain’s impact on today’s world. I found it fascinating how the description of the industrial age front-runner technology resembled the awe and fear of blockchain in modern times. Some quotes are so relevant that changing the “railroad company” to “blockchain protocol” would give the same shilling. After several “bubbles” (actually eight so far) and some huge announcements — remember Libra and TON? — I figured it was a good time to coin (pun intended) the history of the emerging technology that could be the biggest innovation in the last 500 years. An intriguing comparison Why bother? From a distance of two centuries, it is difficult to grasp ...

For the crypto industry, supporting sanctions is an opportunity to rebrand

One of the first punitive measures leveled against Russia in response to the military invasion of Ukraine was the implementation of economic sanctions aimed at isolating the country from the international financial system. On March 12, Russian banks lost access to the international payments and messaging network SWIFT, and private sector payment companies, such as Visa, PayPal and Mastercard, were close behind. But while these highly regulated and publicly scrutinized organizations were quick to react to the crisis, concerns quickly mounted that the Russian state, as well as companies and oligarchs associated with it, could turn to digital currency exchanges as a backdoor to side-step sanctions. In the United Kingdom, the Bank of England and Financial Conduct Authority asked crypto firms t...

There’s more to NFTs than just PFPs — 5 ways nonfungible tokens will transform society

The nonfungible token (NFT) sector has undergone a surge in popularity over the past year and a half as projects like Bored Ape Yacht Club and CryptoPunks captured the attention of the general public. While the idea of fetching a six-figure payday for the latest trending digital art piece has been a major factor in the attention placed on the sector, the truth is that the crypto industry has only scratched the surface of what NFT technology is capable of. Here’s a rundown of some of the next frontiers in the development of NFT technology that has the potential to make substantial changes in everyday life. Medical records and identification Medical records and identification documents are vital pieces of information that are easy to misplace and difficult to replace, even in the digit...

Any dip buyers left? Bulls are largely absent as the total crypto market cap drops to $1.65T

The total crypto market capitalization has been trading within a descending channel for 24 days and the $1.65 trillion support was retested on May 6. The drop to $1.65 trillion was followed by Bitcoin (BTC) reaching $35,550, its lowest price in 70 days. Total crypto market cap, USD billion. Source: TradingView In terms of performance, the aggregate market capitalization of all cryptocurrencies dropped 6% over the past seven days, but this modest correction in the overall market does not represent some mid-capitalization altcoins, which managed to lose 19% or more in the same time frame. As expected, altcoins suffered the most In the last seven days, Bitcoin price dropped 6% and Ether (ETH) declined by 3.5%. Meanwhile, altcoins experienced what can only be described as a bloodbath. Below ar...

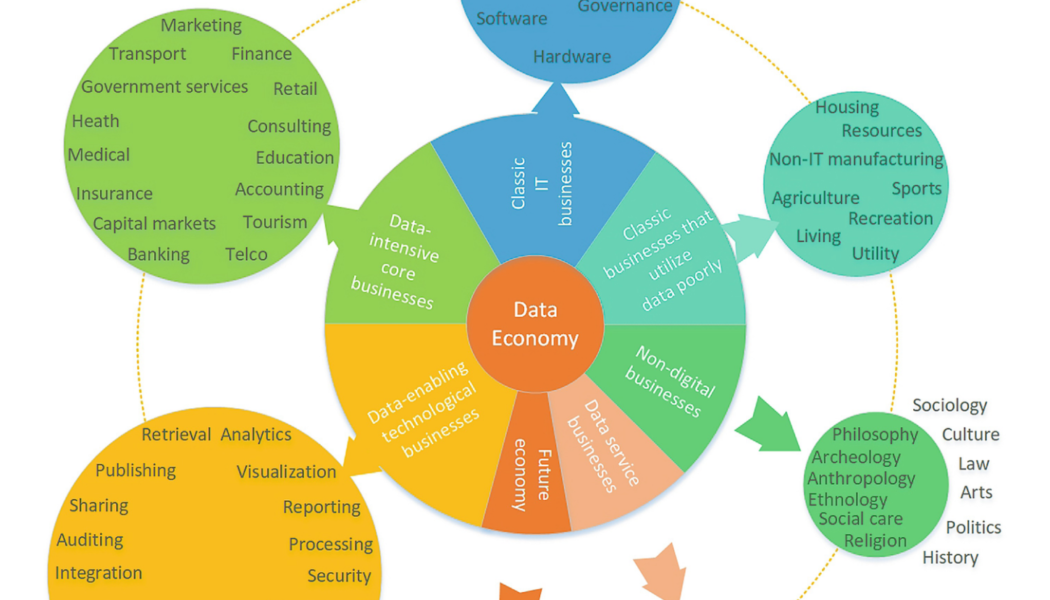

Digital sovereignty: Reclaiming your private data in Web3

As the Fair Data Society puts it, we are laborers in the data economy. Our personal data — basically, the digital blueprint of our lives — gets collected by platforms we interact with, most often in a non-transparent way. At best, it is used to improve our user experience. At worst, our privacy gets breached, monetized and even weaponized against us. It all started with the emergence and growth of the user-generated web, as seemingly free social media networks, search engines and companies saw a new opportunity of profiting and went into the business of gathering, storing, analyzing and selling user data. By 2022, the data market had grown immensely. According to Statista, a total of 64.2 zettabytes of data had been created, consumed and put online worldwide by 2020. By 2025, this number i...

US Fed hikes interest rates, Bitcoin plunges below $36K, and Argentina’s central bank says no to financial institutions offering crypto: Hodler’s Digest, May 1-7

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link. Top Stories This Week Fed hikes interest rates by 50 basis points in effort to combat inflation On Wednesday, the United States Federal Open Market Committee (FOMC) voted to raise interest rates by 0.5%, marking its biggest upward adjustment in over two decades. It was the second rate increase of 2022, with seven increases expected in total for the year. In a press conference following the FOMC meeting, Federal Reserve Chair Jerome Powell further cemented the need to continue raising interest rates to combat inflation. ...

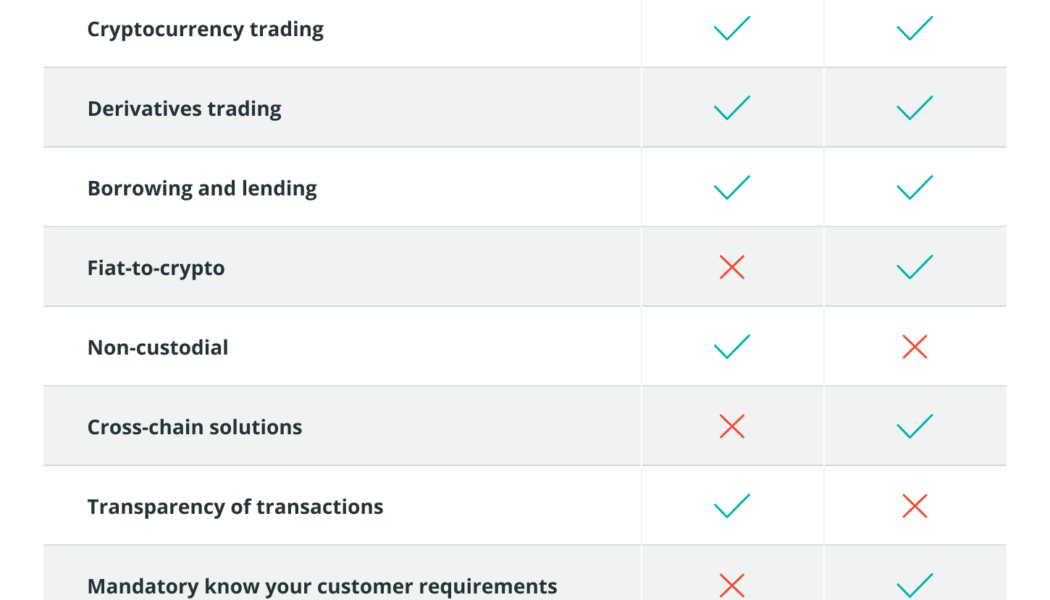

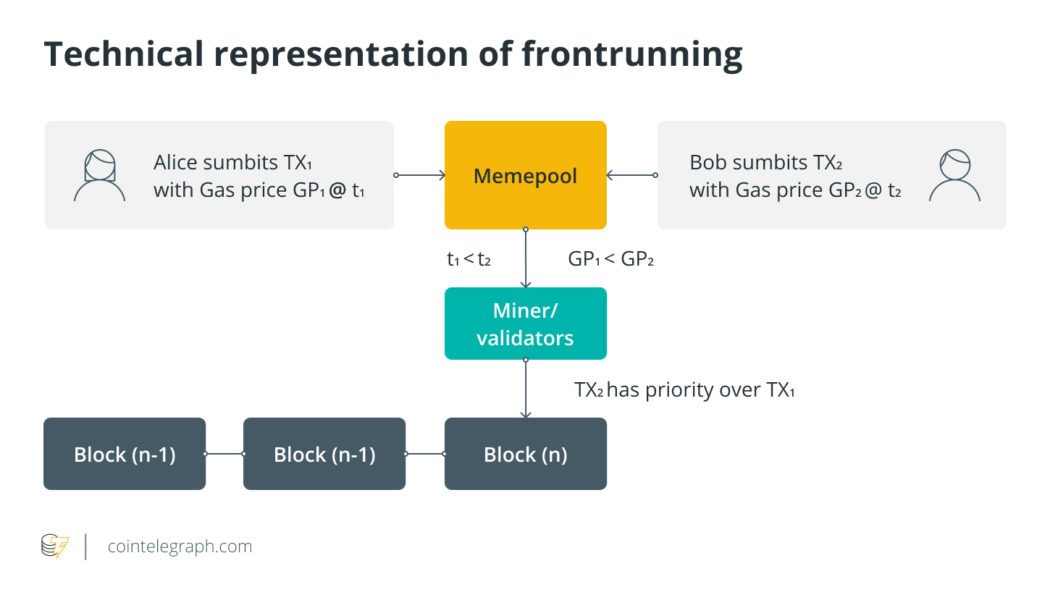

How to avoid front runners on decentralized crypto exchanges

Decentralized exchanges (DEXs) nip in the bud several issues concerning their centralized counterparts such as concentration of liquidity in the hands of a few players, compromise of funds in case of a security breach, closed control structure and more. One issue, however, that has refused to subside is front-running. Unscrupulous players are still finding ways to defraud unsuspecting traders. If you have received less than expected when placing a trade on a DEX, there is a pretty good chance of you getting hit by front runners. These bad actors exploit the automated market maker (AMM) model to make profits at the expense of unsuspecting traders. This article will explain the attack vector and help you understand the basic concept of front-running in crypto trading, the potential consequen...